Form 202 Texas: A Comprehensive Guide

Related Articles: Form 202 Texas: A Comprehensive Guide

- How Many Days Until January 1, 2025?

- Jaguar’s New Models For 2025: Electrifying Performance And Sophisticated Design

- The 2025 BMW M8 Competition: A Symphony Of Speed And Sophistication

- 2025 RAM 1500 RHOT: The Future Of Heavy-Duty Towing

- India’s G20 Presidency 2023: A Path-Breaking Opportunity For Global Leadership

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Form 202 Texas: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Form 202 Texas: A Comprehensive Guide

Form 202 Texas: A Comprehensive Guide

Introduction

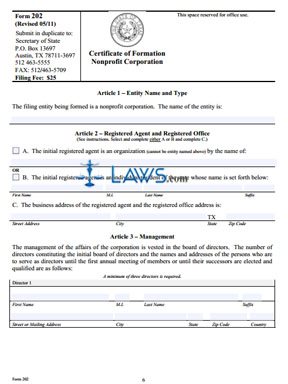

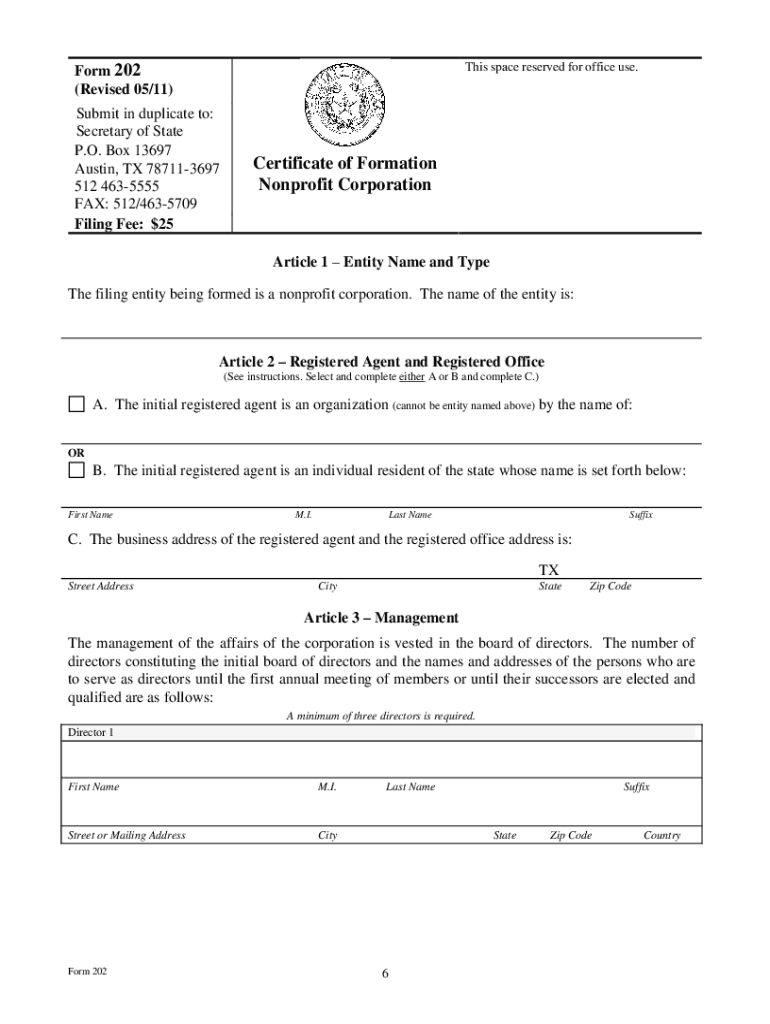

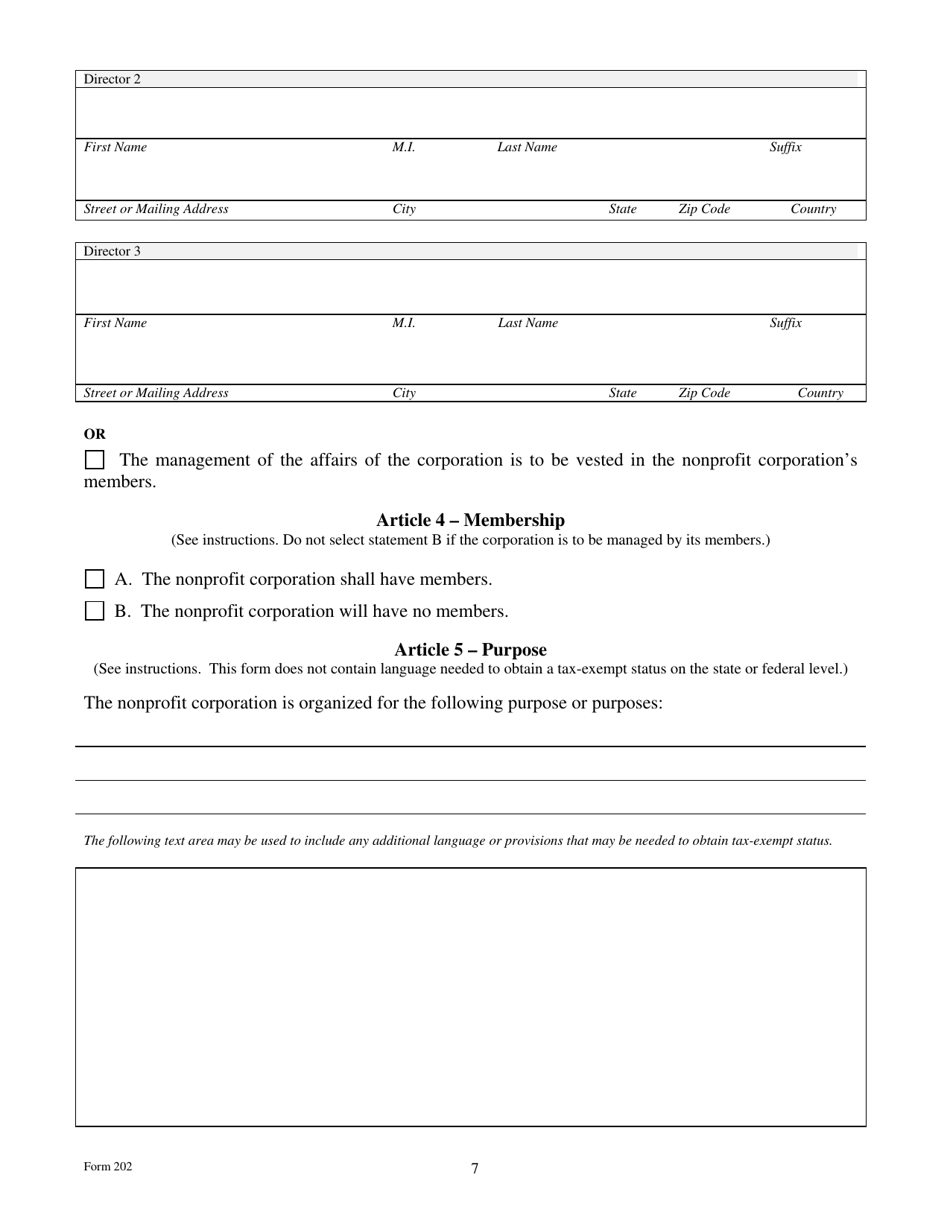

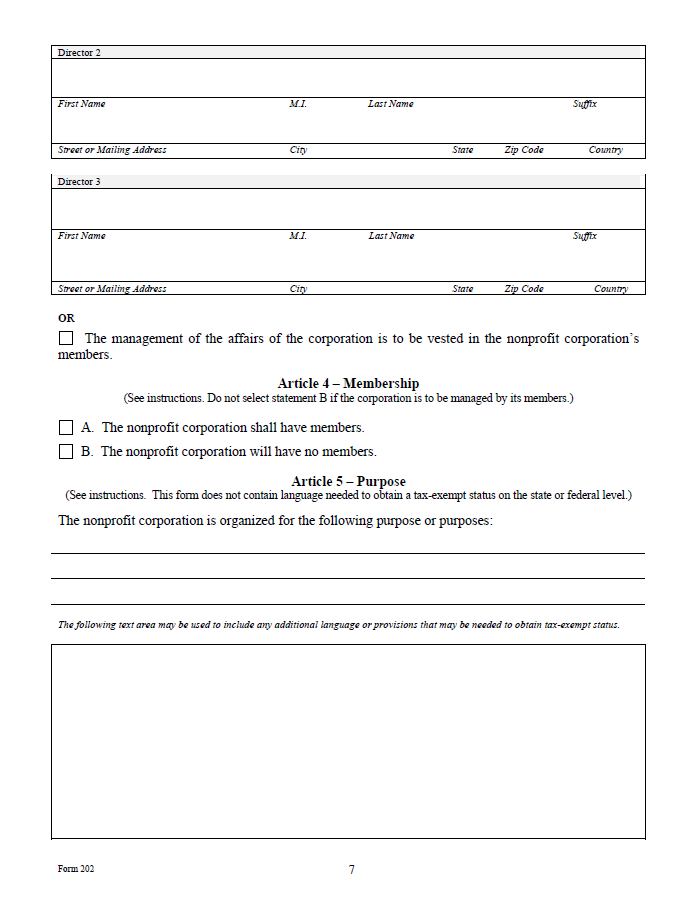

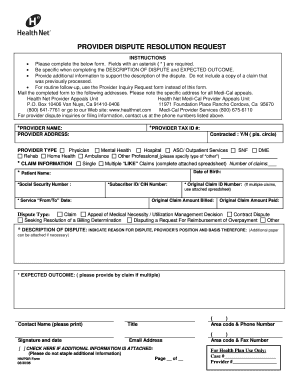

Form 202 Texas, also known as the "Texas Franchise Tax Annual Report," is a crucial document required by the Texas Comptroller of Public Accounts (CPA) from all businesses operating within the state. This report provides vital financial and operational information to the CPA, enabling them to assess and collect franchise taxes from eligible entities. Understanding and accurately completing Form 202 is essential for businesses to fulfill their tax obligations and avoid potential penalties.

Who Needs to File Form 202?

All businesses registered or doing business in Texas are required to file Form 202, regardless of whether they have taxable income. This includes:

- Corporations

- Partnerships

- Limited liability companies (LLCs)

- Sole proprietorships

- Limited liability partnerships (LLPs)

- Trusts

- Estates

- Non-profit organizations

When to File Form 202

The deadline for filing Form 202 is May 15th of each year. However, businesses may request an extension until June 15th by submitting Form 202-EXT.

