Google Stock in 2025: A Comprehensive Analysis and Future Outlook

Related Articles: Google Stock in 2025: A Comprehensive Analysis and Future Outlook

- Bedford Street, Johnstown, PA: A Historical And Cultural Tapestry

- Version 0 Is Not Defined For Fiscal Year 2025: Implications For Financial Reporting And Compliance

- Groundhog Day 2025: A Glimpse Into The Future

- Carnival Mardi Gras Cruises 2025: An Unforgettable Voyage To The Heart Of Carnival’s Fun

- Will 2025 Work For 2032?

Introduction

With great pleasure, we will explore the intriguing topic related to Google Stock in 2025: A Comprehensive Analysis and Future Outlook. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Google Stock in 2025: A Comprehensive Analysis and Future Outlook

Google Stock in 2025: A Comprehensive Analysis and Future Outlook

Introduction

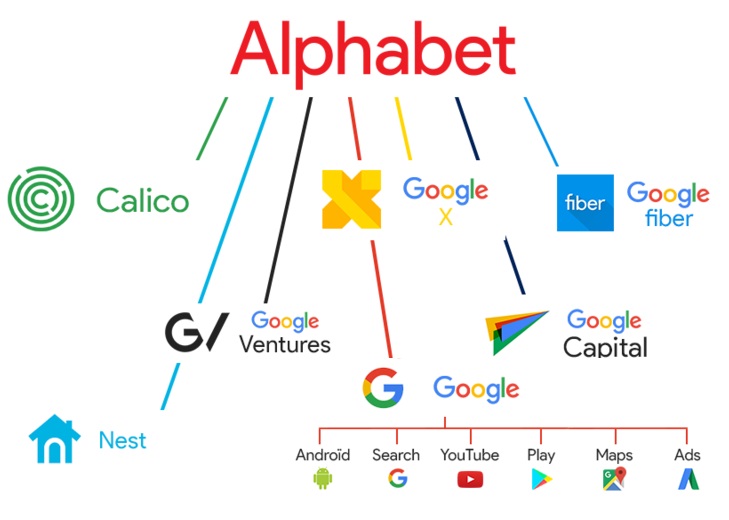

Alphabet Inc., the parent company of Google, has consistently been one of the most dominant forces in the global technology landscape. With its vast portfolio of products and services, including the ubiquitous search engine, cloud computing platform, and mobile operating system, Google has become an integral part of our lives. As we approach 2025, it becomes crucial to examine the potential trajectory of Google stock and its long-term investment prospects.

Current Market Performance and Key Drivers

Google stock (GOOGL) has experienced remarkable growth over the past decade, significantly outperforming the broader market. As of December 2022, the stock has a market capitalization of over $1.2 trillion, making it one of the most valuable companies in the world.

The company’s strong financial performance has been driven by several key factors:

- Dominant market position: Google’s search engine and Android operating system command a vast majority of the market share in their respective domains, providing the company with a significant competitive advantage.

- Cloud computing growth: Google Cloud has emerged as a major player in the cloud infrastructure market, offering a comprehensive suite of services to businesses and organizations worldwide.

- Advertising revenue: Google’s advertising business remains a major source of revenue, with the company leveraging its vast user base to deliver targeted advertising campaigns.

- Emerging technologies: Google is actively investing in cutting-edge technologies such as artificial intelligence, machine learning, and quantum computing, which have the potential to drive future growth.

Future Growth Prospects and Challenges

As we look ahead to 2025, Google is well-positioned to continue its growth trajectory. However, the company also faces several challenges that could impact its future performance:

- Regulatory scrutiny: Google has faced increased regulatory scrutiny in recent years, with concerns over antitrust practices, data privacy, and misinformation. These challenges could potentially limit the company’s growth and profitability.

- Competition: Google operates in highly competitive markets, with rivals such as Amazon, Microsoft, and Apple vying for market share. The company must continue to innovate and adapt to maintain its competitive edge.

- Economic headwinds: The global economy faces significant headwinds, including rising inflation, interest rate hikes, and geopolitical uncertainties. These factors could impact Google’s advertising revenue and overall growth prospects.

- Emerging trends: The technology landscape is constantly evolving, with new technologies and business models emerging. Google must effectively navigate these changes to stay ahead of the curve.

Investment Outlook and Valuation

Despite the challenges, Google remains a compelling investment opportunity for the long term. The company’s dominant market position, strong financial performance, and commitment to innovation make it a solid choice for investors seeking growth and stability.

In terms of valuation, Google stock trades at a premium to its peers due to its strong fundamentals and growth potential. However, the current economic headwinds and regulatory uncertainties could impact its short-term performance.

