2025 Interest Rates Forecast: Navigating An Uncertain Economic Landscape

2025 Interest Rates Forecast: Navigating an Uncertain Economic Landscape

Related Articles: 2025 Interest Rates Forecast: Navigating an Uncertain Economic Landscape

- 2025 Toyota Camry TRD: A Sporty And Sophisticated Sedan

- Captain Underpants: The Second Epic Movie (2025)

- The 2025 Ram 1500 4×4: Power, Performance, And Innovation

- Ontario Street & Rockwell Avenue: A Historic Intersection In Cleveland, Ohio

- Sonic Prime Season 4: An Electrifying Adventure Awaits In 2025

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to 2025 Interest Rates Forecast: Navigating an Uncertain Economic Landscape. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about 2025 Interest Rates Forecast: Navigating an Uncertain Economic Landscape

2025 Interest Rates Forecast: Navigating an Uncertain Economic Landscape

Introduction

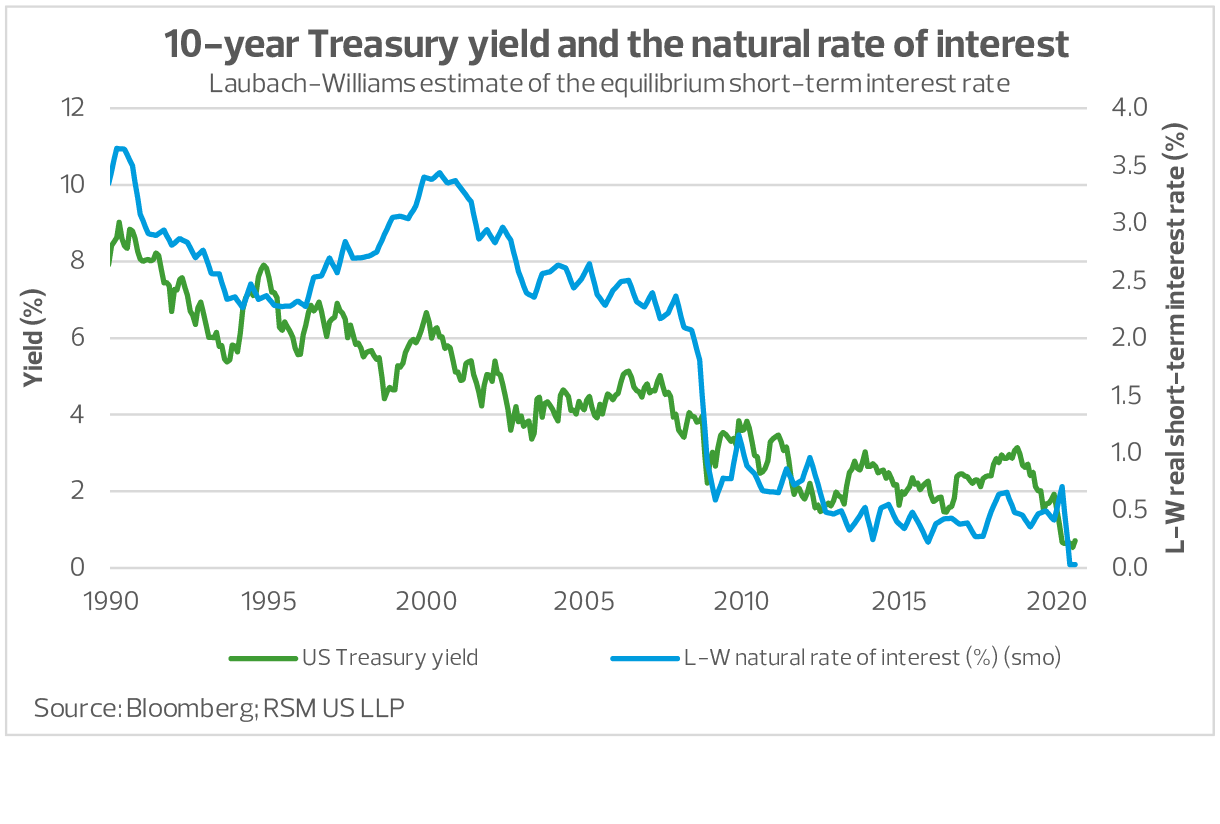

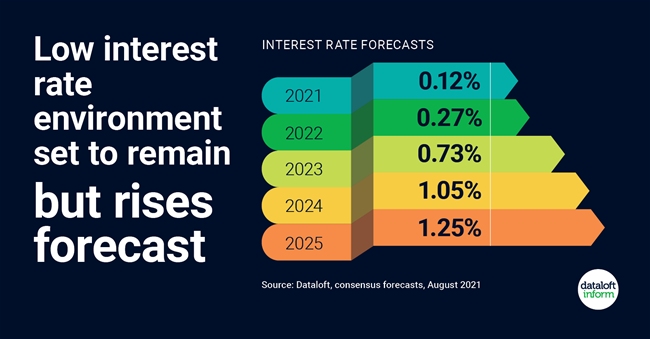

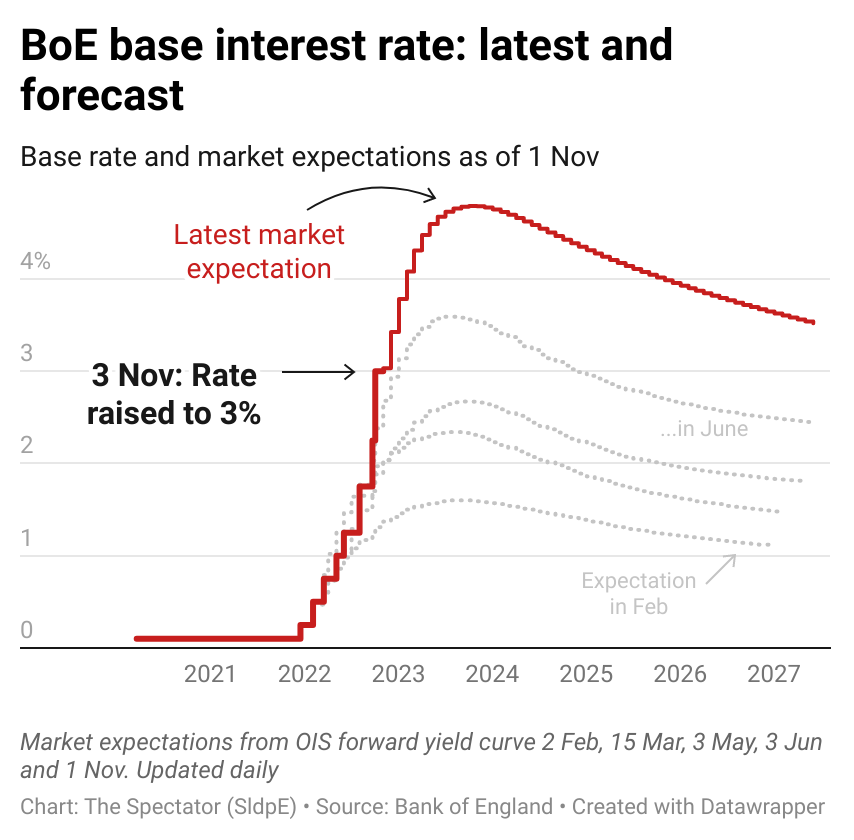

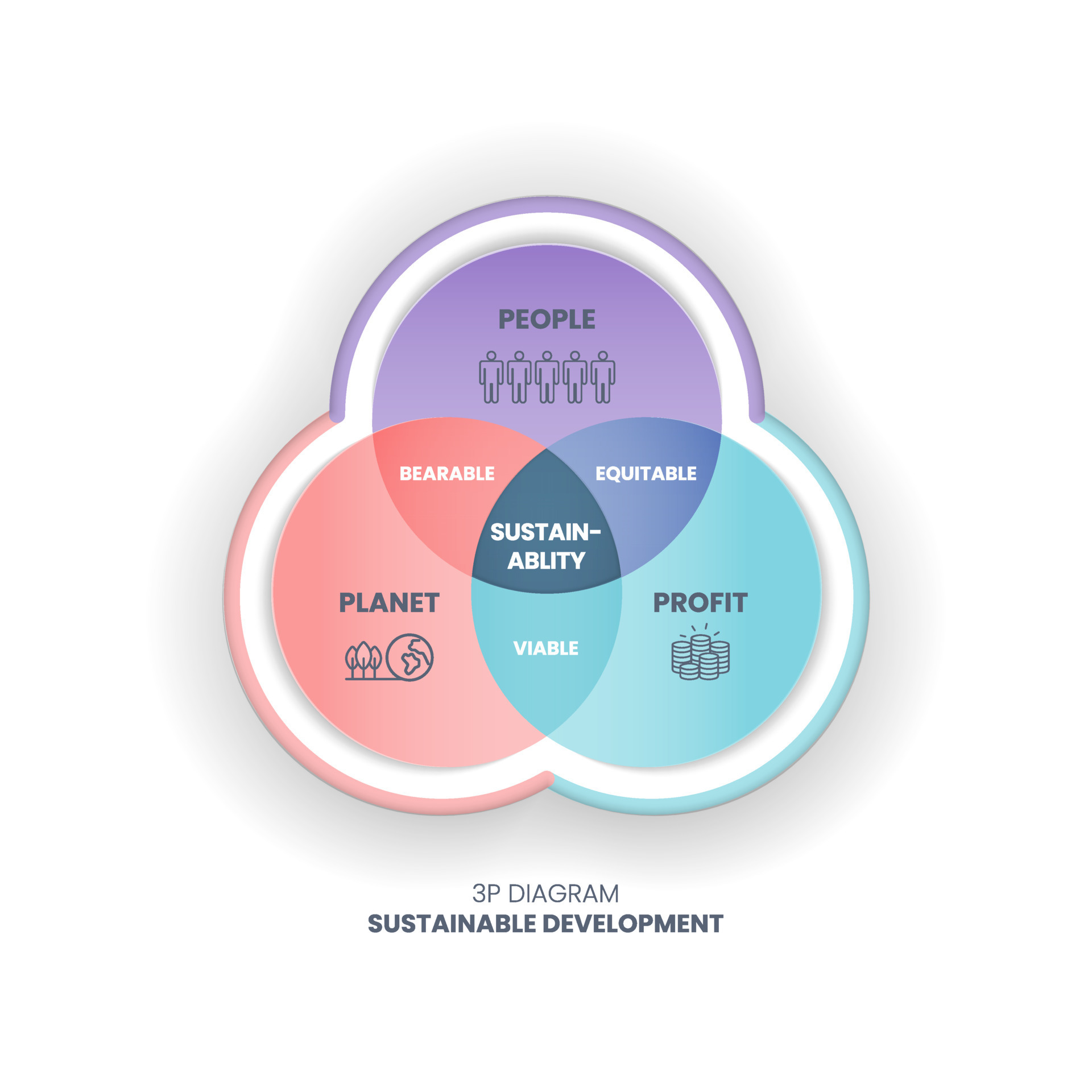

Interest rates play a pivotal role in shaping the economic trajectory of nations. They influence consumer spending, business investment, and overall economic growth. As the global economy navigates the aftermath of the COVID-19 pandemic and faces geopolitical uncertainties, forecasting interest rates in the medium term is crucial for businesses, investors, and policymakers alike. This article presents a comprehensive 2025 interest rates forecast, examining factors that will drive rate movements and potential implications for the economy.

Economic Outlook and Monetary Policy

Central banks, such as the Federal Reserve in the United States and the European Central Bank, adjust interest rates to manage inflation and promote economic stability. The 2025 interest rates forecast will be shaped by the following economic factors:

