Mortgage Interest Rates Forecast 2025 UK: A Comprehensive Analysis

Related Articles: Mortgage Interest Rates Forecast 2025 UK: A Comprehensive Analysis

- 2025 Formula 1 Season: A Preview Of The Future

- 2025 Africa Cup Of Nations Qualifiers: Preview, Fixtures, And Analysis

- Oregon Ducks 2024 Recruiting Class: A Comprehensive Look

- Indian Overseas Bank Share Price News: A Comprehensive Analysis

- Riverside Best Healthcare In Spring 2024

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Mortgage Interest Rates Forecast 2025 UK: A Comprehensive Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Mortgage Interest Rates Forecast 2025 UK: A Comprehensive Analysis

Mortgage Interest Rates Forecast 2025 UK: A Comprehensive Analysis

Introduction

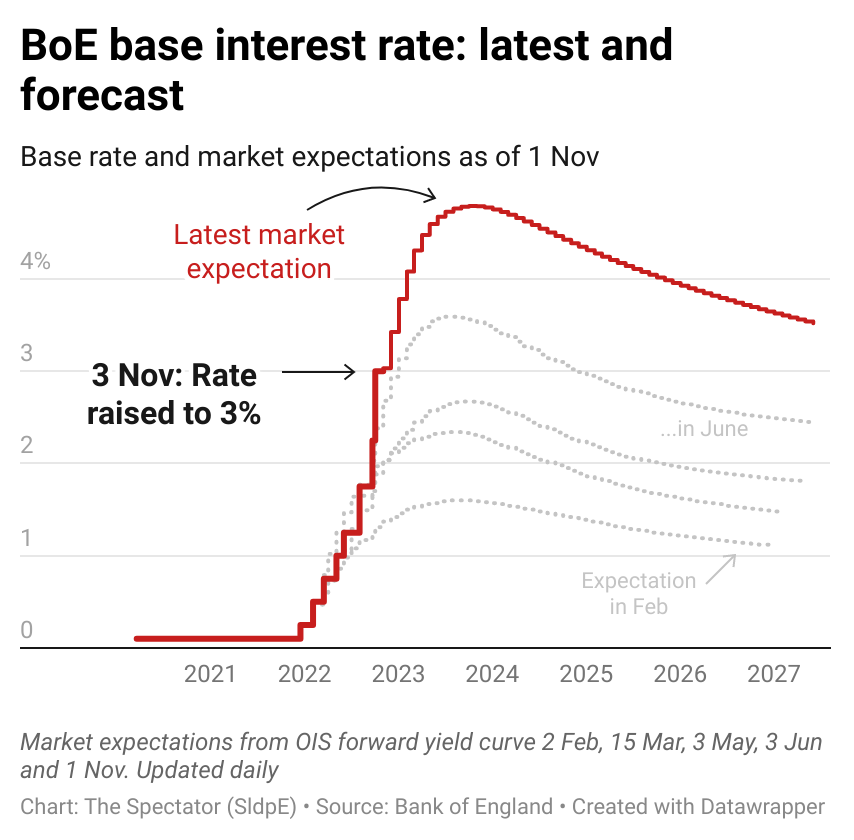

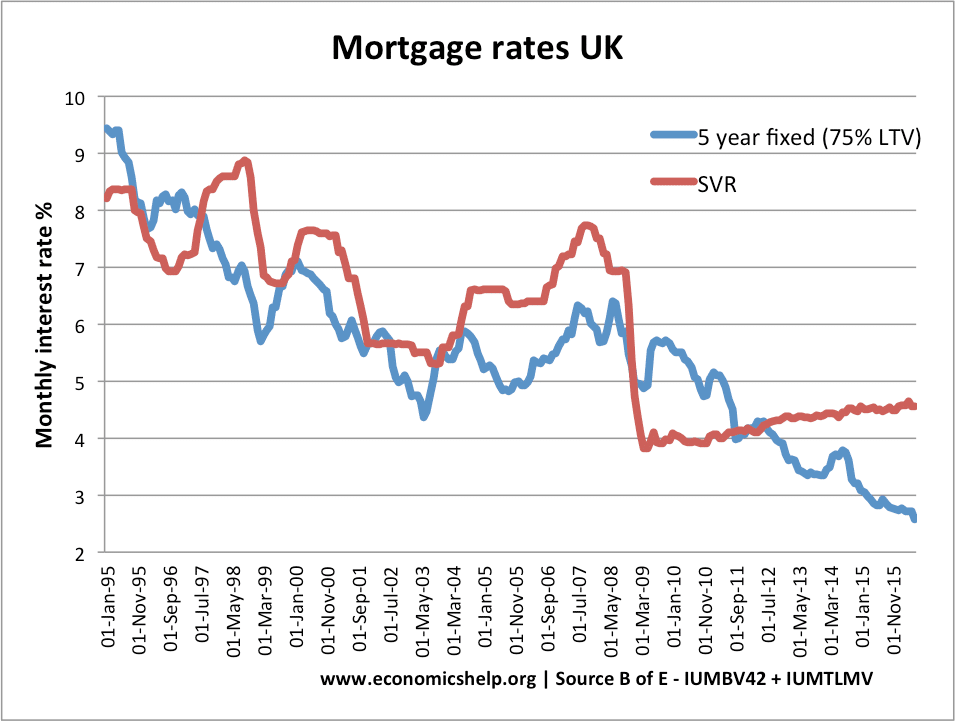

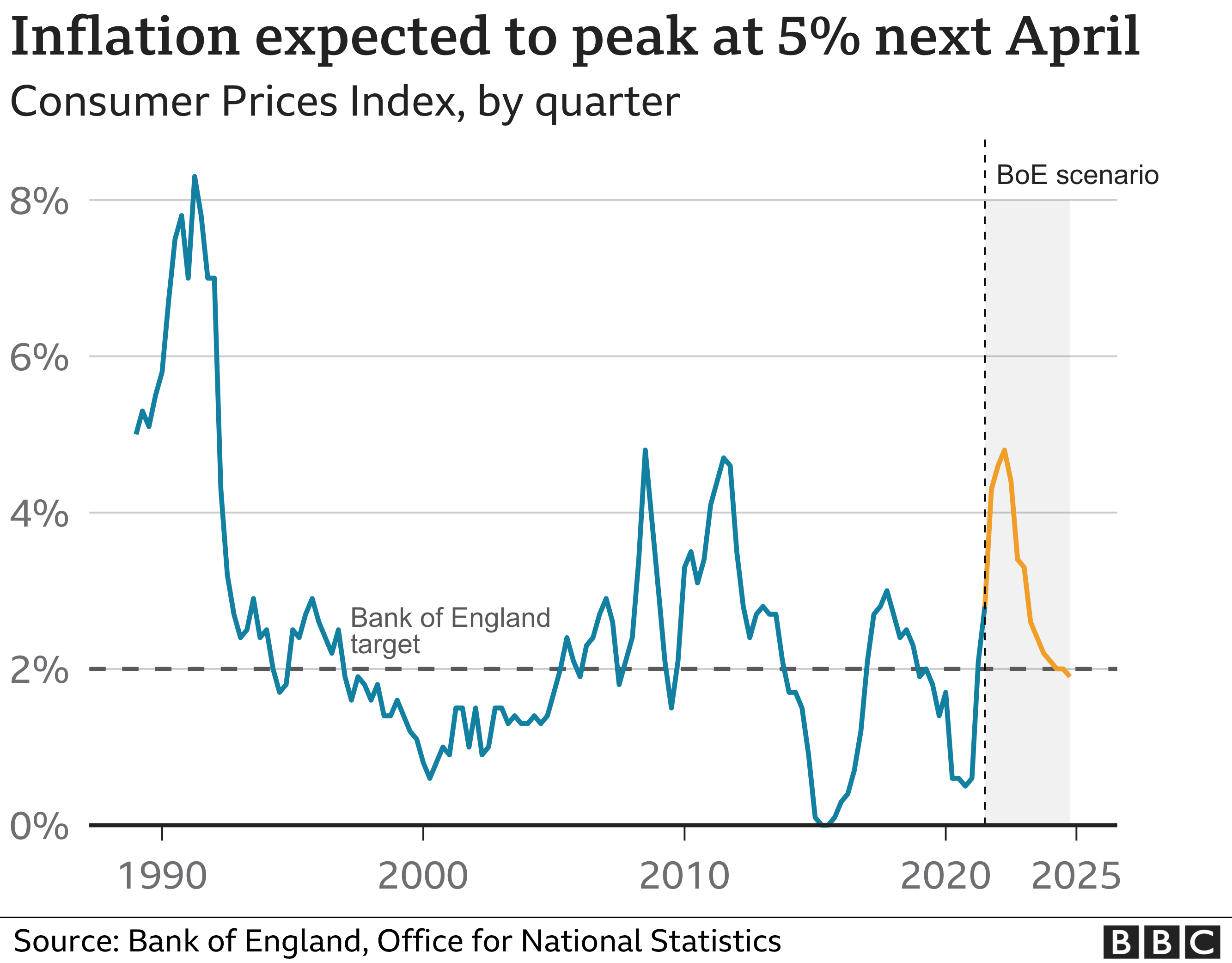

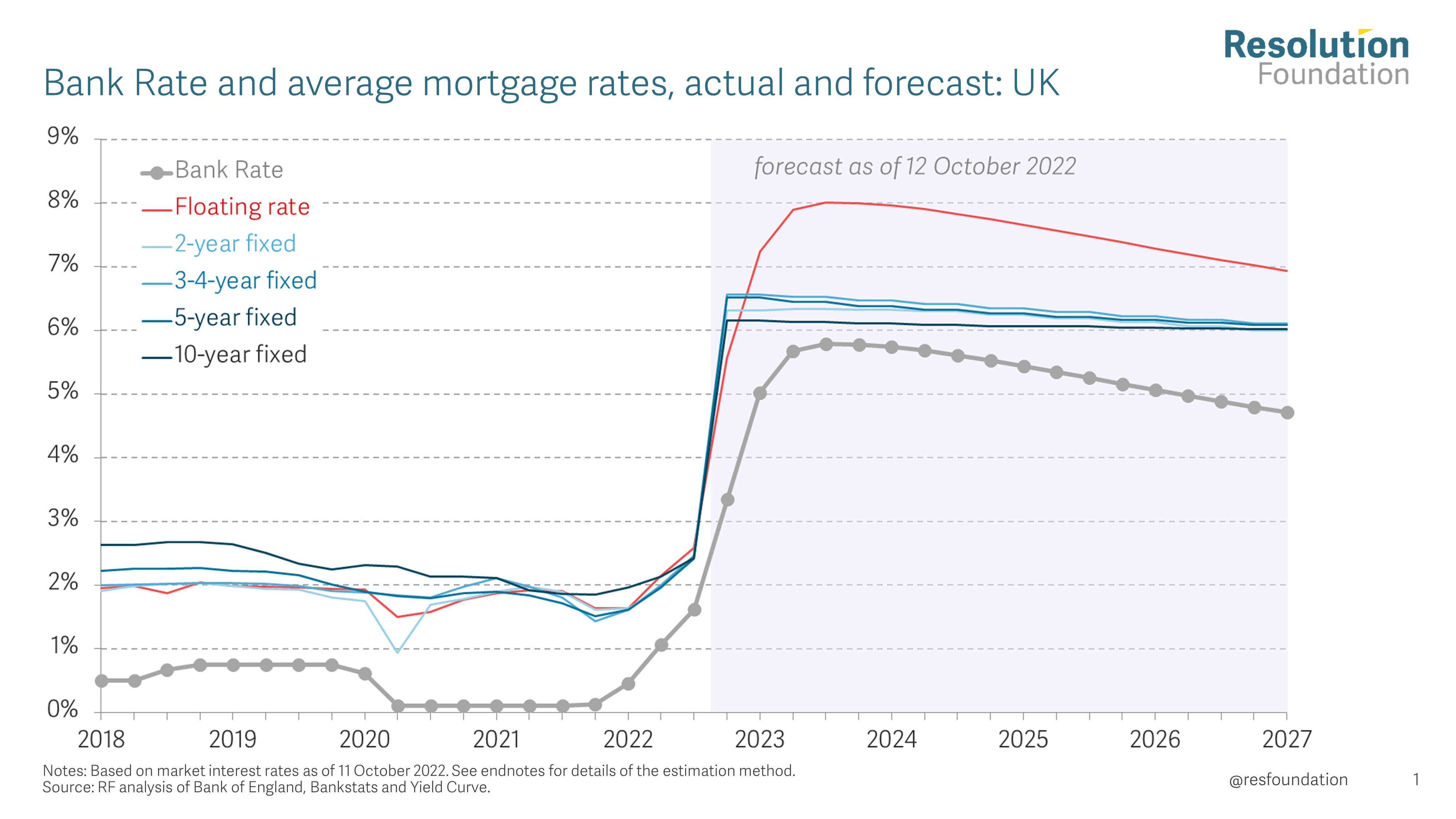

Mortgage interest rates play a crucial role in determining the affordability of homeownership. As the Bank of England (BoE) continues to raise interest rates to combat inflation, it is essential to understand how these changes will impact mortgage rates in the coming years. This article provides a comprehensive forecast of mortgage interest rates in the UK up to 2025, considering various economic factors and market trends.

Current Interest Rate Environment

As of August 2023, the BoE’s base rate stands at 1.75%, the highest level since 2008. This has led to a significant increase in mortgage rates, with the average two-year fixed-rate mortgage now around 4%.

