Biweekly Payroll Calendar 2024: A Comprehensive Guide

Related Articles: Biweekly Payroll Calendar 2024: A Comprehensive Guide

- 2025 World Athletics Championships

- The 2025 BMW EV 3 Series: A Comprehensive Overview

- 2025 Chevrolet Silverado 3500HD Dually: The Ultimate Workhorse

- 2025 Year Calendar Printable: A Comprehensive Guide To Planning Your Year

- The All-New 2025 Hyundai Tucson: A Comprehensive Overview

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Biweekly Payroll Calendar 2024: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Biweekly Payroll Calendar 2024: A Comprehensive Guide

Biweekly Payroll Calendar 2024: A Comprehensive Guide

Managing payroll can be a complex and time-consuming task, especially for businesses that pay their employees on a biweekly basis. To ensure accuracy and efficiency, it is essential to have a well-organized payroll calendar that outlines the key dates and deadlines throughout the year. This article provides a comprehensive biweekly payroll calendar for 2024, along with detailed instructions on how to use it effectively.

What is a Biweekly Payroll Calendar?

A biweekly payroll calendar is a schedule that lists the specific dates on which employees will receive their paychecks for each pay period. It is typically used by businesses that pay their employees every other week, as opposed to monthly or semi-monthly.

Benefits of Using a Biweekly Payroll Calendar

- Improved Accuracy: A well-maintained payroll calendar helps to ensure that employees are paid on time and accurately, reducing the risk of errors and disputes.

- Increased Efficiency: By having a clear schedule, payroll administrators can streamline their workflow and avoid last-minute surprises.

- Enhanced Compliance: Adhering to a consistent payroll schedule helps businesses comply with labor laws and regulations.

- Improved Communication: A payroll calendar provides clear and accessible information to employees, allowing them to plan their finances accordingly.

Instructions for Using the Biweekly Payroll Calendar

The biweekly payroll calendar provided in this article is a flexible tool that can be customized to meet the specific needs of your business. Here are the steps on how to use it:

