TSP 2025 Lifecycle Fund: A Comprehensive Guide

Related Articles: TSP 2025 Lifecycle Fund: A Comprehensive Guide

- 2025 Hyundai Palisade: A Comprehensive Review

- The Grand Solar Minimum Of 2025: A Looming Threat Or Overblown Scare?

- New Jersey Governor Election 2025: A Preview Of The Candidates And Issues

- 2 Credit Cards Charging 0% Interest Until 2025: A Comprehensive Guide

- The Future Of Toyota Camry: Unveiling The 2024 Model

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to TSP 2025 Lifecycle Fund: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about TSP 2025 Lifecycle Fund: A Comprehensive Guide

TSP 2025 Lifecycle Fund: A Comprehensive Guide

Introduction

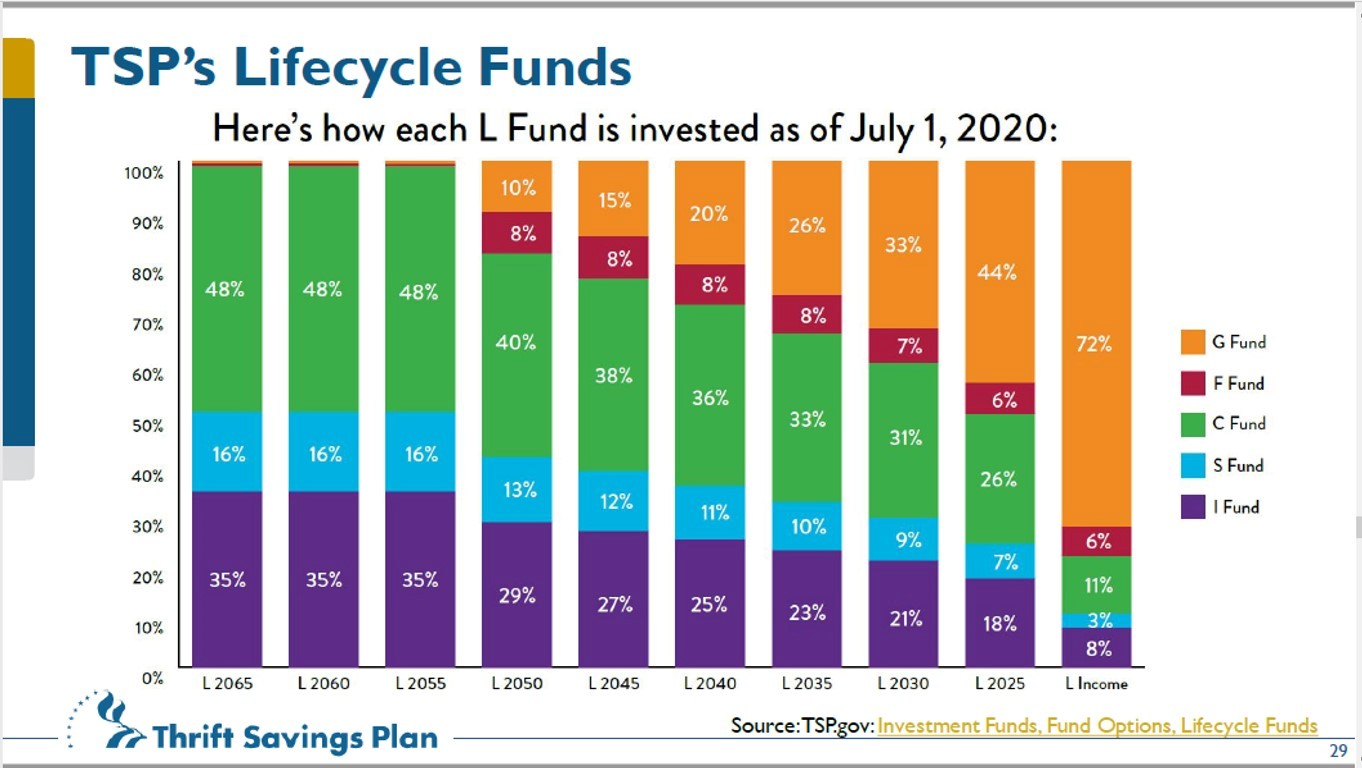

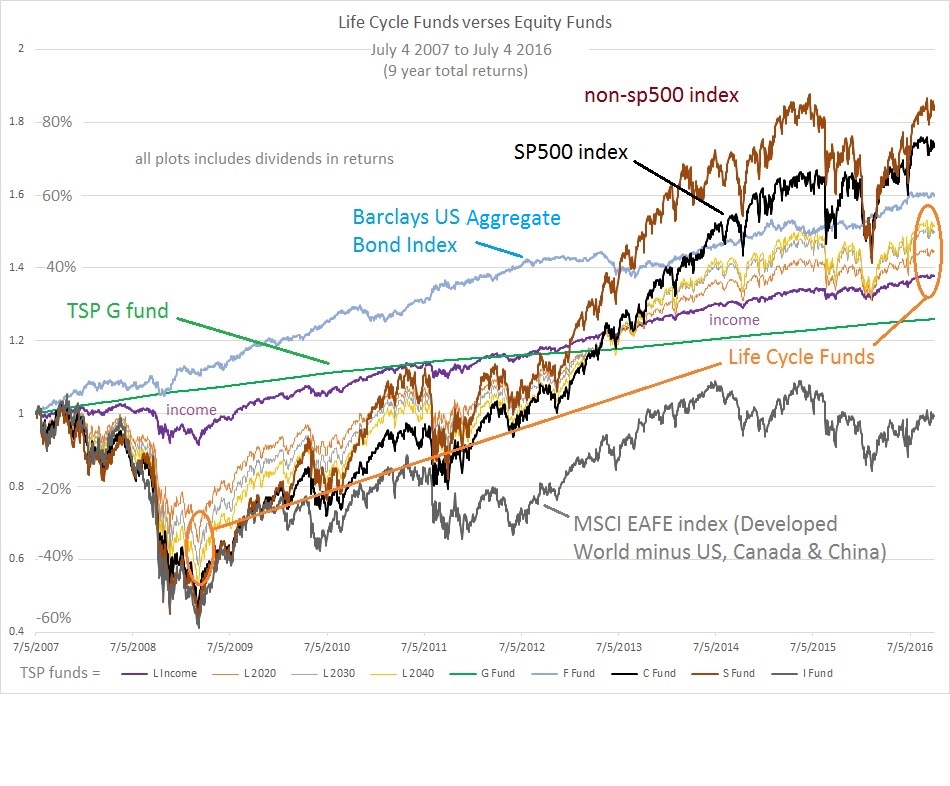

The Thrift Savings Plan (TSP) is a retirement savings plan for federal employees and members of the uniformed services. It offers a variety of investment funds, including the TSP 2025 Lifecycle Fund. This fund is a target-date fund that automatically adjusts its asset allocation based on the participant’s age and retirement date.

