Form Schedule D (Form 1040) for 2025: A Comprehensive Guide

Related Articles: Form Schedule D (Form 1040) for 2025: A Comprehensive Guide

- HISD Calendar 2025-26 PDF: A Comprehensive Guide For Students, Parents, And Educators

- The Removal Of Landlines By 2025: A Step Towards A Wireless Future

- 2025 Infiniti Q50: A Comprehensive Review

- Top 2024 Cars To Lease: A Comprehensive Guide

- 2025 Jeep SUV: A Bold Vision For The Future Of Off-Roading

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Form Schedule D (Form 1040) for 2025: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Form Schedule D (Form 1040) for 2025: A Comprehensive Guide

Form Schedule D (Form 1040) for 2025: A Comprehensive Guide

:max_bytes(150000):strip_icc()/ScheduleD-CapitalGainsandLosses-1-d651471c24974ac79739e2ef580b1c35.png)

Introduction

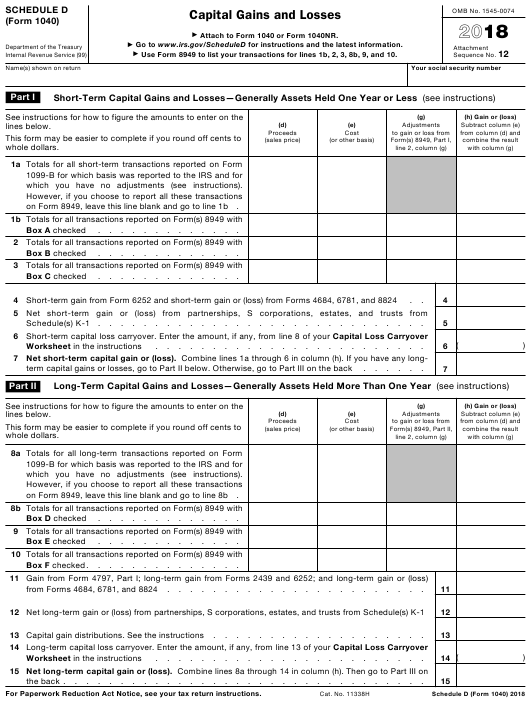

Form Schedule D (Form 1040), also known as the Capital Gains and Losses, is an Internal Revenue Service (IRS) tax form used to report the sale or exchange of capital assets. Capital assets include stocks, bonds, real estate, and other investments. Form Schedule D is used to calculate the amount of capital gains or losses that are taxable or deductible on your federal income tax return.

Who Needs to File Form Schedule D?

You must file Form Schedule D if you sold or exchanged any capital assets during the tax year and you had a capital gain or loss. A capital gain occurs when you sell or exchange a capital asset for more than you paid for it. A capital loss occurs when you sell or exchange a capital asset for less than you paid for it.

When to File Form Schedule D

Form Schedule D must be filed with your federal income tax return by the April 15th tax deadline. If you file an extension to file your tax return, Form Schedule D must be filed by the extended deadline.

How to File Form Schedule D

You can file Form Schedule D electronically or by mail. If you file electronically, you can use tax software or the IRS website. If you file by mail, you can download the form from the IRS website or request a copy by calling the IRS at 1-800-829-3676.

