Mortgage Interest Rates Forecast 2025: A Comprehensive Analysis

Related Articles: Mortgage Interest Rates Forecast 2025: A Comprehensive Analysis

- 2025 Interest Rates Forecast: Navigating An Uncertain Economic Landscape

- Best Target Date Funds For 2055

- When Is The Next DV Lottery Registration 2025?

- CR2025 Battery Holder: A Comprehensive Guide

- Winter Olympics 2025: Milan-Cortina D’Ampezzo To Host The Winter Games

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Mortgage Interest Rates Forecast 2025: A Comprehensive Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Mortgage Interest Rates Forecast 2025: A Comprehensive Analysis

Mortgage Interest Rates Forecast 2025: A Comprehensive Analysis

Introduction

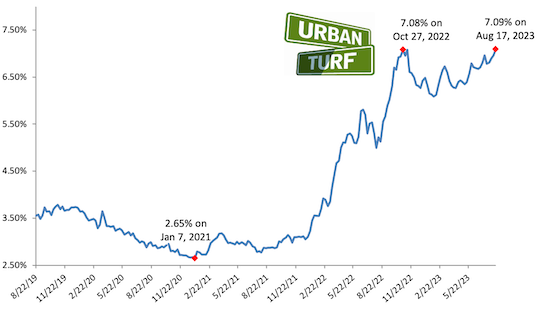

Mortgage interest rates play a pivotal role in determining the affordability and accessibility of homeownership. As such, forecasting future interest rate trends is crucial for individuals planning to purchase a home, refinance their existing mortgage, or make informed financial decisions. This article provides a comprehensive analysis of mortgage interest rates forecast for 2025, examining key factors that will shape their trajectory and offering insights into potential market scenarios.

