Bitcoin Price in 2025: A Comprehensive Analysis and Future Forecast

Related Articles: Bitcoin Price in 2025: A Comprehensive Analysis and Future Forecast

- The 2025 Ford Edge: A Comprehensive Overview

- 2025 Toyota MR2: A Rebirth Of The Iconic Mid-Engine Sports Car

- Marvel Movie Schedule Through 2025: A Comprehensive Guide To The Cinematic Universe

- Projected 2025 IRMAA Brackets: Understanding The Income-Related Monthly Adjustment Amount

- The New VW Bus Microbus: A Retro Revival With A Modern Twist

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Bitcoin Price in 2025: A Comprehensive Analysis and Future Forecast. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Bitcoin Price in 2025: A Comprehensive Analysis and Future Forecast

Bitcoin Price in 2025: A Comprehensive Analysis and Future Forecast

Introduction

Bitcoin, the pioneering cryptocurrency, has captivated the financial world since its inception in 2009. Its decentralized nature, limited supply, and increasing adoption have fueled significant price fluctuations over the years. As we approach 2025, numerous factors will influence the trajectory of Bitcoin’s price, shaping its future trajectory. This article delves into a comprehensive analysis of the potential drivers and challenges that will determine the Bitcoin price in 2025.

Factors Influencing Bitcoin Price

1. Halving Events:

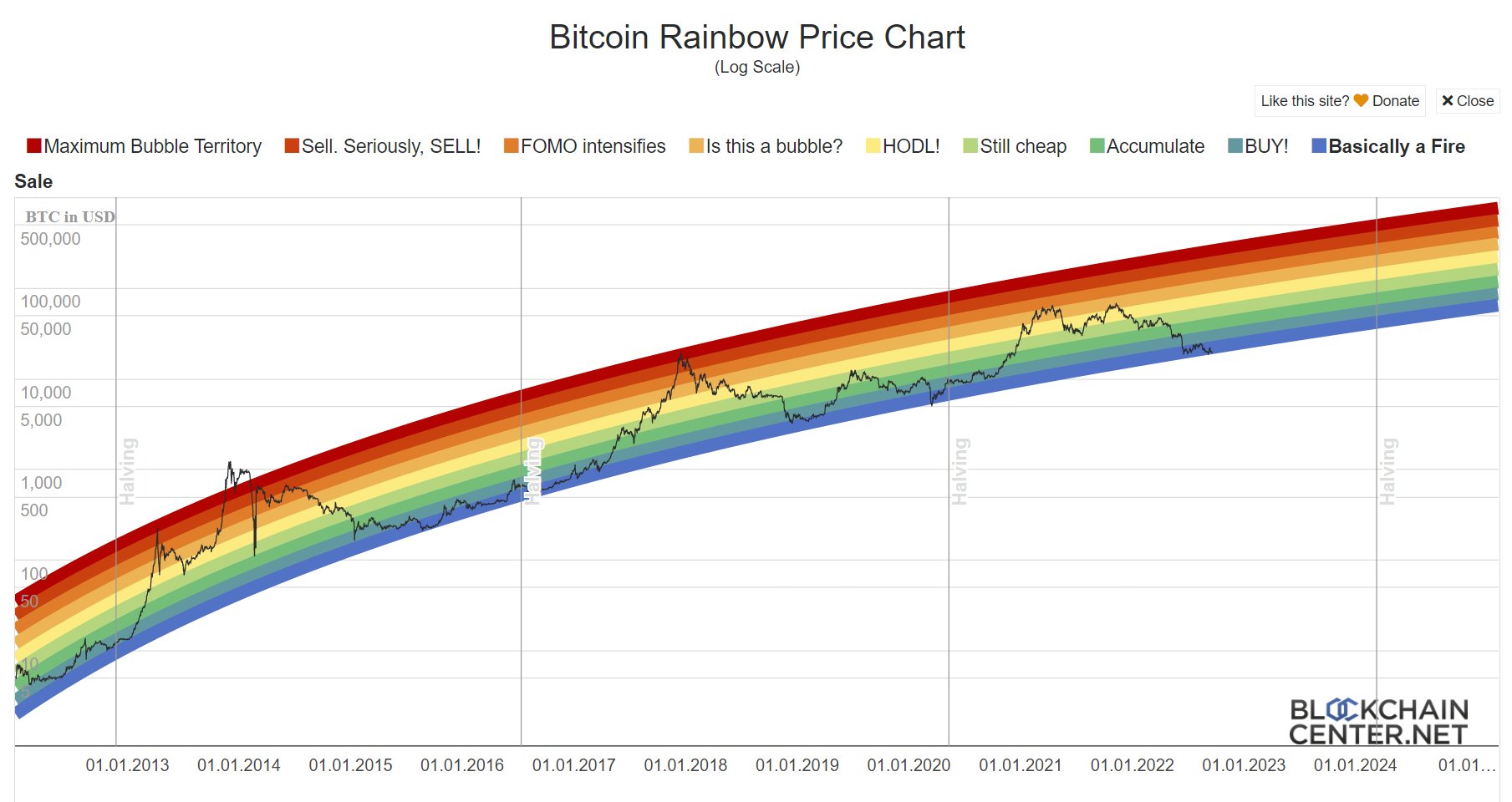

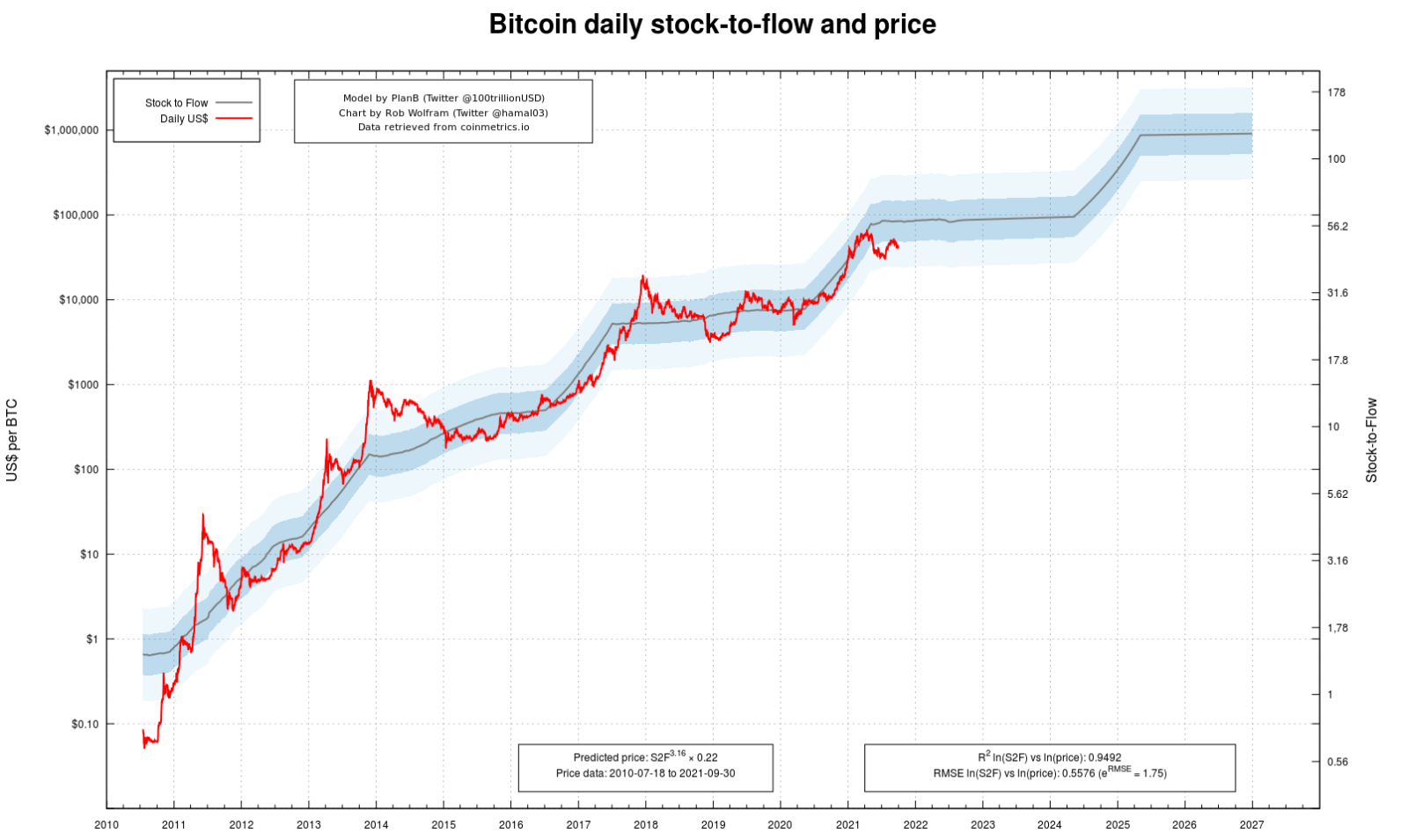

Bitcoin’s halving events occur approximately every four years, reducing the block reward for miners by half. This scarcity mechanism plays a crucial role in influencing Bitcoin’s price. The next halving event is anticipated in 2024, and historically, such events have coincided with significant price increases.