How to File Form 202

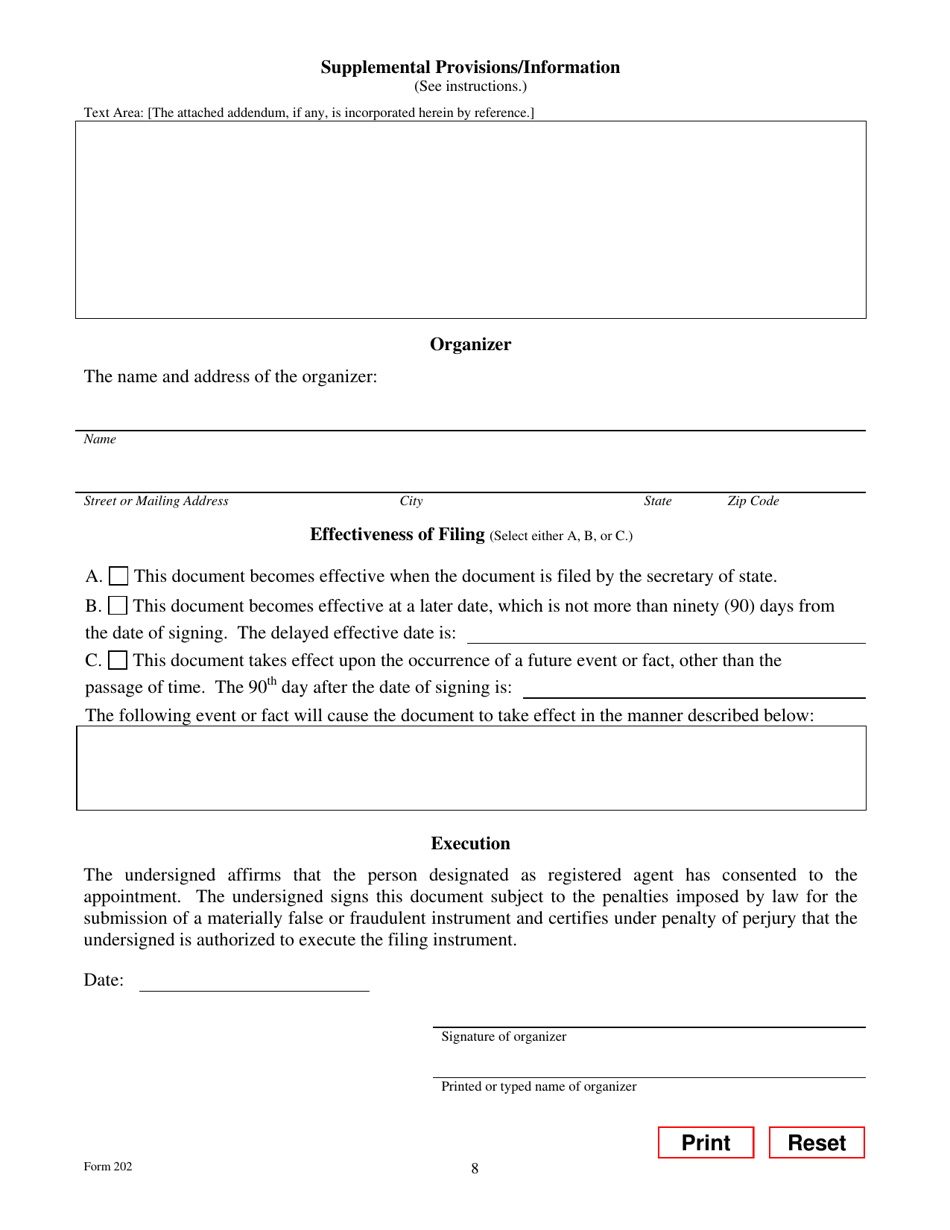

Form 202 can be filed online, by mail, or by using a tax professional.

- Online: Visit the Texas Comptroller’s website (www.comptroller.texas.gov) and select "e-file."

- Mail: Send the completed form to the Texas Comptroller of Public Accounts, P.O. Box 13528, Austin, TX 78711-3528.

- Tax Professional: Hire a tax professional to prepare and file the form on your behalf.

Information Required on Form 202

Form 202 requires businesses to provide detailed information, including:

- Business name and address

- Federal Employer Identification Number (FEIN)

- Taxable period

- Gross receipts

- Deductions

- Taxable income

- Franchise tax liability

- Financial statements (for certain entities)

