Federal Fiscal Year 2025: A Comprehensive Overview

Related Articles: Federal Fiscal Year 2025: A Comprehensive Overview

- The Golden Age Of Games: 2025 And Beyond

- 2025 Calendar With School Holidays

- ESB Post-2025 Market Design: A Comprehensive Overview

- 2025 Camry: A Vision Of Sophistication And Efficiency

- Super Bowl LIX: Unveiling The Host City For The 2025 Gridiron Spectacle

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Federal Fiscal Year 2025: A Comprehensive Overview. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Federal Fiscal Year 2025: A Comprehensive Overview

Federal Fiscal Year 2025: A Comprehensive Overview

Introduction

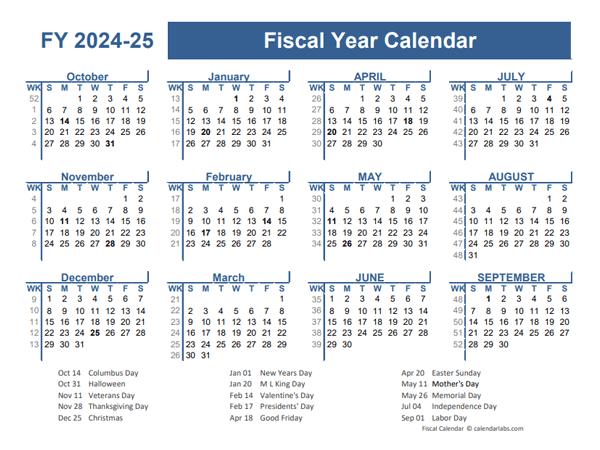

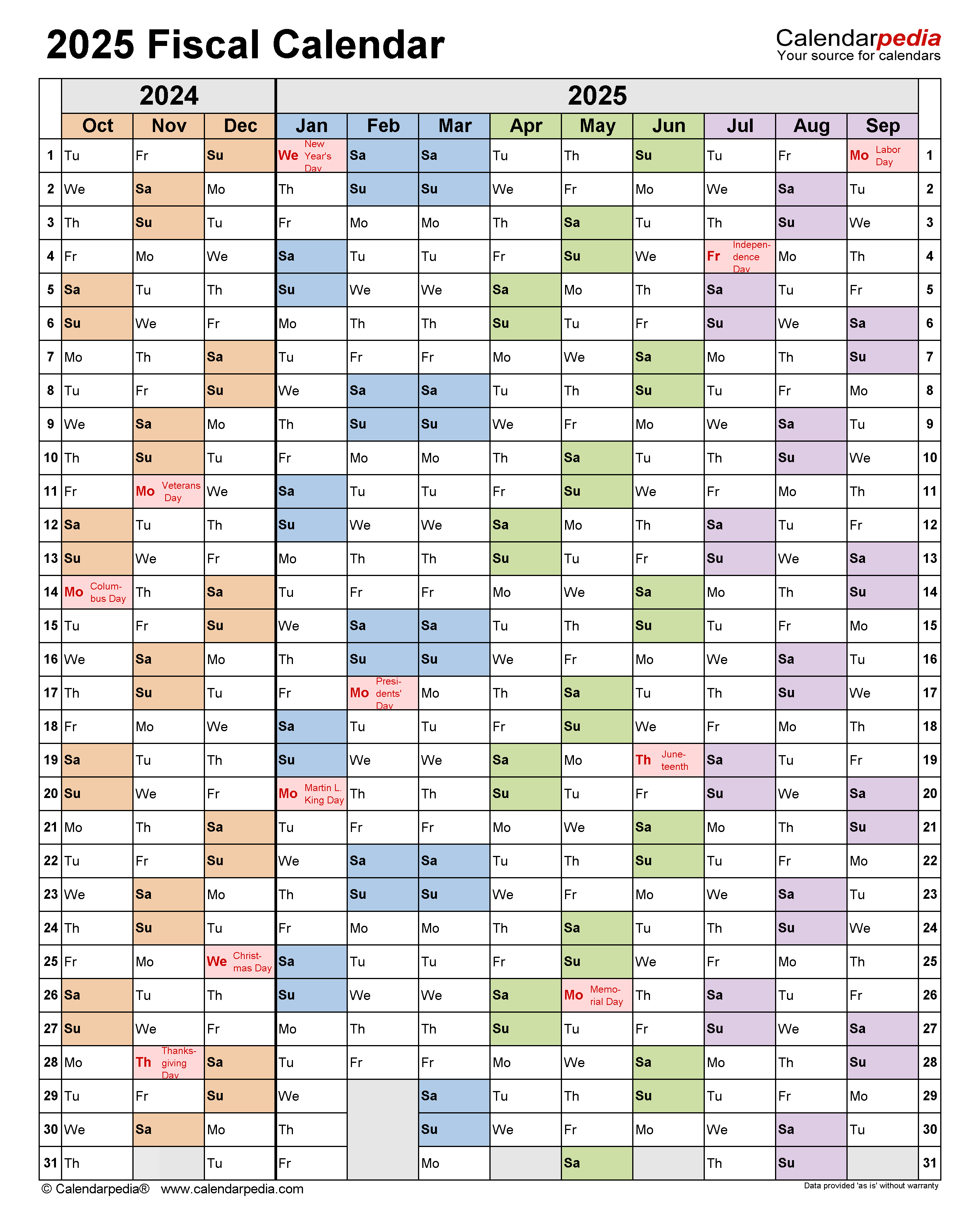

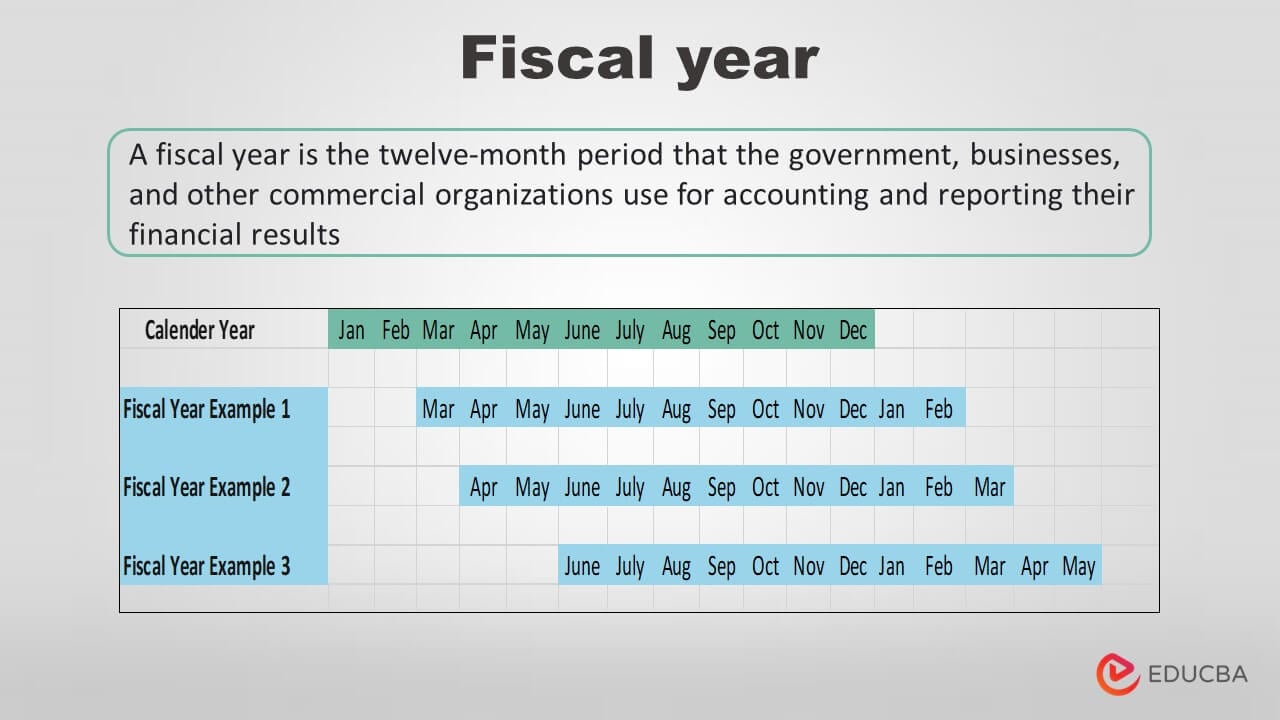

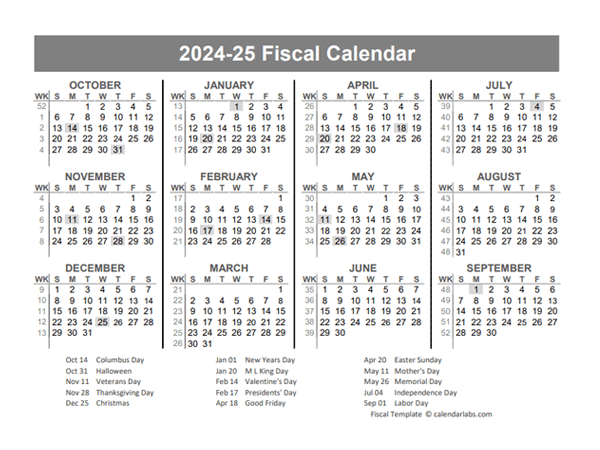

The federal fiscal year (FFY) is a 12-month period that the U.S. government uses to budget and track its financial activities. The FFY runs from October 1st to September 30th of the following year. For example, FFY 2025 will begin on October 1, 2024, and end on September 30, 2025.

Budgetary Process

The federal budget is a comprehensive financial plan that outlines the government’s spending and revenue projections for the upcoming FFY. The process of creating the budget begins with the President submitting a budget proposal to Congress. Congress then reviews and debates the proposal, and ultimately passes a budget resolution that sets spending and revenue targets for the FFY.

Once the budget resolution is passed, Congress appropriates funds to specific government agencies and programs. The appropriations process involves passing individual spending bills that allocate funds to different areas of the government. The President must sign these spending bills into law before they can take effect.

Key Dates in FFY 2025

- October 1, 2024: FFY 2025 begins.

