Exide Battery: A Comprehensive Analysis And 2025 Share Price Target

Exide Battery: A Comprehensive Analysis and 2025 Share Price Target

Related Articles: Exide Battery: A Comprehensive Analysis and 2025 Share Price Target

- XRP Price Prediction 2032: A Comprehensive Analysis

- 2024 US Calendar With Holidays

- Daytona 500 2025: A Race For The Ages

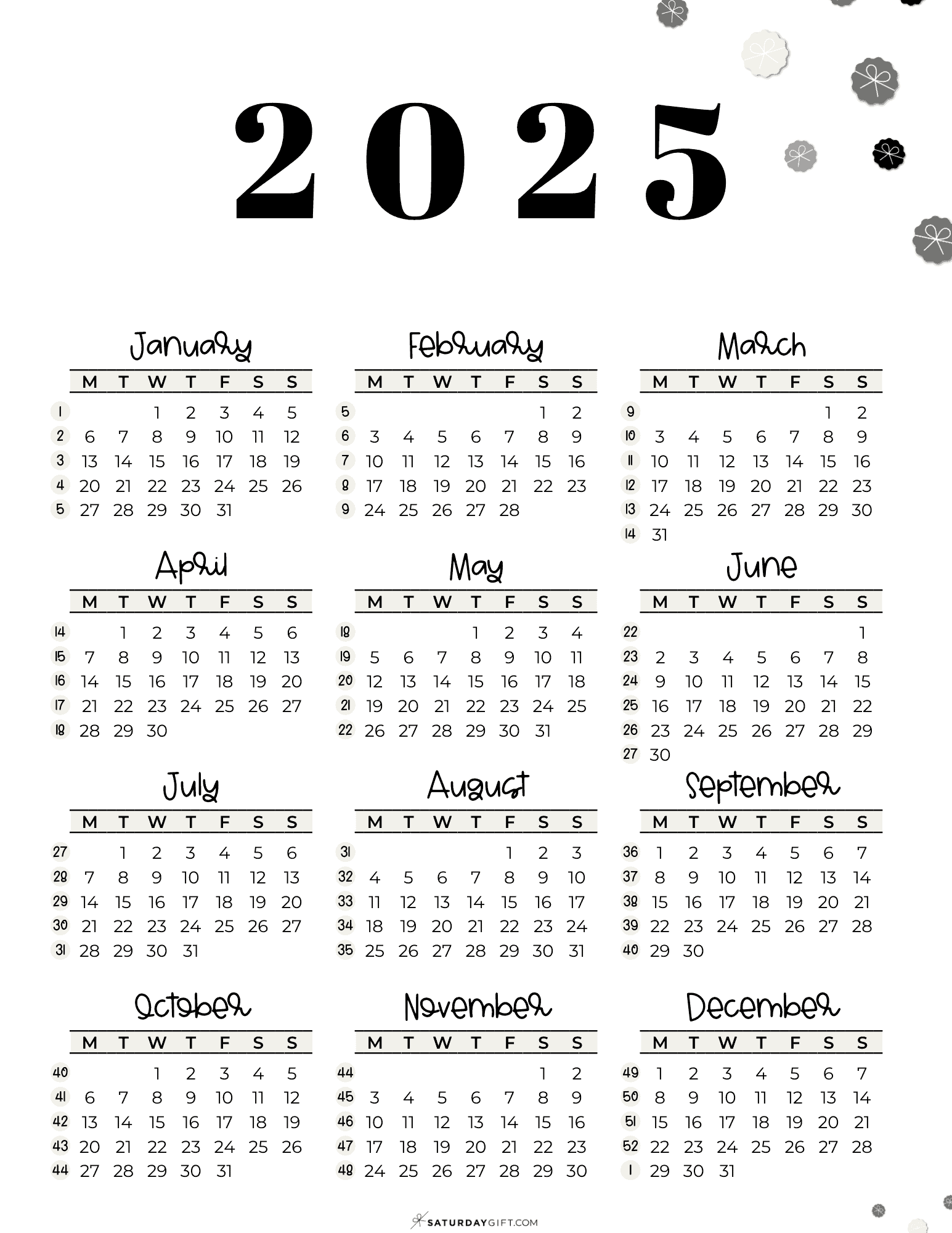

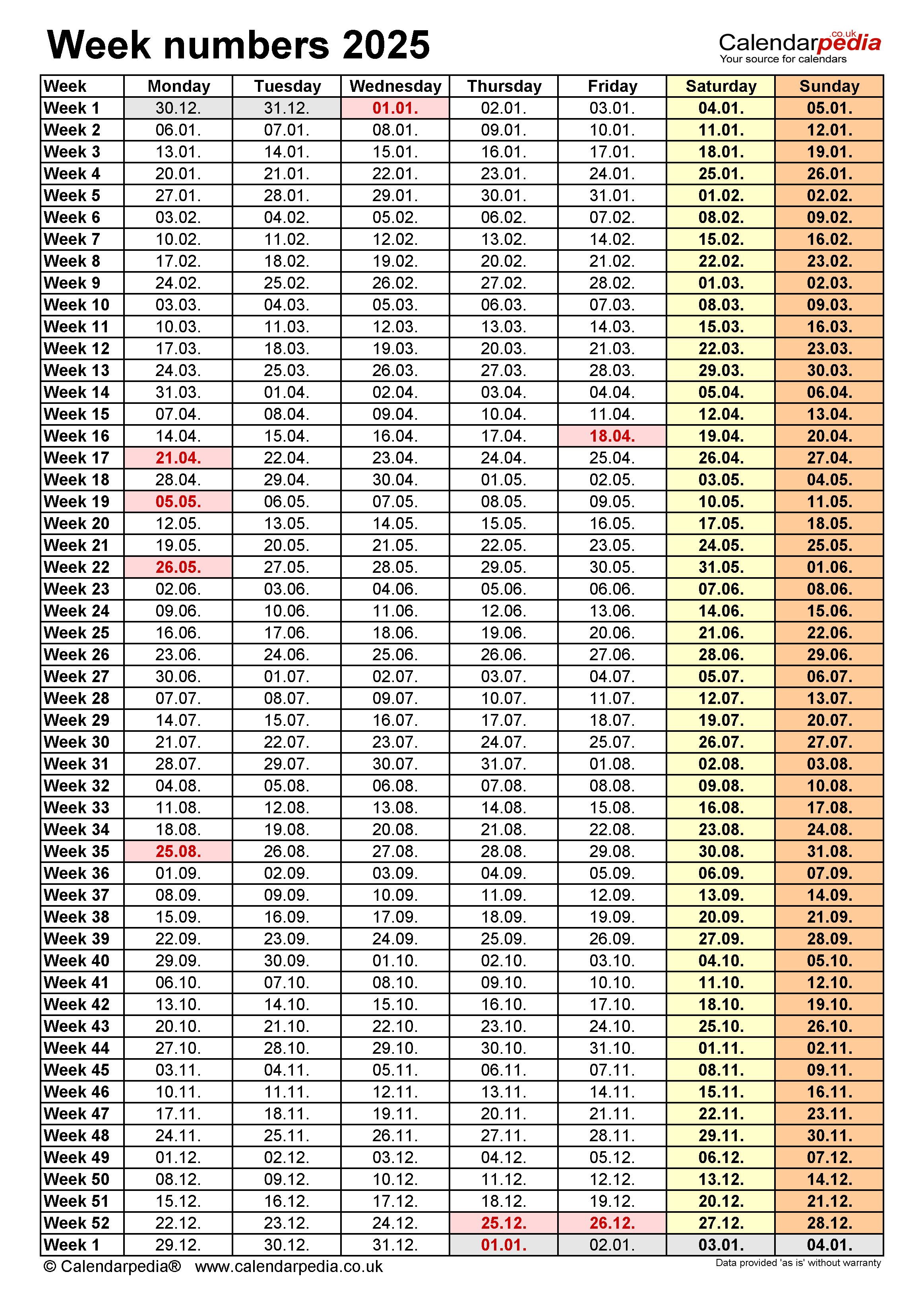

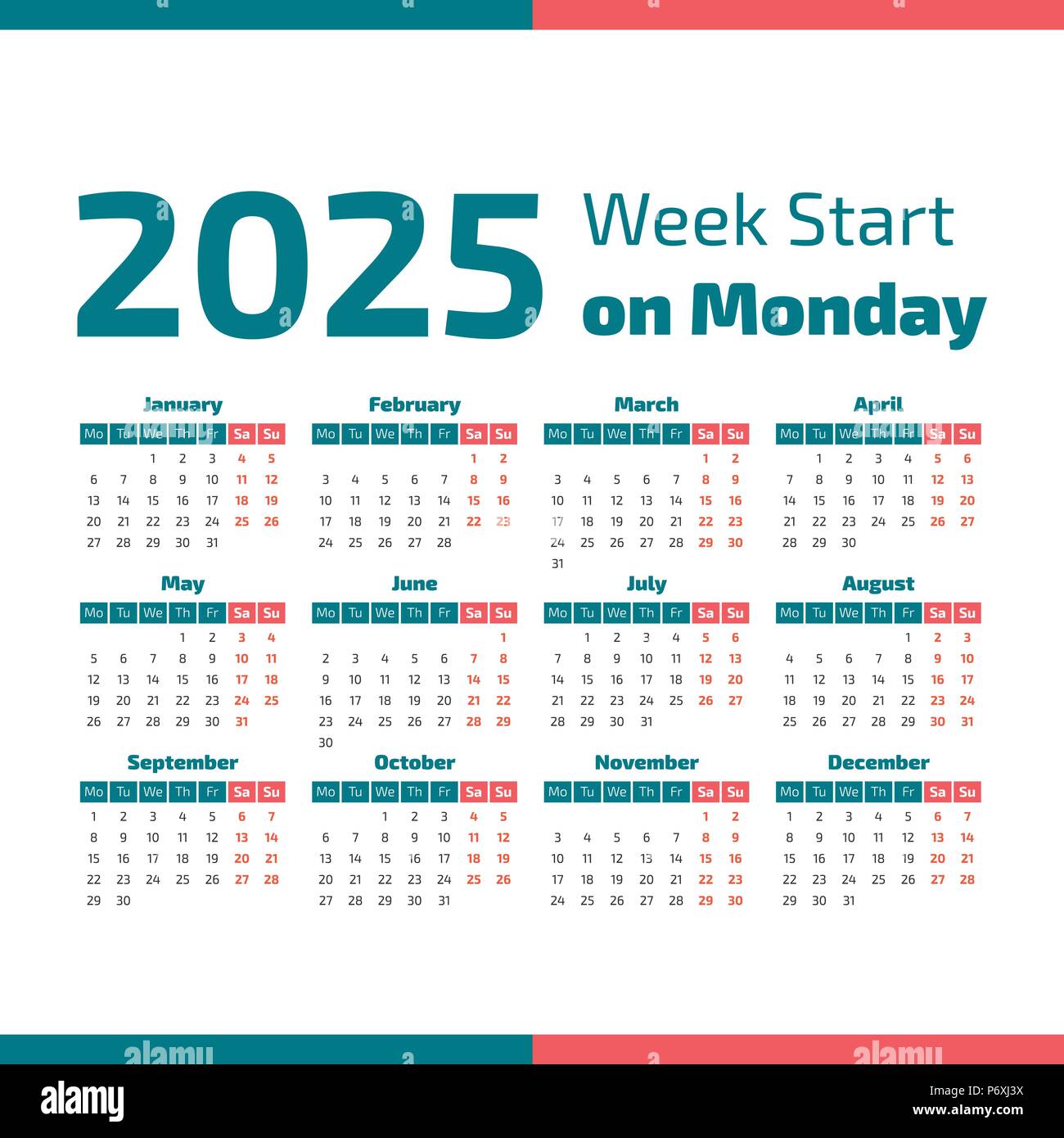

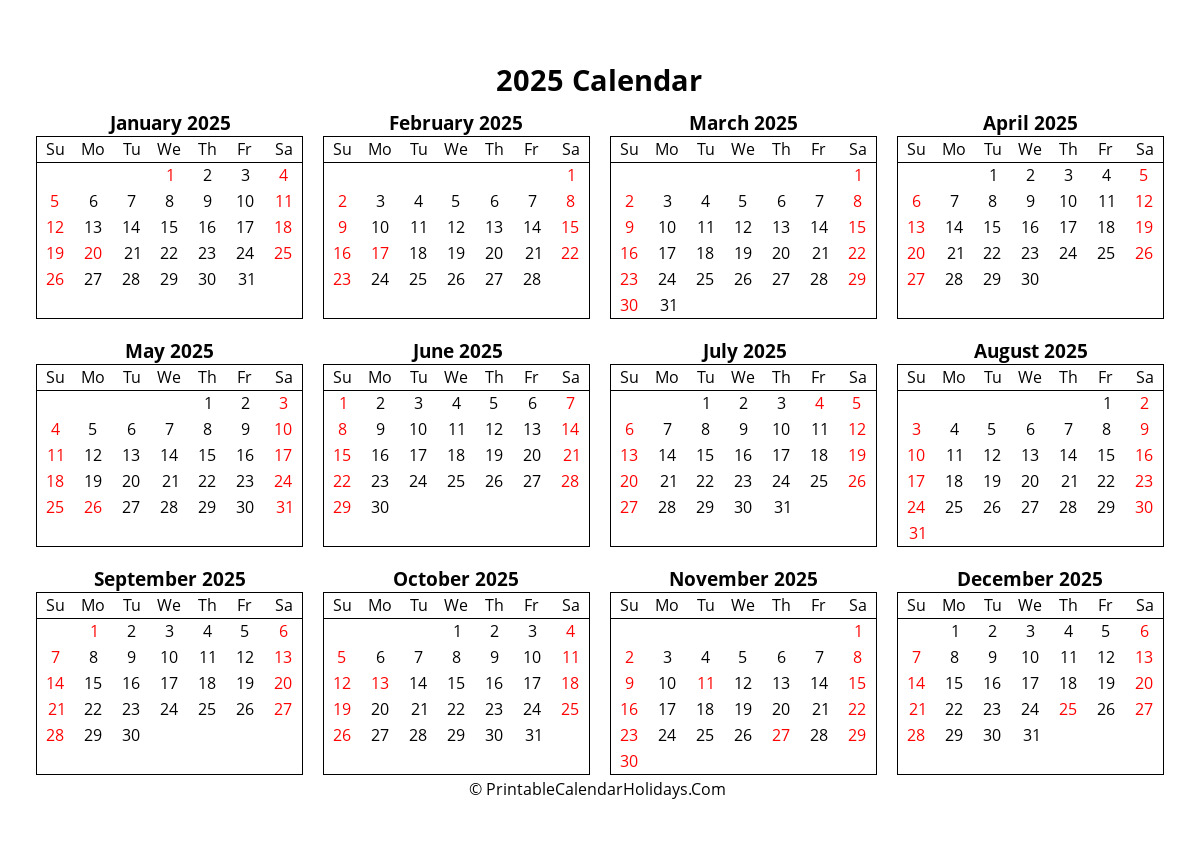

