When is Fiscal Year 2025?

Related Articles: When is Fiscal Year 2025?

- Kanawha County Schools 2024-2025 Calendar

- Books To Film: The Most Anticipated Adaptations Of 2025

- Popular Now On Bingo Games UK 2025: A Comprehensive Guide

- LEAP 2025 Literary Analysis Rubric For Grade 3: A Comprehensive Guide

- The 2023 INFINITI Q50: A Sophisticated Sedan With A Sporty Edge

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to When is Fiscal Year 2025?. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about When is Fiscal Year 2025?

When is Fiscal Year 2025?

Introduction

Fiscal years are used by governments, businesses, and other organizations to track their financial performance. The fiscal year (FY) is a 12-month period that does not necessarily align with the calendar year.

Understanding Fiscal Years

Fiscal years are typically established to align with the organization’s business cycle or reporting requirements. For example, many businesses have fiscal years that end on March 31st or June 30th, which coincides with the end of their busiest quarters.

Fiscal Year 2025

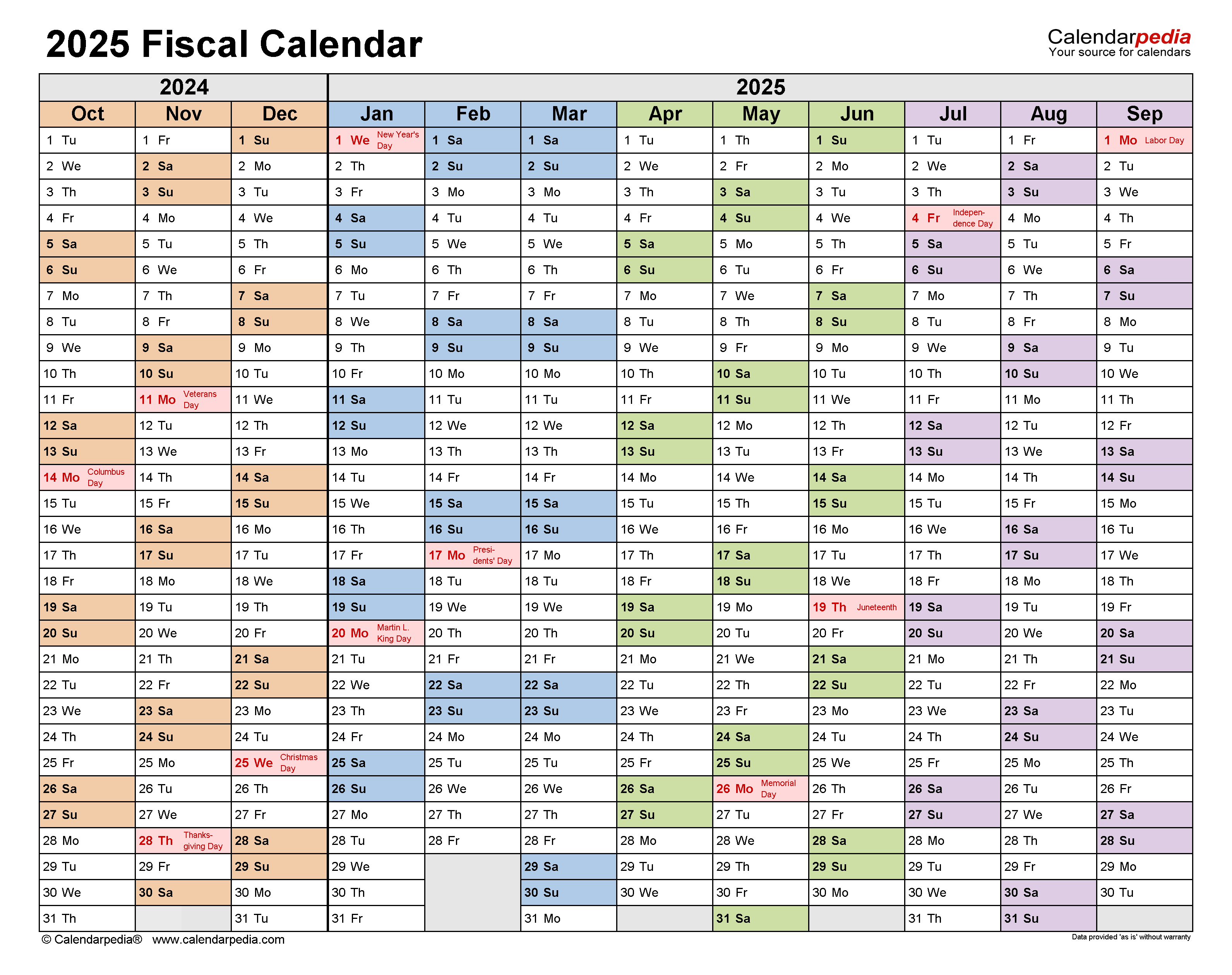

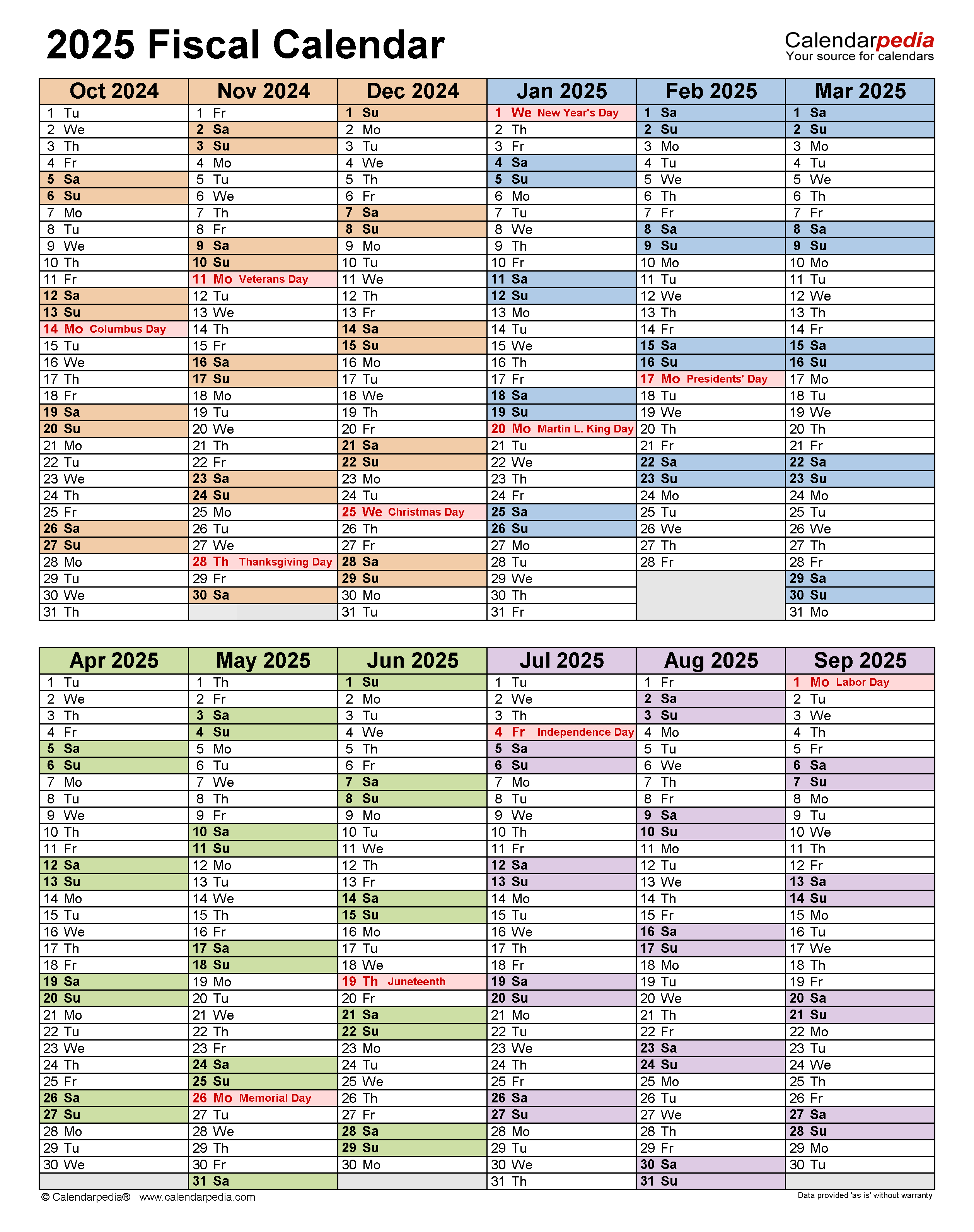

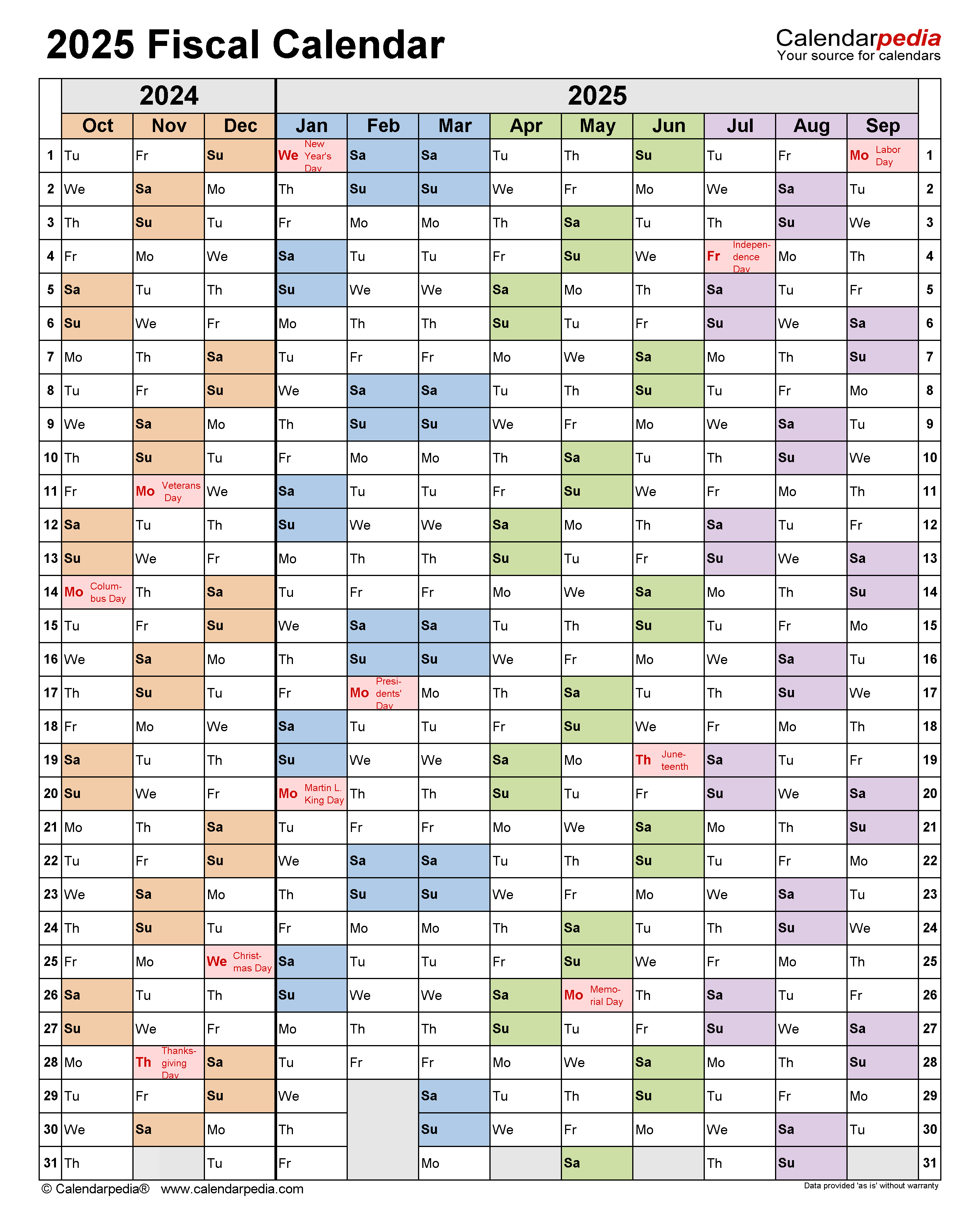

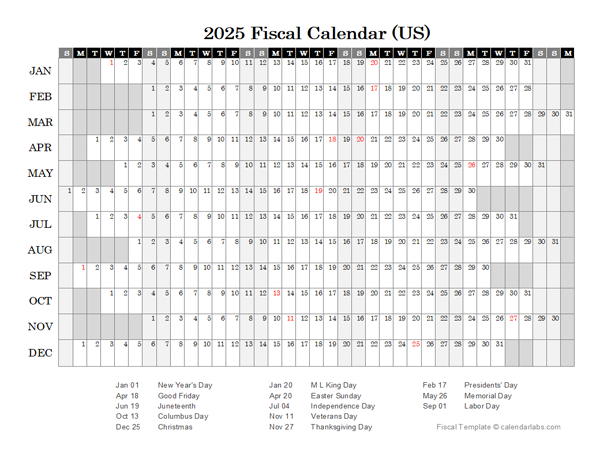

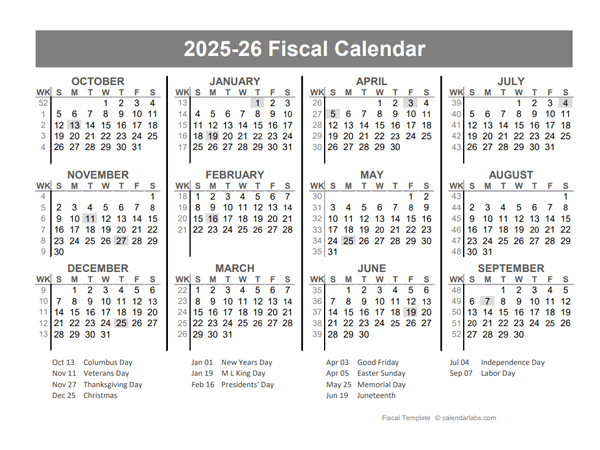

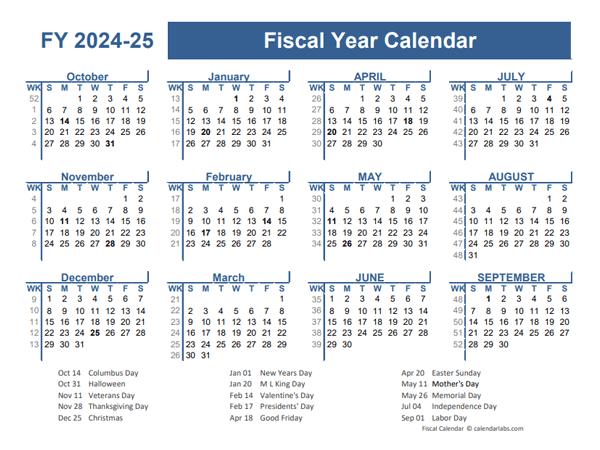

Fiscal year 2025 will begin on October 1, 2024, and end on September 30, 2025. This is based on the federal fiscal year, which is used by the United States government and many other organizations.

Importance of Fiscal Years

Fiscal years play a crucial role in financial planning and reporting. They provide a standardized timeframe for tracking revenues, expenses, and other financial data. This information is used to:

- Create budgets

- Forecast future financial performance

- Track progress towards financial goals

- Comply with reporting requirements

Determining Fiscal Year

To determine the fiscal year for a particular organization, you can:

- Check the organization’s financial statements

- Contact the organization’s accounting department

