Tax Cuts Expiring in 2025: Implications for Individuals and Businesses

Related Articles: Tax Cuts Expiring in 2025: Implications for Individuals and Businesses

- 2025 Kia K5 Release Date: A Comprehensive Look At The Upcoming Sedan

- 2025 IRS Tax Tables: A Comprehensive Guide

- Additional Standard Deduction For Individuals Age 65 Or Older In 2025

- 2025 Lexus RX 350: Price And Specifications

- Worlds 2025: A Look Into The Future Of League Of Legends Esports

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Tax Cuts Expiring in 2025: Implications for Individuals and Businesses. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Tax Cuts Expiring in 2025: Implications for Individuals and Businesses

Tax Cuts Expiring in 2025: Implications for Individuals and Businesses

Introduction

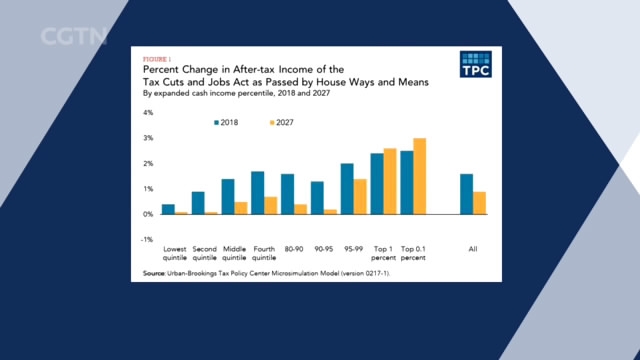

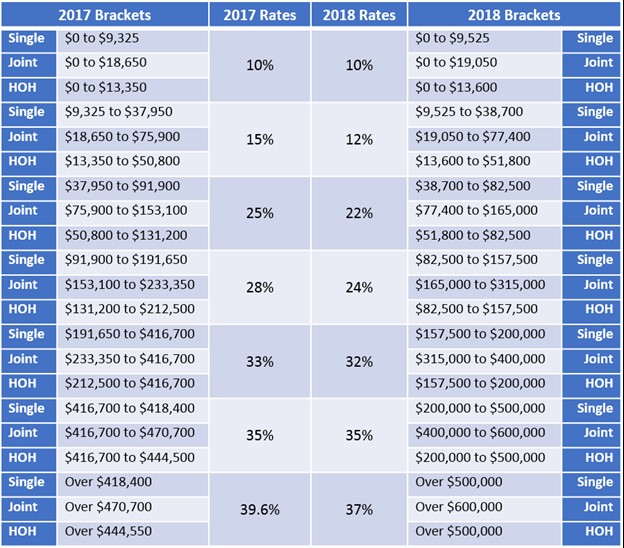

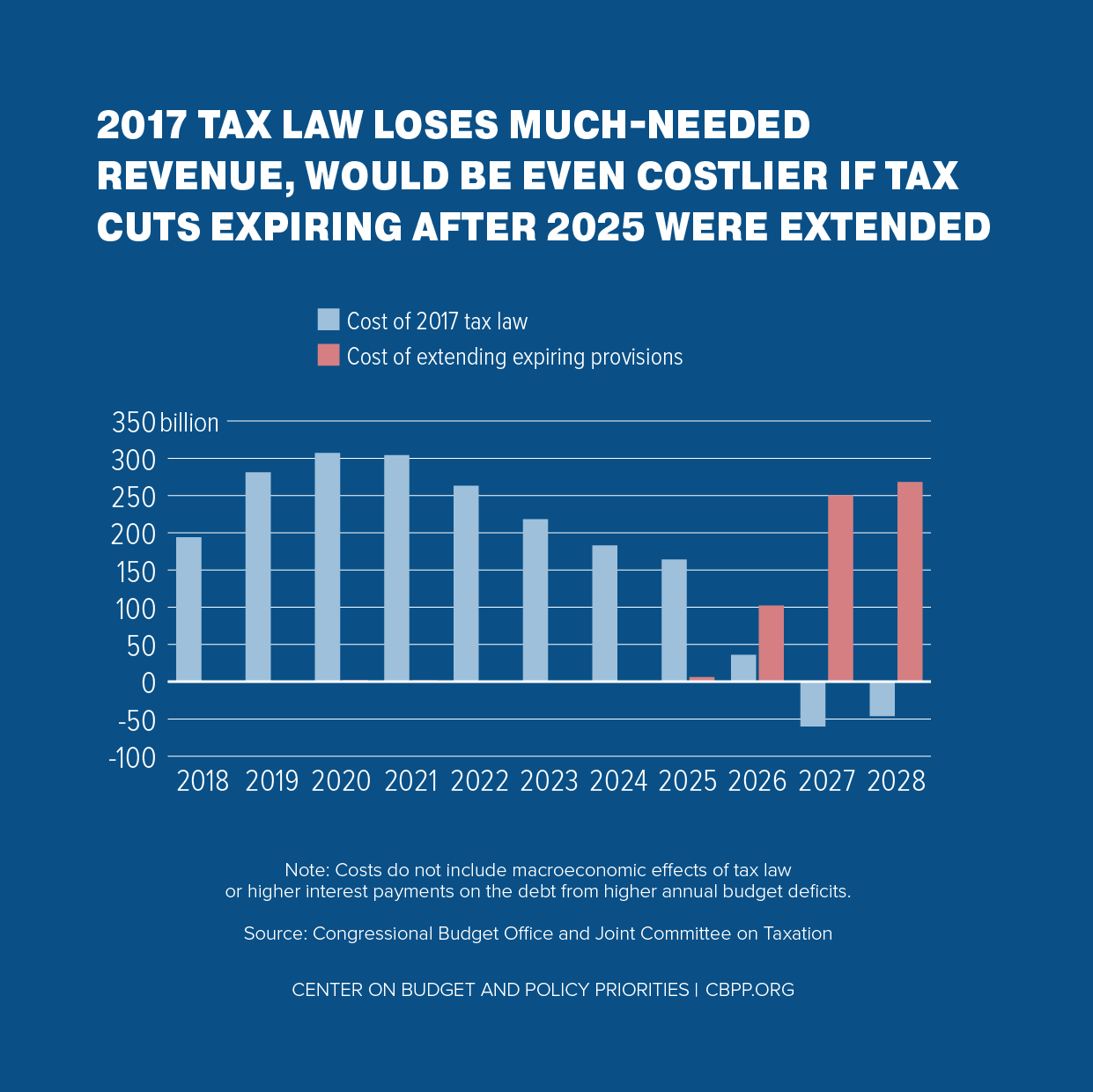

The Tax Cuts and Jobs Act (TCJA) of 2017 introduced significant changes to the U.S. tax code, including a reduction in individual and corporate tax rates. However, many of these provisions are set to expire in 2025, creating uncertainty for taxpayers and businesses. This article examines the implications of the expiring tax cuts and discusses potential outcomes for individuals and businesses.

Individual Tax Cuts

The TCJA reduced individual tax rates across all income brackets, increased the standard deduction, and eliminated personal exemptions. These changes generally resulted in lower tax bills for most Americans. However, the individual tax cuts are scheduled to expire in 2025, reverting to pre-TCJA rates.

Implications for Individuals

If the individual tax cuts expire, taxpayers will face higher tax bills starting in 2026. The impact will vary depending on income level, but all taxpayers will be affected. For example, a single taxpayer with a taxable income of $50,000 would pay approximately $1,000 more in taxes if the TCJA provisions expire.

The expiration of the individual tax cuts could also affect retirement planning. The TCJA increased the contribution limits for retirement accounts, such as 401(k)s and IRAs. If these limits are not extended, individuals may have less incentive to save for retirement.

Corporate Tax Cuts

The TCJA also reduced the corporate tax rate from 35% to 21%. This change has been beneficial for businesses, as it has allowed them to keep more of their earnings. However, the corporate tax cuts are also scheduled to expire in 2025.

Implications for Businesses

If the corporate tax cuts expire, businesses will face higher tax bills starting in 2026. This could reduce corporate profits and lead to lower investment and job creation. Additionally, the expiration of the corporate tax cuts could make the U.S. less competitive globally, as many other countries have lower corporate tax rates.

