2025 IRS Tax Tables: A Comprehensive Guide

2025 IRS Tax Tables: A Comprehensive Guide

Related Articles: 2025 IRS Tax Tables: A Comprehensive Guide

- BMW 2025 4 Series: A Vision Of The Future

- The 154th Open Golf Championship: A Journey To Royal Portrush

- FAST 2025 Best Paper: A Paradigm Shift In Automotive Connectivity

- Form 202-I IRS: A Comprehensive Guide

- Government Pay Raise 2025: A Comprehensive Analysis

Introduction

With great pleasure, we will explore the intriguing topic related to 2025 IRS Tax Tables: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about 2025 IRS Tax Tables: A Comprehensive Guide

2025 IRS Tax Tables: A Comprehensive Guide

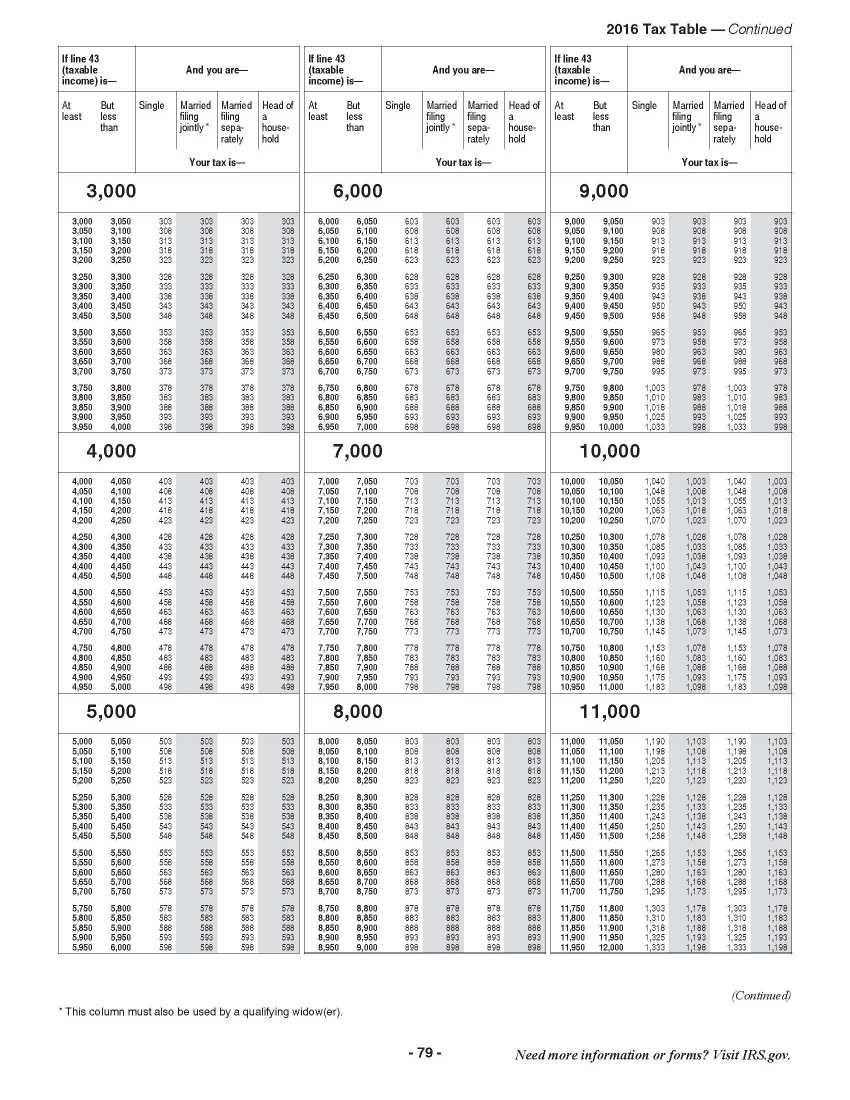

