Should I Buy a House Now or Wait Until 2024?

Related Articles: Should I Buy a House Now or Wait Until 2024?

- Cruise Around The World 2015: An Unforgettable Odyssey

- Is It 2024 Or 2025? The Curious Case Of The Presidential Election Year

- Morocco To Host 2025 Africa Cup Of Nations

- White Mountain Resort: A Winter Wonderland In Conway, New Hampshire

- 2024-2025 Two-Year Calendar: A Comprehensive Guide For Planning And Scheduling

Introduction

With great pleasure, we will explore the intriguing topic related to Should I Buy a House Now or Wait Until 2024?. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Should I Buy a House Now or Wait Until 2024?

Should I Buy a House Now or Wait Until 2024?

The decision of whether to buy a house now or wait until 2024 is a complex one, influenced by a multitude of factors. While there is no universally correct answer, this article aims to provide a comprehensive analysis of the current real estate market, economic outlook, and potential risks and benefits to help you make an informed decision.

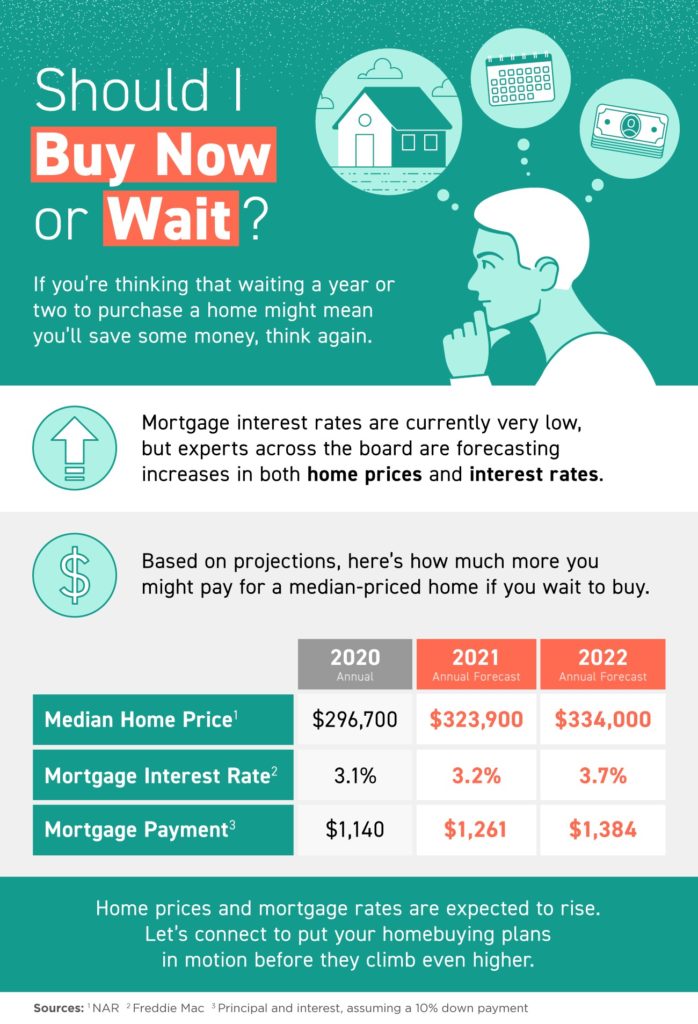

Current Real Estate Market

The real estate market in the United States has been on a steady upswing since the COVID-19 pandemic. Home prices have surged, driven by low interest rates, a shortage of homes for sale, and increased demand from buyers. According to the National Association of Realtors (NAR), the median home price in the US reached $375,300 in May 2023, a 14.8% increase from the same period last year.

While the market has shown signs of cooling in recent months, it remains competitive. In May 2023, the average number of days a home was on the market was 17 days, down from 20 days in May 2022. This indicates that homes are still selling quickly, and buyers are facing multiple offers.

Economic Outlook

The economic outlook for 2024 is uncertain. The Federal Reserve is expected to continue raising interest rates to combat inflation, which could lead to a slowdown in economic growth. However, many economists believe that a recession is unlikely in the near term.

The unemployment rate remains low, and consumer spending is strong. This suggests that the economy is still on solid footing, but it is important to monitor economic indicators closely for any signs of a downturn.

Potential Risks and Benefits

Buying Now:

-

Pros:

- Lock in a low interest rate on a mortgage.

- Build equity in a home.

- Take advantage of potential tax deductions.

-

Cons:

- High home prices.

- Competitive market with multiple offers.

- Risk of interest rates rising in the future.

Waiting Until 2024:

-

Pros:

- Home prices may decline due to a potential economic slowdown.

- Interest rates may stabilize or even decline.

- More homes may be available for sale.

-

Cons:

- Miss out on potential home appreciation.

- Interest rates could continue to rise.

- Economic conditions could worsen.

Factors to Consider:

When making your decision, it is important to consider your individual circumstances and financial goals. Here are some key factors to weigh:

- Financial Stability: Ensure you have a stable income and good credit score to qualify for a mortgage.

- Down Payment: Aim to have a down payment of at least 20% to avoid private mortgage insurance (PMI).

- Mortgage Affordability: Calculate your monthly mortgage payments and ensure they fit comfortably within your budget.

- Long-Term Goals: Consider your future plans and whether homeownership aligns with your lifestyle and financial aspirations.

- Market Conditions: Research the local real estate market and stay informed about trends and forecasts.

Conclusion

The decision of whether to buy a house now or wait until 2024 is a personal one. There are potential risks and benefits to both options, and the best choice depends on your individual circumstances.

If you are financially stable, have a good credit score, and are confident in your long-term financial goals, buying a house now may be a good option. However, if you are concerned about high home prices or economic uncertainty, it may be prudent to wait until 2024.

Ultimately, it is important to consult with a qualified financial advisor and real estate agent to assess your individual needs and make an informed decision.

Closure

Thus, we hope this article has provided valuable insights into Should I Buy a House Now or Wait Until 2024?. We appreciate your attention to our article. See you in our next article!