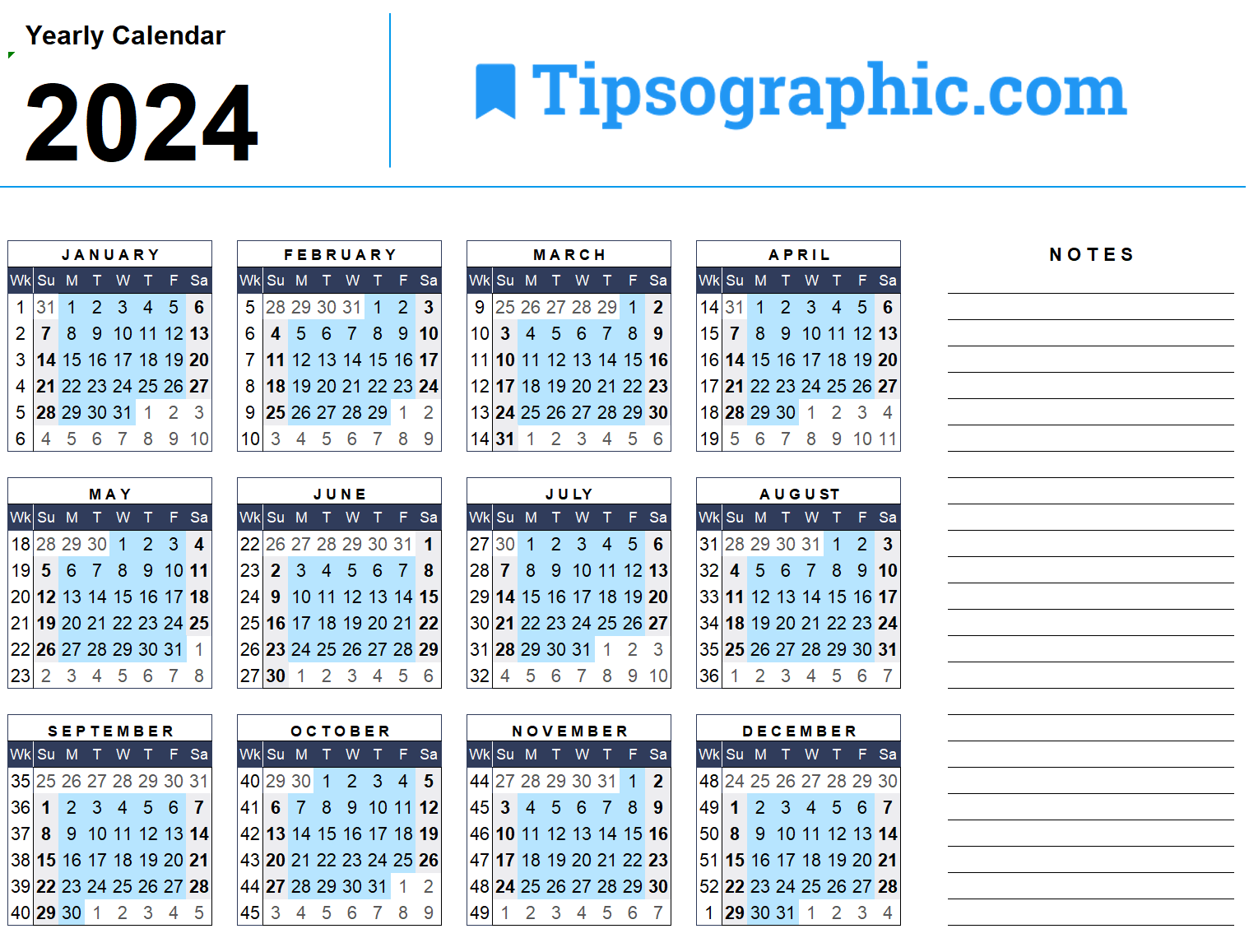

Step 1: Determine Pay Periods

Identify the start and end dates of each pay period. Pay periods typically begin on a Monday and end on a Sunday, but you can adjust these dates to align with your business’s needs.

Step 2: Calculate Pay Dates

Once you have determined the pay periods, calculate the pay dates for each period. Pay dates are typically on a Friday, two weeks after the end of the pay period. However, you can adjust these dates to accommodate your business’s payment cycle.

Step 3: Note Key Dates

In addition to pay dates, the payroll calendar should also include other important dates, such as:

- Cutoff Dates: The last day employees can submit timecards or other payroll information for the pay period.

- Processing Dates: The dates on which payroll is processed and checks are printed or direct deposits are made.

- Holidays: Any holidays that fall within the pay period that may affect payroll processing.

Step 4: Customize the Calendar

The provided payroll calendar is a template that can be customized to meet the specific requirements of your business. You can add or remove dates, adjust pay periods, and include any additional information that is relevant to your payroll process.

Step 5: Communicate the Calendar

Once the payroll calendar is finalized, it is important to communicate it to all employees. This can be done through email, intranet, or a printed handout. Employees should be made aware of the pay dates, cutoff dates, and any other important information.