Factors Influencing Mortgage Interest Rates

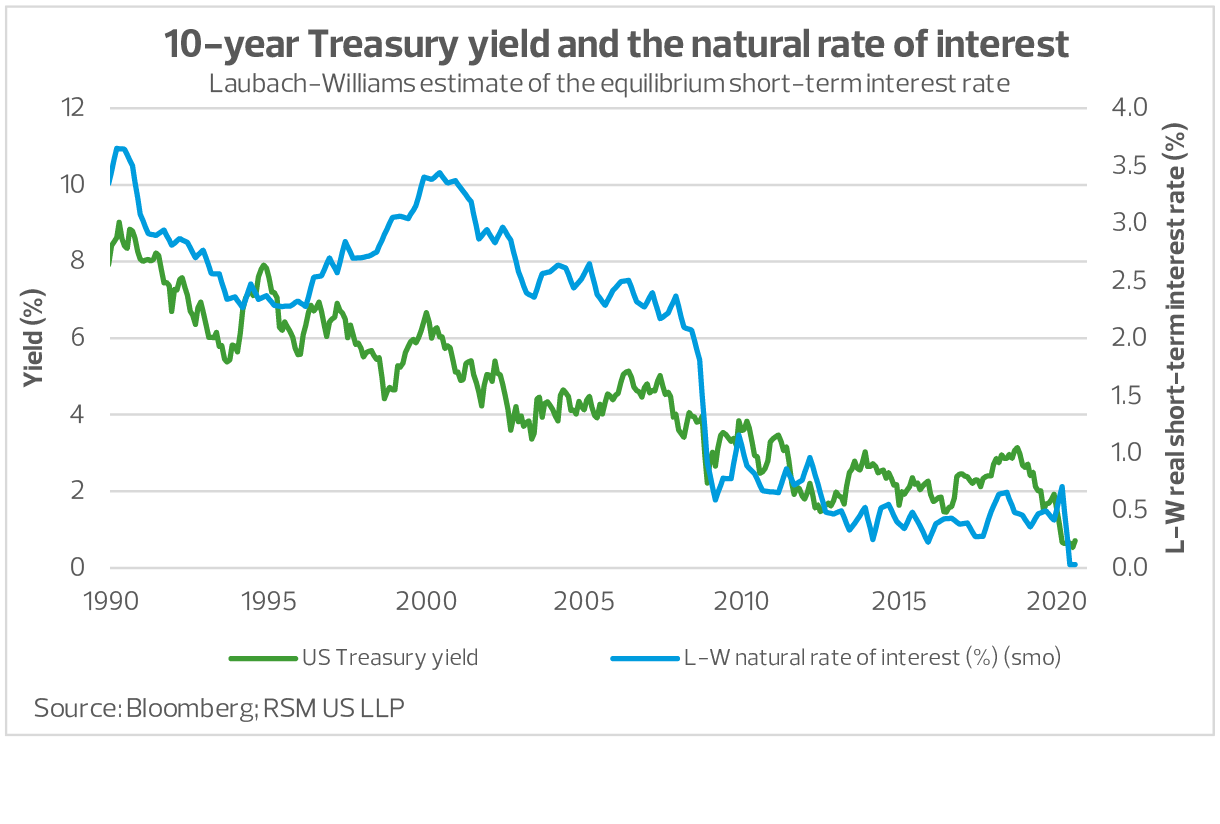

- Federal Reserve Policy: The Federal Reserve (Fed) is the primary driver of interest rates in the United States. Its decisions on monetary policy, such as raising or lowering interest rates, have a direct impact on mortgage rates.

- Economic Conditions: Economic growth, inflation, and unemployment rates influence the Fed’s policy decisions. A strong economy with low unemployment and rising wages typically leads to higher interest rates.

- Global Market Conditions: Global economic events, such as geopolitical tensions or changes in foreign economies, can also affect mortgage rates.

- Mortgage Bond Market: Mortgage bonds are the underlying securities that determine mortgage rates. The supply and demand for these bonds influence their prices and, consequently, mortgage rates.

