t rowe price 2025 r

Related Articles: t rowe price 2025 r

- Carnival Mardi Gras Cruises 2025: An Unforgettable Voyage To The Heart Of Carnival’s Fun

- Harry Potter: The Return Of The Dark Lord (2025)

- 2025 Abbot Road, Suite 100: A Prime Location In East Lansing’s Thriving Tech Hub

- Delhi Elections 2025: A Battle For The Capital’s Heart

- The Dodge Challenger Quarter Mile: A Muscle Car Masterpiece

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to t rowe price 2025 r. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about t rowe price 2025 r

T. Rowe Price 2025 Retirement Fund: A Comprehensive Analysis

Introduction

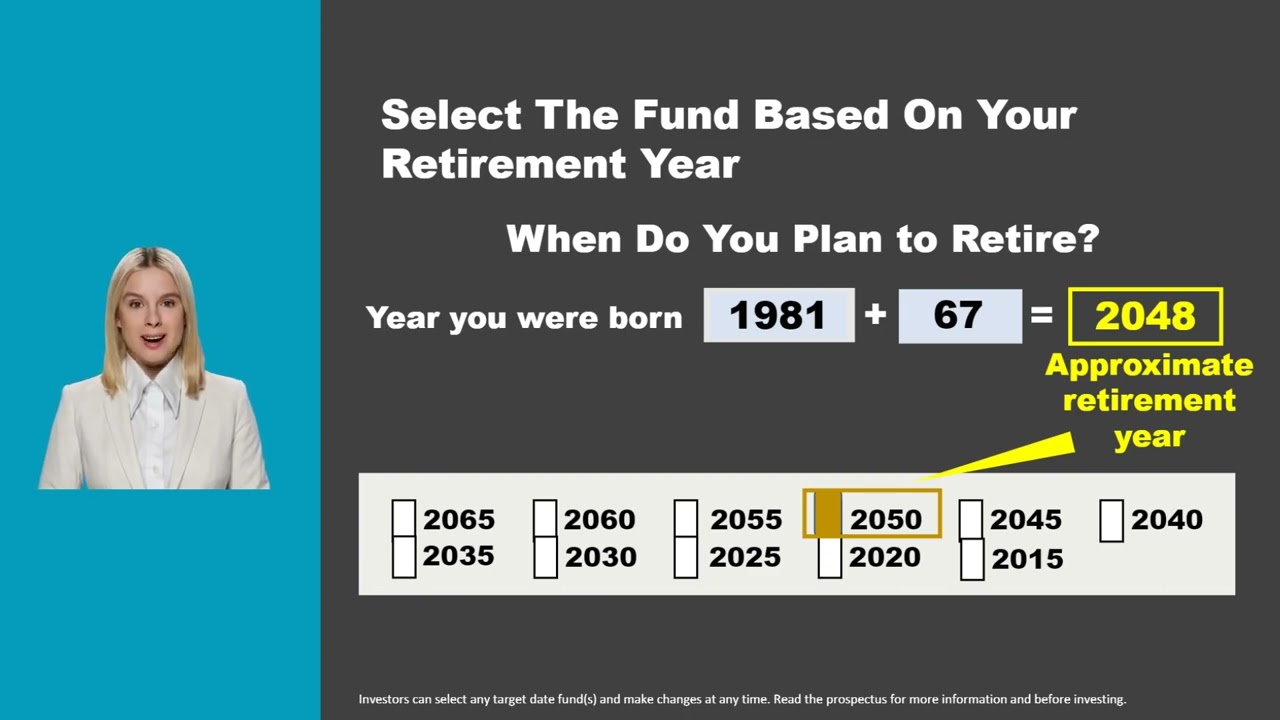

Retirement planning is a crucial aspect of financial well-being. Choosing the right retirement fund is essential to ensure a secure and comfortable retirement. T. Rowe Price, a leading investment management firm, offers a diverse range of retirement funds, including the T. Rowe Price 2025 Retirement Fund. This fund is designed specifically for individuals approaching retirement in 2025 and seeks to provide a balanced approach to risk and return.

Fund Overview

The T. Rowe Price 2025 Retirement Fund is a target-date fund, which means its asset allocation gradually shifts over time to become more conservative as the target retirement date approaches. The fund invests in a mix of stocks, bonds, and other assets to provide a diversified portfolio that aims to meet the evolving needs of investors nearing retirement.

Asset Allocation

As of December 31, 2023, the fund’s asset allocation was as follows:

- Stocks: 60%

- Bonds: 30%

- Other assets: 10%

The stock allocation is primarily invested in U.S. and international large-cap growth stocks, which have the potential for higher returns over the long term. The bond allocation consists of a combination of investment-grade corporate bonds, government bonds, and mortgage-backed securities. The "other assets" category includes real estate investment trusts (REITs) and commodities.

Investment Strategy

The fund’s investment strategy is based on the following principles:

- Diversification: The fund invests in a wide range of asset classes to reduce risk and enhance returns.

- Growth Potential: The stock allocation seeks to provide growth potential for investors who are still several years away from retirement.

- Income Generation: The bond allocation generates income that can supplement investors’ retirement income.

- Gradual Shift to Conservative: As the target retirement date approaches, the fund gradually shifts its asset allocation towards more conservative investments to preserve capital.

Risk Profile

The fund’s risk profile is considered moderate, which is appropriate for investors who are several years away from retirement and can tolerate a moderate amount of risk. However, it is important to note that all investments carry some degree of risk, and the fund’s value can fluctuate over time.

