Projected Interest Rates for 2025: A Comprehensive Analysis

Related Articles: Projected Interest Rates for 2025: A Comprehensive Analysis

- LSAT 2025 Registration Deadlines: A Comprehensive Guide

- Tamil Calendar May 2025

- Mortgage Interest Rates Forecast 2025: A Comprehensive Analysis

- 2025 Ford Explorer ST: A Powerful And Versatile SUV For The Modern Adventurer

- Electric Cars On The Horizon: A Comprehensive Look At Upcoming Releases In 2025

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Projected Interest Rates for 2025: A Comprehensive Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Projected Interest Rates for 2025: A Comprehensive Analysis

Projected Interest Rates for 2025: A Comprehensive Analysis

Introduction

Interest rates play a crucial role in the financial system, impacting economic growth, inflation, and investment decisions. Understanding the projected interest rates for the future is essential for businesses, investors, and policymakers alike. This article provides a comprehensive analysis of the projected interest rates for 2025, examining the factors influencing their trajectory and exploring the potential implications for various stakeholders.

Factors Influencing Interest Rates

Several factors influence interest rates, including:

- Economic Growth: Strong economic growth typically leads to higher interest rates as businesses and consumers borrow more to finance expansion.

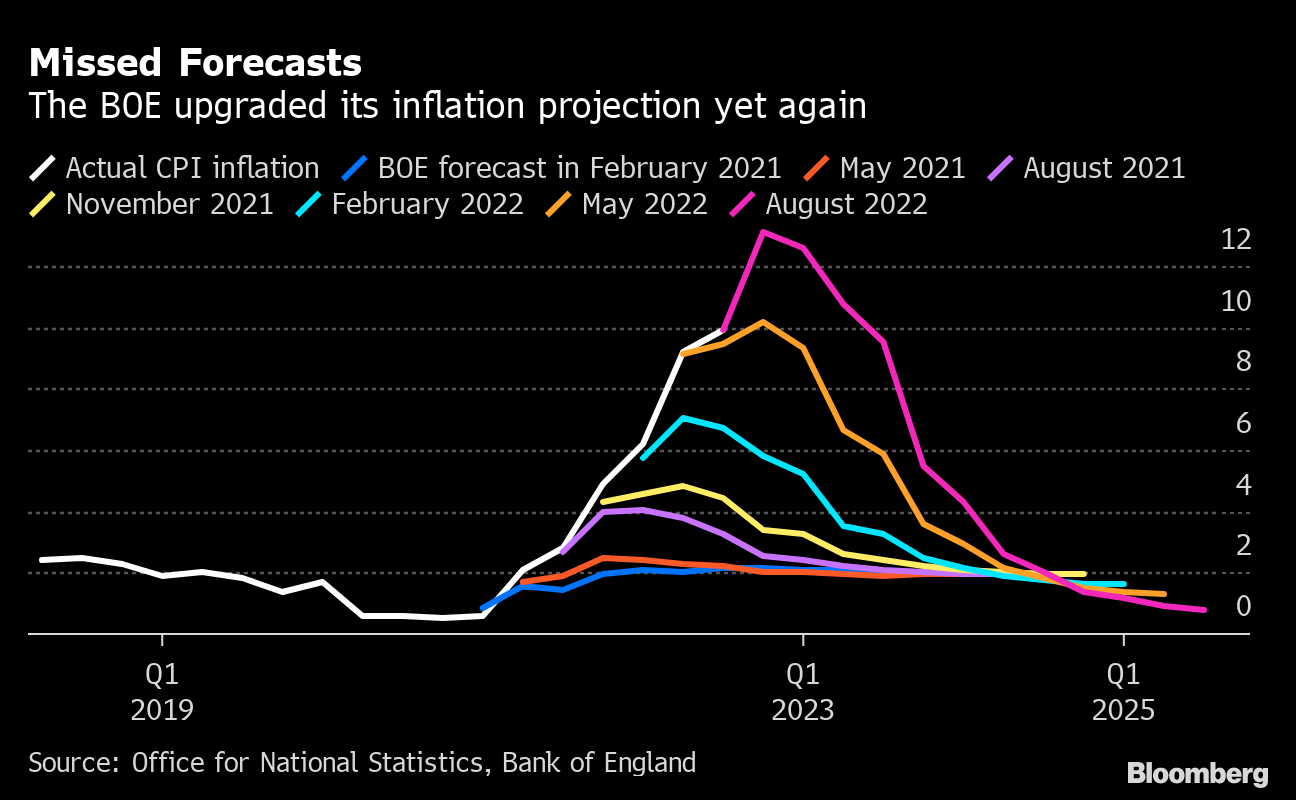

- Inflation: High inflation erodes the value of money, prompting central banks to raise interest rates to curb price increases.