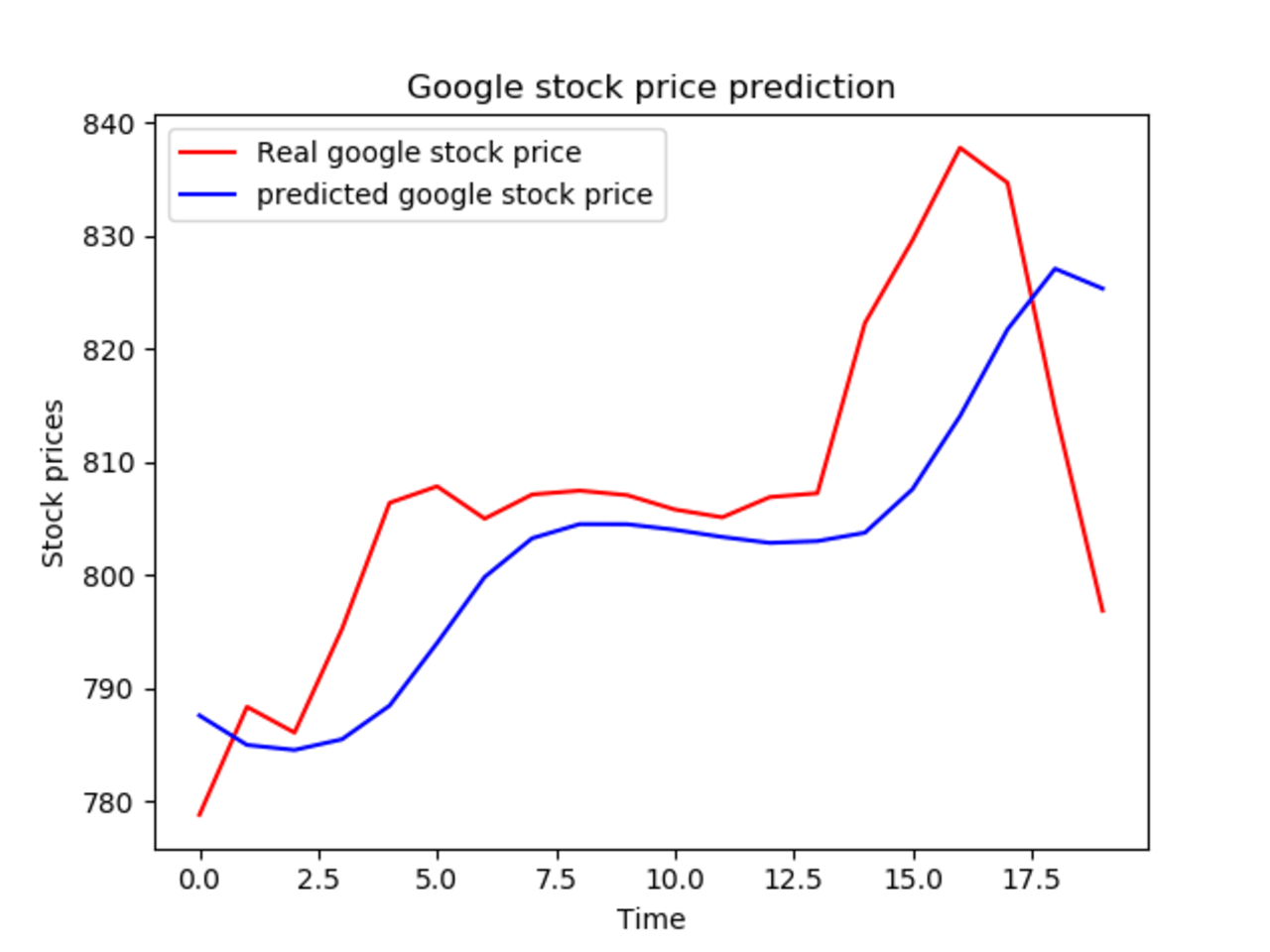

Analysts have varying price targets for Google stock in 2025, ranging from $2,000 to $3,000 per share. These estimates are based on factors such as the company’s expected financial performance, market conditions, and potential regulatory developments.

Conclusion

Google stock is poised to continue its growth trajectory in the years leading up to 2025. While the company faces certain challenges, its strong fundamentals, dominant market position, and commitment to innovation make it a compelling investment opportunity for long-term investors. However, it is essential to remain aware of the potential risks and uncertainties that could impact the company’s performance. By carefully considering these factors, investors can make informed decisions about investing in Google stock and potentially reap the rewards of its continued growth.

Closure

Thus, we hope this article has provided valuable insights into Google Stock in 2025: A Comprehensive Analysis and Future Outlook. We hope you find this article informative and beneficial. See you in our next article!