Vanguard 2025 Target Fund Review: A Comprehensive Analysis for Retirement Planning

Related Articles: Vanguard 2025 Target Fund Review: A Comprehensive Analysis for Retirement Planning

- Timeshare Calendar 2025: A Comprehensive Guide To Planning Your Vacations

- Avatar 3: The Seed Bearer – Unveiling The Cast For The Epic Sequel

- Good Friday And Easter 2025: The Significance And Celebrations

- 2025 Logistics Drive: A Modern Logistics Hub In The Heart Of Mississauga

- Six Nations 2025 Fixtures And Dates: A Comprehensive Overview

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Vanguard 2025 Target Fund Review: A Comprehensive Analysis for Retirement Planning. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Vanguard 2025 Target Fund Review: A Comprehensive Analysis for Retirement Planning

Vanguard 2025 Target Fund Review: A Comprehensive Analysis for Retirement Planning

Introduction

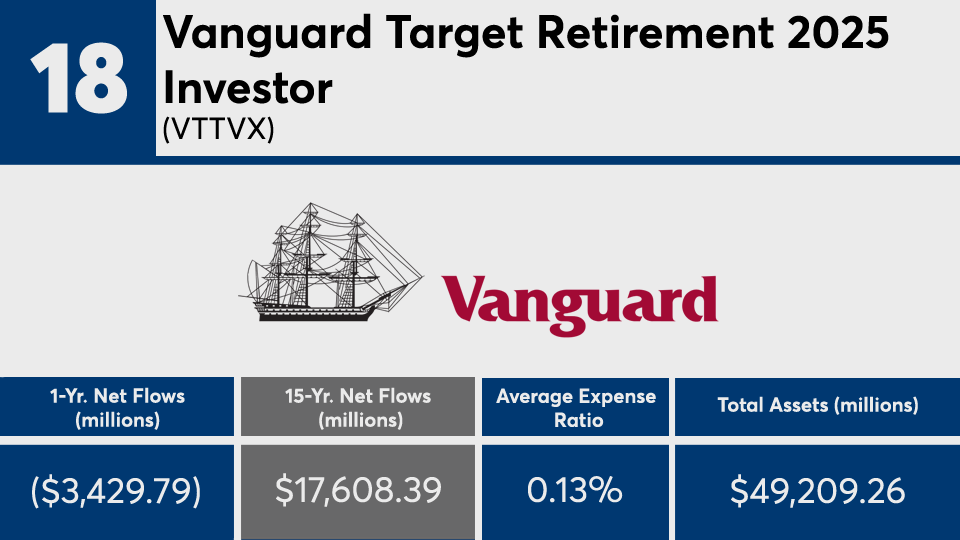

As you approach retirement, it becomes increasingly important to ensure that your investments are aligned with your financial goals. Target-date funds, such as the Vanguard 2025 Target Fund, offer a convenient and diversified investment option that automatically adjusts its asset allocation based on your target retirement date. In this comprehensive review, we will delve into the key features, performance, and suitability of the Vanguard 2025 Target Fund to help you make an informed investment decision.

Key Features

- Target Retirement Date: 2025

- Asset Allocation: Gradually shifts from a growth-oriented portfolio (80% stocks, 20% bonds) to a more conservative portfolio (50% stocks, 50% bonds) as the target retirement date approaches.

- Fund Manager: Vanguard

- Expense Ratio: 0.15%

- Minimum Investment: $1,000

Asset Allocation Strategy

The Vanguard 2025 Target Fund follows a glide path approach to asset allocation. This means that the fund’s asset allocation gradually shifts from a more aggressive stance (higher stock allocation) to a more conservative stance (higher bond allocation) over time. The fund’s current asset allocation is as follows:

- Stocks: 70.8%

- Bonds: 29.2%

Performance

The Vanguard 2025 Target Fund has a strong track record of performance. Over the past 5 years, the fund has generated an annualized return of 7.44%. This return has outperformed the average return of target-date funds in the same category.

Suitability

The Vanguard 2025 Target Fund is a suitable investment option for individuals who are planning to retire around 2025. The fund’s glide path approach to asset allocation is designed to meet the evolving investment needs of individuals as they approach retirement.

Advantages

- Convenience: Target-date funds offer a convenient investment solution for retirement planning. They automatically adjust their asset allocation based on your target retirement date, eliminating the need for manual adjustments.

- Diversification: Target-date funds provide broad diversification across asset classes, reducing the overall risk of your portfolio.

- Low Expense Ratio: The Vanguard 2025 Target Fund has a low expense ratio of 0.15%, which is significantly lower than the average expense ratio for target-date funds.

- Strong Performance: The fund has a strong track record of performance, outperforming the average return of target-date funds in the same category.

Disadvantages

- Limited Control: Target-date funds do not allow for individual customization of the asset allocation. This may not be suitable for investors who prefer to have more control over their investments.

- Potential for Volatility: As the target retirement date approaches, the fund’s asset allocation becomes more conservative. This can lead to potential volatility in the portfolio’s value.

- May Not Meet Specific Retirement Needs: Target-date funds are designed to provide a general retirement solution. They may not be suitable for individuals with specific retirement goals or needs.

Alternatives

- Vanguard Target Retirement Income Fund: This fund is designed to provide income during retirement. It has a more conservative asset allocation and a higher expense ratio than the Vanguard 2025 Target Fund.

- Fidelity Freedom Index 2025 Target Date Fund: This fund is a low-cost alternative to the Vanguard 2025 Target Fund. It has a similar asset allocation and a lower expense ratio.

- Schwab Target 2025 Index Fund: This fund is another low-cost alternative to the Vanguard 2025 Target Fund. It has a slightly more aggressive asset allocation than the Vanguard fund.

Conclusion

The Vanguard 2025 Target Fund is a well-managed and cost-effective target-date fund that can be a suitable investment option for individuals planning to retire around 2025. Its glide path approach to asset allocation and strong performance make it a compelling choice for investors seeking a convenient and diversified retirement solution. However, it is important to consider the fund’s potential for volatility and limited control over asset allocation before investing. By carefully evaluating the fund’s features, performance, and suitability, you can make an informed investment decision that aligns with your retirement goals.

Closure

Thus, we hope this article has provided valuable insights into Vanguard 2025 Target Fund Review: A Comprehensive Analysis for Retirement Planning. We thank you for taking the time to read this article. See you in our next article!