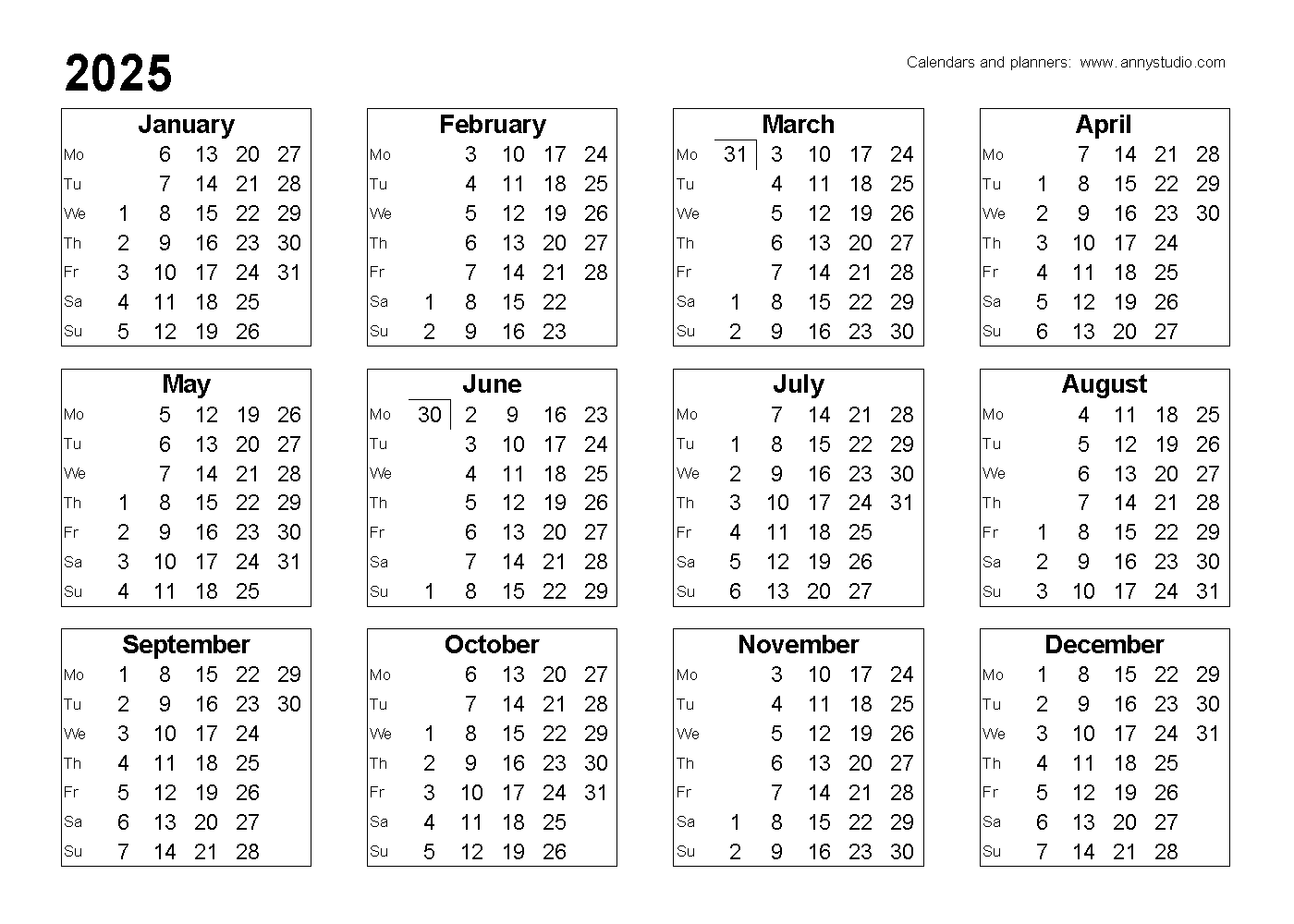

- Important Dates In 2025: A Comprehensive Guide

- 2025 Toyota 4Runner: A Comprehensive Overview

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Exide Battery: A Comprehensive Analysis and 2025 Share Price Target. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Exide Battery: A Comprehensive Analysis and 2025 Share Price Target

Exide Battery: A Comprehensive Analysis and 2025 Share Price Target

Introduction

Exide Industries Limited is a leading manufacturer of automotive and industrial batteries in India. With over 75 years of experience, the company has established a strong market presence and a wide product portfolio. This article provides a comprehensive analysis of Exide Battery’s financial performance, competitive landscape, growth prospects, and a detailed share price target projection for 2025.

Financial Performance

Exide Battery has consistently delivered strong financial performance over the past several years. The company’s revenue has grown at a steady pace, driven by rising demand for automotive and industrial batteries. In the fiscal year 2022, the company reported a total revenue of Rs. 11,846 crores, representing an increase of 15% year-over-year.

Exide Battery’s profitability has also been impressive. The company’s operating profit margin has remained stable at around 12-14% in recent years. This indicates the company’s ability to control costs and maintain profitability even in a competitive market.

Competitive Landscape

Exide Battery operates in a competitive market, both domestically and internationally. The company faces competition from domestic players such as Amara Raja Batteries and Tata AutoComp, as well as international giants such as Johnson Controls and GS Yuasa.

Despite the intense competition, Exide Battery has maintained its market leadership position through its strong brand reputation, extensive distribution network, and innovative product offerings. The company’s focus on research and development has enabled it to stay ahead of the competition and introduce cutting-edge battery technologies.

