Standard Deduction Decrease in 2025: What It Means for Taxpayers

Related Articles: Standard Deduction Decrease in 2025: What It Means for Taxpayers

- Will 2025 Work For 2032?

- 2025 Jeep SUV: A Bold Vision For The Future Of Off-Roading

- 2025 Toyota Camry: A Comprehensive Look At Cost And Features

- 2025 Toyota Camry: A Vision Of Future Automotive Excellence

- 2025 Porsche 911: Specs, Features, And Performance Outlook

Introduction

With great pleasure, we will explore the intriguing topic related to Standard Deduction Decrease in 2025: What It Means for Taxpayers. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Standard Deduction Decrease in 2025: What It Means for Taxpayers

Standard Deduction Decrease in 2025: What It Means for Taxpayers

:max_bytes(150000):strip_icc()/standarddeduction-resized-8f2ac3f88bca4ef099d637cb80f79e29.jpg)

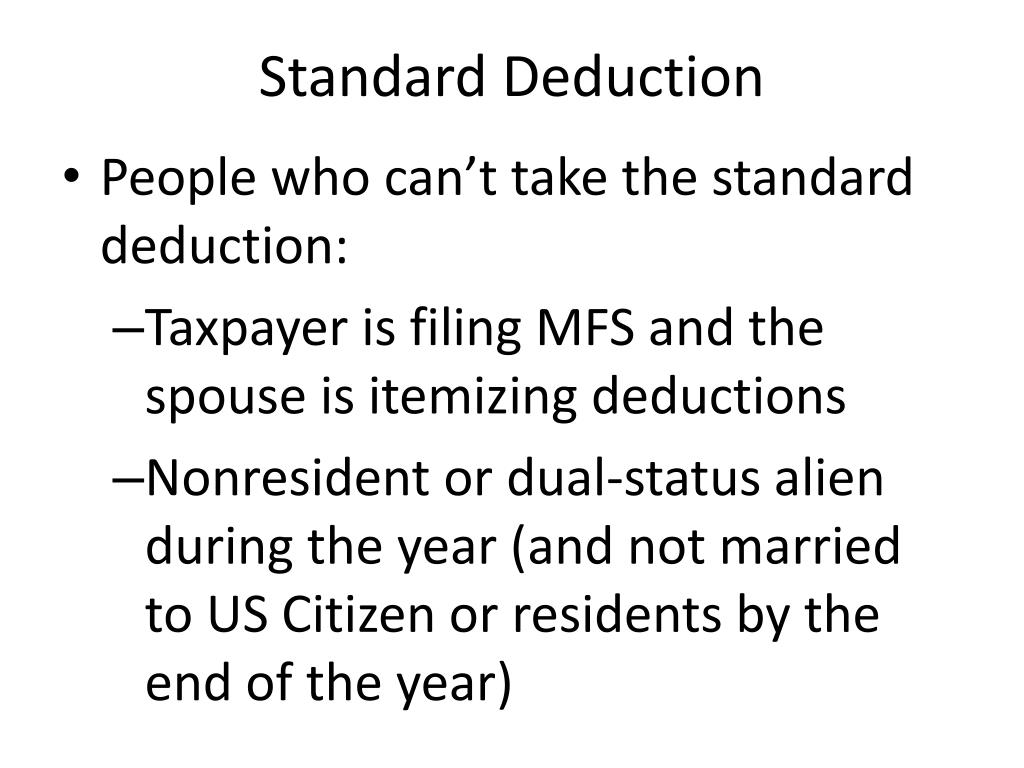

The standard deduction is a specific amount that taxpayers can deduct from their taxable income before calculating their taxes. This deduction helps to reduce the amount of income that is subject to taxation, thereby lowering the overall tax liability.