Economic Factors Influencing Interest Rates

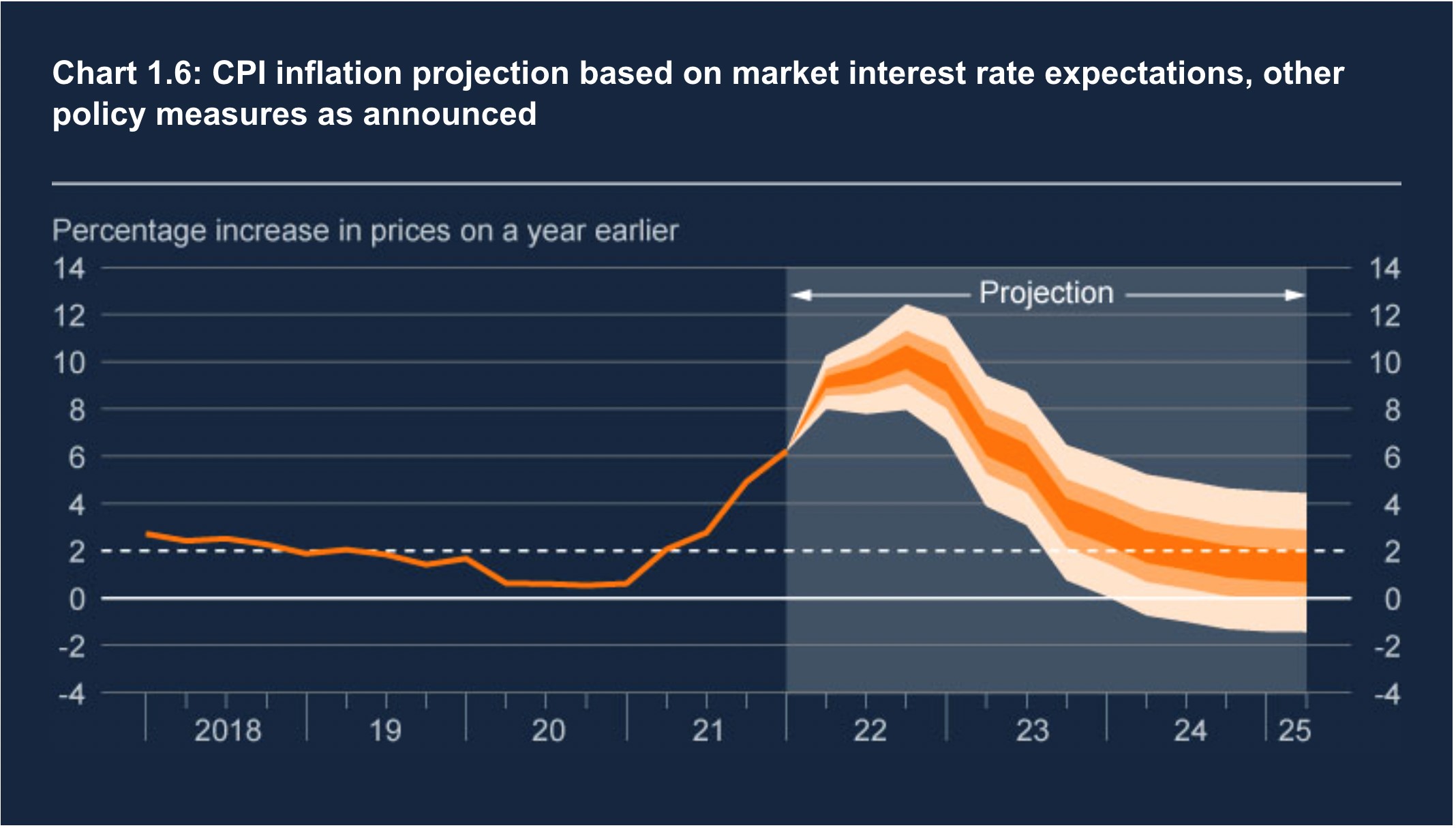

Inflation: The BoE’s primary mandate is to maintain price stability. With inflation currently at 9.4%, well above the target of 2%, the BoE is likely to continue raising interest rates to bring inflation under control.

Economic Growth: The UK economy is expected to slow in the coming years, with the International Monetary Fund (IMF) forecasting growth of just 0.5% in 2023. This could lead to a reduction in demand for mortgages, potentially putting downward pressure on interest rates.

Global Financial Conditions: The global economy is facing a period of uncertainty, with the war in Ukraine and rising energy prices creating significant headwinds. This could lead to a flight to safety, increasing demand for UK government bonds and potentially pushing mortgage rates lower.

Market Trends

Fixed-Rate Mortgages: Fixed-rate mortgages are likely to remain popular in the current environment of rising interest rates. Borrowers can lock in a rate for a fixed period, providing certainty in their monthly mortgage payments.

Variable-Rate Mortgages: Variable-rate mortgages, such as tracker mortgages, are likely to become more expensive as the BoE raises interest rates. Borrowers with these mortgages could see their monthly payments increase significantly.

Mortgage Affordability: Rising interest rates are making it more difficult for potential homebuyers to qualify for mortgages. This could lead to a decline in house prices, which would in turn reduce demand for mortgages and potentially lower interest rates.

Forecast for 2025

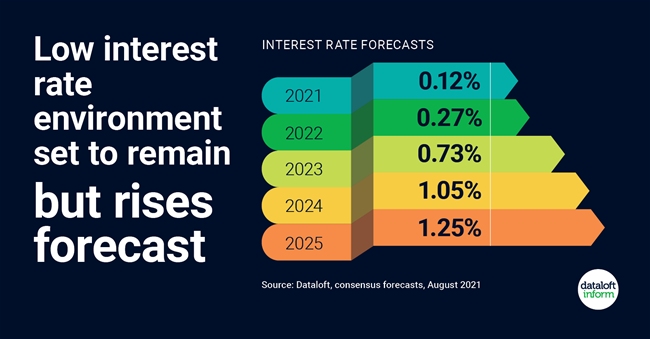

Based on the current economic outlook and market trends, we forecast that mortgage interest rates in the UK will remain elevated in the near term but are likely to moderate in the medium term.