Growth Prospects

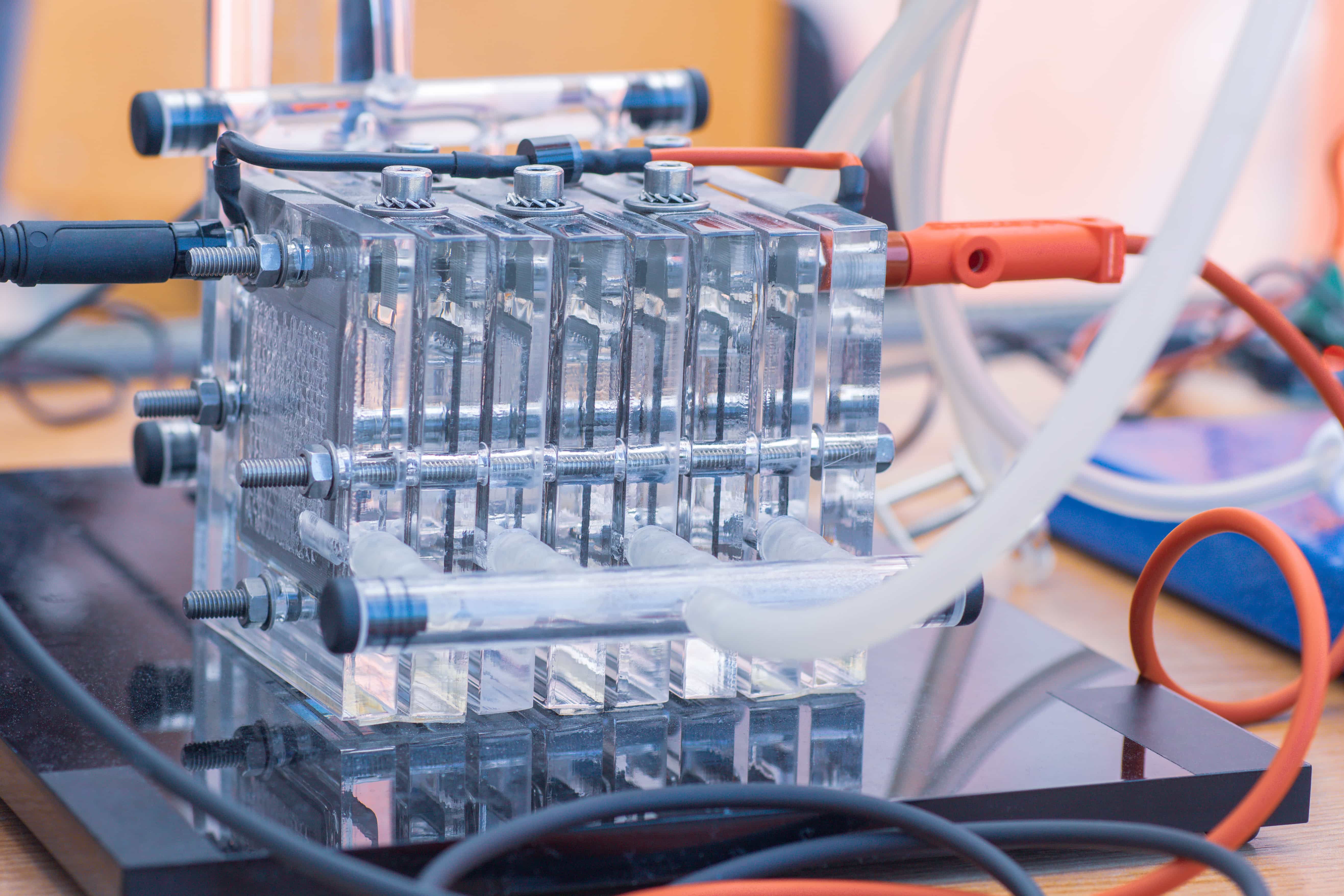

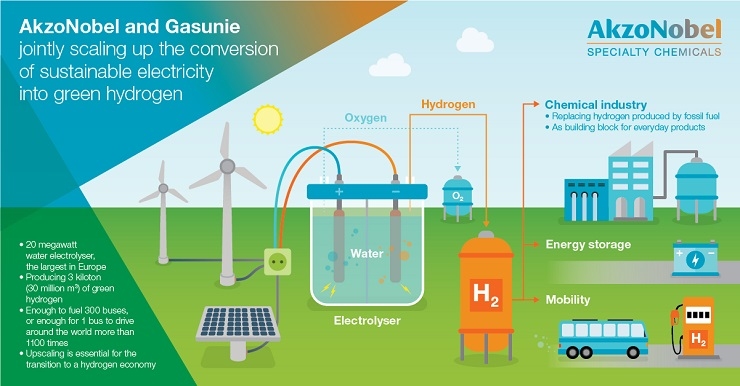

Exide Battery is well-positioned for continued growth in the coming years. The increasing demand for automotive and industrial batteries, driven by factors such as rising vehicle ownership and the adoption of electric vehicles, presents significant growth opportunities for the company.

Additionally, Exide Battery is expanding its geographic reach and diversifying its product portfolio. The company is investing in new manufacturing facilities in emerging markets and introducing new products such as energy storage systems and solar batteries.