- Fiscal Policy: Government spending and borrowing can impact interest rates. Large fiscal deficits can put upward pressure on rates.

- Monetary Policy: Central banks use monetary policy tools, such as interest rate adjustments, to manage inflation and economic growth.

- Global Economic Conditions: Interest rates in one country can be influenced by economic conditions in other countries, especially in a globalized economy.

Current Interest Rate Environment

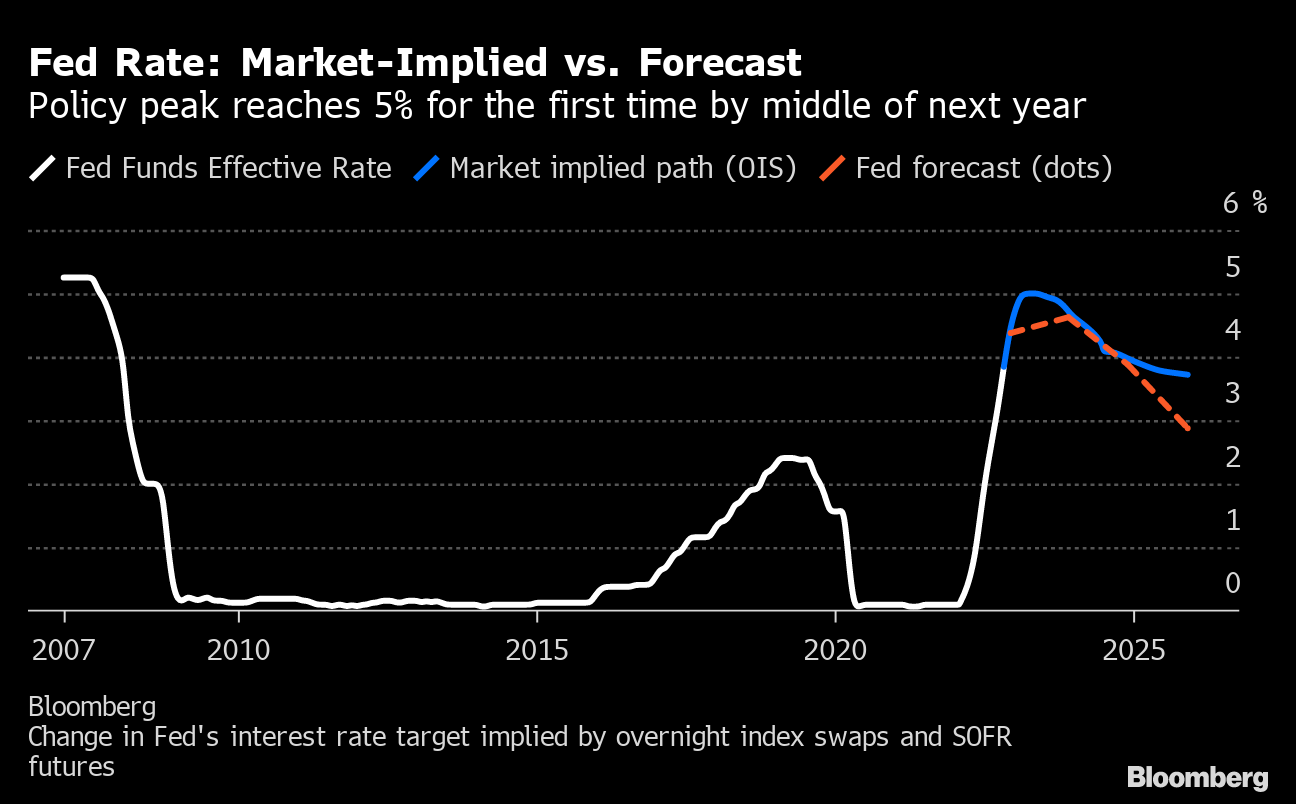

As of [date], the Federal Reserve’s target range for the federal funds rate is 4.25% to 4.50%. This represents a significant increase from the near-zero rates maintained during the COVID-19 pandemic. The Fed has been aggressively raising rates to combat persistent inflation, which has reached a 40-year high.