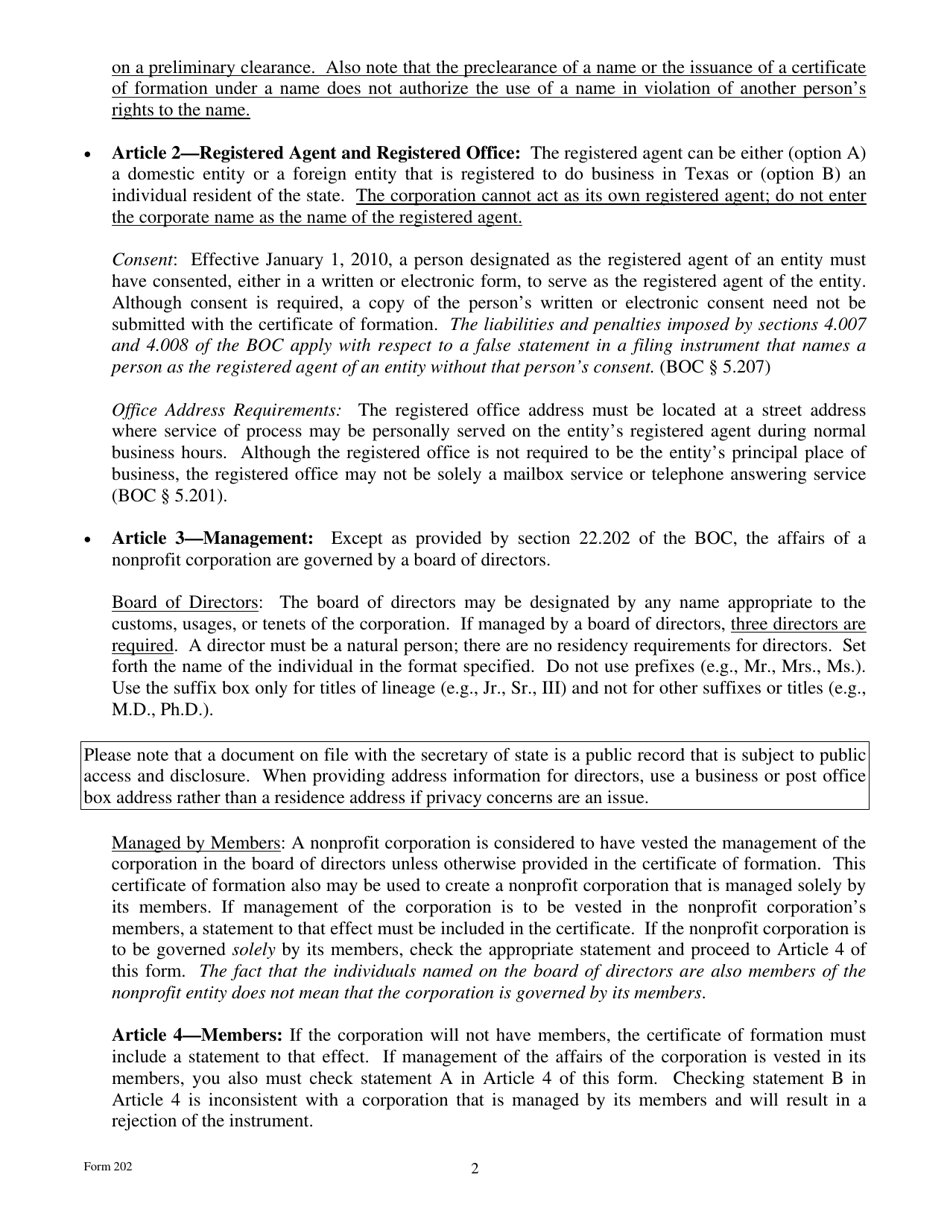

Specific Instructions for Completing Form 202

- Gross Receipts: Include all gross receipts from all sources, both within and outside Texas.

-

Deductions: Only certain deductions are allowed on Form 202. These include:

- Cost of goods sold

- Salaries and wages

- Rent

- Utilities

- Depreciation

- Taxable Income: Calculate taxable income by subtracting allowed deductions from gross receipts.

- Franchise Tax Liability: Multiply taxable income by the applicable franchise tax rate. The current rate is 0.5%.

- Financial Statements: Certain entities, such as corporations and partnerships with more than 100 shareholders, are required to attach financial statements to Form 202.

