IR 2025 Como Fazer: A Comprehensive Guide to Achieving Retirement Success

Related Articles: IR 2025 Como Fazer: A Comprehensive Guide to Achieving Retirement Success

- Holidays To Mauritius In 2025: A Comprehensive Guide To Paradise

- Ontario Street & Rockwell Avenue: A Historic Intersection In Cleveland, Ohio

- The All-New 2025 Kia Carnival AWD: A Revolutionary Minivan

- Harry Potter: The Return Of The Dark Lord (2025)

- YouTube Premiere: The Future Of Live Entertainment Unveiled On May 1, 2025

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to IR 2025 Como Fazer: A Comprehensive Guide to Achieving Retirement Success. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about IR 2025 Como Fazer: A Comprehensive Guide to Achieving Retirement Success

IR 2025 Como Fazer: A Comprehensive Guide to Achieving Retirement Success

Introduction

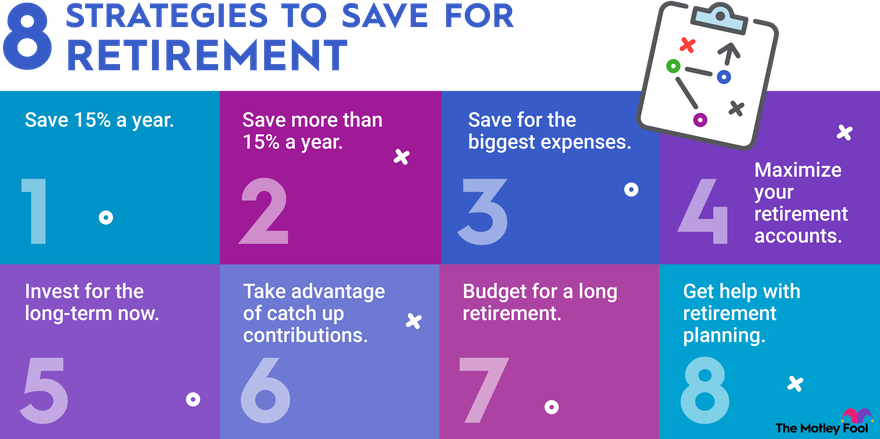

Retirement planning is a crucial aspect of financial well-being, ensuring a comfortable and secure future. IR 2025, or Individual Retirement Plan 2025, is a tax-advantaged retirement savings plan offered by the Brazilian government. By understanding the IR 2025 Como Fazer (How to Make IR 2025), individuals can maximize their retirement savings and achieve financial freedom.

Understanding IR 2025

IR 2025 is a private pension plan that allows individuals to save for retirement through contributions made from their monthly income. These contributions are tax-deductible, reducing the individual’s taxable income and potentially saving them money on taxes.

There are two types of IR 2025 plans:

- Traditional IR 2025: Contributions are tax-deductible, but withdrawals in retirement are taxed as income.

- Roth IR 2025: Contributions are made after taxes, but withdrawals in retirement are tax-free.

Eligibility for IR 2025

To participate in IR 2025, individuals must meet the following eligibility criteria:

- Be a resident of Brazil

- Have a valid CPF (Cadastro de Pessoas Físicas) number

- Be an active contributor to the Brazilian social security system (INSS)

Contribution Limits

The maximum annual contribution limit for IR 2025 is 12% of the individual’s taxable income. However, individuals who are self-employed or receive income from other sources may be eligible for higher contribution limits.

Tax Benefits

One of the primary benefits of IR 2025 is the tax savings it offers. Contributions to IR 2025 are tax-deductible, reducing the individual’s taxable income. Additionally, withdrawals from Roth IR 2025 accounts are tax-free in retirement.

Investment Options

IR 2025 offers a range of investment options, including:

- Fixed income: Treasury bonds, corporate bonds, and certificates of deposit

- Variable income: Stocks, mutual funds, and exchange-traded funds (ETFs)

- Real estate: Real estate investment trusts (REITs) and direct real estate investments

Choosing the Right IR 2025 Plan

The choice between a traditional IR 2025 and a Roth IR 2025 depends on the individual’s financial situation and retirement goals.

- Traditional IR 2025: Suitable for individuals who expect to be in a lower tax bracket in retirement.

- Roth IR 2025: Suitable for individuals who expect to be in a higher tax bracket in retirement.

