Projected 2025 IRMAA Brackets: Understanding the Income-Related Monthly Adjustment Amount

Related Articles: Projected 2025 IRMAA Brackets: Understanding the Income-Related Monthly Adjustment Amount

- When Is The Super Bowl In 2025?

- The All-New Volvo XC40: Redefining The Compact SUV In 2025

- Shows Coming Out In 2025: A Preview Of The Future Of Television

- 2025 NHL Entry Draft Prospects: A Look At The Future Of Hockey

- Canada Captures Gold At 2025 World Juniors, Defeating Sweden In Thrilling Final

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Projected 2025 IRMAA Brackets: Understanding the Income-Related Monthly Adjustment Amount. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Projected 2025 IRMAA Brackets: Understanding the Income-Related Monthly Adjustment Amount

Projected 2025 IRMAA Brackets: Understanding the Income-Related Monthly Adjustment Amount

Introduction

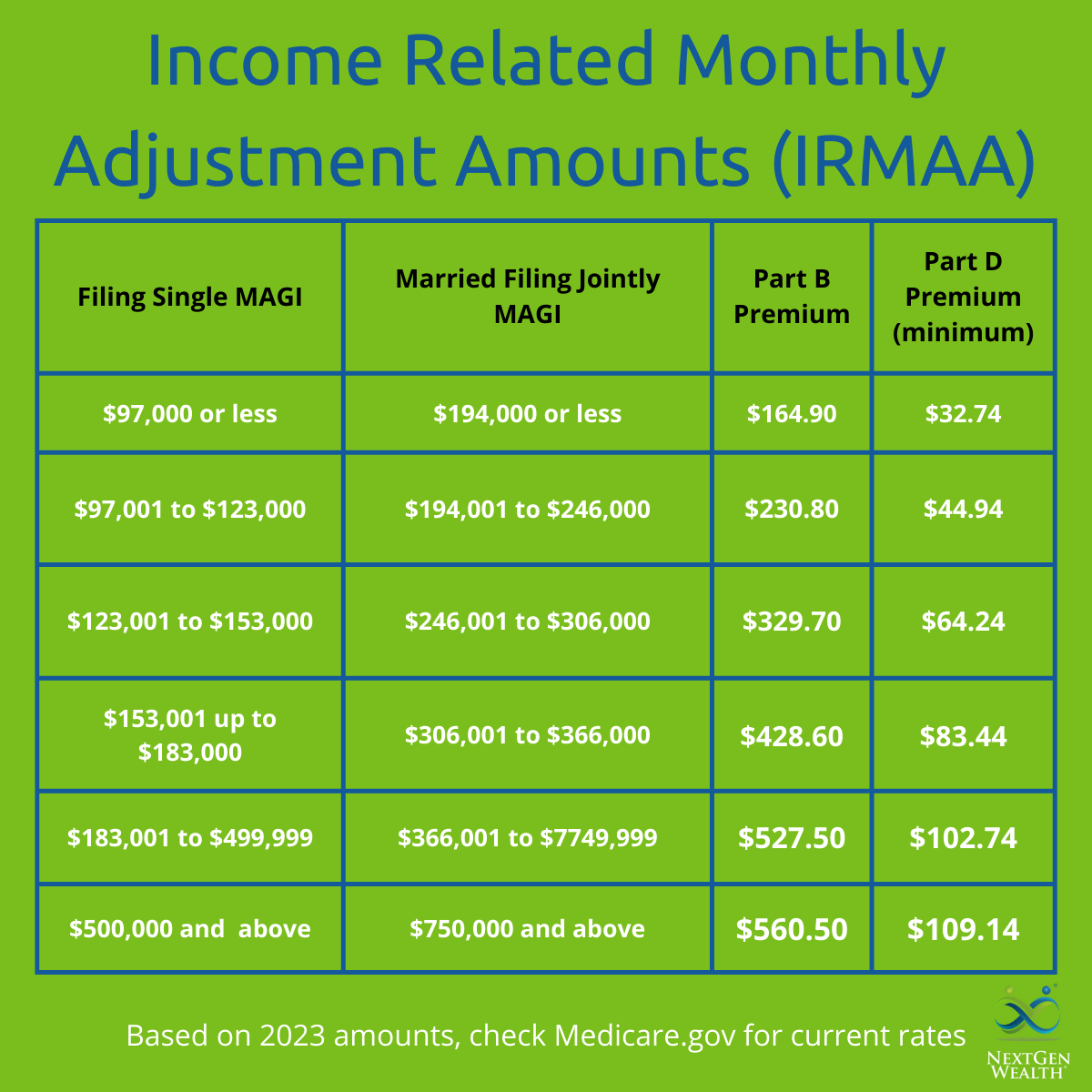

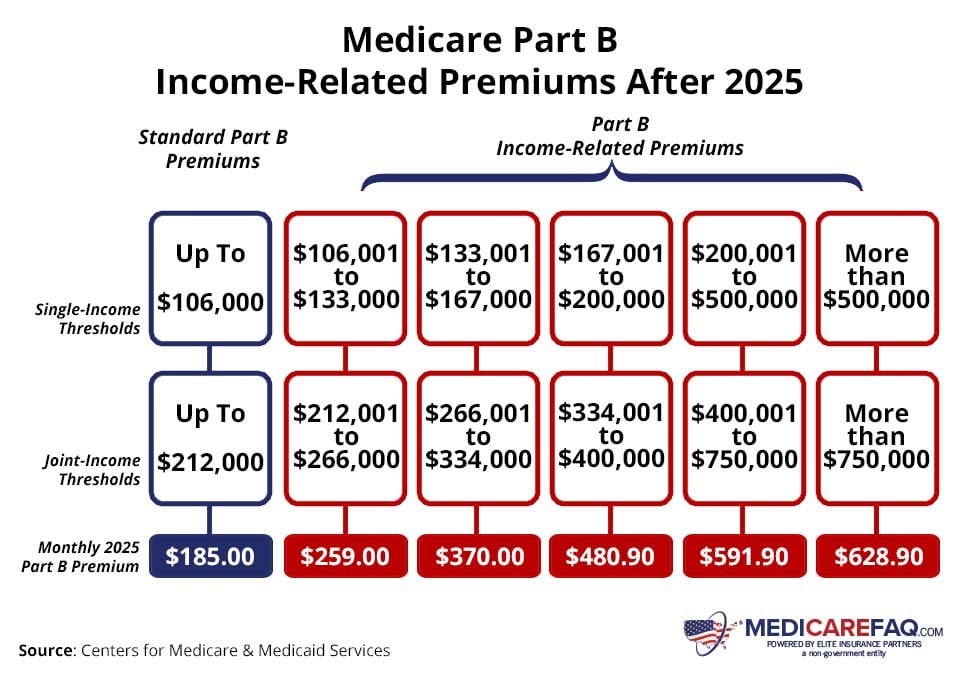

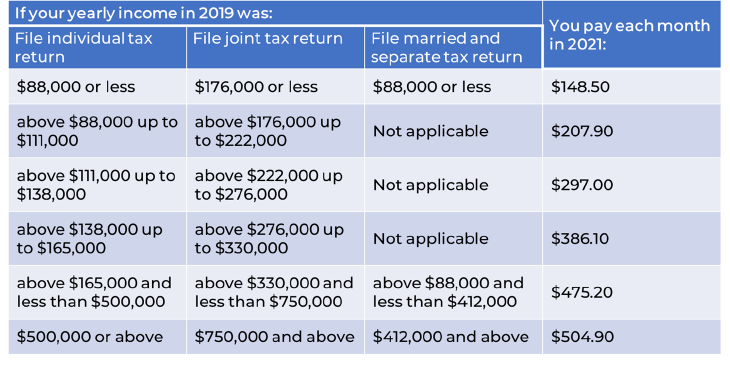

The Income-Related Monthly Adjustment Amount (IRMAA) is a surcharge imposed on high-income Medicare Part B and Part D beneficiaries. IRMAA brackets adjust annually based on changes in the cost of living and are used to determine the additional amount individuals must pay for their Medicare premiums. Understanding the projected 2025 IRMAA brackets is crucial for Medicare beneficiaries to plan their healthcare expenses effectively.