Share Price Target Projection for 2025

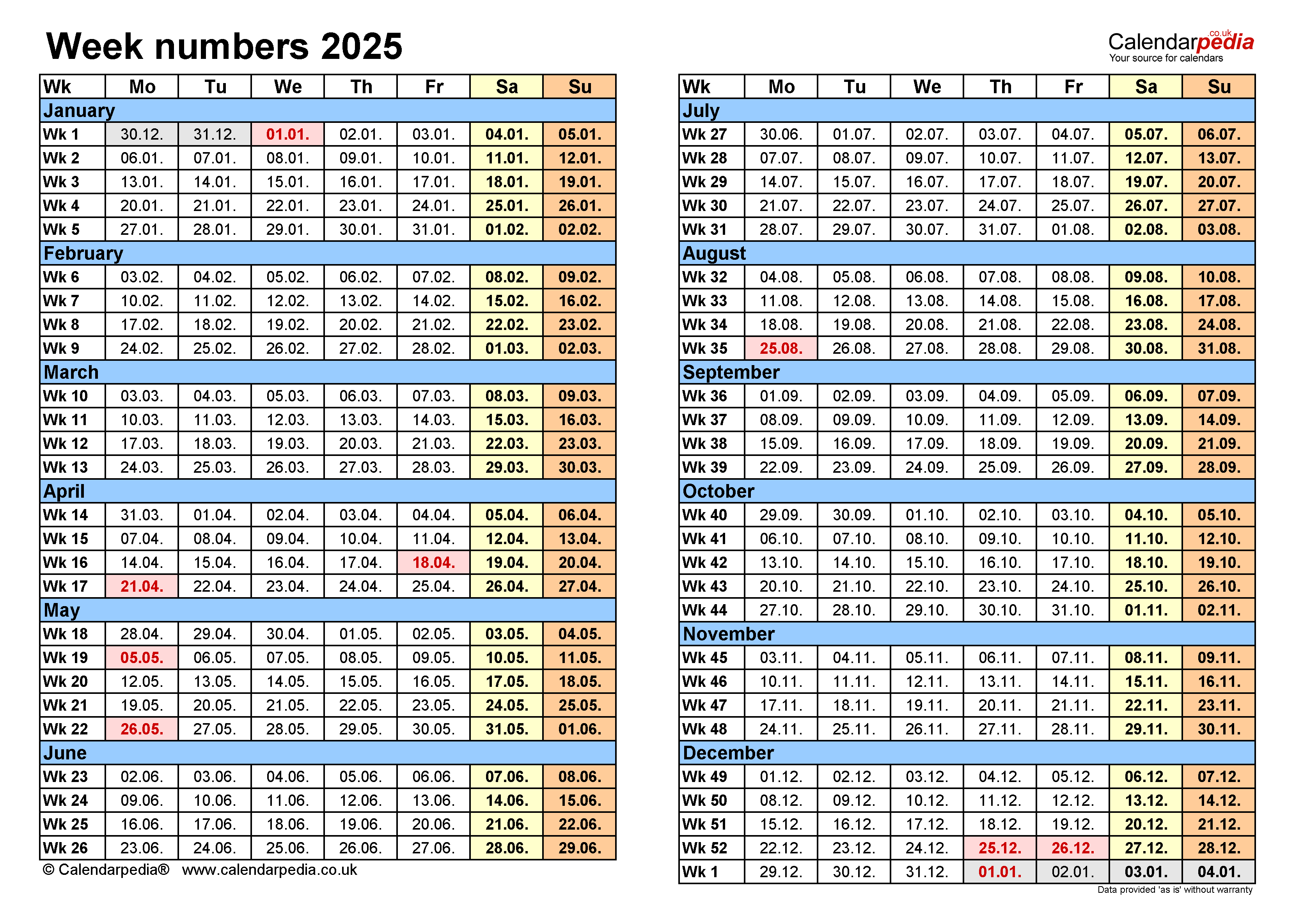

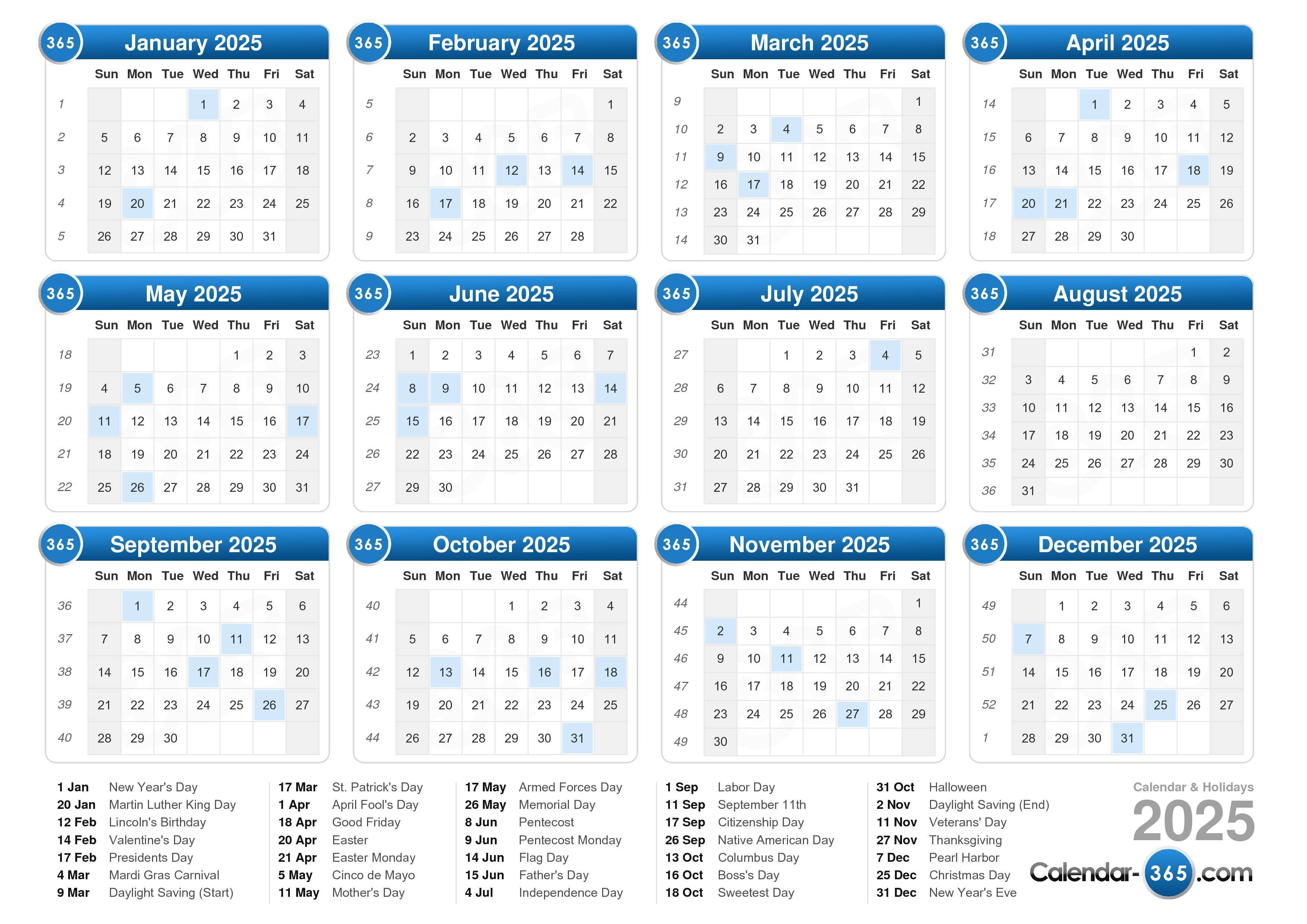

Based on the company’s strong financial performance, competitive advantages, and growth prospects, we project a share price target of Rs. 350 for Exide Battery by 2025. This target represents a potential upside of approximately 50% from the current market price.

Our share price target is based on the following assumptions:

- Revenue growth of 10-12% per annum over the next three years

- Operating profit margin of 12-14%

- Earnings per share (EPS) growth of 15-17% per annum

- Price-to-earnings (P/E) ratio of 20-22

Factors Supporting Share Price Target

Several factors support our share price target projection for Exide Battery:

- Strong demand for automotive and industrial batteries

- Market leadership position and strong brand reputation

- Extensive distribution network and global reach

- Focus on research and development and innovative product offerings

- Diversification into new markets and product segments

Risks to Share Price Target

While we believe that Exide Battery has strong growth potential, there are some risks that could impact our share price target:

- Intense competition from domestic and international players

- Fluctuations in raw material prices