Potential Outcomes

The expiration of the tax cuts in 2025 could have significant implications for the U.S. economy. One potential outcome is that the government will extend the tax cuts beyond 2025. This would provide certainty to taxpayers and businesses and prevent a sharp increase in taxes.

Another potential outcome is that the government will let the tax cuts expire, but implement other tax reforms to offset the impact. For example, the government could increase the standard deduction or provide tax credits for specific activities.

Finally, the government could allow the tax cuts to expire without any offsetting measures. This would result in higher taxes for individuals and businesses, potentially slowing economic growth.

Conclusion

The expiration of the tax cuts in 2025 is a significant issue that will affect both individuals and businesses. The outcome of this issue will have important implications for the U.S. economy. It is important for taxpayers and businesses to be aware of the potential consequences of the expiring tax cuts and to plan accordingly.

Additional Considerations

In addition to the direct impact on taxes, the expiration of the tax cuts could also have indirect effects on the economy. For example, higher taxes could reduce consumer spending and investment, which could slow economic growth. Additionally, the uncertainty surrounding the tax cuts could make businesses less willing to invest and hire new workers.

The expiration of the tax cuts could also have political implications. If the tax cuts are allowed to expire, it could lead to increased pressure on the government to provide tax relief to individuals and businesses. This could result in additional tax cuts or other measures to offset the impact of the expiring tax cuts.

Recommendations

In light of the uncertainty surrounding the expiring tax cuts, it is important for taxpayers and businesses to take the following steps:

- Review your tax situation. Determine how the expiring tax cuts will affect your tax bill and make adjustments as necessary.

- Plan for the future. Consider how the expiring tax cuts could affect your retirement planning, investment decisions, and other financial goals.

- Stay informed. Monitor developments related to the expiring tax cuts and be prepared to adjust your plans as necessary.

By taking these steps, taxpayers and businesses can minimize the impact of the expiring tax cuts and position themselves for success in the future.

Closure

Thus, we hope this article has provided valuable insights into Tax Cuts Expiring in 2025: Implications for Individuals and Businesses. We thank you for taking the time to read this article. See you in our next article!