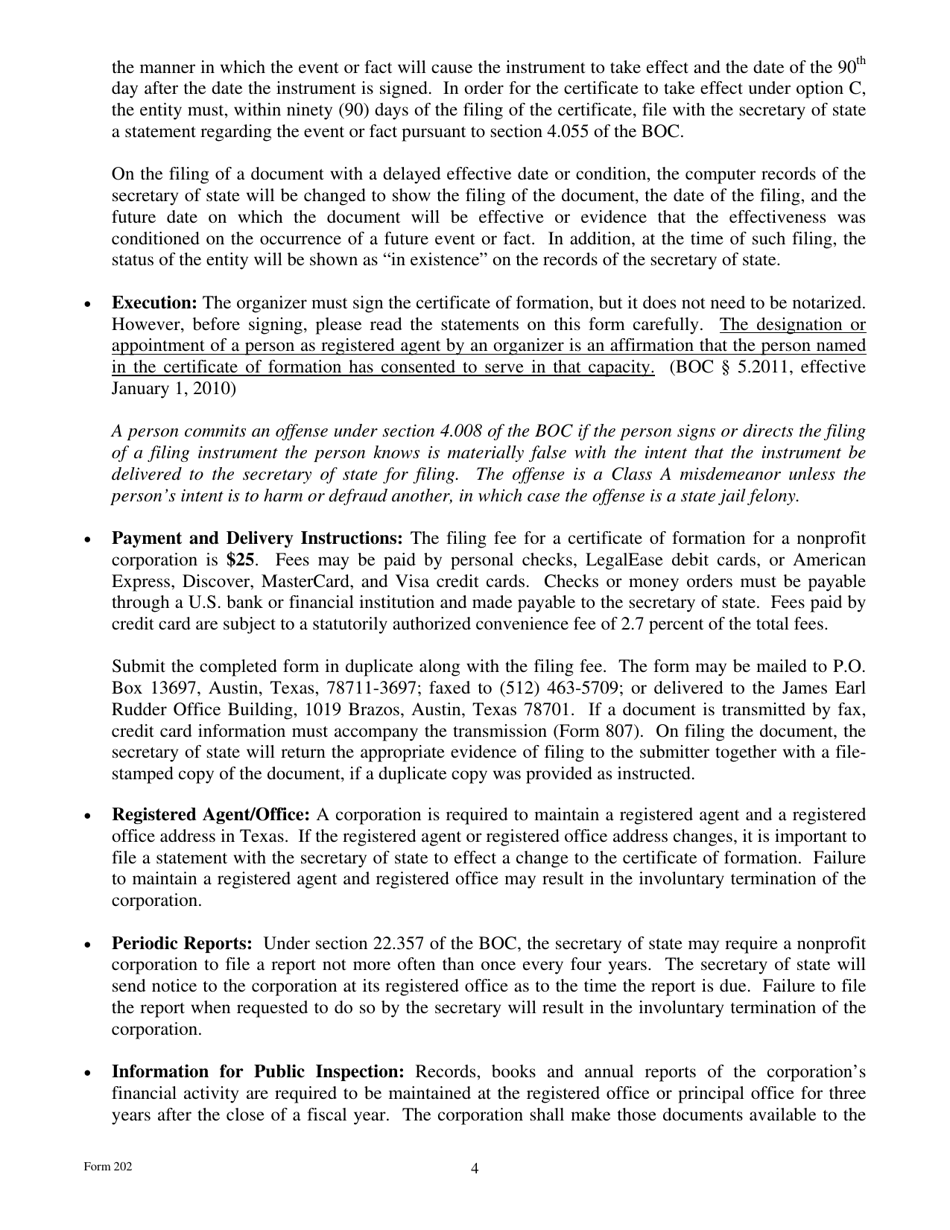

Penalties for Late or Incorrect Filing

Failure to file Form 202 on time or providing incorrect information can result in penalties and interest charges. Penalties can range from $100 to $1,000, depending on the severity of the offense.

Additional Considerations

- Estimated Tax Payments: Businesses with a franchise tax liability of $1,000 or more are required to make estimated tax payments throughout the year.

- Exemptions: Certain businesses may qualify for exemptions or deductions from franchise taxes. Consult the Texas Comptroller’s website or a tax professional for more information.

- Tax Identification Number (TIN): Businesses without a FEIN must obtain one from the Internal Revenue Service (IRS) before filing Form 202.

Conclusion

Form 202 Texas is a crucial document that all businesses operating in Texas must complete and file annually. By understanding the requirements, deadlines, and specific instructions for completing Form 202, businesses can ensure compliance with Texas franchise tax laws and avoid potential penalties.

Closure

Thus, we hope this article has provided valuable insights into Form 202 Texas: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!