Forecast for 2025

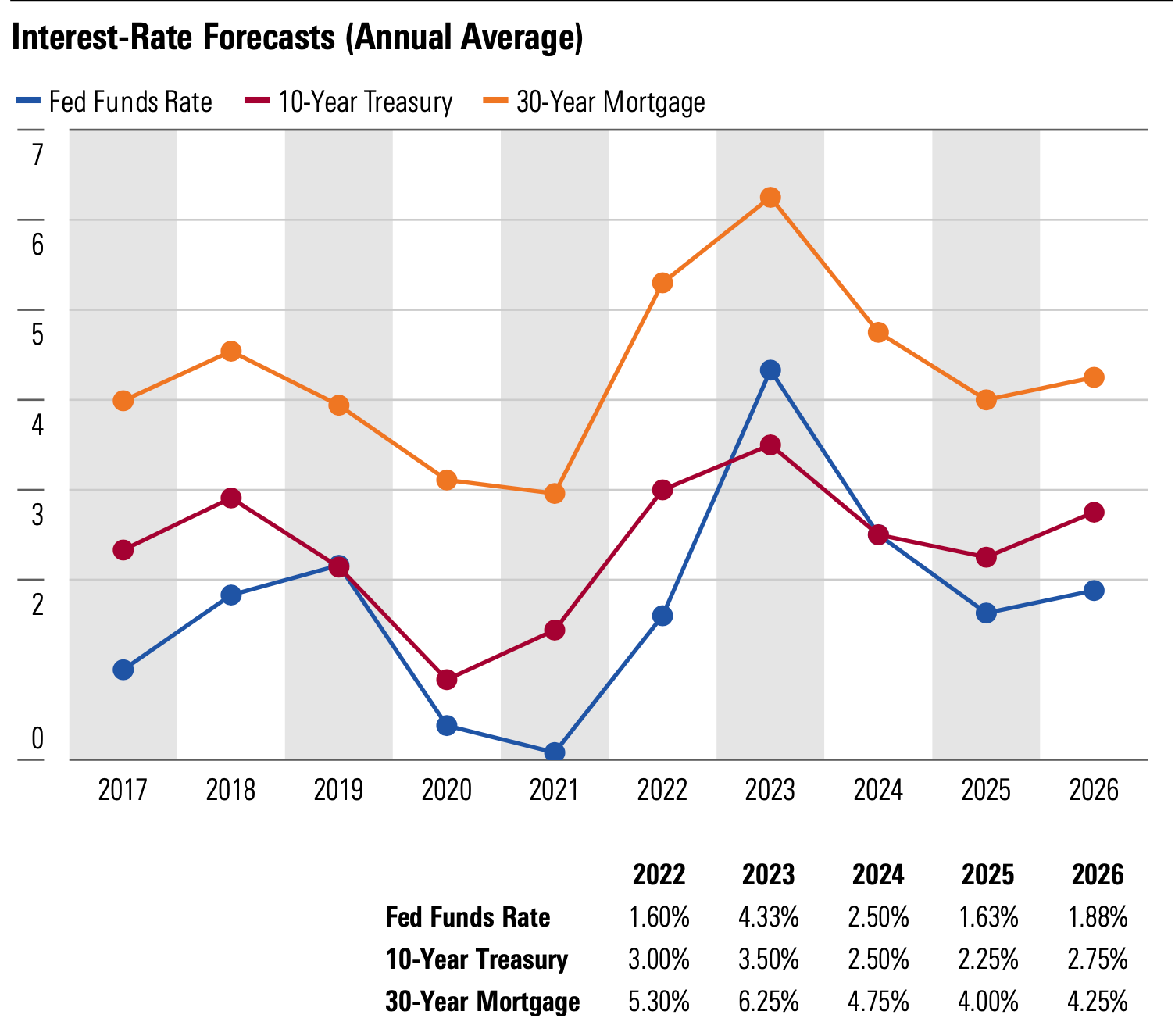

Scenario 1: Gradual Increase

- Assumptions: Continued economic growth, moderate inflation, and stable global markets.