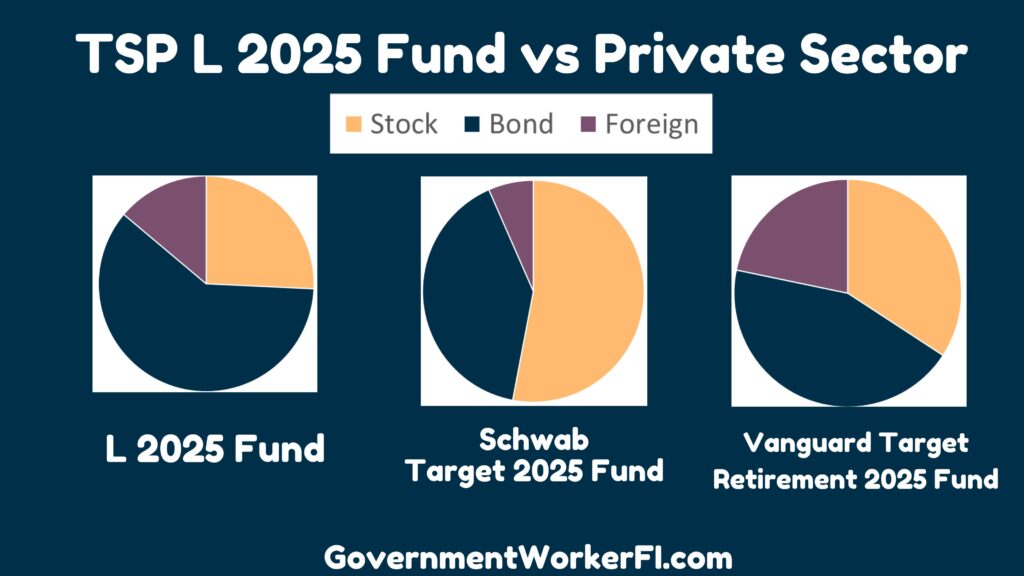

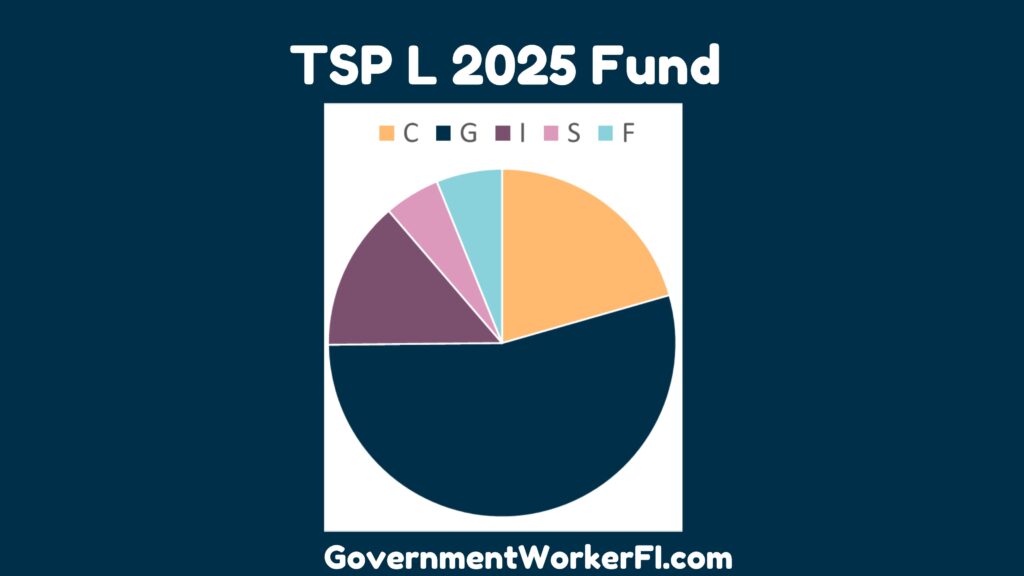

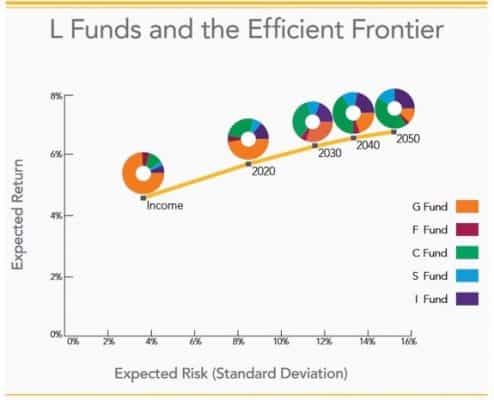

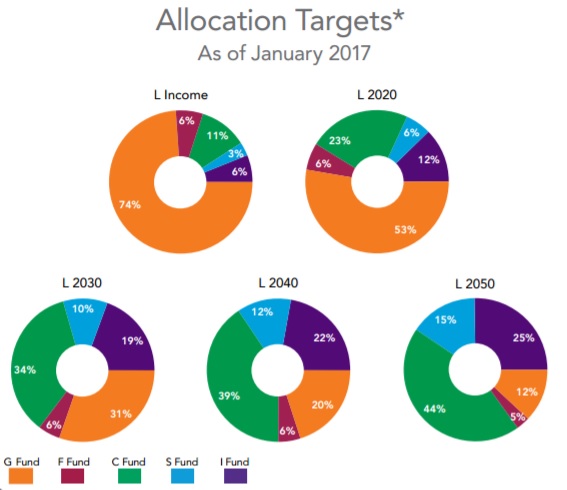

Asset Allocation

The TSP 2025 Lifecycle Fund invests in a mix of stocks, bonds, and international securities. The asset allocation is designed to provide a balance of growth potential and risk tolerance. As the participant ages and approaches their retirement date, the fund gradually shifts its asset allocation to a more conservative mix.

Stock Allocation

The stock allocation of the TSP 2025 Lifecycle Fund is initially invested in a diversified mix of large-cap, mid-cap, and small-cap stocks. As the participant ages, the stock allocation gradually decreases in favor of bonds.

Bond Allocation

The bond allocation of the TSP 2025 Lifecycle Fund is invested in a mix of government bonds, corporate bonds, and international bonds. As the participant ages, the bond allocation gradually increases in favor of stocks.

International Allocation

The international allocation of the TSP 2025 Lifecycle Fund is invested in a mix of developed and emerging market stocks and bonds. The international allocation is designed to provide diversification and potential for growth.

Target Retirement Date

The target retirement date for the TSP 2025 Lifecycle Fund is 2025. This means that the fund’s asset allocation is designed to be most appropriate for participants who plan to retire around that year.

Age-Based Adjustment

The TSP 2025 Lifecycle Fund automatically adjusts its asset allocation based on the participant’s age. The fund’s asset allocation is more aggressive for younger participants and becomes more conservative as the participant ages.

Benefits

The TSP 2025 Lifecycle Fund offers a number of benefits, including:

- Simplicity: The fund’s target-date approach makes it easy for participants to invest in a diversified portfolio without having to make complex investment decisions.

- Automatic Rebalancing: The fund automatically rebalances its asset allocation as the participant ages, ensuring that the portfolio remains aligned with their risk tolerance and retirement goals.