Projected Interest Rates for 2025

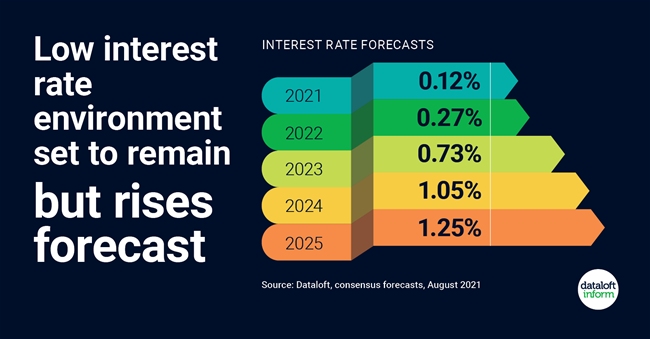

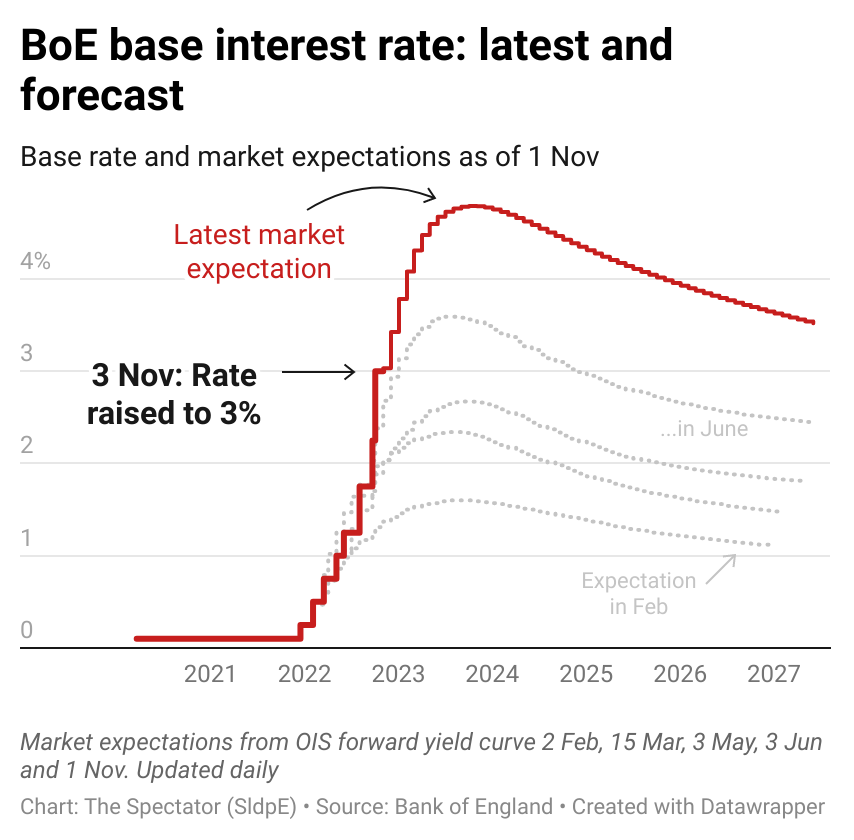

Various financial institutions and economic analysts have provided projections for interest rates in 2025. These projections vary depending on their assumptions about economic growth, inflation, and monetary policy.

- Bloomberg Economics: Projects the federal funds rate to be 3.8% by the end of 2025.

