FSA Rollover 2025 to 2026: Maximizing Your Tax-Advantaged Savings

Related Articles: FSA Rollover 2025 to 2026: Maximizing Your Tax-Advantaged Savings

- Harry Potter: The Return Of The Dark Lord (2025)

- Where Will The Olympics Be Held In 2036?

- Groundhog Day 2025: A Glimpse Into The Future

- 2025 Toyota RAV4: A Comprehensive Overview

- Lakewood Ranch’s Market Street: A Thriving Hub Of Shopping, Dining, And Entertainment

Introduction

With great pleasure, we will explore the intriguing topic related to FSA Rollover 2025 to 2026: Maximizing Your Tax-Advantaged Savings. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about FSA Rollover 2025 to 2026: Maximizing Your Tax-Advantaged Savings

FSA Rollover 2025 to 2026: Maximizing Your Tax-Advantaged Savings

Introduction

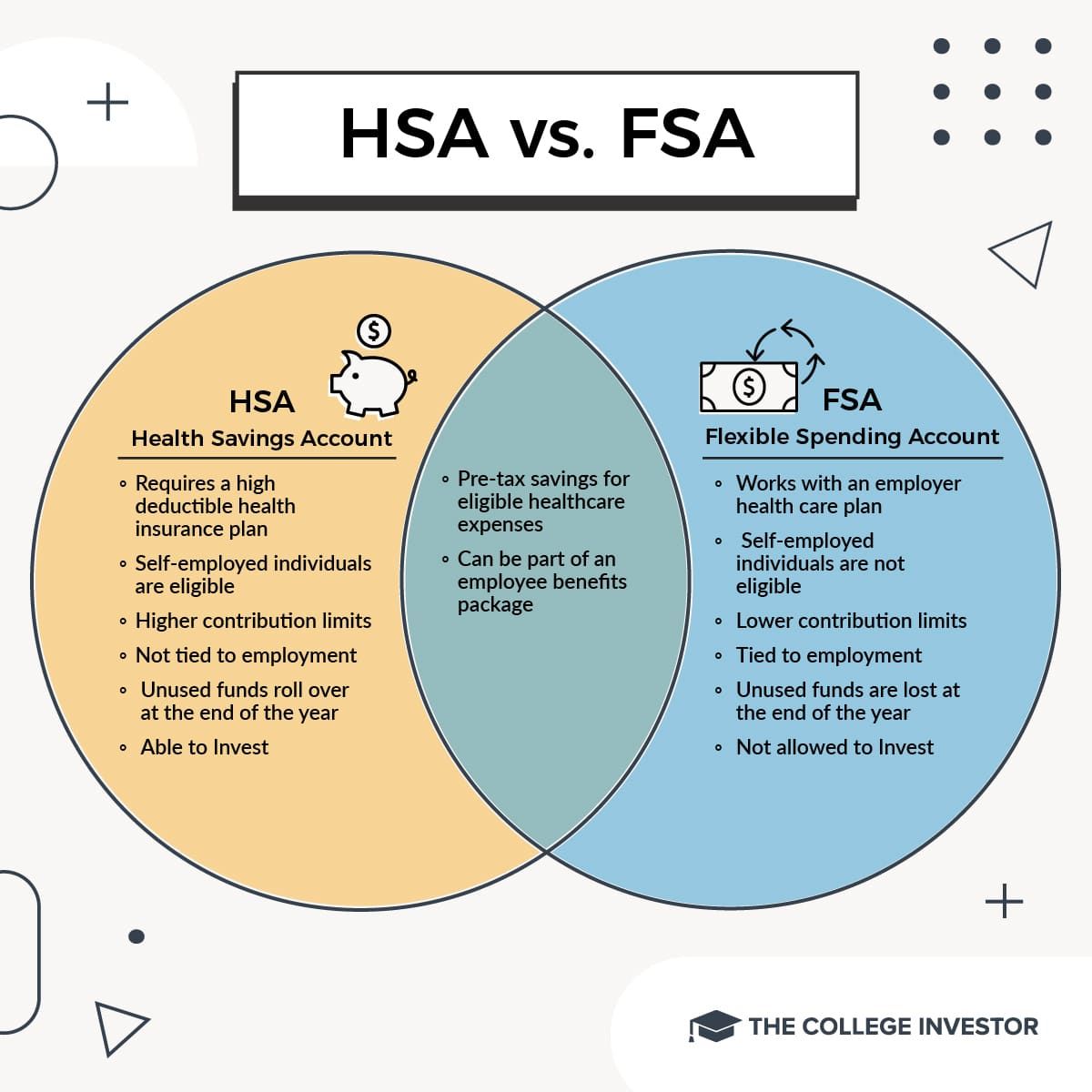

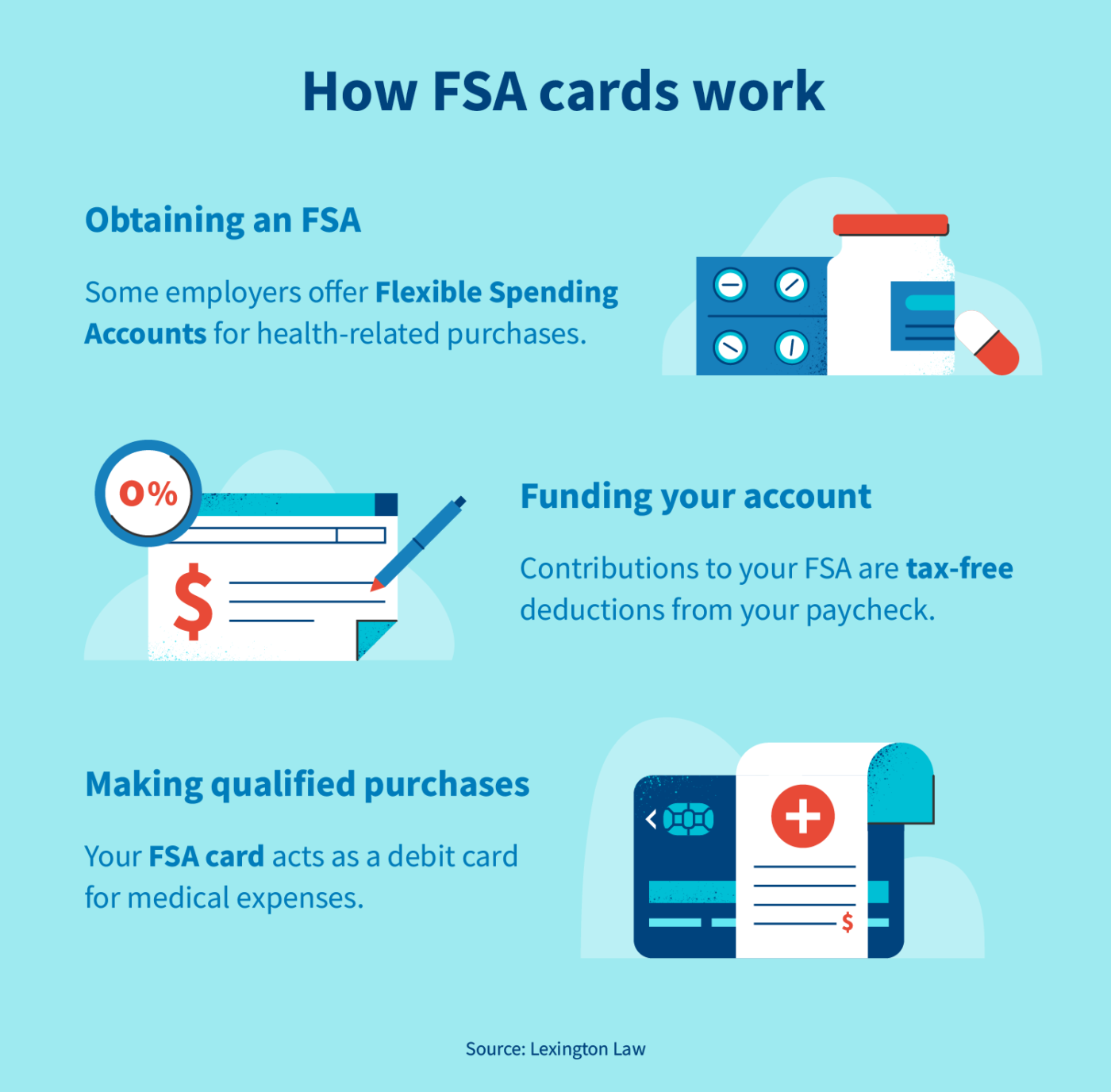

Flexible spending accounts (FSAs) are tax-advantaged savings accounts that allow employees to set aside pre-tax dollars to pay for qualified medical and dental expenses. The funds in an FSA can be used to cover a wide range of out-of-pocket healthcare costs, including deductibles, copayments, and prescription drugs.

In 2025, the maximum contribution limit for FSAs will increase to $3,050, up from the current limit of $2,850. This increase provides employees with an opportunity to save even more money on their healthcare expenses.

FSA Rollover Rules

FSAs are subject to a "use-it-or-lose-it" rule, which means that any funds that are not used by the end of the plan year are forfeited. However, there is an exception to this rule for unused funds in health FSAs.

Under the FSA rollover rule, employees can carry over up to $550 of unused funds from their health FSA to the following plan year. This rollover amount is increased to $650 for participants who are age 55 or older by the end of the plan year.

Benefits of FSA Rollover

Rolling over unused FSA funds has several benefits, including:

- Increased savings: By rolling over unused funds, employees can save more money on their healthcare expenses in the following year.

- Tax savings: The funds that are rolled over are still tax-free, so employees can continue to save money on their taxes.