- January 2025: President submits budget proposal to Congress.

- April 15, 2025: Tax filing deadline for individuals and businesses.

- September 30, 2025: FFY 2025 ends.

Economic Outlook

The economic outlook for FFY 2025 is uncertain, as it is dependent on a number of factors, including the global economy, interest rates, and inflation. However, the Congressional Budget Office (CBO) has projected that the economy will continue to grow moderately in FFY 2025, with real GDP growth of 2.1%. The CBO also projects that the unemployment rate will decline to 3.7% by the end of FFY 2025.

Fiscal Policy

The federal government’s fiscal policy, which involves the use of spending and taxation to influence the economy, will play a significant role in FFY 2025. The Biden administration has proposed a number of fiscal measures, including increased spending on infrastructure, education, and healthcare. These measures are intended to stimulate economic growth and address long-term challenges facing the country.

Revenue Projections

The CBO projects that the federal government will collect $4.4 trillion in revenue in FFY 2025. This represents a 5.2% increase from the projected revenue for FFY 2024. The largest sources of revenue are expected to be individual income taxes (39.5%), payroll taxes (34.1%), and corporate income taxes (11.7%).

Spending Projections

The CBO projects that the federal government will spend $5.9 trillion in FFY 2025. This represents a 4.6% increase from the projected spending for FFY 2024. The largest categories of spending are expected to be Social Security (24.4%), Medicare (18.3%), and national defense (14.3%).

Budget Deficit

The budget deficit is the difference between the government’s revenue and spending. The CBO projects that the federal government will run a budget deficit of $1.5 trillion in FFY 2025. This represents a slight increase from the projected deficit for FFY 2024.