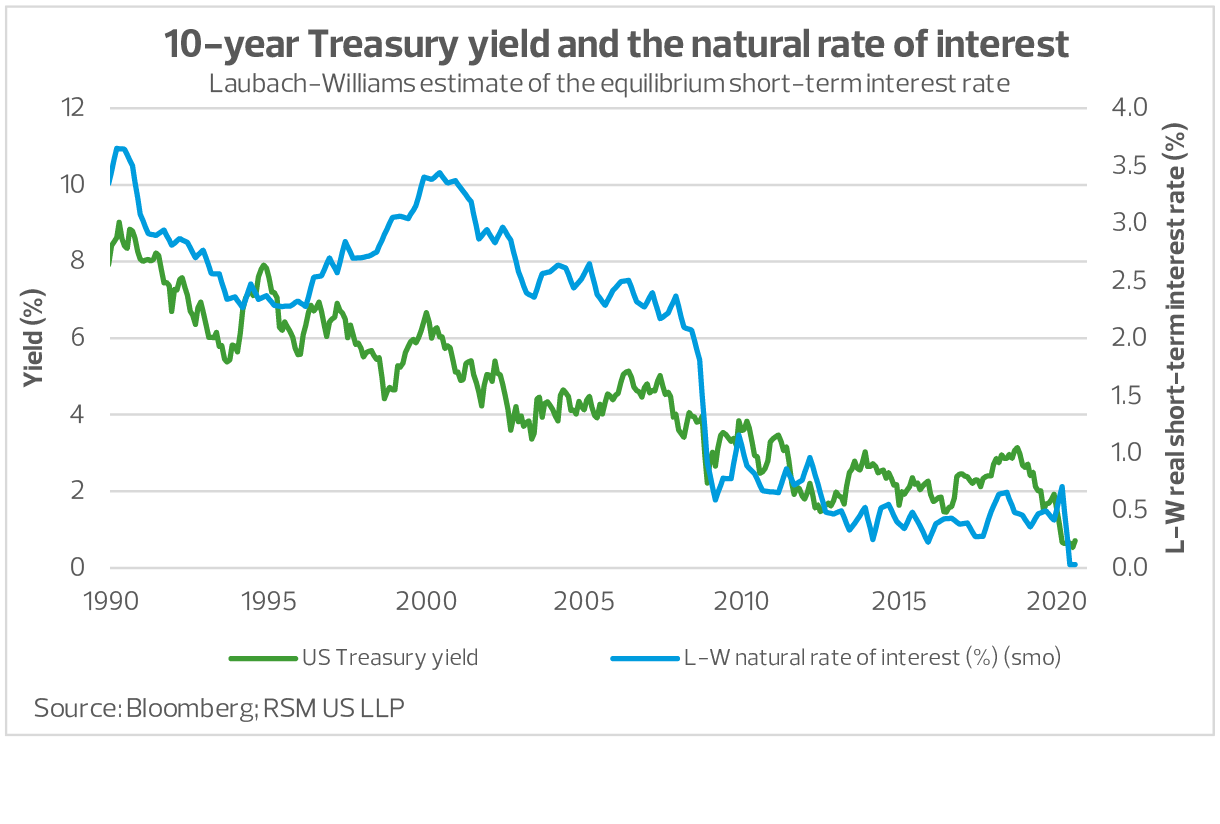

- Goldman Sachs: Forecasts the 10-year Treasury yield to decline to 3.5% by 2025.

- Bank of America: Estimates the 30-year fixed mortgage rate to be around 6% in 2025.

Factors Influencing Projections

The following factors influence the projections for interest rates in 2025:

- Economic Growth: The pace of economic growth is a key determinant of interest rates. A strong recovery from the pandemic could lead to higher rates.

- Inflation: Continued elevated inflation would likely prompt the Fed to keep interest rates higher for longer.

- Monetary Policy: The Fed’s response to inflation and economic conditions will significantly impact interest rates.

- Fiscal Policy: Government spending and borrowing plans could influence the demand for borrowing and thus affect interest rates.

- Global Economic Conditions: The global economic outlook and interest rates in other countries can impact domestic interest rates.

Implications for Stakeholders

The projected interest rates for 2025 have implications for various stakeholders, including:

- Businesses: Higher interest rates can increase borrowing costs for businesses, potentially affecting their investment and expansion plans.

- Consumers: Mortgage rates are likely to remain elevated in 2025, impacting home affordability and consumer spending.

- Investors: Interest rates influence the returns on investments, such as bonds and stocks. Investors should adjust their portfolios accordingly.

- Policymakers: Central banks face the challenge of balancing inflation control with economic growth. Interest rate decisions will have significant implications for the economy.

Conclusion

The projected interest rates for 2025 are subject to change based on various economic and policy factors. However, the current consensus among financial experts suggests that interest rates are likely to remain elevated in the near term. Businesses, consumers, investors, and policymakers should closely monitor interest rate developments and adjust their strategies accordingly. Understanding the projected interest rate trajectory is crucial for making informed financial decisions and navigating the evolving economic landscape.

Closure

Thus, we hope this article has provided valuable insights into Projected Interest Rates for 2025: A Comprehensive Analysis. We hope you find this article informative and beneficial. See you in our next article!