LCID Stock Price Prediction 2025: A Comprehensive Analysis

Related Articles: LCID Stock Price Prediction 2025: A Comprehensive Analysis

- 2025 UK Calendar: A Comprehensive Overview

- CEO Of Google 2025: A Profile Of Leadership And Innovation

- 2025 Land Cruiser Prado: A Comprehensive Overview

- 2025 Ford Mustang Cobra: A Return To Glory

- William & Mary 2024-2025 Calendar: A Legacy Of Academic Excellence And Campus Tradition

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to LCID Stock Price Prediction 2025: A Comprehensive Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about LCID Stock Price Prediction 2025: A Comprehensive Analysis

LCID Stock Price Prediction 2025: A Comprehensive Analysis

Introduction

Lucid Group, Inc. (LCID), an American electric vehicle (EV) manufacturer, has emerged as a formidable player in the rapidly evolving automotive industry. As the world transitions towards sustainable transportation, investors are keen on understanding the potential growth trajectory of LCID stock and its long-term prospects. This article aims to provide a comprehensive analysis of LCID’s stock price prediction for 2025, considering various factors that may influence its future performance.

Market Outlook and Industry Trends

The global EV market is expected to witness exponential growth in the coming years, driven by increasing environmental concerns, government incentives, and technological advancements. According to market research firm Allied Market Research, the global EV market size is projected to reach $1,318.1 billion by 2028, growing at a CAGR of 24.3% from 2021 to 2028.

Within the EV market, Lucid is positioned in the luxury segment, competing with established automakers such as Tesla, Mercedes-Benz, and BMW. The luxury EV segment is characterized by high demand for premium vehicles, advanced technology, and exceptional performance. As more consumers embrace luxury EVs, Lucid is well-positioned to capture a significant market share.

Financial Performance and Growth Strategy

Lucid’s financial performance has been marked by significant investments in research and development, production capacity expansion, and marketing initiatives. In 2022, the company reported a net loss of $2.2 billion, primarily due to these investments. However, Lucid’s revenue is expected to grow rapidly in the coming years as production ramps up and demand for its vehicles increases.

Lucid’s growth strategy revolves around expanding its product portfolio, increasing production capacity, and establishing a global presence. The company plans to launch new models, including the Lucid Gravity SUV and the Lucid Air sedan in different variants, to cater to a wider range of customers. Additionally, Lucid is investing heavily in its manufacturing facilities in Arizona and Saudi Arabia to meet the growing demand for its vehicles.

Competitive Landscape and Market Share

Lucid faces intense competition from established automakers and emerging EV startups. Tesla remains the dominant player in the luxury EV market, with a significant market share and a strong brand reputation. Mercedes-Benz and BMW are also formidable competitors, offering a range of premium EVs with advanced technology and performance.

Despite the competitive landscape, Lucid has managed to establish a niche for itself by focusing on high-performance luxury EVs. The company’s vehicles have received critical acclaim for their innovative design, exceptional performance, and advanced technology. As Lucid expands its product portfolio and increases production, it is expected to gain market share in the luxury EV segment.