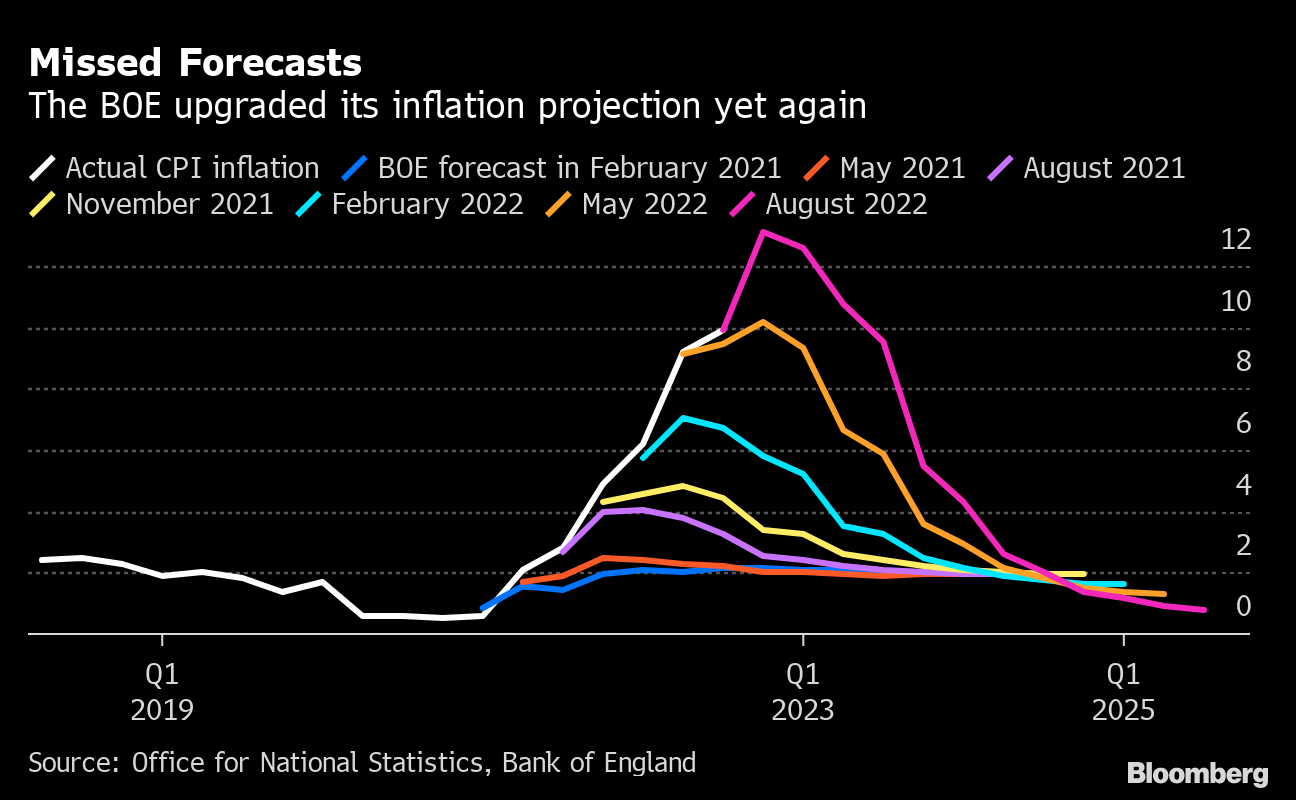

- Inflation: Inflation has surged in recent years due to supply chain disruptions and geopolitical tensions. Central banks are expected to maintain a hawkish stance, raising interest rates to curb inflation.

- Economic Growth: Global economic growth is expected to moderate in the coming years. Central banks will balance inflation control with supporting economic growth, potentially leading to gradual interest rate increases.

- Labor Market: Strong labor markets with low unemployment rates could support wage growth and further inflation pressures, necessitating higher interest rates.