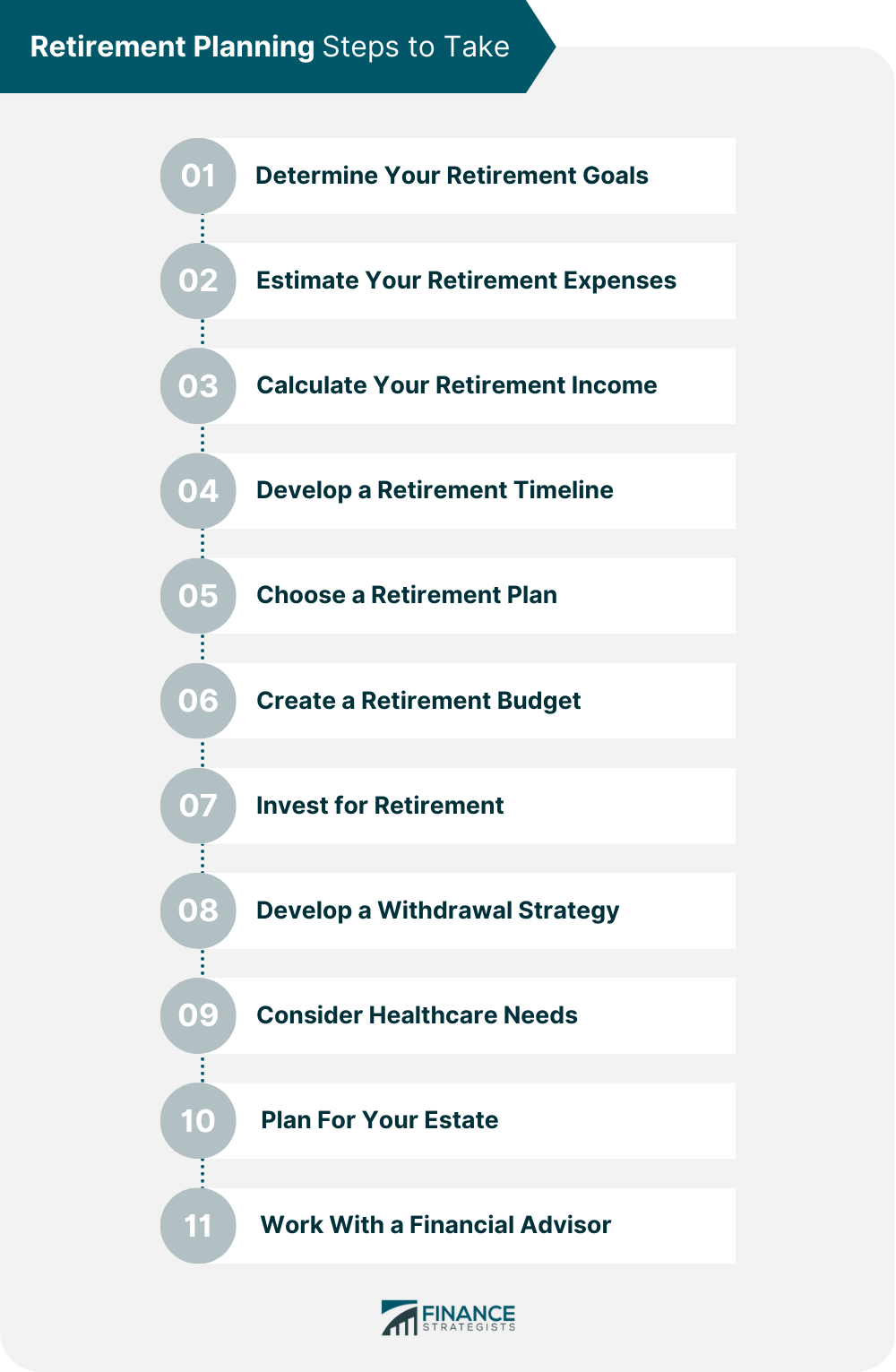

Steps to Make IR 2025

To make IR 2025, individuals can follow these steps:

- Open an account: Open an IR 2025 account with a financial institution authorized by the Brazilian Central Bank.

- Choose an investment option: Select an investment option that aligns with the individual’s risk tolerance and retirement goals.

- Make contributions: Contribute to the IR 2025 account on a regular basis.

- Declare contributions: Declare IR 2025 contributions on the annual income tax return.

- Withdraw funds in retirement: Withdraw funds from the IR 2025 account in retirement, subject to applicable taxes and regulations.