- Economic slowdown or recession

- Technological disruptions

Conclusion

Exide Battery is a well-established and financially sound company with a strong market position. The company’s focus on innovation, diversification, and geographic expansion provides it with significant growth opportunities. Based on our analysis, we project a share price target of Rs. 350 for Exide Battery by 2025, representing a potential upside of approximately 50%. While there are some risks to consider, we believe that the company’s strong fundamentals and growth prospects make it a compelling investment opportunity.

Closure

Thus, we hope this article has provided valuable insights into Exide Battery: A Comprehensive Analysis and 2025 Share Price Target. We thank you for taking the time to read this article. See you in our next article!

_o19.jpg)

_o19.jpg)

_o19.jpg)

_O19.jpg?crop=(27,49,263.8627450980389,200)u0026cropxunits=300u0026cropyunits=200u0026quality=85u0026scale=bothu0026)

_o19.jpg)

_o19.jpg)

![2025 Kia Soul: Release Date, Features, Price & Specs [Update] - EVsBuzz.com](https://evsbuzz.com/wp-content/uploads/2023/09/2025-kia-soul.webp)

![2025 Kia Soul: Release Date, Price And Redesign [Update]](https://electriccarhindime.com/wp-content/uploads/2023/09/pasted-image-0-19-1-1024x684.png)