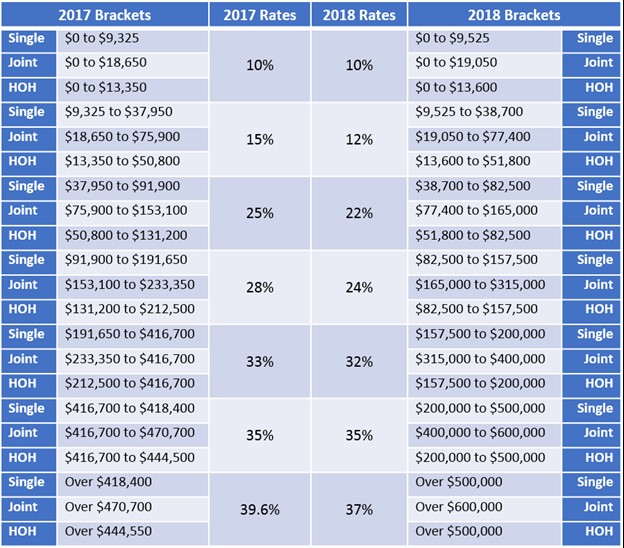

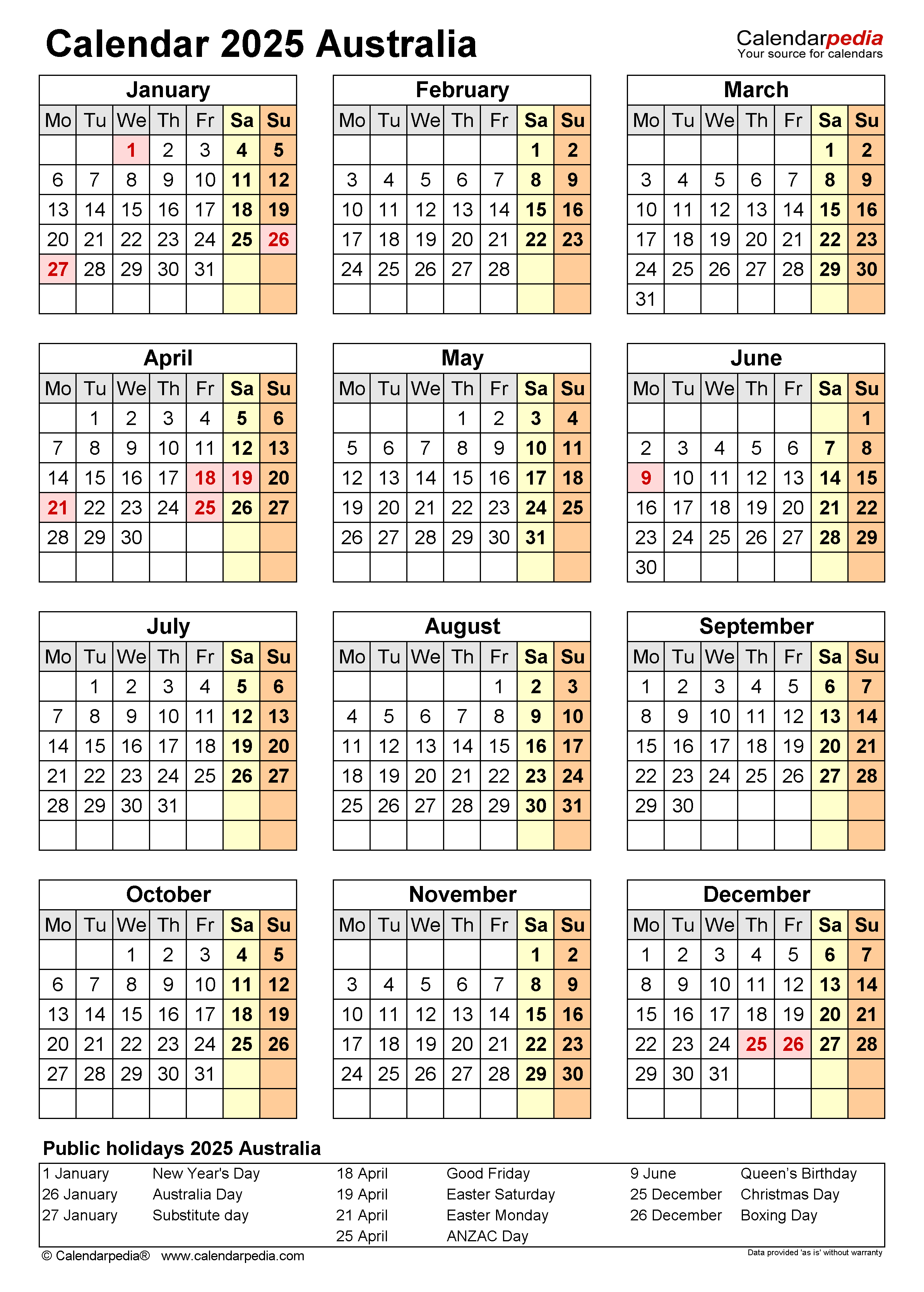

The Internal Revenue Service (IRS) recently released the 2025 tax tables, which will be used to calculate federal income taxes for the 2025 tax year. The tables have been updated to reflect the changes made by the Tax Cuts and Jobs Act (TCJA) of 2017, which significantly revised the federal tax code.

Overview of the 2025 Tax Tables

The 2025 tax tables are structured similarly to the tables used in previous years. They are organized by filing status and taxable income, and they provide the amount of tax that taxpayers owe. The filing statuses are:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