IRMAA Overview

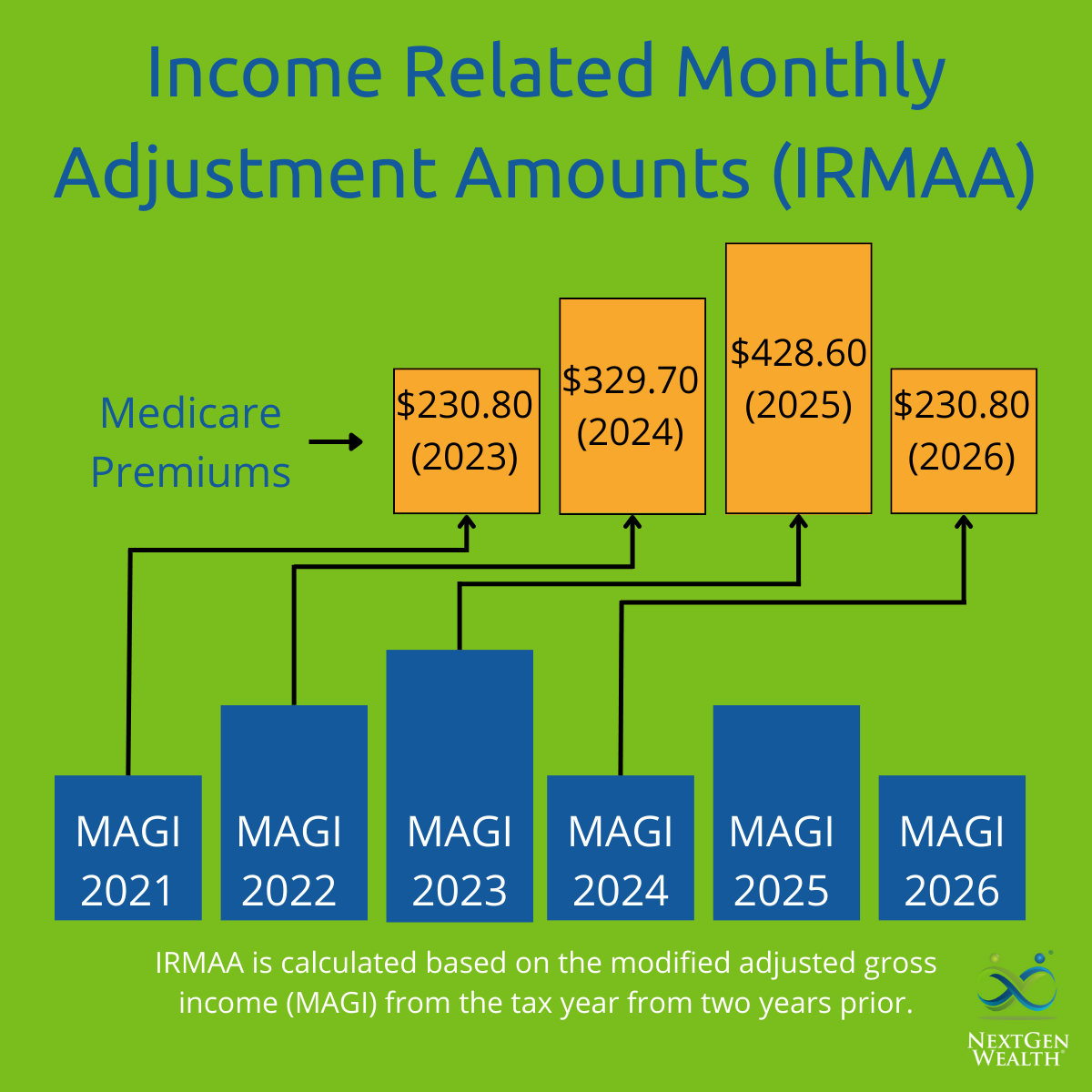

IRMAA was introduced in 2007 as part of the Medicare Prescription Drug, Improvement, and Modernization Act. Its purpose is to ensure that higher-income beneficiaries contribute more towards the cost of their Medicare benefits. IRMAA is calculated based on the individual’s modified adjusted gross income (MAGI) from two years prior to the current year.

Projected 2025 IRMAA Brackets

The Centers for Medicare & Medicaid Services (CMS) has released the projected IRMAA brackets for 2025. These brackets are subject to change based on actual cost-of-living adjustments.