- Refer to the organization’s website or other official documents

Fiscal Year vs. Calendar Year

While fiscal years are typically 12 months long, they do not always align with the calendar year. The calendar year runs from January 1st to December 31st, while fiscal years can start and end on any date.

Benefits of Using Fiscal Years

Using fiscal years can provide several benefits, including:

- Alignment with business cycle: Fiscal years can be aligned with the organization’s business cycle, allowing for more accurate financial reporting.

- Smoothing financial performance: Fiscal years can help smooth out seasonal fluctuations in revenues and expenses, providing a more stable view of financial performance.

- Easier budgeting: Fiscal years provide a consistent timeframe for budgeting, making it easier to plan and track financial resources.

- Compliance with reporting requirements: Many organizations are required to report their financial performance using fiscal years, such as for tax or regulatory purposes.

Challenges of Using Fiscal Years

There are also some challenges associated with using fiscal years:

- Complexity: Fiscal years can be more complex than calendar years, especially for organizations that operate in multiple countries or have complex business cycles.

- Transition costs: Changing fiscal years can involve significant transition costs, such as updating accounting systems and adjusting financial reporting schedules.

- Misalignment with external reporting: Fiscal years may not align with the reporting requirements of external stakeholders, such as investors or creditors.

Conclusion

Fiscal years are an important tool for financial planning and reporting. They provide a standardized timeframe for tracking financial performance and aligning with business cycles. Understanding when fiscal year 2025 begins and ends is crucial for organizations to ensure accurate financial reporting and planning.

Closure

Thus, we hope this article has provided valuable insights into When is Fiscal Year 2025?. We hope you find this article informative and beneficial. See you in our next article!