How Much FSA Rollover into 2025: A Comprehensive Guide

Related Articles: How Much FSA Rollover into 2025: A Comprehensive Guide

- Holidays To Mauritius In 2025: A Comprehensive Guide To Paradise

- YouTube Premiere: The Future Of Live Entertainment Unveiled On May 1, 2025

- Popular Colors Of 2025: A Glimpse Into The Future Of Design And Aesthetics

- Windows 10 Support Beyond 2025: What You Need To Know

- 2025 Ford Mustang GT-D Speed: The Ultimate Electric Pony Car

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to How Much FSA Rollover into 2025: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about How Much FSA Rollover into 2025: A Comprehensive Guide

How Much FSA Rollover into 2025: A Comprehensive Guide

Introduction

Flexible Spending Accounts (FSAs) are tax-advantaged savings accounts that allow employees to set aside pre-tax dollars to cover qualified medical expenses. FSAs offer several benefits, including reducing taxable income and providing tax-free access to funds for healthcare costs. However, there are limits on how much money can be contributed to an FSA each year, and any unused funds at the end of the plan year are typically forfeited.

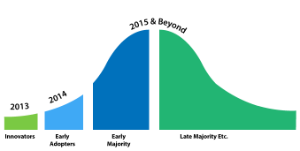

In recent years, there have been changes to the FSA rollover rules. For plan years beginning in 2023, the maximum FSA rollover amount is $610. This amount is expected to increase to $650 for plan years beginning in 2025.

Understanding the FSA Rollover

The FSA rollover allows employees to carry over a portion of their unused FSA funds into the following plan year. This can be beneficial for employees who anticipate having high medical expenses in the future or who simply want to maximize their tax savings.

The amount that can be rolled over is limited to the lesser of the following:

- The unused balance in the FSA at the end of the plan year

- The maximum rollover amount for the plan year

FSA Rollover Limits for 2025

For plan years beginning in 2025, the maximum FSA rollover amount is expected to be $650. This means that employees can carry over up to $650 of their unused FSA funds into the following plan year.

Eligibility for FSA Rollover

To be eligible for the FSA rollover, the following conditions must be met:

- The FSA must be a qualified plan under Section 125 of the Internal Revenue Code.

- The employee must have unused funds in their FSA at the end of the plan year.

- The plan document must allow for rollovers.

How to Roll Over FSA Funds

The process for rolling over FSA funds typically involves the following steps:

- Contact the FSA administrator to request a rollover form.

- Complete the rollover form and indicate the amount you wish to roll over.

- Submit the rollover form to the FSA administrator by the deadline specified in the plan document.

Benefits of FSA Rollover

There are several benefits to rolling over FSA funds, including:

- Tax savings: FSA funds are contributed pre-tax, which reduces taxable income. Rolling over unused funds allows employees to continue to benefit from this tax savings.

- Increased access to healthcare funds: Rolling over FSA funds provides employees with additional funds to cover qualified medical expenses. This can be especially beneficial for employees who anticipate having high healthcare costs in the future.

- Flexibility: FSA rollovers allow employees to plan for future healthcare expenses and adjust their savings strategy accordingly.

Considerations Before Rolling Over FSA Funds

Before rolling over FSA funds, it is important to consider the following:

- Need for funds: Employees should carefully consider whether they anticipate needing the FSA funds in the future. If they do not, it may be better to forfeit the unused funds and receive a refund.

- Investment options: FSA funds cannot be invested, so employees who wish to grow their savings may want to consider other investment options.

- Plan limits: Employees should be aware of the maximum FSA contribution and rollover limits for the plan year.

Conclusion

The FSA rollover is a valuable benefit that allows employees to carry over unused FSA funds into the following plan year. By understanding the rules and limitations of the FSA rollover, employees can maximize their tax savings and ensure that they have access to funds for qualified medical expenses.

:max_bytes(150000):strip_icc()/Does-money-flexible-spending-account-fsa-roll-over_final-2a963663ba524f5e89bf25dca5f1422e.png)

Closure

Thus, we hope this article has provided valuable insights into How Much FSA Rollover into 2025: A Comprehensive Guide. We appreciate your attention to our article. See you in our next article!