Part B IRMAA Brackets

| Filing Status | MAGI Threshold | IRMAA Surcharge |

|---|---|---|

| Single | $97,000 | $56.80 |

| Married Filing Jointly | $194,000 | $113.60 |

| Married Filing Separately | $97,000 | $113.60 |

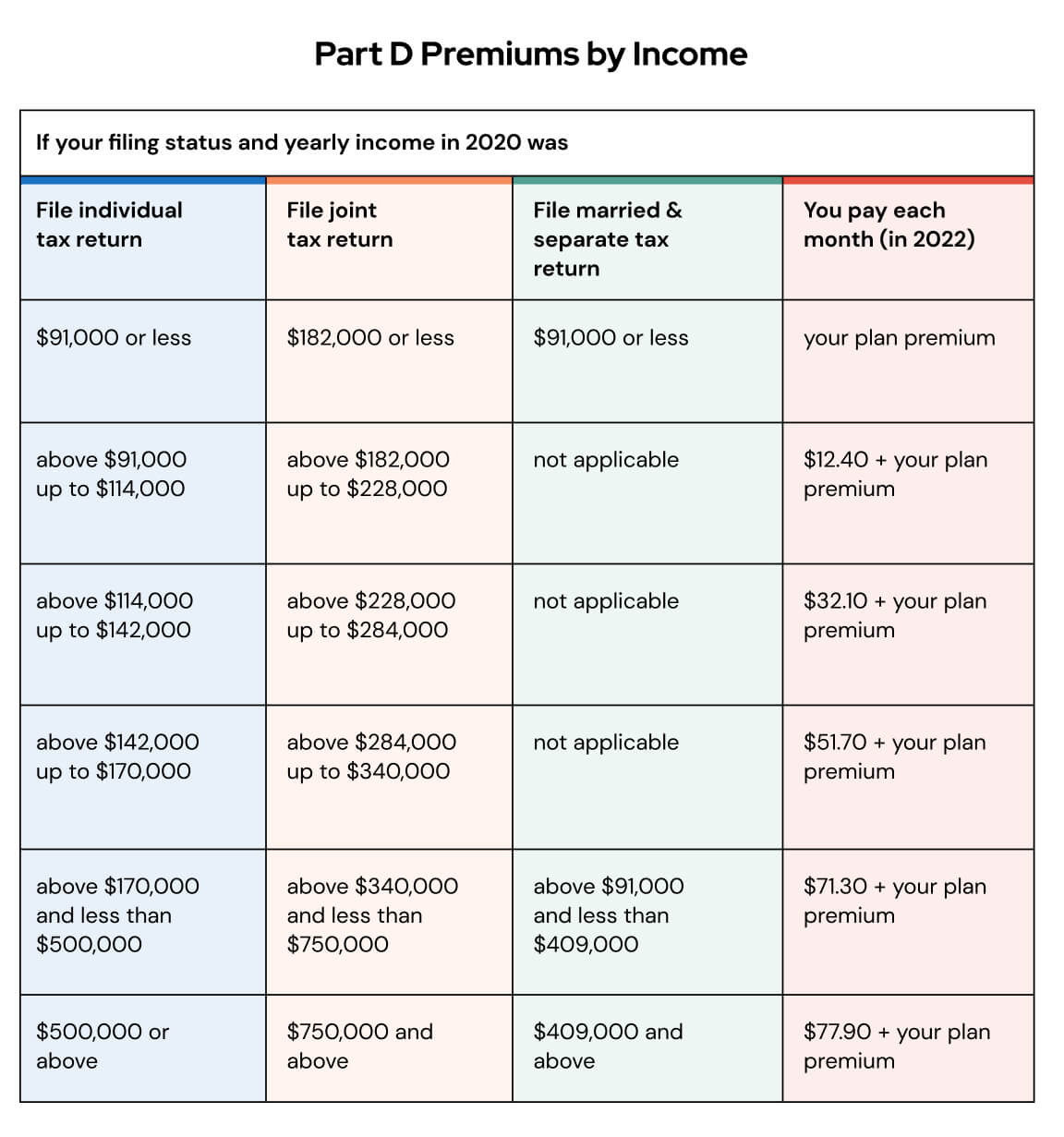

Part D IRMAA Brackets

| Filing Status | MAGI Threshold | IRMAA Surcharge |

|---|---|---|

| Single | $91,000 | $12.40 |

| Married Filing Jointly | $182,000 | $24.80 |

| Married Filing Separately | $91,000 | $24.80 |

Impact of IRMAA

IRMAA can significantly impact Medicare premiums for high-income beneficiaries. For individuals with MAGIs above the IRMAA thresholds, the additional surcharges can add hundreds of dollars to their monthly premiums.

Planning for IRMAA

To minimize the impact of IRMAA, Medicare beneficiaries can consider the following strategies:

- Maximize Deductions and Contributions: Reducing MAGI by maximizing deductions and contributions to retirement accounts can lower IRMAA surcharges.

- Delay Social Security Benefits: Delaying the start of Social Security benefits can reduce MAGI, as Social Security benefits are included in the IRMAA calculation.

- Consider Medicare Advantage Plans: Medicare Advantage plans often include Part B and Part D coverage, and some may have lower premiums than traditional Medicare with IRMAA surcharges.

Conclusion

The projected 2025 IRMAA brackets provide valuable insights for Medicare beneficiaries to plan their healthcare expenses. By understanding the thresholds and impact of IRMAA, individuals can make informed decisions to minimize their financial burden and ensure they have access to the necessary healthcare coverage. It is essential to consult with a financial advisor or Medicare specialist for personalized advice and guidance on IRMAA-related matters.

Closure

Thus, we hope this article has provided valuable insights into Projected 2025 IRMAA Brackets: Understanding the Income-Related Monthly Adjustment Amount. We appreciate your attention to our article. See you in our next article!