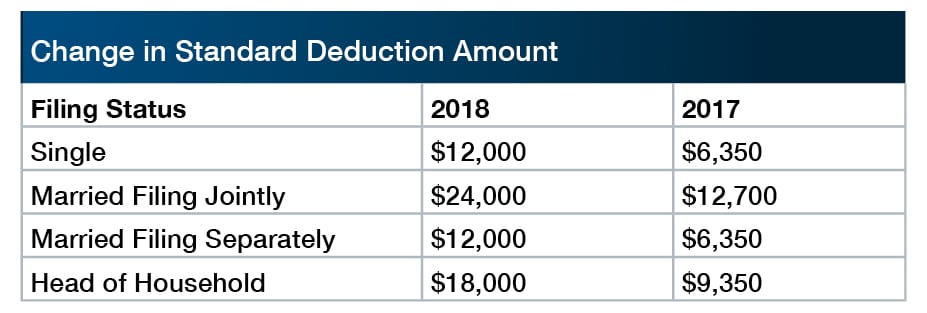

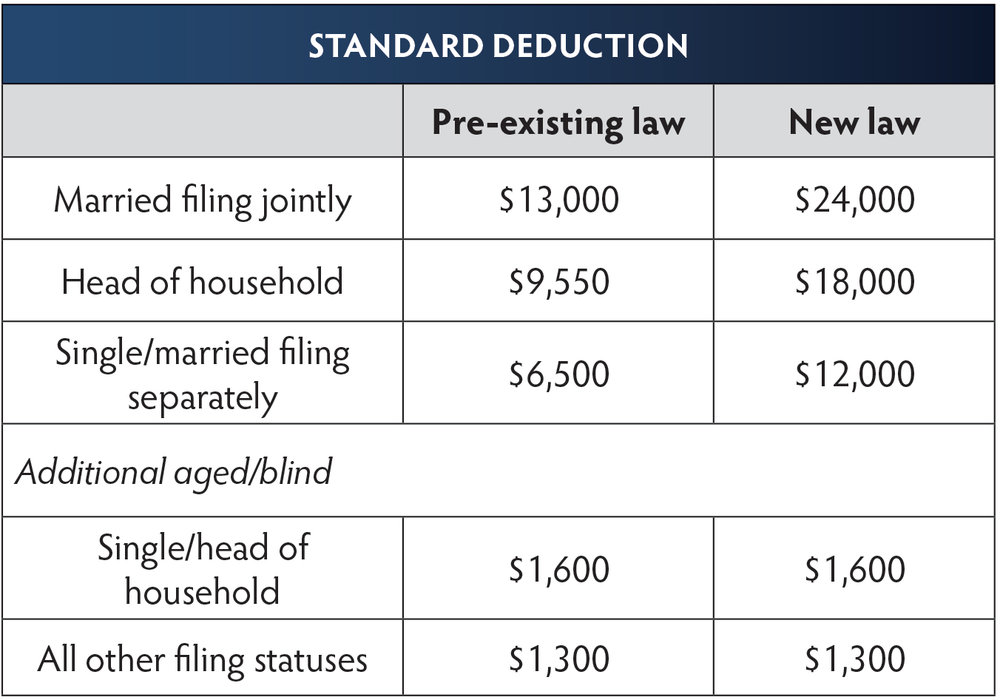

In recent years, the standard deduction has been increasing annually due to inflation adjustments. However, the Tax Cuts and Jobs Act (TCJA) of 2017 made significant changes to the standard deduction, including a temporary increase for the 2018 through 2025 tax years.

According to the TCJA, the standard deduction for single filers and married couples filing separately will be $12,950 for 2023, $13,850 for 2024, and $14,750 for 2025. For married couples filing jointly, the standard deduction will be $25,900 for 2023, $27,700 for 2024, and $29,500 for 2025.

However, it is important to note that these increased standard deduction amounts are scheduled to expire after the 2025 tax year. As a result, the standard deduction will revert to its pre-TCJA levels in 2026.

What does this mean for taxpayers?

The decrease in the standard deduction in 2026 will result in an increase in taxable income for many taxpayers. This means that they will have to pay more in taxes unless they take steps to reduce their taxable income.

What can taxpayers do to reduce their taxable income?

There are a number of things that taxpayers can do to reduce their taxable income, including:

- Contribute to a retirement account. Contributions to traditional IRAs and 401(k) plans are tax-deductible, meaning that they can be subtracted from taxable income.

- Make charitable donations. Donations to qualified charities are also tax-deductible, up to certain limits.

- Itemize deductions. Itemizing deductions allows taxpayers to deduct certain expenses from their taxable income, such as mortgage interest, state and local taxes, and medical expenses.

Is itemizing deductions still worthwhile?

Prior to the TCJA, many taxpayers itemized their deductions because the standard deduction was relatively low. However, the increased standard deduction amounts under the TCJA have made itemizing deductions less advantageous for many taxpayers.

In general, taxpayers should only itemize their deductions if the total amount of their itemized deductions exceeds the standard deduction. For most taxpayers, this means that they will only itemize deductions if they have significant mortgage interest, state and local taxes, or medical expenses.

What should taxpayers do now?

Taxpayers should be aware of the upcoming decrease in the standard deduction and start planning now to reduce their taxable income. They should consider contributing to retirement accounts, making charitable donations, and itemizing deductions if it is advantageous for them.

By taking these steps, taxpayers can minimize the impact of the standard deduction decrease and ensure that they are paying the lowest possible amount of taxes.

Additional Information

The following table shows the standard deduction amounts for 2023, 2024, and 2025, as well as the projected amounts for 2026 and beyond:

| Year | Single | Married Filing Jointly | Married Filing Separately | Head of Household |

|---|---|---|---|---|

| 2023 | $12,950 | $25,900 | $12,950 | $20,800 |

| 2024 | $13,850 | $27,700 | $13,850 | $21,950 |

| 2025 | $14,750 | $29,500 | $14,750 | $23,100 |

| 2026 and beyond | $12,550 | $25,100 | $12,550 | $20,100 |

Taxpayers should also be aware that the standard deduction is adjusted annually for inflation. As a result, the actual standard deduction amounts for 2026 and beyond may be slightly different from the projected amounts shown in the table.

:max_bytes(150000):strip_icc()/standard-deduction-3193021-FINAL-2020121-92f98d614dad4d72b36e54b867362f18.png)

:max_bytes(150000):strip_icc()/tax-deduction.asp-Final-163716aa2a244bac8f059f5e289bf913.png)

Closure

Thus, we hope this article has provided valuable insights into Standard Deduction Decrease in 2025: What It Means for Taxpayers. We thank you for taking the time to read this article. See you in our next article!