TSP L 2045 Fund: A Long-Term Savings Plan for a Secure Retirement

Related Articles: TSP L 2045 Fund: A Long-Term Savings Plan for a Secure Retirement

- How Many Days Are In February 2028?

- Lunar New Year 2050: A Glimpse Into The Future Of Lunar Celebrations

- Harry Potter: The Return Of The Dark Lord (2025)

- 2025 Ford Mustang GT-D Speed: The Ultimate Electric Pony Car

- 2025 RAM 1500 RHOT: The Future Of Heavy-Duty Towing

Introduction

With great pleasure, we will explore the intriguing topic related to TSP L 2045 Fund: A Long-Term Savings Plan for a Secure Retirement. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about TSP L 2045 Fund: A Long-Term Savings Plan for a Secure Retirement

TSP L 2045 Fund: A Long-Term Savings Plan for a Secure Retirement

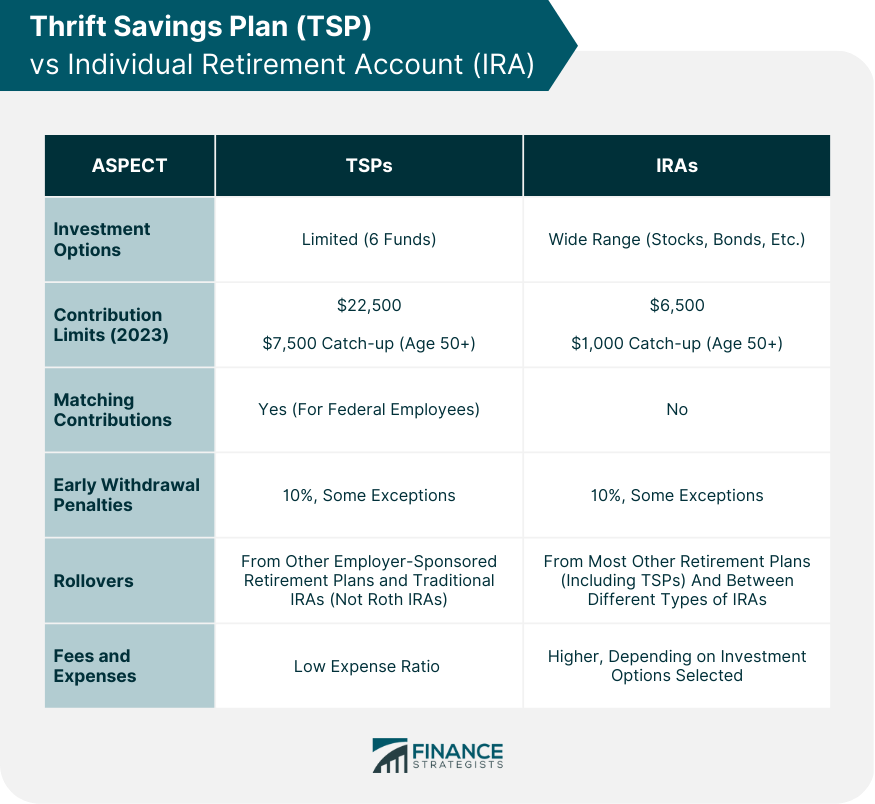

The Thrift Savings Plan (TSP) is a retirement savings and investment plan available to federal employees and members of the uniformed services. It offers a variety of investment options, including the TSP L 2045 Fund, a target-date fund designed to provide a balanced approach to investing for retirement.

Target-Date Funds: A Simplified Approach to Retirement Planning

Target-date funds are a type of mutual fund that automatically adjust their asset allocation based on the investor’s expected retirement date. As the investor approaches retirement, the fund gradually shifts from higher-risk investments, such as stocks, to lower-risk investments, such as bonds. This helps to preserve the investor’s savings and reduce the risk of losing money in the years leading up to retirement.

The TSP L 2045 Fund is designed for investors who plan to retire in or around the year 2045. It invests in a mix of stock and bond index funds, with the stock allocation decreasing and the bond allocation increasing over time. This glide path is designed to provide a balance between growth potential and risk management.

Benefits of Investing in the TSP L 2045 Fund

- Simplicity: Target-date funds offer a simplified approach to retirement planning. Investors do not need to make complex investment decisions or monitor their portfolio regularly.

- Diversification: The TSP L 2045 Fund invests in a wide range of asset classes, including domestic and international stocks and bonds. This diversification helps to reduce the risk of losing money due to any one asset class underperforming.

- Automatic Rebalancing: The fund automatically rebalances its asset allocation based on the investor’s expected retirement date. This ensures that the investor’s portfolio remains aligned with their risk tolerance and investment goals.

- Low Fees: The TSP L 2045 Fund has low expense ratios compared to similar target-date funds. This means that more of the investor’s savings are invested in the fund and not eaten up by fees.

Investment Strategy of the TSP L 2045 Fund

The TSP L 2045 Fund invests in the following index funds:

- C Fund (Common Stock Index Investment Fund): Invests in a broad range of U.S. stocks.

- S Fund (Small Cap Stock Index Investment Fund): Invests in smaller U.S. companies.

- I Fund (International Stock Index Investment Fund): Invests in stocks of companies outside the U.S.

- G Fund (Government Securities Investment Fund): Invests in U.S. Treasury securities.

- F Fund (Fixed Income Index Investment Fund): Invests in a broad range of U.S. bonds.

