What Will the 2026 Tax Brackets Be?

Related Articles: What Will the 2026 Tax Brackets Be?

- African Cup Of Nations Qualification 2025: Format, Draw, And Schedule

- 2024-2025 School Year Calendar For Broward County Public Schools

- Golf R 20 Years Edition: A Comprehensive Comparison To The Standard Golf R

- BMW X5 M 2025: A Comprehensive Overview Of Pricing And Features

- 2025 Interest Rates Forecast: Navigating An Uncertain Economic Landscape

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to What Will the 2026 Tax Brackets Be?. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about What Will the 2026 Tax Brackets Be?

What Will the 2026 Tax Brackets Be?

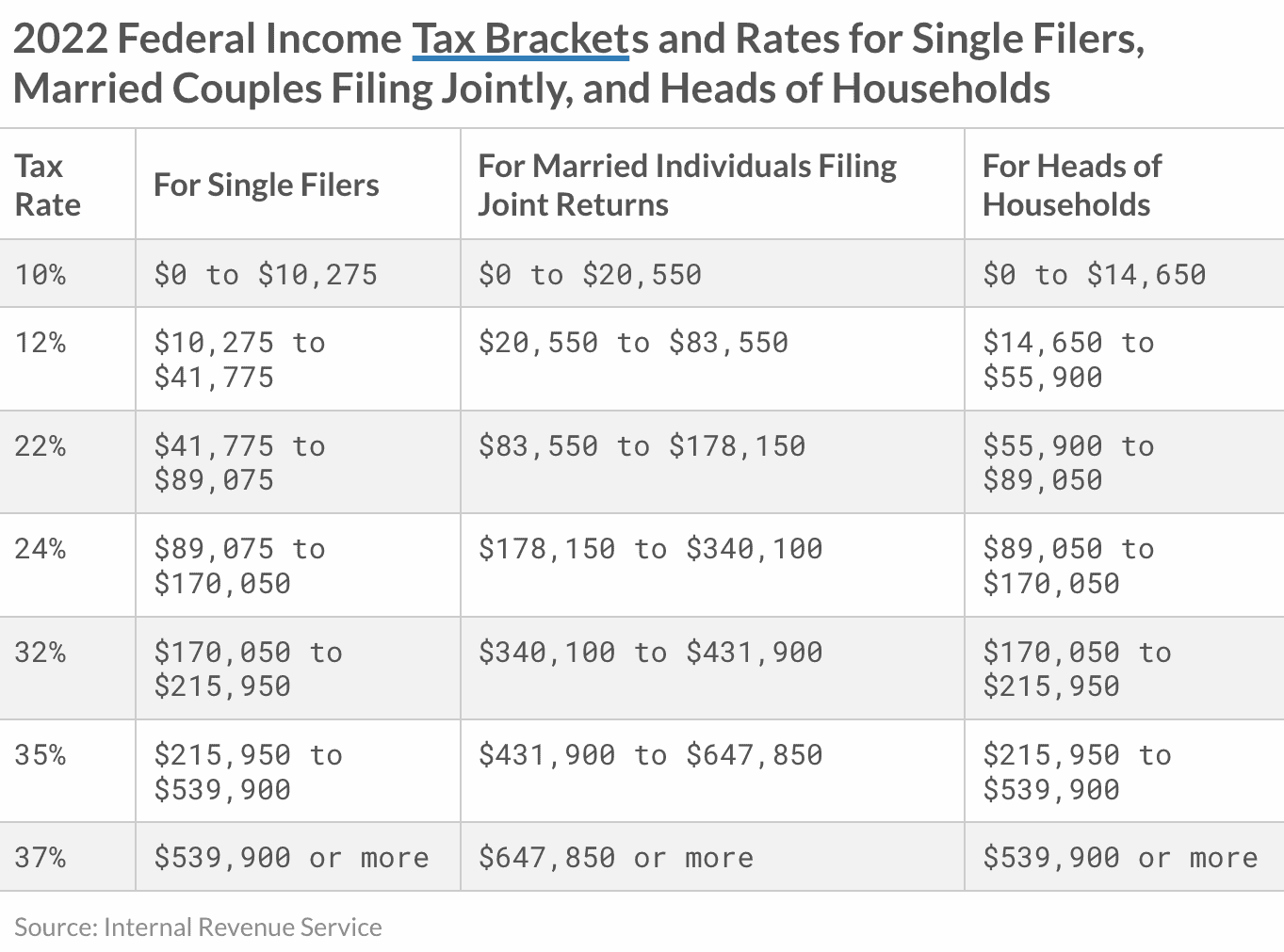

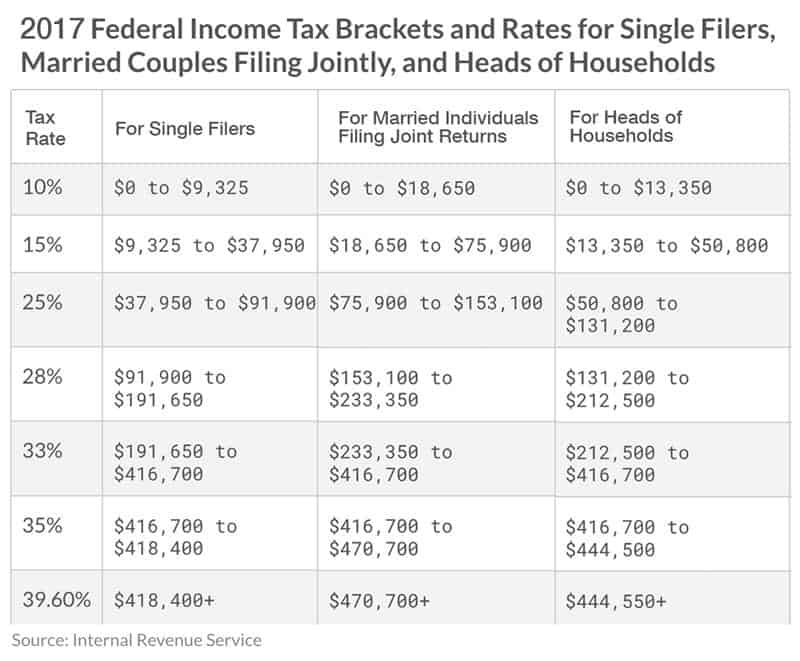

The Tax Cuts and Jobs Act (TCJA) of 2017 made significant changes to the individual income tax brackets. These changes were originally set to expire in 2025, but the Consolidated Appropriations Act of 2023 extended them through 2026.

As a result, the 2026 tax brackets will be the same as the 2023 tax brackets, which are as follows:

| Filing Status | Tax Bracket | Tax Rate |

|---|---|---|

| Single | $0-$11,850 | 10% |

| Single | $11,851-$44,725 | 12% |

| Single | $44,726-$89,450 | 22% |

| Single | $89,451-$178,900 | 24% |

| Single | $178,901-$238,350 | 32% |

| Single | $238,351-$539,900 | 35% |

| Single | $539,901-$1,077,350 | 37% |

| Single | Over $1,077,350 | 39.6% |

| Married Filing Jointly | $0-$23,700 | 10% |

| Married Filing Jointly | $23,701-$89,450 | 12% |

| Married Filing Jointly | $89,451-$178,900 | 22% |

| Married Filing Jointly | $178,901-$268,600 | 24% |

| Married Filing Jointly | $268,601-$447,250 | 32% |