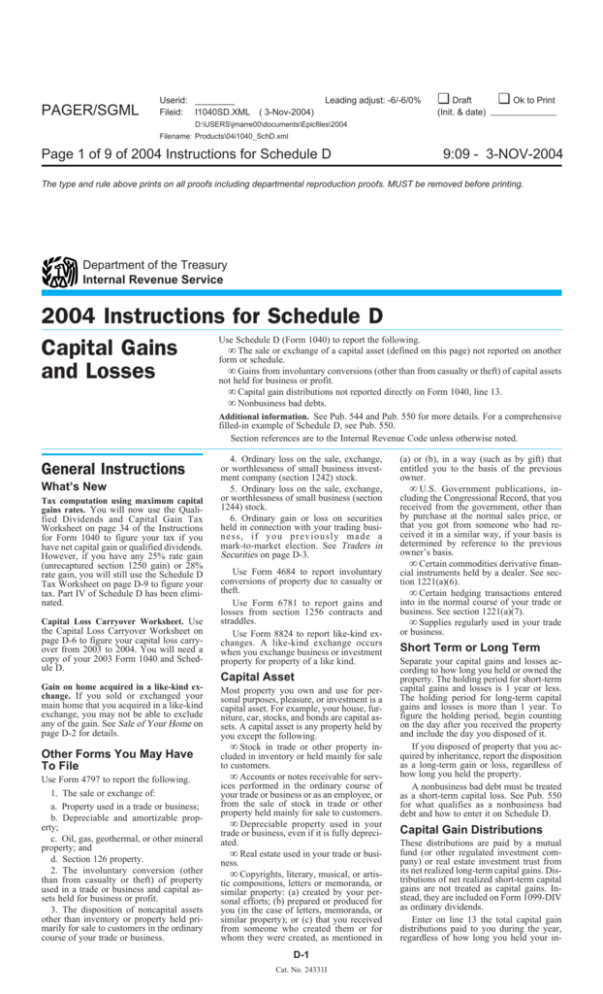

Instructions for Form Schedule D

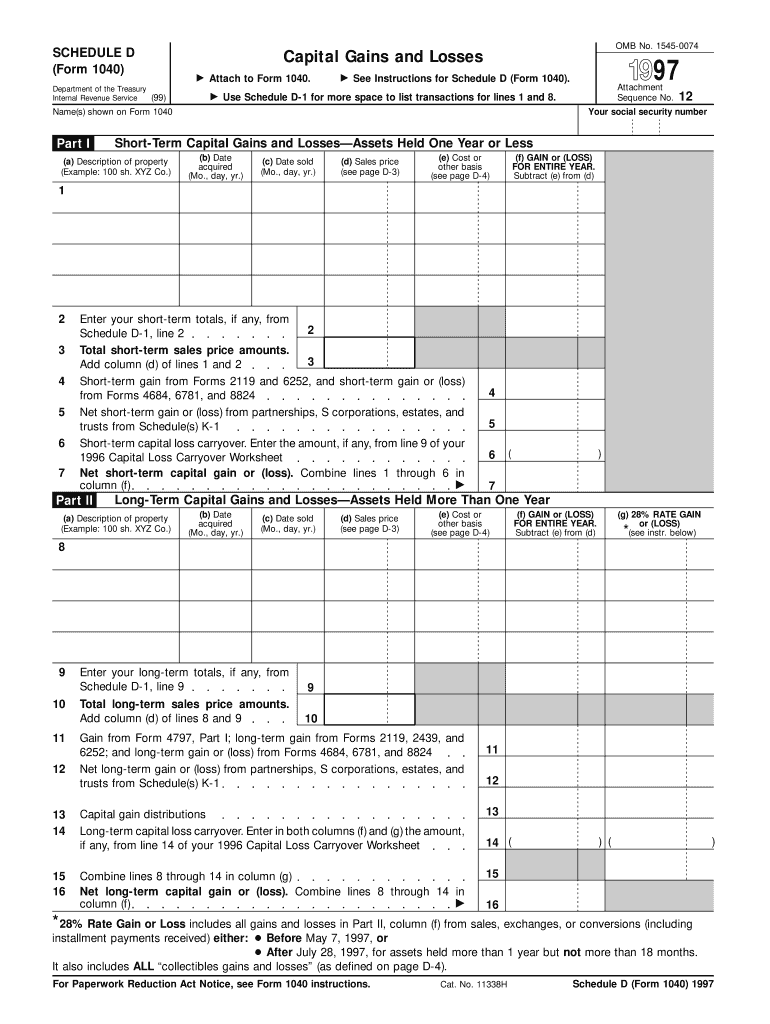

Form Schedule D is divided into four parts:

- Part I: General Information

- Part II: Short-Term Capital Gains and Losses

- Part III: Long-Term Capital Gains and Losses

- Part IV: Summary of Capital Gains and Losses

Part I: General Information

In Part I, you will provide general information about yourself, such as your name, address, and Social Security number. You will also indicate whether you are filing Form Schedule D as an individual or a fiduciary.

Part II: Short-Term Capital Gains and Losses

In Part II, you will report any short-term capital gains or losses. Short-term capital gains or losses are gains or losses from the sale or exchange of capital assets that you held for one year or less.

Part III: Long-Term Capital Gains and Losses

In Part III, you will report any long-term capital gains or losses. Long-term capital gains or losses are gains or losses from the sale or exchange of capital assets that you held for more than one year.

Part IV: Summary of Capital Gains and Losses

In Part IV, you will summarize your total capital gains and losses. You will also calculate your net capital gain or loss. Your net capital gain or loss is the total of your capital gains minus your capital losses.

Tax Treatment of Capital Gains and Losses

Capital gains and losses are taxed at different rates depending on the length of time you held the asset. Short-term capital gains are taxed at your ordinary income tax rate. Long-term capital gains are taxed at a lower rate of 0%, 15%, or 20%, depending on your taxable income. Capital losses can be used to offset capital gains. If you have a net capital loss, you can deduct up to $3,000 of the loss from your ordinary income.

Additional Information

Form Schedule D is a complex form. If you need help completing the form, you can consult with a tax professional. You can also find additional information on Form Schedule D on the IRS website.

Conclusion

Form Schedule D is an important tax form that is used to report the sale or exchange of capital assets. If you sold or exchanged any capital assets during the tax year, you must file Form Schedule D with your federal income tax return. By following the instructions in this article, you can complete Form Schedule D accurately and on time.

Closure

Thus, we hope this article has provided valuable insights into Form Schedule D (Form 1040) for 2025: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!