Valuation and Stock Price Prediction

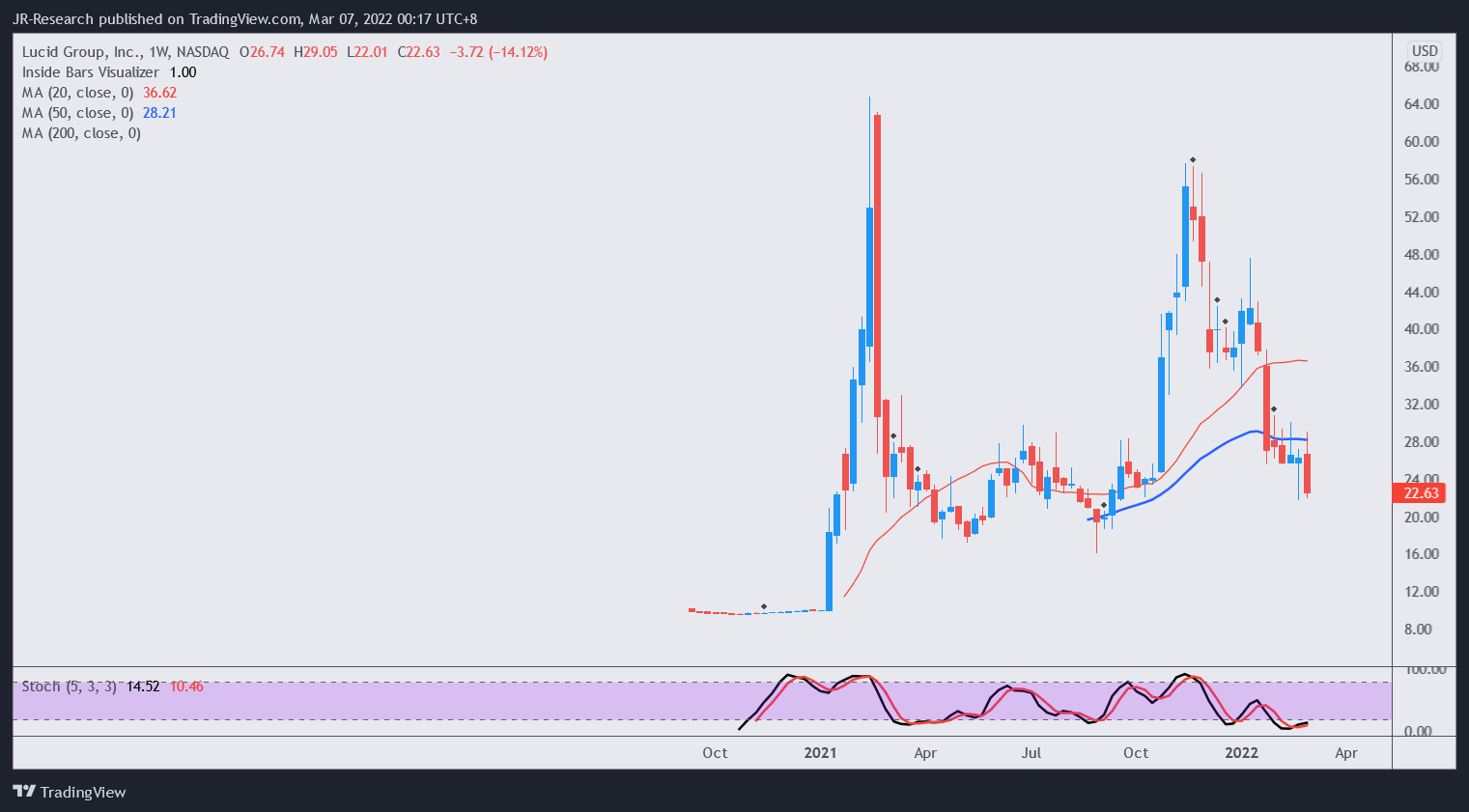

Various factors can influence LCID’s stock price, including financial performance, market trends, competitive dynamics, and investor sentiment. Analysts have provided different stock price predictions for LCID in 2025, based on their own assumptions and methodologies.

- Bullish Prediction: Some analysts believe that LCID’s stock price could reach $50-$70 by 2025, driven by strong demand for its vehicles, increasing production capacity, and positive financial performance.

- Neutral Prediction: Other analysts take a more conservative approach, predicting that LCID’s stock price could range between $30-$45 by 2025, considering the competitive landscape and the challenges of ramping up production.

- Bearish Prediction: A few analysts have expressed concerns about Lucid’s financial performance and the intense competition in the EV market, predicting that its stock price could fall below $20 by 2025.

Risks and Challenges

Despite its promising outlook, Lucid faces several risks and challenges that could impact its stock price performance.

- Production Delays and Supply Chain Issues: Lucid’s production ramp-up could face delays due to supply chain disruptions, labor shortages, or other unforeseen circumstances. Such delays could affect the company’s revenue and profitability.

- Intense Competition: The luxury EV market is highly competitive, with established automakers and emerging startups vying for market share. Lucid must differentiate itself through innovative products, exceptional performance, and strong brand recognition.

- Financial Performance: Lucid’s financial performance will be crucial in determining its stock price performance. The company must manage its expenses effectively, increase revenue, and achieve profitability to sustain growth and investor confidence.

Conclusion

LCID stock price prediction for 2025 is a complex matter, influenced by various factors such as market trends, financial performance, competitive dynamics, and investor sentiment. While analysts have provided different predictions, it is important to note that stock price predictions are inherently uncertain and should be taken with caution.

Lucid Group is well-positioned in the rapidly growing EV market, with its focus on luxury vehicles, innovative technology, and global expansion plans. However, the company faces significant risks and challenges, including production delays, intense competition, and the need to achieve profitability. Investors should carefully consider these factors and conduct their own due diligence before making investment decisions.

Closure

Thus, we hope this article has provided valuable insights into LCID Stock Price Prediction 2025: A Comprehensive Analysis. We appreciate your attention to our article. See you in our next article!