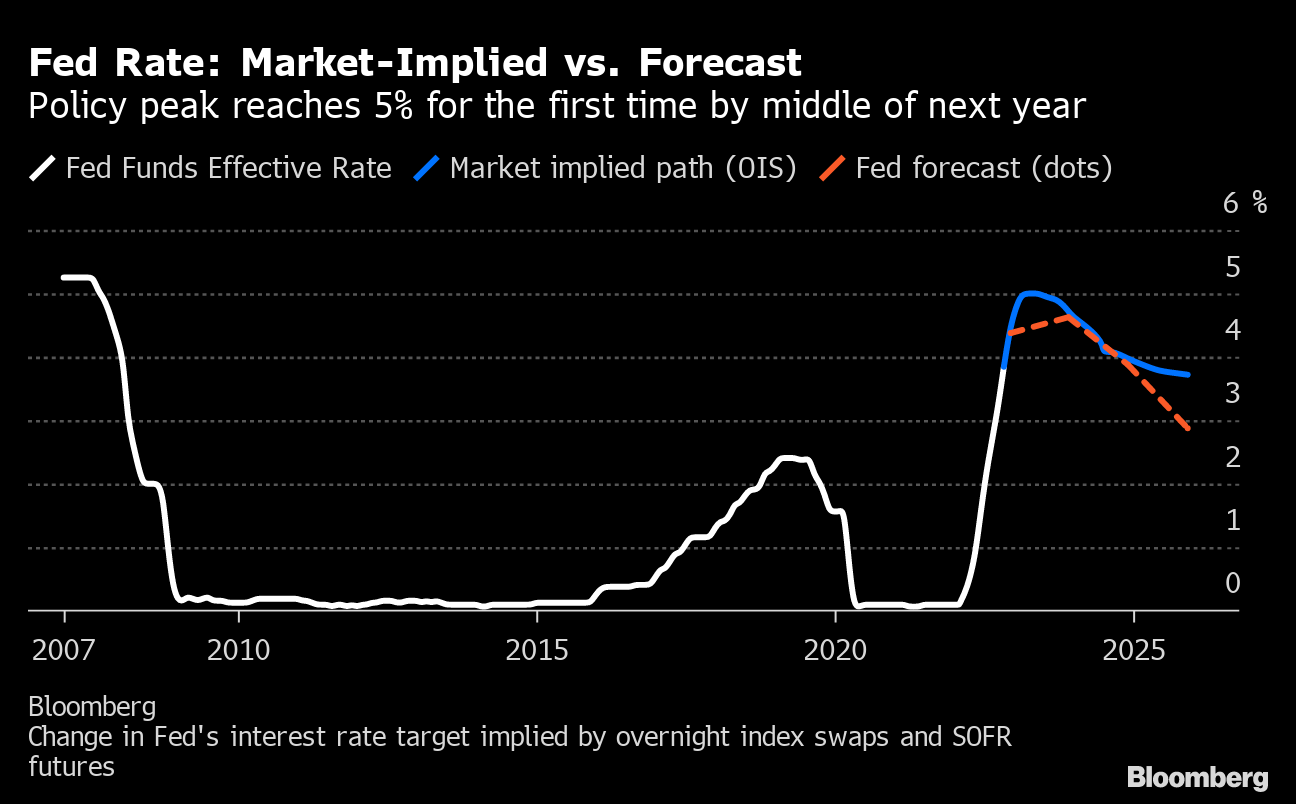

Federal Reserve Policy

The Federal Reserve is the most influential central bank globally, and its interest rate decisions have far-reaching implications. The Fed’s current target range for the federal funds rate is 4.25%-4.50%. According to the Fed’s latest economic projections, the median forecast for the federal funds rate in 2025 is 3.8%. This suggests that the Fed anticipates a gradual reduction in interest rates as inflation subsides and economic growth moderates.

European Central Bank Policy

The European Central Bank has been more cautious in raising interest rates than the Fed due to concerns about the impact on the eurozone economy. The ECB’s current deposit facility rate is 2.00%. The ECB’s latest economic projections indicate that the deposit facility rate will reach 3.00% by the end of 2023 and remain at that level in 2024 and 2025.