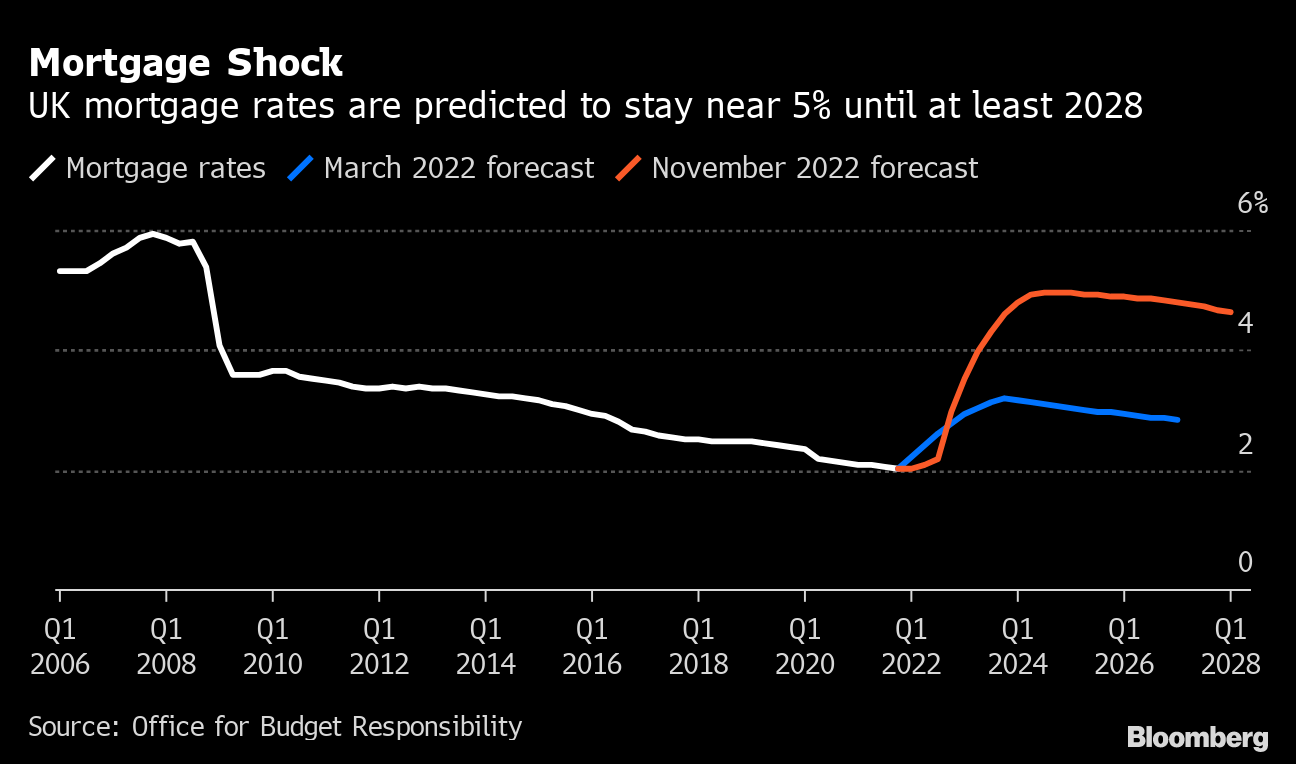

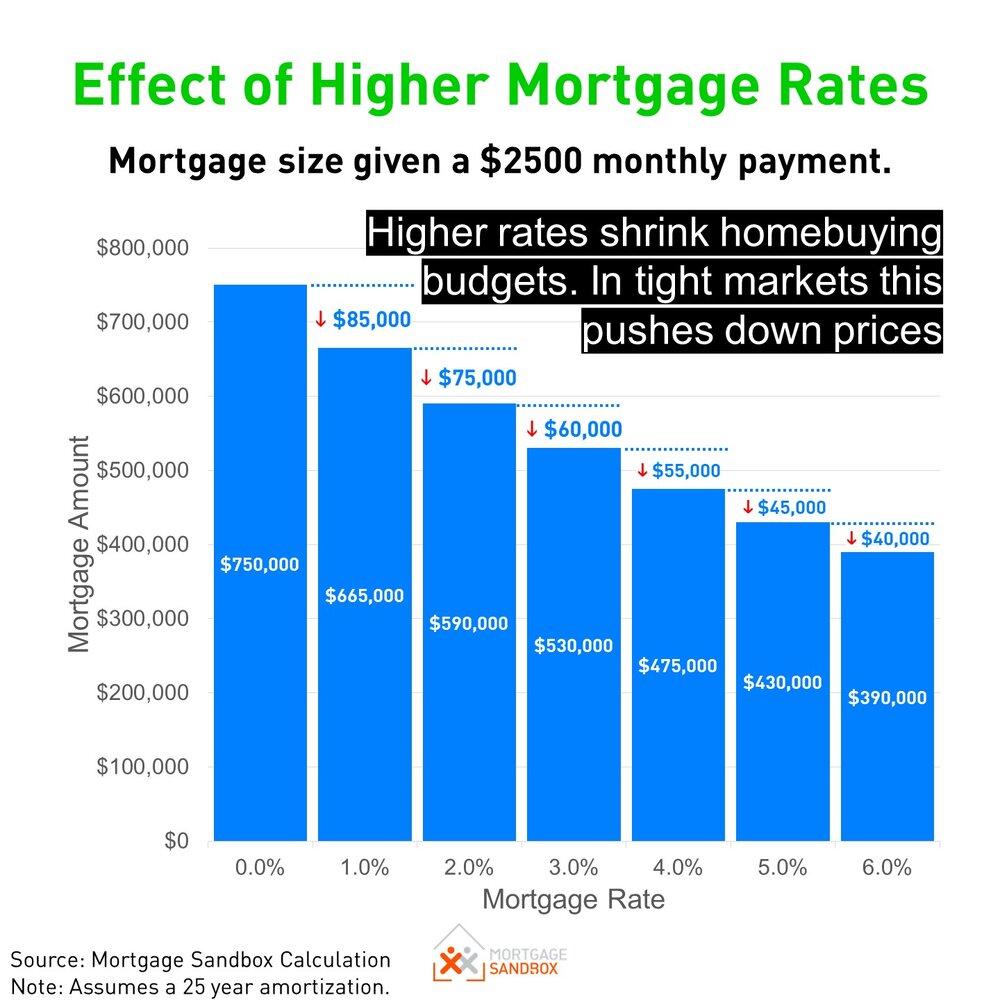

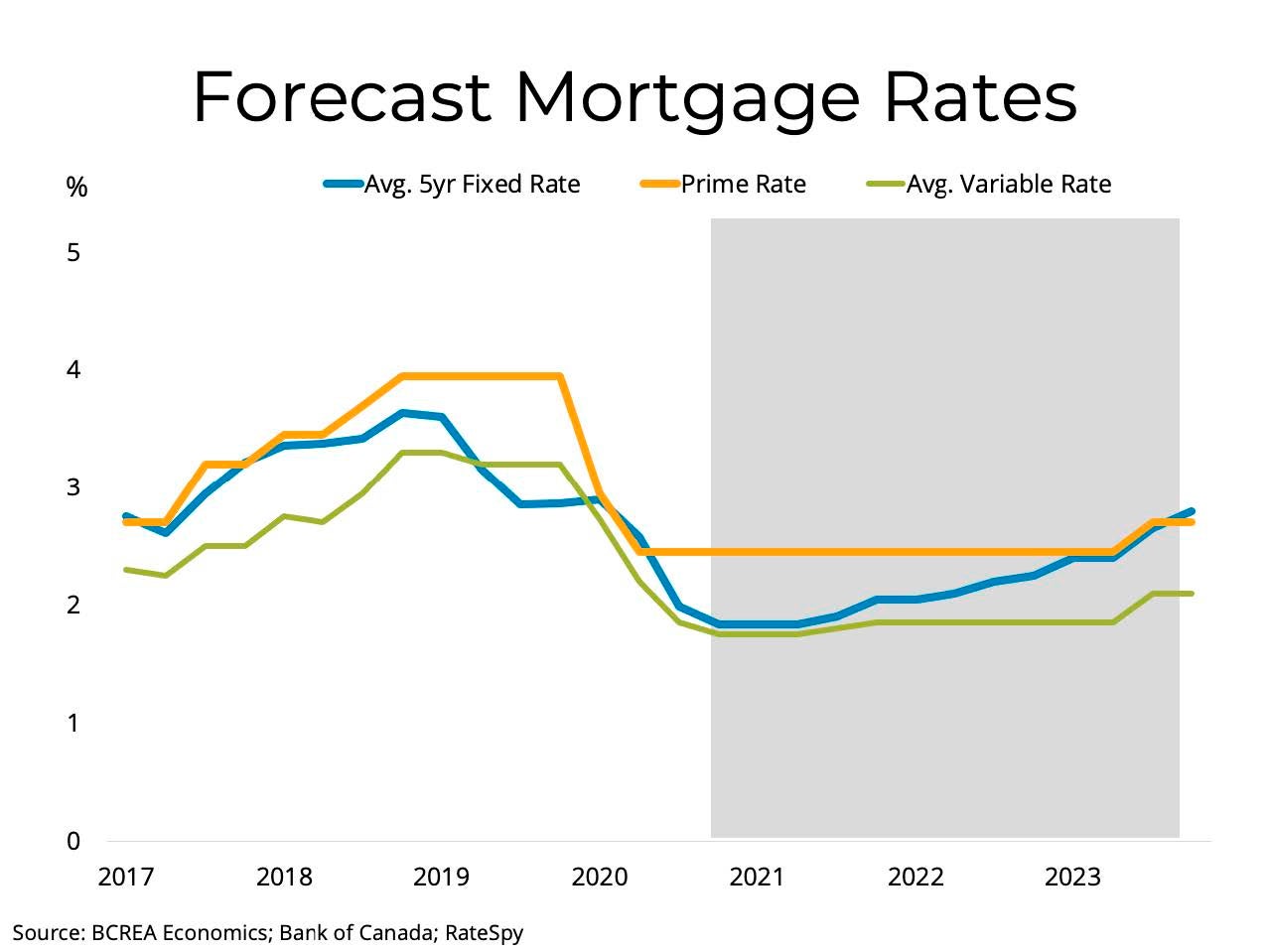

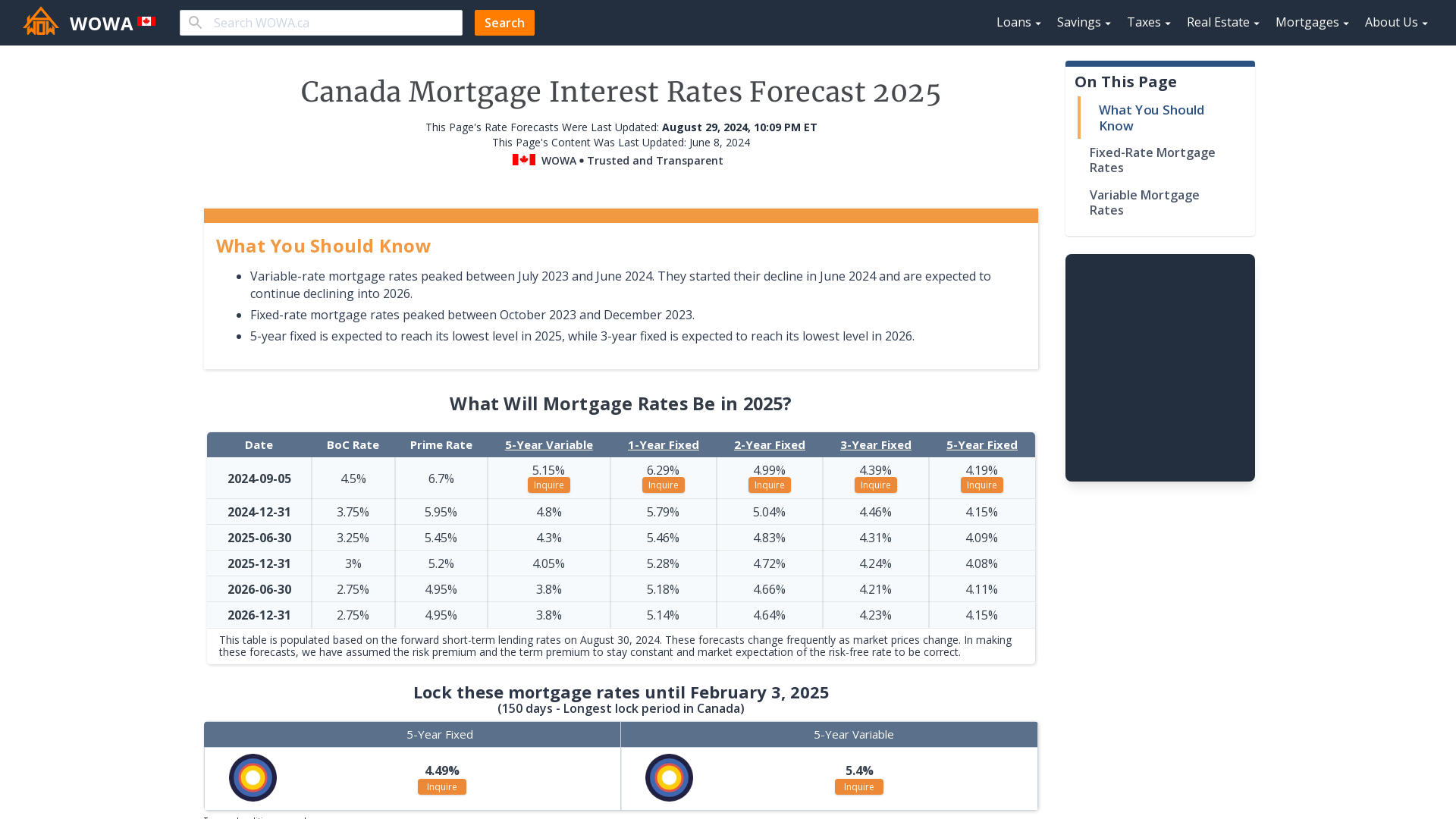

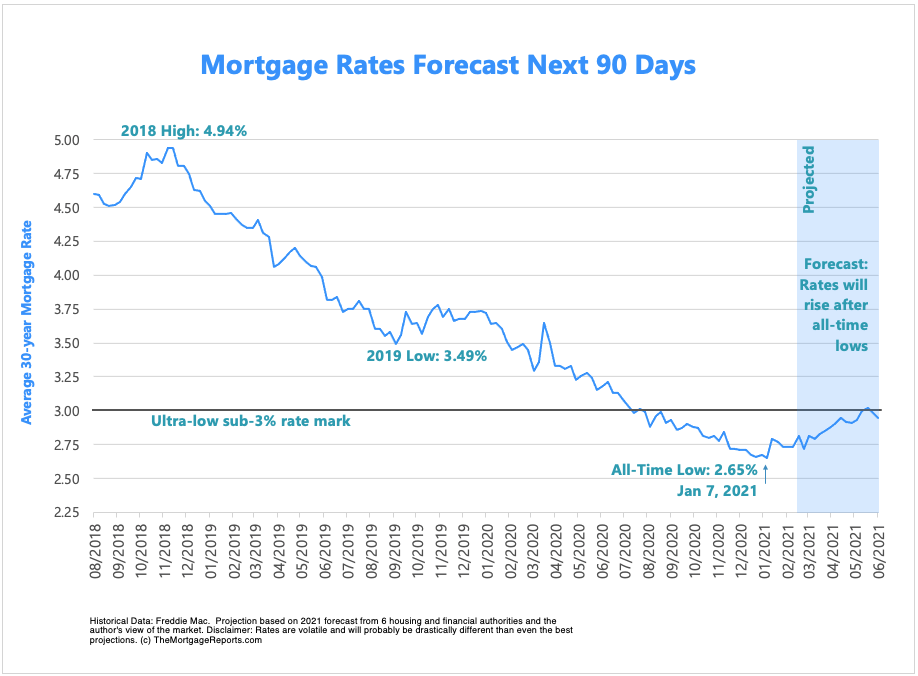

- Forecast: Mortgage rates gradually rise over the next few years, reaching an average of 5.5% by 2025. This scenario implies a steady increase in homeownership costs but remains within a manageable range.

Scenario 2: Moderate Rise

- Assumptions: Stronger economic growth, higher inflation, and geopolitical uncertainties.

- Forecast: Mortgage rates rise more sharply, reaching an average of 6.5% by 2025. This scenario would lead to increased homeownership expenses and may impact affordability for some buyers.

