Vanguard 2025 Fund: A Comprehensive Guide

Related Articles: Vanguard 2025 Fund: A Comprehensive Guide

- What Is Supposed To Happen In 2025: Technological Advancements, Global Events, And Societal Changes

- Marvel Movie Schedule Through 2025: A Comprehensive Guide To The Cinematic Universe

- G20 Countries Summit 2025: Shaping The Future Of Global Cooperation

- Auto Detailing Rates During Summer 2025: A Comprehensive Guide

- Holidays To Mauritius In 2025: A Comprehensive Guide To Paradise

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Vanguard 2025 Fund: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Vanguard 2025 Fund: A Comprehensive Guide

Vanguard 2025 Fund: A Comprehensive Guide

Introduction

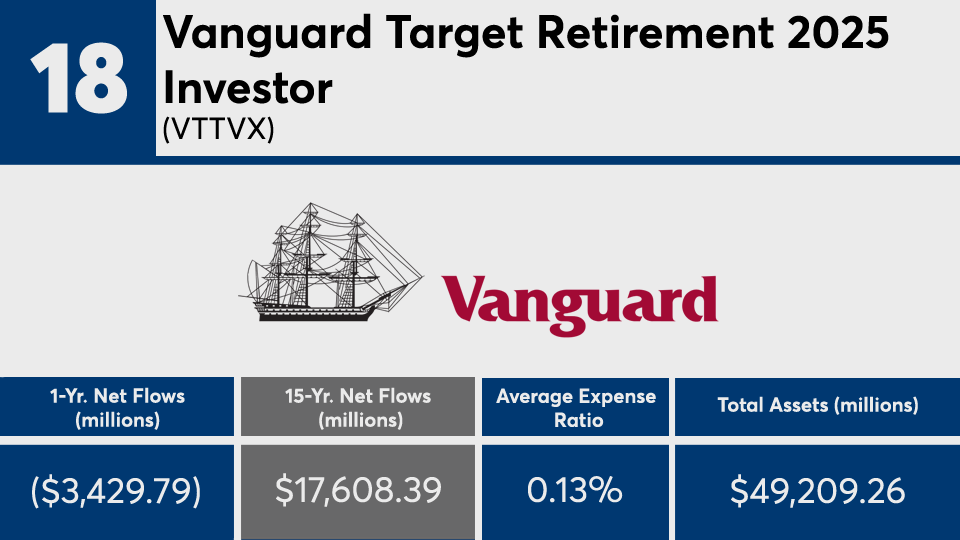

Vanguard 2025 Fund (VTWNX) is a target-date fund that invests in a diversified portfolio of stocks and bonds. The fund’s asset allocation is designed to gradually shift from stocks to bonds as the target date of 2025 approaches. This strategy is intended to help investors preserve their capital as they approach retirement.

Investment Strategy

The Vanguard 2025 Fund invests in a combination of domestic and international stocks and bonds. The fund’s asset allocation is as follows:

- 60% stocks

- 40% bonds

The fund’s stock allocation is invested in a variety of different sectors, including large-cap growth, large-cap value, mid-cap growth, mid-cap value, small-cap growth, and small-cap value. The fund’s bond allocation is invested in a variety of different maturities, including short-term, intermediate-term, and long-term bonds.

Target Date

The Vanguard 2025 Fund has a target date of 2025. This means that the fund’s asset allocation will gradually shift from stocks to bonds as the target date approaches. The fund’s asset allocation will be as follows in 2025:

- 30% stocks

- 70% bonds

Risk and Return

The Vanguard 2025 Fund is a moderate-risk investment. The fund’s volatility is expected to be lower than that of a pure stock fund, but higher than that of a pure bond fund. The fund’s return is expected to be commensurate with its risk.

Fees

The Vanguard 2025 Fund has an expense ratio of 0.15%. This means that the fund charges $1.50 for every $1,000 invested. The fund’s expense ratio is below average for target-date funds.

Who Should Invest in the Vanguard 2025 Fund?

The Vanguard 2025 Fund is a good investment for investors who are planning to retire in or around 2025. The fund’s target-date strategy is designed to help investors preserve their capital as they approach retirement. The fund is also a good investment for investors who are looking for a moderate-risk investment.

How to Invest in the Vanguard 2025 Fund

Investors can invest in the Vanguard 2025 Fund through a variety of different methods, including:

- Vanguard’s website

- Vanguard’s mobile app

- A financial advisor

Conclusion

The Vanguard 2025 Fund is a well-diversified target-date fund that is a good investment for investors who are planning to retire in or around 2025. The fund’s target-date strategy is designed to help investors preserve their capital as they approach retirement. The fund is also a good investment for investors who are looking for a moderate-risk investment.

Closure

Thus, we hope this article has provided valuable insights into Vanguard 2025 Fund: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!