- Low Expenses: The TSP 2025 Lifecycle Fund has low operating expenses, which can help maximize investment returns.

Risks

As with any investment, there are risks associated with investing in the TSP 2025 Lifecycle Fund. These risks include:

- Market Risk: The value of the fund’s investments can fluctuate with market conditions.

- Interest Rate Risk: The value of the fund’s bond investments can fluctuate with interest rates.

- Currency Risk: The value of the fund’s international investments can fluctuate with currency exchange rates.

Suitability

The TSP 2025 Lifecycle Fund is suitable for participants who:

- Are planning to retire around 2025

- Are comfortable with a moderate level of risk

- Are looking for a simple and convenient investment solution

Comparison to Other TSP Funds

The TSP 2025 Lifecycle Fund is one of a series of lifecycle funds offered by the TSP. These funds are designed to provide a range of investment options for participants with different retirement dates and risk tolerances.

The TSP 2025 Lifecycle Fund is most similar to the TSP 2030 Lifecycle Fund and the TSP 2040 Lifecycle Fund. However, the TSP 2025 Lifecycle Fund has a slightly more aggressive asset allocation than the TSP 2030 Lifecycle Fund and a slightly more conservative asset allocation than the TSP 2040 Lifecycle Fund.

How to Invest

Participants can invest in the TSP 2025 Lifecycle Fund through their TSP account. The fund is available through the TSP website or by calling the TSP Customer Service Center.

Conclusion

The TSP 2025 Lifecycle Fund is a target-date fund that provides a convenient and cost-effective investment solution for participants who are planning to retire around 2025. The fund’s automatic rebalancing and low expenses make it a suitable option for participants who are looking for a simple and hassle-free way to invest for retirement.

Closure

Thus, we hope this article has provided valuable insights into TSP 2025 Lifecycle Fund: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!