Scenario 3: Steep Decline

- Assumptions: Economic slowdown, deflation, and global market instability.

- Forecast: Mortgage rates decline significantly, reaching an average of 4.5% by 2025. This scenario would provide significant relief for homebuyers and homeowners, reducing monthly mortgage payments and increasing affordability.

Key Considerations

- Short-Term Volatility: Mortgage rates may experience short-term fluctuations in response to economic data or market events. It is important to consider these fluctuations when making financial decisions.

- Individual Circumstances: The impact of interest rate changes on individuals will vary based on their financial situation, credit history, and loan terms.

- Alternative Financing Options: If mortgage rates rise significantly, borrowers may consider alternative financing options, such as adjustable-rate mortgages or government-backed loans.

- Market Timing: Predicting the exact timing of interest rate changes is challenging. It is often more prudent to focus on long-term affordability and financial stability rather than trying to time the market.

Conclusion

Mortgage interest rates forecast for 2025 is subject to a range of factors that will shape their trajectory. While it is difficult to predict with certainty, the scenarios outlined in this article provide a framework for understanding potential market outcomes. By considering these factors and their implications, individuals can make informed decisions about their mortgage plans and navigate the evolving housing market. It is always advisable to consult with a qualified financial advisor or mortgage professional for personalized guidance and to stay abreast of the latest market developments.

Closure

Thus, we hope this article has provided valuable insights into Mortgage Interest Rates Forecast 2025: A Comprehensive Analysis. We hope you find this article informative and beneficial. See you in our next article!