Working Day Payroll Calendar 2025

Related Articles: Working Day Payroll Calendar 2025

- 2025 BMW X3 Redesign: A Comprehensive Outlook

- Oregon Ducks Football Recruiting: Class Of 2025 Outlook

- PS Form 2025: A Comprehensive Guide

- 2025 Logistics Drive: A Modern Logistics Hub In The Heart Of Mississauga

- Dodge Viper 2025: Unleashing The Beast With Unparalleled Performance

Introduction

With great pleasure, we will explore the intriguing topic related to Working Day Payroll Calendar 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Working Day Payroll Calendar 2025

Working Day Payroll Calendar 2025

Introduction

The working day payroll calendar is an essential tool for businesses to ensure that employees are paid accurately and on time. It provides a comprehensive overview of the scheduled working days and paydays for the entire year. This calendar is particularly useful for businesses that operate on a bi-weekly or semi-monthly payroll schedule.

Purpose of the Working Day Payroll Calendar

The primary purpose of the working day payroll calendar is to:

- Determine the number of working days in each pay period

- Calculate the gross and net pay for each employee

- Issue paychecks or direct deposits on the designated paydays

- Comply with payroll regulations and tax withholding requirements

Benefits of Using a Working Day Payroll Calendar

Using a working day payroll calendar offers several benefits to businesses:

- Improved Payroll Accuracy: By having a clear schedule of working days and paydays, businesses can minimize errors in payroll calculations.

- Timely Payouts: The calendar ensures that employees receive their paychecks on the scheduled dates, preventing delays and potential penalties.

- Compliance with Regulations: It helps businesses comply with payroll regulations and tax withholding requirements, avoiding potential legal issues.

- Efficient Payroll Processing: The calendar streamlines payroll processing by providing a structured framework for calculating pay and issuing payments.

- Improved Employee Communication: Employees can easily access the calendar to view their upcoming paydays, ensuring transparency and reducing inquiries.

How to Create a Working Day Payroll Calendar

Creating a working day payroll calendar involves the following steps:

- Determine the Payroll Frequency: Establish whether the payroll will be processed weekly, bi-weekly, or semi-monthly.

- Identify Holidays and Non-Working Days: List all national holidays and any other scheduled non-working days.

- Calculate the Working Days: Subtract the holidays and non-working days from the total number of calendar days in each pay period.

- Set Paydays: Determine the specific dates when paychecks will be issued or direct deposits will be made.