- Flexibility: The rollover funds can be used to cover any qualified medical or dental expenses, including those that may not be covered by insurance.

- Peace of mind: Rolling over unused funds provides employees with peace of mind knowing that they have a cushion of funds to cover unexpected healthcare costs.

How to Roll Over FSA Funds

To roll over unused FSA funds, employees must contact their plan administrator. The plan administrator will provide instructions on how to transfer the funds to the following plan year.

It is important to note that not all FSA plans allow for rollovers. Employees should check with their plan administrator to determine if their plan allows for rollovers.

FSA Rollover Deadline

The deadline for rolling over unused FSA funds is the end of the plan year. The plan year is typically the same as the calendar year, but it can vary depending on the employer.

Employees who do not roll over their unused FSA funds by the deadline will forfeit the funds.

Example of FSA Rollover

Let’s say an employee has an FSA with a contribution limit of $2,850. The employee contributes the maximum amount to their FSA and uses $2,200 of the funds during the plan year.

At the end of the plan year, the employee has $650 of unused FSA funds. The employee can roll over these funds to the following plan year.

In the following plan year, the employee can use the $650 of rolled-over funds to cover qualified medical or dental expenses.

Conclusion

The FSA rollover rule is a valuable tool that can help employees save money on their healthcare expenses. By rolling over unused FSA funds, employees can increase their savings, save on taxes, and gain flexibility in their healthcare spending.

Employees should contact their plan administrator to determine if their FSA plan allows for rollovers and to obtain instructions on how to roll over their unused funds.

Closure

Thus, we hope this article has provided valuable insights into FSA Rollover 2025 to 2026: Maximizing Your Tax-Advantaged Savings. We hope you find this article informative and beneficial. See you in our next article!