2023: We expect the BoE to continue raising interest rates in 2023, with the base rate reaching 2.5% by the end of the year. This will lead to further increases in mortgage rates, with the average two-year fixed-rate mortgage rising to around 4.5%.

2024: As inflation begins to moderate, the BoE is likely to slow the pace of interest rate hikes. The base rate is expected to reach 3% by the end of 2024, leading to a slight decrease in mortgage rates.

2025: We forecast that the BoE will begin to cut interest rates in 2025, as the economy slows and inflation falls towards the target. The base rate is expected to drop to 2.5% by the end of 2025, resulting in a further reduction in mortgage rates.

Impact on Homebuyers

Rising mortgage interest rates will have a significant impact on homebuyers. First-time buyers will face higher upfront costs and monthly mortgage payments, making it more difficult to get onto the property ladder. Existing homeowners with variable-rate mortgages could see their monthly payments increase significantly, potentially putting a strain on their finances.

Conclusion

Mortgage interest rates in the UK are expected to remain elevated in the near term but are likely to moderate in the medium term. The BoE’s monetary policy decisions will play a key role in determining the trajectory of mortgage rates. Homebuyers should carefully consider the impact of rising interest rates on their affordability and make informed decisions about their mortgage choices.

Closure

Thus, we hope this article has provided valuable insights into Mortgage Interest Rates Forecast 2025 UK: A Comprehensive Analysis. We appreciate your attention to our article. See you in our next article!