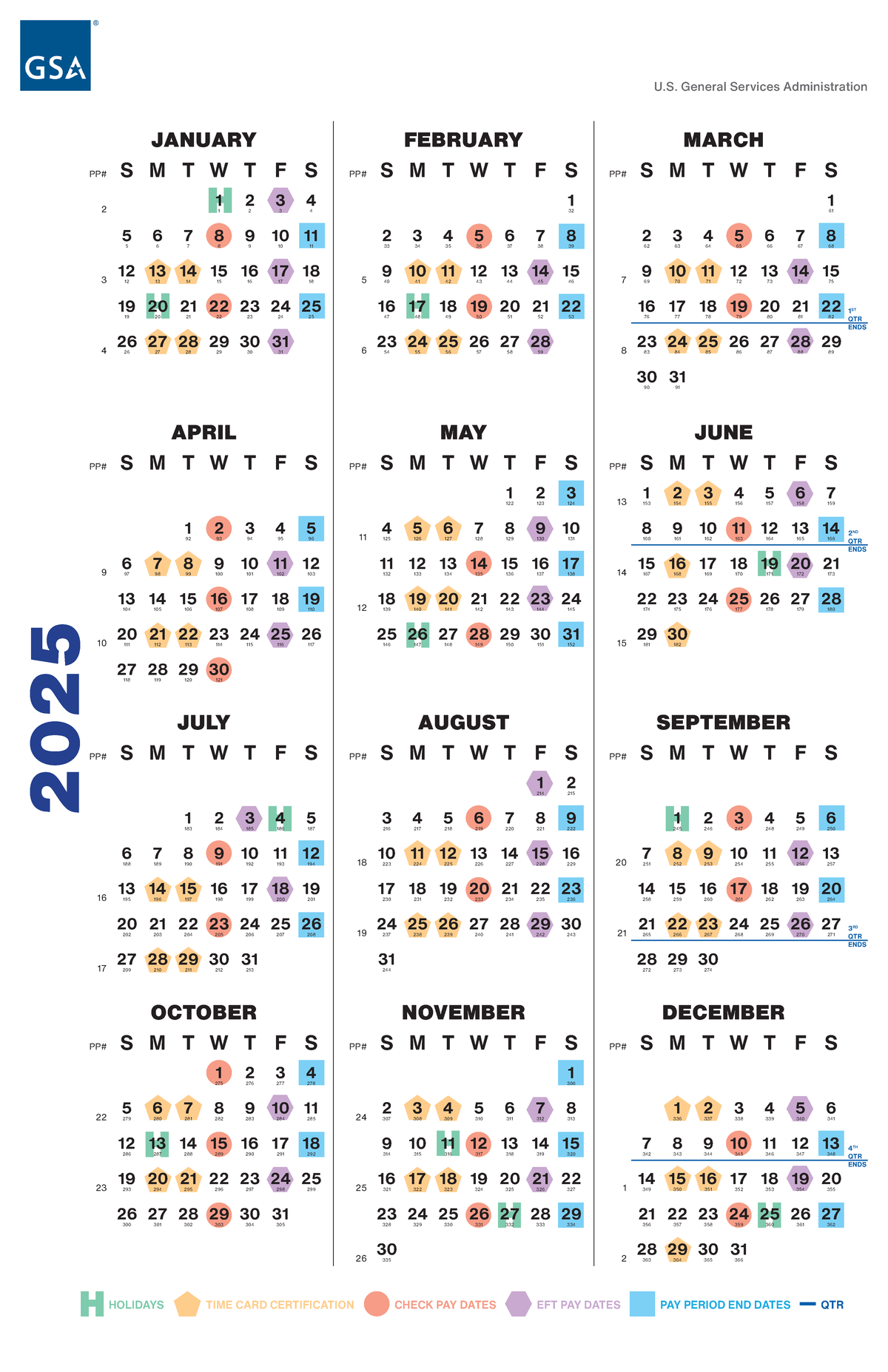

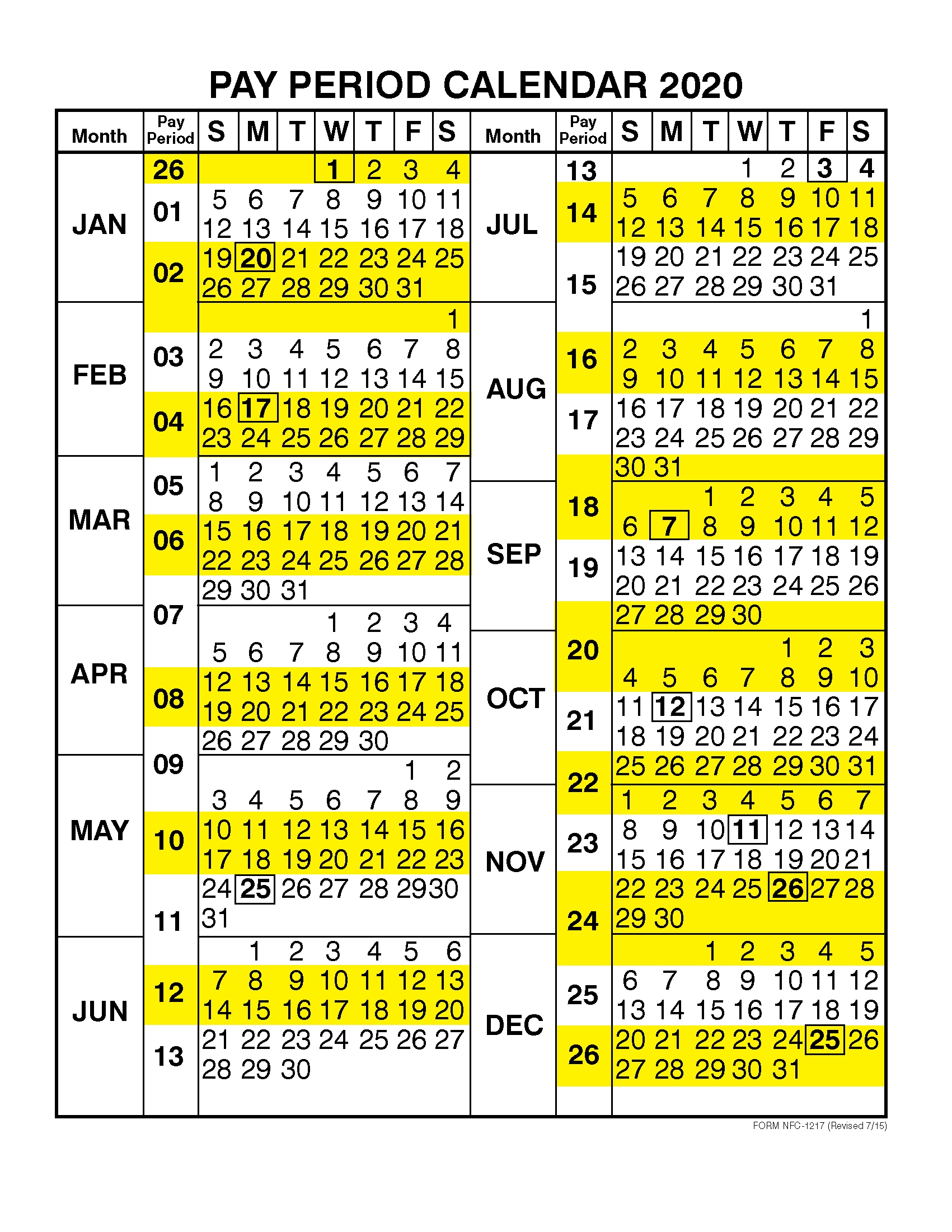

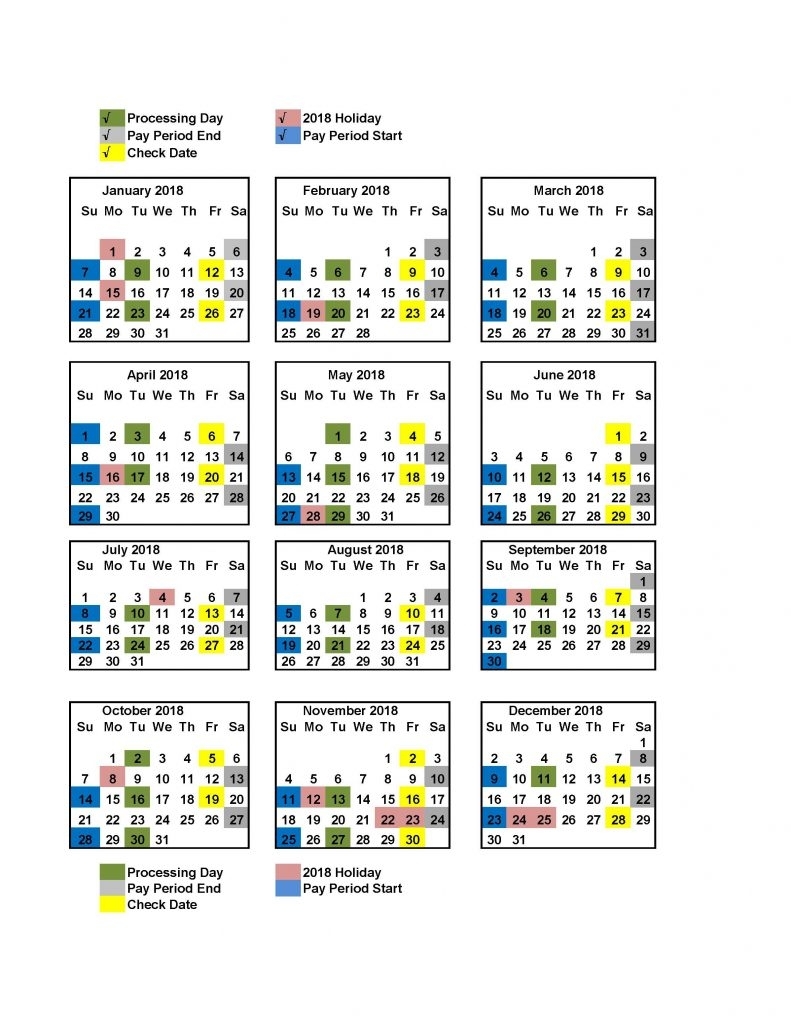

2025 Working Day Payroll Calendar

The following table provides a working day payroll calendar for 2025:

| Month | Pay Period Start | Pay Period End | Payday | Working Days |

|---|---|---|---|---|

| January | January 1 | January 14 | January 15 | 11 |

| February | January 15 | January 28 | January 29 | 11 |

| March | January 29 | March 11 | March 12 | 21 |

| April | March 12 | April 1 | April 2 | 16 |

| May | April 2 | April 15 | April 16 | 11 |

| June | April 16 | May 13 | May 14 | 20 |

| July | May 14 | June 10 | June 11 | 18 |

| August | June 11 | July 29 | July 30 | 29 |

| September | July 30 | September 16 | September 17 | 21 |

| October | September 17 | October 14 | October 15 | 19 |

| November | October 15 | November 11 | November 12 | 16 |

| December | November 12 | December 30 | December 31 | 21 |

Additional Considerations

- Bank Holidays: If a payday falls on a bank holiday, the payment may be processed on the previous business day.

- Overtime and Bonuses: Overtime pay and bonuses may need to be calculated and paid separately from regular wages.

- Employee Deductions: Deductions for taxes, insurance, and other benefits should be accounted for in payroll calculations.

- Compliance with Laws: Businesses must ensure that their payroll practices comply with all applicable federal, state, and local laws.

Conclusion

The working day payroll calendar is a valuable tool for businesses to manage payroll effectively and ensure timely payments to employees. By following the steps outlined above, businesses can create an accurate and comprehensive calendar that meets their specific payroll needs.

Closure

Thus, we hope this article has provided valuable insights into Working Day Payroll Calendar 2025. We thank you for taking the time to read this article. See you in our next article!