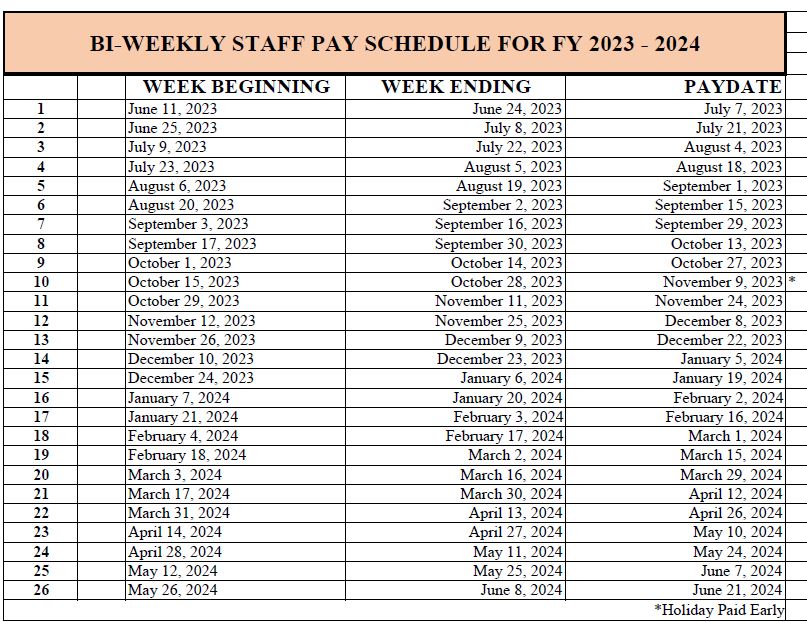

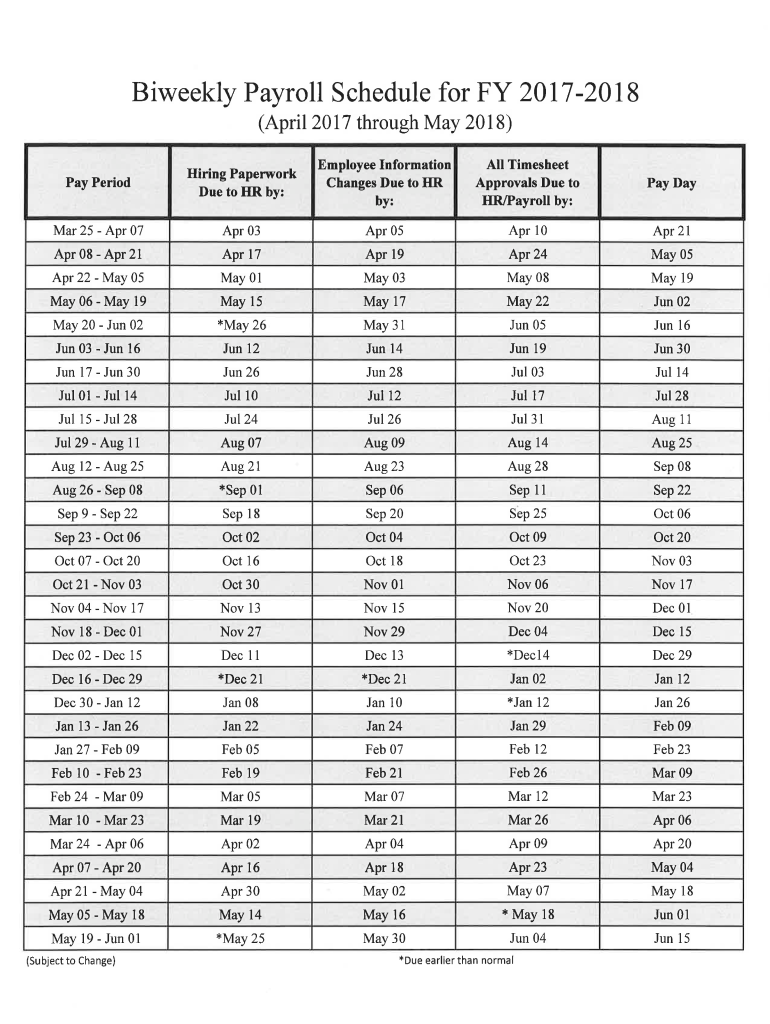

Biweekly Payroll Calendar 2024

The following table provides a biweekly payroll calendar for 2024, with pay dates falling on Fridays:

| Pay Period | Cutoff Date | Processing Date | Pay Date |

|---|---|---|---|

| 1 | January 5, 2024 | January 12, 2024 | January 19, 2024 |

| 2 | January 19, 2024 | January 26, 2024 | February 2, 2024 |

| 3 | February 2, 2024 | February 9, 2024 | February 16, 2024 |

| 4 | February 16, 2024 | February 23, 2024 | March 1, 2024 |

| 5 | March 1, 2024 | March 8, 2024 | March 15, 2024 |

| 6 | March 15, 2024 | March 22, 2024 | March 29, 2024 |

| 7 | March 29, 2024 | April 5, 2024 | April 12, 2024 |

| 8 | April 12, 2024 | April 19, 2024 | April 26, 2024 |

| 9 | April 26, 2024 | May 3, 2024 | May 10, 2024 |

| 10 | May 10, 2024 | May 17, 2024 | May 24, 2024 |

| 11 | May 24, 2024 | May 31, 2024 | June 7, 2024 |

| 12 | June 7, 2024 | June 14, 2024 | June 21, 2024 |

| 13 | June 21, 2024 | June 28, 2024 | July 5, 2024 |

| 14 | July 5, 2024 | July 12, 2024 | July 19, 2024 |

| 15 | July 19, 2024 | July 26, 2024 | August 2, 2024 |

| 16 | August 2, 2024 | August 9, 2024 | August 16, 2024 |

| 17 | August 16, 2024 | August 23, 2024 | August 30, 2024 |

| 18 | August 30, 2024 | September 6, 2024 | September 13, 2024 |

| 19 | September 13, 2024 | September 20, 2024 | September 27, 2024 |

| 20 | September 27, 2024 | October 4, 2024 | October 11, 2024 |

| 21 | October 11, 2024 | October 18, 2024 | October 25, 2024 |

| 22 | October 25, 2024 | November 1, 2024 | November 8, 2024 |

| 23 | November 8, 2024 | November 15, 2024 | November 22, 2024 |

| 24 | November 22, 2024 | November 29, 2024 | December 6, 2024 |

| 25 | December 6, 2024 | December 13, 2024 | December 20, 2024 |

| 26 | December 20, 2024 | December 27, 2024 | January 3, 2025 |

Additional Considerations

- Holidays: The payroll calendar does not include holidays. If a holiday falls within a pay period, it may affect the cutoff date or pay date.

- Cutoff Dates: Cutoff dates may need to be adjusted to accommodate early or late holidays or other circumstances.

- Direct Deposit: If you offer direct deposit, ensure that the processing date allows sufficient time for funds to be deposited into employees’ accounts on the pay date.

- Review and Update: Regularly review and update the payroll calendar to ensure it remains accurate and reflects any changes in your business’s payroll practices.

Conclusion

An organized biweekly payroll calendar is an essential tool for businesses that pay their employees on a regular schedule. By following the steps outlined in this article and using the provided calendar, you can streamline your payroll process, improve accuracy, and ensure that your employees are paid on time and correctly. Remember to customize the calendar to meet the specific needs of your business and communicate it effectively to all stakeholders.

![[FREE] Biweekly Payroll Calendar Google Sheets - 2024 - YouTube](https://i.ytimg.com/vi/2Keo0ZBxcdQ/maxresdefault.jpg)

![2024 Biweekly Payroll Calendar [3 Paycheck Months of 2024] - My Worthy Penny](https://myworthypenny.com/wp-content/uploads/2023/03/2024-biweekly-payroll-calendar-640x960.png)

Closure

Thus, we hope this article has provided valuable insights into Biweekly Payroll Calendar 2024: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!