The fund’s asset allocation gradually shifts from stocks to bonds as the investor approaches retirement. The following table shows the target asset allocation for different age ranges:

| Age Range | Stock Allocation | Bond Allocation |

|---|---|---|

| Under 35 | 80% | 20% |

| 35-49 | 70% | 30% |

| 50-59 | 55% | 45% |

| 60-64 | 40% | 60% |

| 65 and over | 30% | 70% |

Who Should Invest in the TSP L 2045 Fund?

The TSP L 2045 Fund is a suitable investment option for federal employees and members of the uniformed services who:

- Are planning to retire in or around the year 2045

- Are comfortable with a moderate level of risk

- Do not want to make complex investment decisions

- Are looking for a low-cost retirement savings option

How to Invest in the TSP L 2045 Fund

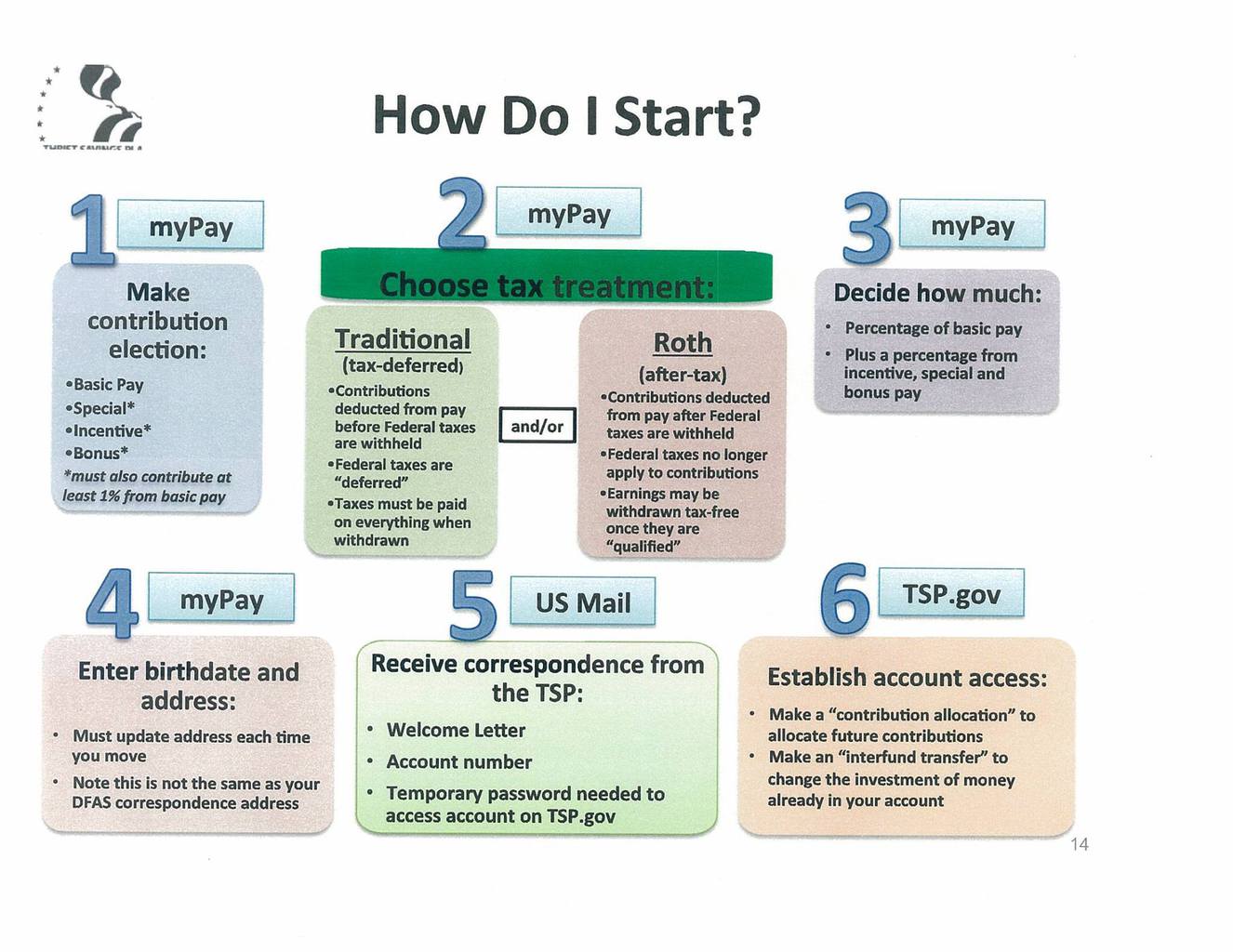

Federal employees and members of the uniformed services can invest in the TSP L 2045 Fund through their TSP account. They can choose to contribute a percentage of their salary or make one-time contributions. The fund is also available as an investment option for the Roth TSP, which offers tax-free withdrawals in retirement.

Conclusion

The TSP L 2045 Fund is a well-diversified target-date fund that offers a convenient and cost-effective way to save for retirement. It is designed to provide a balanced approach to investing, with a gradual shift from stocks to bonds as the investor approaches retirement. By investing in the TSP L 2045 Fund, federal employees and members of the uniformed services can take a proactive approach to securing their financial future.

Closure

Thus, we hope this article has provided valuable insights into TSP L 2045 Fund: A Long-Term Savings Plan for a Secure Retirement. We appreciate your attention to our article. See you in our next article!