Vanguard Target Retirement 2025 Fact Sheet

Related Articles: Vanguard Target Retirement 2025 Fact Sheet

- 2025 Jaguar F-Pace SVR: Unleashing The Beast With 600 Horsepower

- Browns Draft Picks 2025: A Comprehensive Analysis

- Porsche 911 2025: A Vision Of The Future

- Saskatchewan Summer Games 2024: A Legacy Of Sport And Community

- 2025 Toyota Camry AWD: A Revolutionary Sedan With Enhanced Performance And Capability

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Vanguard Target Retirement 2025 Fact Sheet. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Vanguard Target Retirement 2025 Fact Sheet

Vanguard Target Retirement 2025 Fact Sheet

Investment Objective

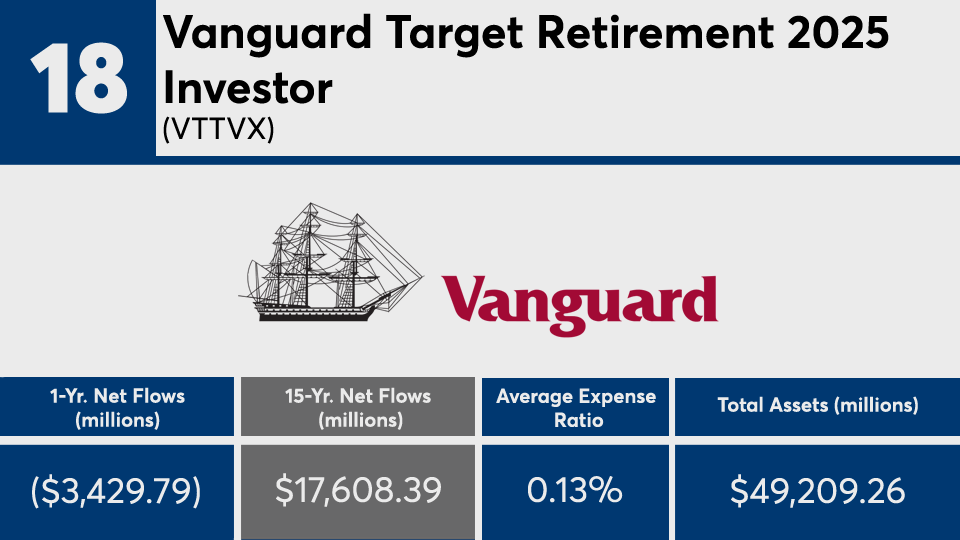

The Vanguard Target Retirement 2025 Fund (VTWNX) seeks to provide capital appreciation and income over the long term, with a target retirement date of 2025.

Fees and Expenses

The fund’s annual operating expenses are 0.15%.