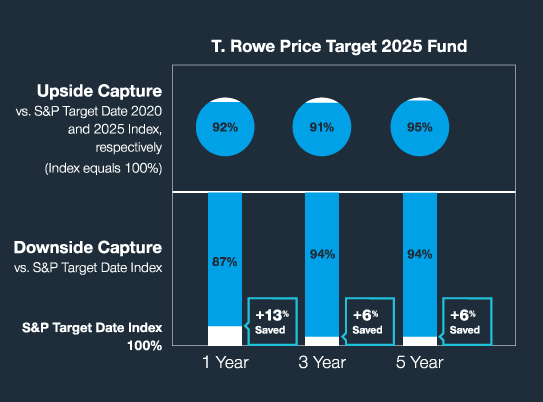

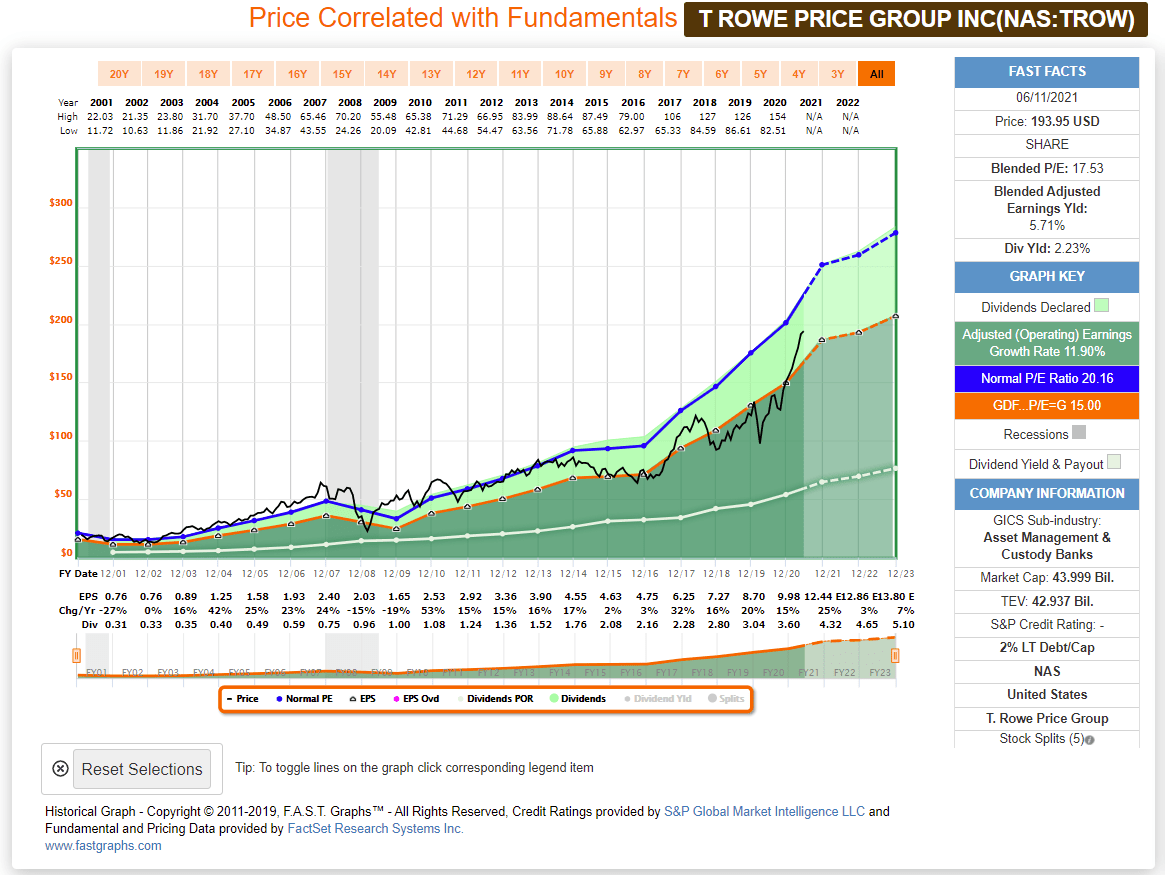

Performance

The fund has a track record of strong performance over the long term. Over the past 10 years, the fund has returned an average of 8.5% per year. However, it is important to remember that past performance is not a guarantee of future results.

Fees and Expenses

The fund has an annual expense ratio of 0.75%, which is in line with the industry average for target-date funds. The expense ratio covers the fund’s operating costs, including management fees and administrative expenses.

Suitability

The T. Rowe Price 2025 Retirement Fund is suitable for individuals who are approximately 10-15 years away from retirement and are seeking a balanced and diversified retirement savings option. Investors should carefully consider their risk tolerance, investment horizon, and financial goals before investing in any retirement fund.

Conclusion

The T. Rowe Price 2025 Retirement Fund is a well-managed and diversified target-date fund that can be a valuable component of a retirement savings plan. Its moderate risk profile and gradual shift to conservative investments make it suitable for investors who are nearing retirement and seeking a balanced approach to risk and return. As always, investors should consult with a financial advisor to determine if the fund is right for their individual needs.

Closure

Thus, we hope this article has provided valuable insights into t rowe price 2025 r. We hope you find this article informative and beneficial. See you in our next article!