2. Institutional Adoption:

The growing acceptance of Bitcoin by institutional investors, such as hedge funds and pension funds, has contributed to its increased legitimacy and stability. As more institutions allocate funds to Bitcoin, demand will rise, potentially driving up its price.

3. Regulatory Environment:

Government regulations can significantly impact Bitcoin’s price. Favorable regulations, such as clear guidelines for cryptocurrency trading and taxation, can foster investor confidence and boost adoption. Conversely, restrictive regulations can hinder growth and dampen prices.

4. Technological Advancements:

Ongoing advancements in Bitcoin’s underlying technology, such as the Lightning Network, can enhance scalability, security, and usability. These improvements can attract new users and facilitate wider adoption, potentially leading to price appreciation.

5. Global Economic Conditions:

Economic uncertainty and geopolitical events can influence Bitcoin’s price. In times of economic instability, investors may seek alternative assets like Bitcoin, which could drive up its value. However, economic downturns can also lead to sell-offs, affecting its price negatively.

6. Competition from Alternative Cryptocurrencies:

The emergence of alternative cryptocurrencies, such as Ethereum and Solana, poses a competitive threat to Bitcoin. If these alternatives gain significant market share, they could potentially divert investment away from Bitcoin and impact its price.

Challenges and Risks

1. Price Volatility:

Bitcoin’s price is known for its volatility, which can be both an opportunity and a risk. While rapid price increases can generate substantial profits, sudden declines can result in significant losses. Investors should be aware of this volatility and manage their exposure accordingly.

2. Security Breaches and Hacks:

Cryptocurrency exchanges and wallets have been targets of cyberattacks and hacks. These incidents can erode investor confidence and negatively impact Bitcoin’s price. Robust security measures are crucial to mitigate these risks.

3. Scalability Limitations:

Bitcoin’s transaction processing capacity is limited, which can lead to congestion and high transaction fees. If these scalability issues are not addressed, they could hinder adoption and affect Bitcoin’s price negatively.

4. Regulatory Uncertainty:

The regulatory landscape for cryptocurrencies remains fluid, with different jurisdictions adopting varying approaches. Unclear or restrictive regulations can create uncertainty for investors and potentially stifle Bitcoin’s growth.

5. Environmental Concerns:

Bitcoin mining consumes a significant amount of electricity, raising environmental concerns. If these concerns intensify and lead to regulatory restrictions, they could impact Bitcoin’s price and adoption.

Price Forecast for 2025

Based on the aforementioned factors and challenges, analysts have provided a range of price forecasts for Bitcoin in 2025. While predictions can vary, the consensus suggests that Bitcoin’s price will continue to be influenced by a combination of positive and negative factors.

-

Bullish Predictions: Some analysts believe that Bitcoin could reach $100,000 or even higher by 2025, driven by increasing institutional adoption, technological advancements, and a favorable economic environment.

-

Bearish Predictions: Others anticipate that Bitcoin’s price could fall below $20,000, citing regulatory uncertainty, security breaches, and the emergence of alternative cryptocurrencies as potential challenges.

-

Moderate Predictions: A more moderate view suggests that Bitcoin’s price could range between $30,000 and $50,000 by 2025, reflecting a balance between positive and negative factors influencing its trajectory.

Conclusion

Predicting the Bitcoin price in 2025 is a challenging endeavor due to the inherent volatility and multitude of factors that can influence its value. However, by considering the key drivers and challenges outlined in this analysis, investors can gain a better understanding of the potential trajectory of Bitcoin’s price in the years to come.

While Bitcoin’s future remains uncertain, its underlying technology, increasing adoption, and potential as a store of value make it a compelling investment opportunity for those willing to navigate its inherent risks. As the world continues to evolve and embrace digital assets, Bitcoin’s price in 2025 will undoubtedly be shaped by the interplay of technological advancements, regulatory landscapes, and global economic conditions.

Closure

Thus, we hope this article has provided valuable insights into Bitcoin Price in 2025: A Comprehensive Analysis and Future Forecast. We hope you find this article informative and beneficial. See you in our next article!