| Married Filing Jointly | $447,251-$622,050 | 35% |

| Married Filing Jointly | $622,051-$1,077,350 | 37% |

| Married Filing Jointly | Over $1,077,350 | 39.6% |

| Head of Household | $0-$14,700 | 10% |

| Head of Household | $14,701-$55,900 | 12% |

| Head of Household | $55,901-$89,450 | 22% |

| Head of Household | $89,451-$178,900 | 24% |

| Head of Household | $178,901-$238,350 | 32% |

| Head of Household | $238,351-$539,900 | 35% |

| Head of Household | $539,901-$1,077,350 | 37% |

| Head of Household | Over $1,077,350 | 39.6% |

In addition to the tax brackets, the TCJA also made changes to the standard deduction and personal exemption. The standard deduction for 2026 will be $13,850 for single filers and $27,700 for married couples filing jointly. The personal exemption was eliminated by the TCJA.

These changes to the tax brackets, standard deduction, and personal exemption will result in lower taxes for most taxpayers. However, some high-income taxpayers may see a small increase in their taxes.

Inflation Adjustments

The tax brackets are adjusted each year for inflation. This means that the dollar amounts in the tax brackets will increase each year to reflect the rising cost of living. The IRS typically announces the inflation-adjusted tax brackets for the following year in October or November.

Conclusion

The 2026 tax brackets will be the same as the 2023 tax brackets. These brackets are lower than the tax brackets that were in effect before the TCJA was passed. As a result, most taxpayers will see lower taxes in 2026.

Closure

Thus, we hope this article has provided valuable insights into What Will the 2026 Tax Brackets Be?. We thank you for taking the time to read this article. See you in our next article!