Investment Strategy

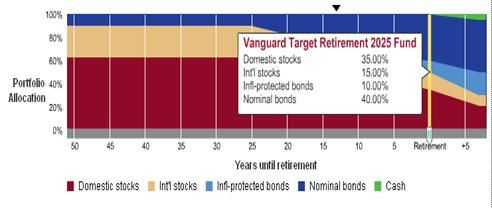

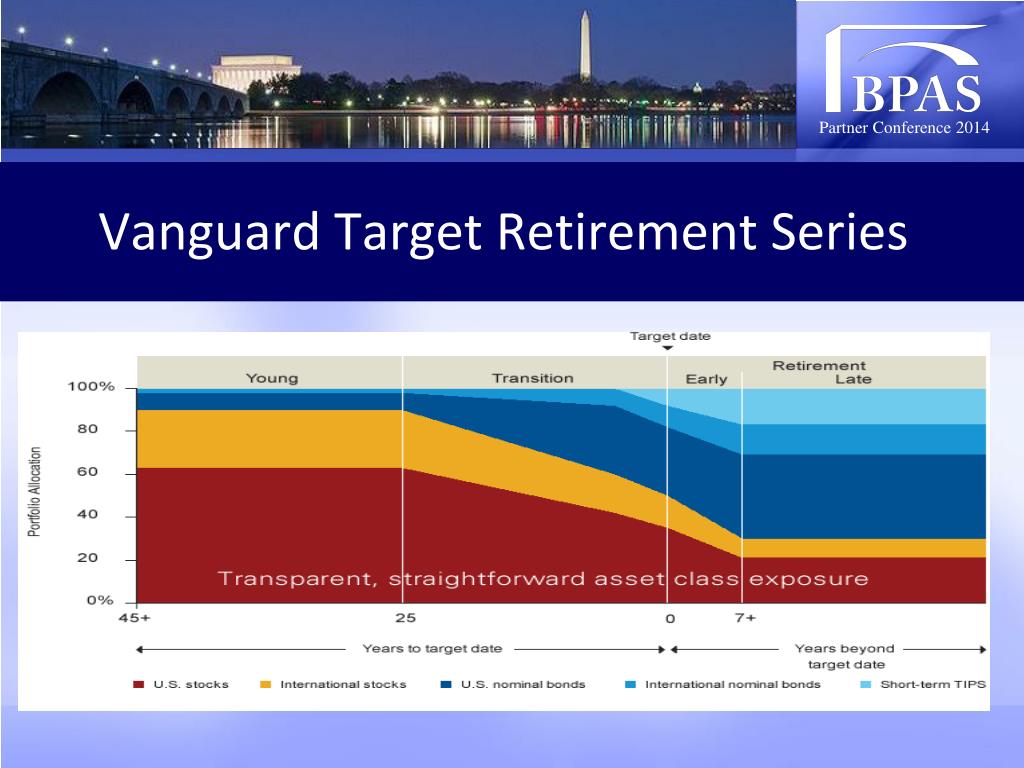

The fund invests in a diversified portfolio of stocks, bonds, and other investments. The asset allocation is designed to gradually shift from higher-risk investments to lower-risk investments as the target retirement date approaches.

Asset Allocation

As of December 31, 2022, the fund’s asset allocation was as follows:

- Stocks: 55%

- Bonds: 35%

- Other investments: 10%

Stock Allocation

The fund’s stock allocation is divided among the following sectors:

- Large-cap growth: 25%

- Large-cap value: 20%

- Mid-cap growth: 15%

- Mid-cap value: 15%

- Small-cap growth: 10%

- Small-cap value: 5%

Bond Allocation

The fund’s bond allocation is divided among the following types of bonds:

- Investment-grade bonds: 80%

- High-yield bonds: 20%

Other Investments

The fund’s other investments include real estate, commodities, and cash equivalents.

Risk Profile

The fund’s risk profile is considered moderate. The fund is exposed to the risks associated with investing in stocks, bonds, and other investments, including the risk of loss of principal.

Performance

The fund’s annualized returns since inception (December 2005) are as follows:

- 1 year: 10.1%

- 3 years: 7.2%

- 5 years: 6.5%

- 10 years: 6.2%

Suitability

The fund is suitable for investors who are planning to retire around 2025 and are comfortable with a moderate level of risk.

Additional Information

- The fund is managed by Vanguard, one of the world’s largest investment management companies.

- The fund is available in both individual and institutional accounts.

- The fund has a minimum investment of $1,000.

- The fund is not available for purchase through all brokerages.

Important Disclosure

Past performance is not a guarantee of future results. The value of your investment in the fund may fluctuate, and you could lose money.

Before investing in the fund, you should carefully consider the fund’s investment objectives, risks, charges, and expenses. This and other information is contained in the fund’s prospectus, which you can obtain by calling 1-800-662-7447 or visiting vanguard.com. Please read the prospectus carefully before investing.

Vanguard Investment Products

Vanguard offers a wide range of investment products, including mutual funds, ETFs, and annuities. Vanguard is committed to providing investors with low-cost, high-quality investment products.

Closure

Thus, we hope this article has provided valuable insights into Vanguard Target Retirement 2025 Fact Sheet. We appreciate your attention to our article. See you in our next article!