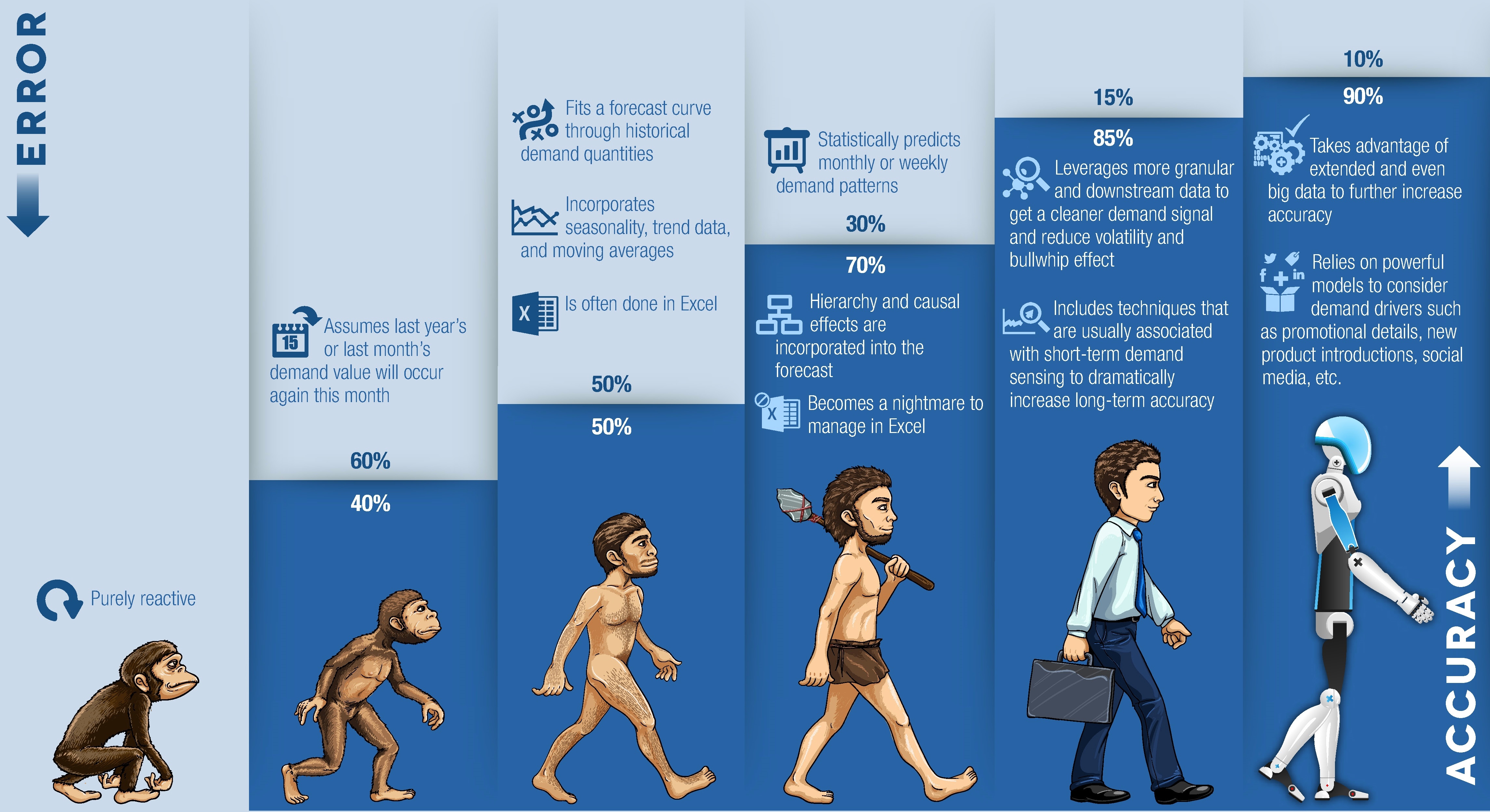

The taxable income ranges are divided into brackets, and the tax rate increases as the taxable income increases. The tax rates for the 2025 tax year are as follows:

- 10% for taxable income up to $10,275 (single) or $20,550 (married filing jointly)

- 12% for taxable income between $10,275 and $41,775 (single) or $20,550 and $83,550 (married filing jointly)

- 22% for taxable income between $41,775 and $89,075 (single) or $83,550 and $178,150 (married filing jointly)

- 24% for taxable income between $89,075 and $170,050 (single) or $178,150 and $356,300 (married filing jointly)

- 32% for taxable income between $170,050 and $215,950 (single) or $356,300 and $539,900 (married filing jointly)

- 35% for taxable income between $215,950 and $539,900 (single) or $539,900 and $1,079,800 (married filing jointly)

- 37% for taxable income over $539,900 (single) or $1,079,800 (married filing jointly)

Changes from the 2024 Tax Tables

The 2025 tax tables have been updated to reflect the following changes from the 2024 tax tables:

- The standard deduction has increased by $500 for all filing statuses.

- The child tax credit has increased from $2,000 to $3,000 per child.

- The earned income tax credit has been expanded for certain low- and moderate-income taxpayers.

- The alternative minimum tax (AMT) exemption has increased for all filing statuses.

How to Use the 2025 Tax Tables

To use the 2025 tax tables, follow these steps:

- Determine your filing status.

- Find your taxable income on the table that corresponds to your filing status.

- Read across the row to find the amount of tax that you owe.

Example

Suppose that you are single and your taxable income is $50,000. To calculate your federal income tax, you would use the tax table for single filers. You would find the row for taxable income between $41,775 and $89,075. The amount of tax that you owe is $9,967.50.

Conclusion

The 2025 IRS tax tables are an important tool for calculating federal income taxes. The tables have been updated to reflect the changes made by the TCJA of 2017, and they provide taxpayers with the information they need to determine how much tax they owe. Taxpayers should consult the 2025 tax tables when preparing their 2025 tax returns.

Closure

Thus, we hope this article has provided valuable insights into 2025 IRS Tax Tables: A Comprehensive Guide. We appreciate your attention to our article. See you in our next article!

![[PROMO CODE INSIDE] KidsFest! 2024 Unveils Enchanting Lineup: Theatre Magic and Whimsical](https://media.alvinology.com/uploads/2024/01/Image-3_-Were-Going-On-A-Bear-Hunt-1024x1024.jpg)