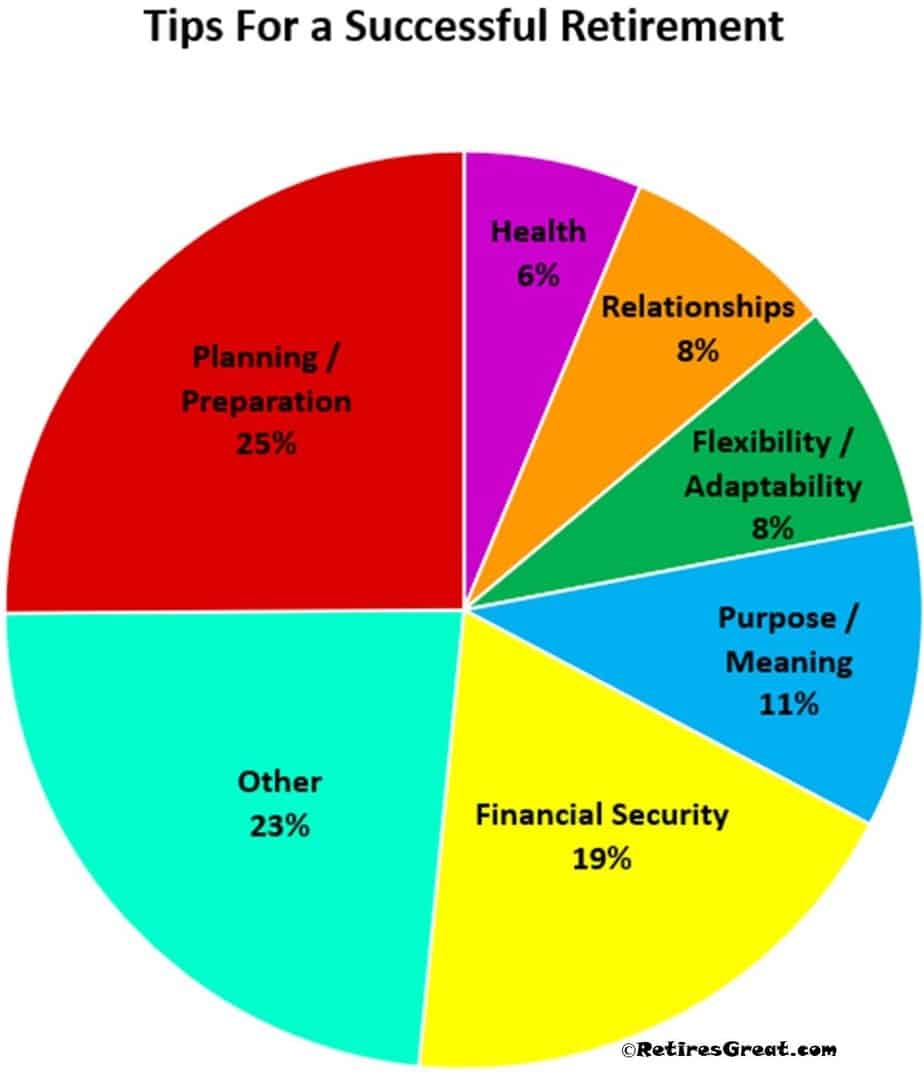

Benefits of IR 2025

Participating in IR 2025 offers numerous benefits, including:

- Tax savings: Contributions are tax-deductible, reducing the individual’s taxable income.

- Tax-free withdrawals: Withdrawals from Roth IR 2025 accounts are tax-free in retirement.

- Long-term growth: IR 2025 contributions have the potential to grow over time, providing a secure retirement nest egg.

- Financial discipline: Regular contributions to IR 2025 promote financial discipline and encourage long-term savings.

- Retirement security: IR 2025 provides individuals with a stable source of income during retirement.

Conclusion

IR 2025 Como Fazer is an essential guide for individuals seeking to achieve retirement success. By understanding the eligibility criteria, contribution limits, tax benefits, investment options, and steps involved in making IR 2025, individuals can maximize their retirement savings and secure their financial future. By embracing the power of IR 2025, individuals can pave the way for a comfortable and fulfilling retirement.

.png?width=550u0026name=steps%20in%20retirement%20planning%20(2).png)

Closure

Thus, we hope this article has provided valuable insights into IR 2025 Como Fazer: A Comprehensive Guide to Achieving Retirement Success. We hope you find this article informative and beneficial. See you in our next article!