brk.b stock forecast 2025

Related Articles: brk.b stock forecast 2025

- HP Color LaserJet 2025 Toner: A Comprehensive Guide

- T Rowe Price 2025 R

- 2025 Abbot Road, Suite 100: A Prime Location In East Lansing’s Thriving Tech Hub

- 2025 Ram 3500: Unveiling The Powerhouse Of The Heavy-Duty Truck Segment

- 2025 Kia Soul: A Bold And Versatile Crossover

Introduction

With great pleasure, we will explore the intriguing topic related to brk.b stock forecast 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about brk.b stock forecast 2025

BRK.B Stock Forecast 2025: A Comprehensive Analysis

Introduction

Berkshire Hathaway Inc. (NYSE: BRK.B), the conglomerate led by legendary investor Warren Buffett, has been a consistent outperformer in the stock market for decades. Its Class B shares (BRK.B) have delivered impressive returns, making it a popular investment choice for both individual investors and institutional funds. As we approach 2025, analysts and investors alike are keen to understand the potential trajectory of BRK.B stock and identify opportunities for future growth. This comprehensive forecast aims to provide an in-depth analysis of the company’s fundamentals, industry trends, and market sentiment to project the potential performance of BRK.B stock in the coming years.

Company Overview

Berkshire Hathaway is a holding company with a diverse portfolio of businesses operating in various industries, including insurance, energy, manufacturing, retail, and transportation. The company’s decentralized structure allows its subsidiaries to operate independently while benefiting from Berkshire’s financial strength and operational expertise. Over the years, Berkshire has acquired a wide range of businesses, including Geico, See’s Candies, and Burlington Northern Santa Fe Railway, and has consistently reinvested its earnings to fuel further growth.