Implications for Individuals and Businesses

FFY 2025 will have a number of implications for individuals and businesses. The following are some key areas to consider:

- Taxes: The Biden administration has proposed a number of tax changes that could affect individuals and businesses in FFY 2025. These changes include increasing the corporate tax rate, raising taxes on high-income earners, and expanding tax credits for low- and middle-income families.

- Spending: The increased spending proposed by the Biden administration could lead to higher levels of inflation. This could erode the purchasing power of individuals and businesses.

- Interest rates: The Federal Reserve is expected to continue raising interest rates in FFY 2025. This could make it more expensive for individuals and businesses to borrow money.

- Economic growth: The moderate economic growth projected for FFY 2025 could lead to increased job opportunities and wage growth. However, the economic outlook is uncertain, and there are risks to the projected growth rate.

Conclusion

FFY 2025 is a critical period for the U.S. government. The decisions made in this FFY will have a significant impact on the country’s economic future. The Biden administration’s proposed policies, including increased spending and tax changes, could have a major impact on individuals and businesses. It is important to monitor the FFY 2025 budget process and its potential implications.

![FEDERAL FISCAL YEAR 202-2025 TRANSPORTATION … - [PDF Document]](https://cdn.vdocument.in/doc/1200x630/627ecc10961c3847f82ef6c0/federal-fiscal-year-202-2025-transportation-.jpg?t=1682897922)

Closure

Thus, we hope this article has provided valuable insights into Federal Fiscal Year 2025: A Comprehensive Overview. We appreciate your attention to our article. See you in our next article!