Other Central Banks

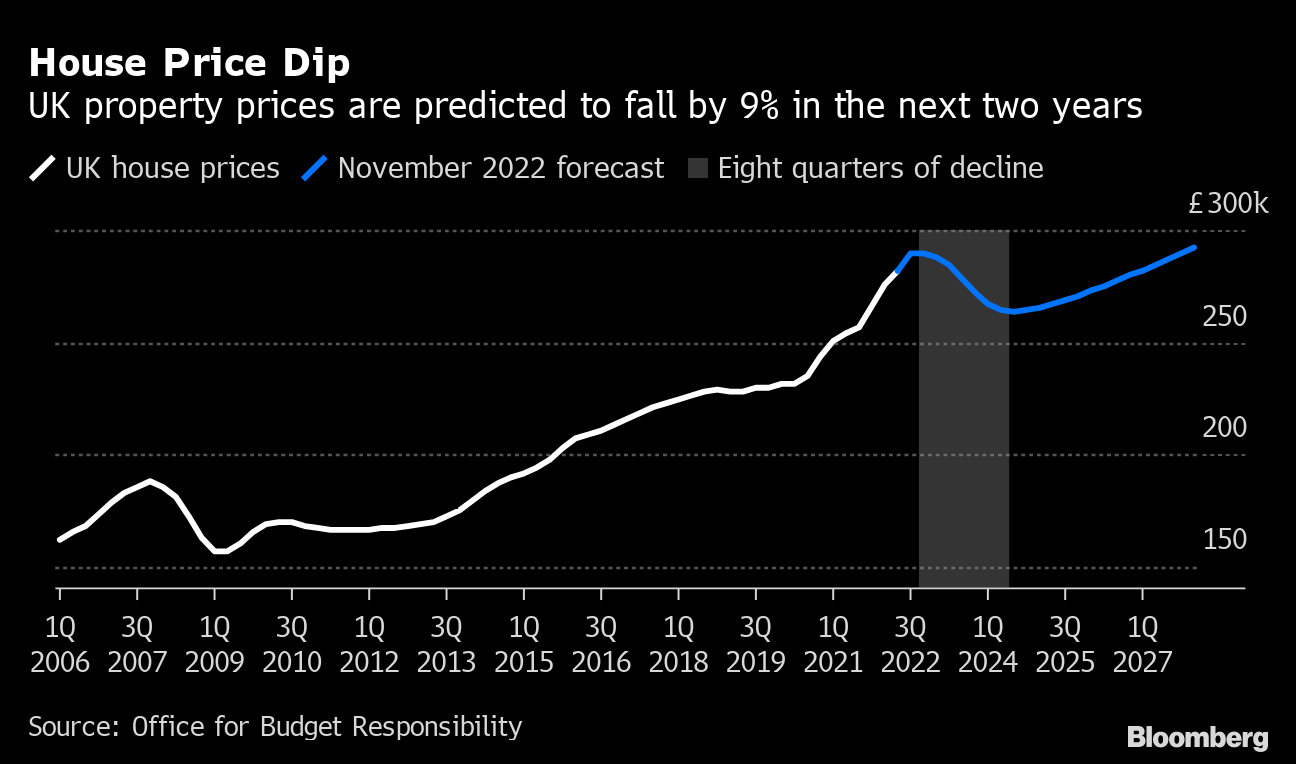

Central banks in other major economies, such as the Bank of England, the Bank of Japan, and the People’s Bank of China, are expected to follow a similar path to the Fed and the ECB, raising interest rates to combat inflation while supporting economic growth.

Implications for Businesses and Investors

Higher interest rates can have significant implications for businesses and investors:

- Businesses: Higher interest rates increase borrowing costs for businesses, potentially reducing investment and expansion plans.

- Consumers: Higher interest rates make it more expensive for consumers to borrow money for mortgages, car loans, and other purchases, potentially reducing consumer spending.

- Investors: Higher interest rates can boost returns on fixed-income investments, such as bonds, but can also lead to declines in equity markets as investors seek higher-yielding assets.

Risks and Uncertainties

The 2025 interest rates forecast is subject to several risks and uncertainties:

- Inflation Persistence: If inflation proves more persistent than anticipated, central banks may need to raise interest rates more aggressively, leading to a sharper slowdown in economic growth.

- Economic Downturn: A sharp economic downturn could prompt central banks to cut interest rates sooner than expected to stimulate growth.

- Geopolitical Events: Geopolitical tensions, such as the ongoing conflict in Ukraine, could disrupt global supply chains and further fuel inflation, necessitating higher interest rates.

Conclusion

The 2025 interest rates forecast is shaped by a complex interplay of economic factors and central bank policies. While the current outlook suggests gradual interest rate increases, risks and uncertainties remain. Businesses, investors, and policymakers should closely monitor economic developments and central bank communications to adapt their strategies accordingly. By understanding the drivers of interest rate movements, they can better navigate the uncertain economic landscape and position themselves for success in the years to come.

Closure

Thus, we hope this article has provided valuable insights into 2025 Interest Rates Forecast: Navigating an Uncertain Economic Landscape. We thank you for taking the time to read this article. See you in our next article!

%2C_Venom_(Symbiote)_(Earth-TRN009)%2C_and_Peter_Parker_(Earth-TRN009)_from_Spider-Man_Web_of_Shadows_001.png/revision/latest?cb=20191104151059)