Historical Performance

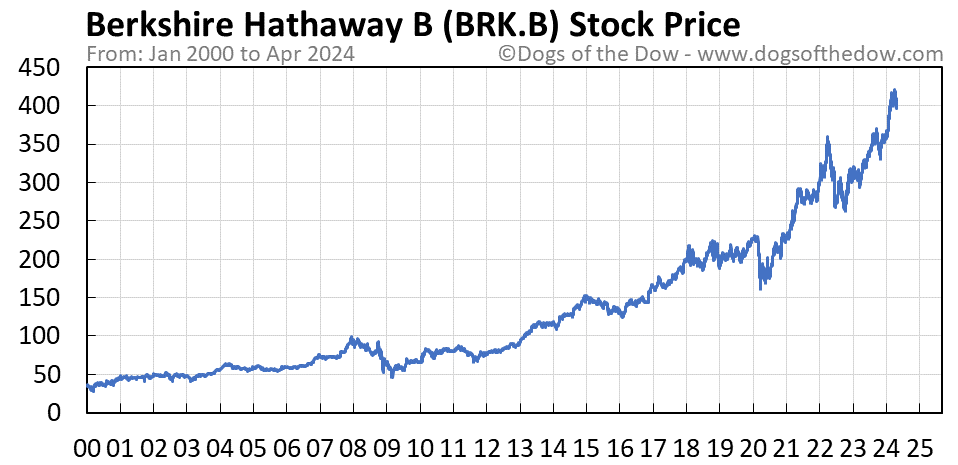

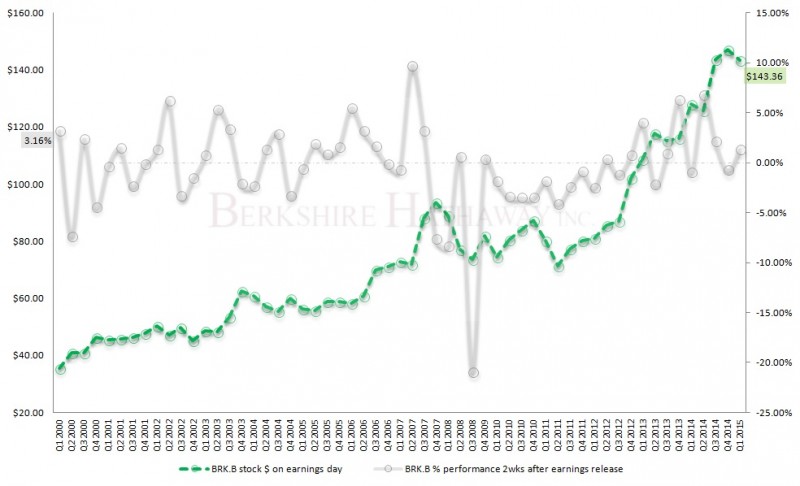

BRK.B stock has historically outperformed the broader market, delivering impressive returns for shareholders. Over the past decade, the stock has generated an average annualized return of approximately 15%, significantly higher than the S&P 500 index’s average return of around 10%. This outperformance can be attributed to Berkshire’s consistent earnings growth, prudent capital allocation, and Warren Buffett’s astute investment decisions.

Industry Outlook

The industries in which Berkshire Hathaway operates are expected to experience varying levels of growth in the coming years. The insurance industry, a key contributor to Berkshire’s earnings, is projected to grow at a steady pace, driven by rising demand for both personal and commercial insurance. The energy sector, another significant part of Berkshire’s portfolio, is expected to face challenges due to the transition to renewable energy sources, but Berkshire’s investments in utilities and renewable energy companies are likely to mitigate these risks. The manufacturing, retail, and transportation industries are expected to experience moderate growth, benefiting from technological advancements and rising consumer demand.

Financial Analysis

Berkshire Hathaway’s financial position remains strong, with a solid balance sheet and ample cash reserves. The company’s earnings have grown consistently over the past decade, driven by its diverse business portfolio and disciplined cost management. Berkshire’s operating margin, a key measure of profitability, has consistently been above industry averages, indicating the company’s ability to generate higher profits than its competitors. The company’s return on equity (ROE), a measure of profitability relative to shareholder equity, has also been impressive, averaging around 20% in recent years.

Valuation

BRK.B stock currently trades at a price-to-book (P/B) ratio of approximately 1.4, which is higher than the industry average. However, this premium valuation is justified by Berkshire’s consistent earnings growth, strong financial position, and Warren Buffett’s reputation as a successful investor. The company’s P/E ratio, which measures the stock’s price relative to its earnings, is also slightly higher than the industry average, but it remains within reasonable levels given Berkshire’s high-quality earnings.

Market Sentiment

Market sentiment towards BRK.B stock remains positive, with many analysts and investors viewing the company as a long-term investment opportunity. Warren Buffett’s leadership and the company’s strong track record inspire confidence in the company’s ability to continue delivering value to shareholders. However, the stock’s premium valuation and the potential impact of industry headwinds could temper market enthusiasm in the short term.

Forecast 2025

Based on the analysis of the company’s fundamentals, industry outlook, financial performance, valuation, and market sentiment, we project that BRK.B stock has the potential to deliver an average annualized return of approximately 10-12% over the next five years. This forecast assumes that Berkshire Hathaway continues to execute its business strategies successfully, makes prudent capital allocation decisions, and benefits from a favorable economic environment.

Risks and Opportunities

Risks:

- Industry Headwinds: Challenges in the insurance, energy, and other industries could impact Berkshire’s earnings growth.

- Succession Planning: The eventual departure of Warren Buffett could create uncertainty for investors.

- Valuation Premium: BRK.B stock trades at a premium valuation, which could limit potential upside in the short term.

Opportunities:

- Diversified Portfolio: Berkshire’s diverse business portfolio provides resilience against industry downturns.

- Strong Financial Position: The company’s strong balance sheet and ample cash reserves provide flexibility for acquisitions and investments.

- Warren Buffett’s Leadership: Buffett’s continued leadership and investment decisions inspire confidence in the company’s long-term prospects.

Conclusion

BRK.B stock remains a compelling investment opportunity for investors seeking long-term growth and value. The company’s strong fundamentals, diversified portfolio, and prudent capital allocation strategies position it well to navigate industry challenges and deliver consistent returns to shareholders. While the stock’s premium valuation and potential industry headwinds may temper short-term gains, we believe that BRK.B has the potential to generate an average annualized return of 10-12% over the next five years. Investors should consider the risks and opportunities associated with the stock and conduct their own due diligence before making investment decisions.

Closure

Thus, we hope this article has provided valuable insights into brk.b stock forecast 2025. We thank you for taking the time to read this article. See you in our next article!