Bitcoin Crypto Price Prediction 2025: A Comprehensive Analysis

Related Articles: Bitcoin Crypto Price Prediction 2025: A Comprehensive Analysis

- How Many Days Until New Year’s 2025?

- 2025 Philippine Presidential Election: A Preview Of The Race

- Bitcoin Price In 2025: A Comprehensive Analysis And Future Forecast

- 2025 Jeep Gladiator: A Comprehensive Overview

- Nissan LEAF E: A Comprehensive Exploration Of Its Specifications

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Bitcoin Crypto Price Prediction 2025: A Comprehensive Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Bitcoin Crypto Price Prediction 2025: A Comprehensive Analysis

Bitcoin Crypto Price Prediction 2025: A Comprehensive Analysis

Introduction

Bitcoin, the world’s leading cryptocurrency, has experienced a remarkable journey since its inception in 2009. Characterized by its decentralized nature, finite supply, and increasing adoption, Bitcoin has garnered significant attention from investors and enthusiasts alike. As the crypto market continues to evolve, predicting Bitcoin’s future price trajectory becomes a topic of paramount importance. This article presents a comprehensive analysis of Bitcoin’s crypto price prediction for 2025, considering various factors that may influence its value.

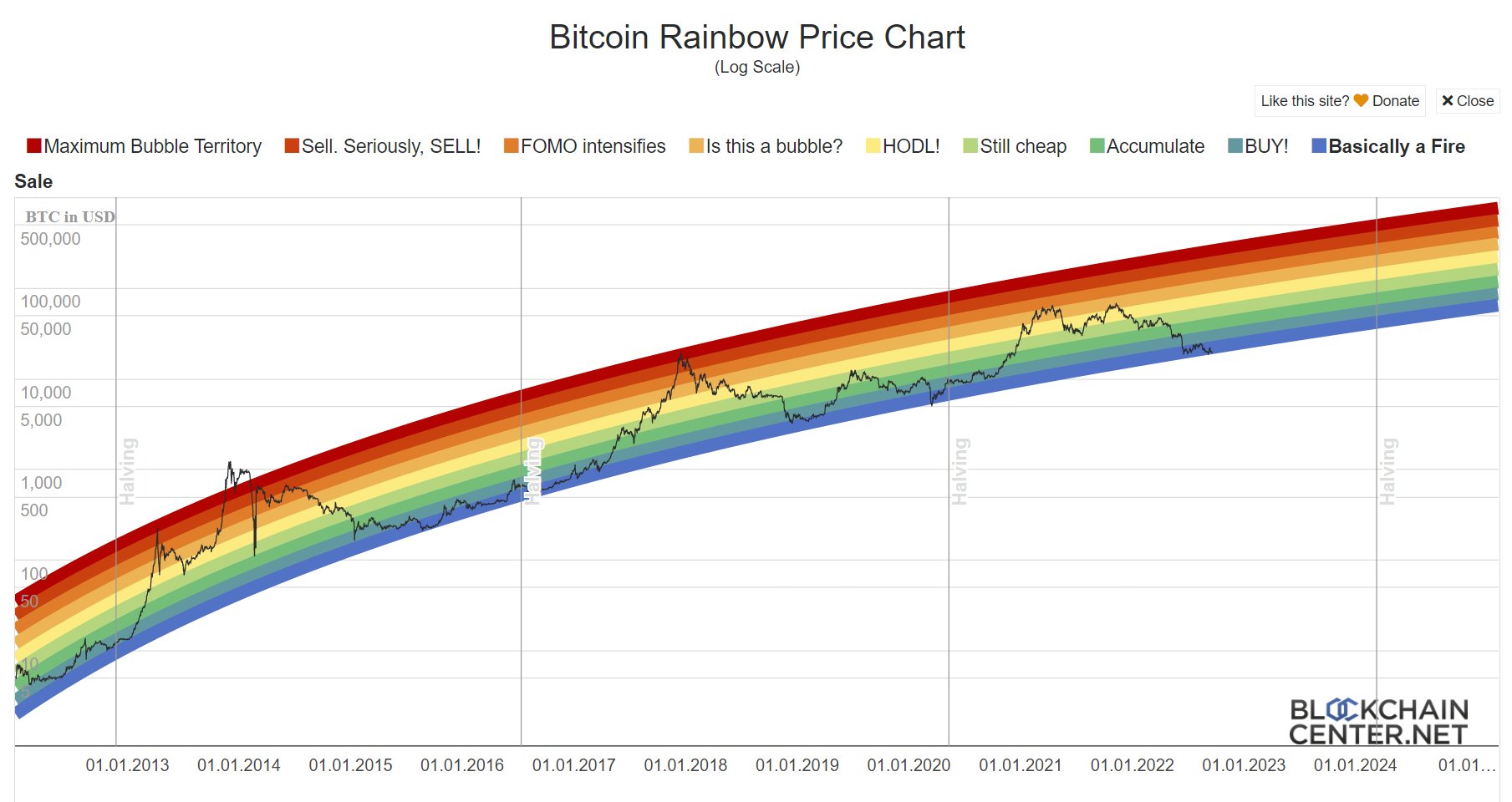

Historical Performance and Market Trends

To understand Bitcoin’s potential price trajectory, it is essential to examine its historical performance. Bitcoin has experienced significant price volatility over the years, marked by both substantial gains and sharp declines. However, despite these fluctuations, Bitcoin has maintained a long-term upward trend.

In 2021, Bitcoin reached its all-time high of approximately $69,000, driven by factors such as increased institutional adoption and the halving event that reduced the issuance of new Bitcoins. However, the market subsequently witnessed a significant correction, with Bitcoin’s price falling below $30,000.

The cryptocurrency market has since rebounded, and Bitcoin’s price has stabilized around the $40,000 mark. This recovery indicates that the market is regaining confidence in Bitcoin’s long-term potential.

Factors Influencing Bitcoin’s Price

Numerous factors can influence Bitcoin’s price, including:

- Supply and Demand: Bitcoin has a finite supply of 21 million coins, which creates scarcity and can drive up its value.

- Institutional Adoption: As more financial institutions and corporations embrace Bitcoin, its demand and price tend to increase.

- Regulatory Environment: Favorable regulatory frameworks can provide stability and legitimacy to Bitcoin, boosting its appeal.

- Technological Advancements: Developments in blockchain technology and the wider crypto ecosystem can enhance Bitcoin’s functionality and value.

- Economic Conditions: Economic uncertainty or inflation can lead investors to seek alternative assets like Bitcoin, potentially driving up its price.

Expert Predictions and Market Sentiment

Industry experts and analysts have provided varying predictions for Bitcoin’s price in 2025. Some believe it could reach new all-time highs, while others anticipate a more conservative growth trajectory.

- Bullish Outlook: Some analysts predict that Bitcoin could surpass $100,000 or even $200,000 by 2025, citing factors such as increased adoption, halving events, and a growing institutional investor base.

- Bearish Outlook: Others suggest that Bitcoin’s price may face resistance around the $50,000 to $60,000 range, as market volatility and regulatory challenges could hinder its progress.

Market sentiment plays a significant role in influencing Bitcoin’s price. Positive sentiment, driven by news of partnerships, technological advancements, or favorable regulatory developments, can fuel buying pressure and drive up its value. Conversely, negative sentiment, caused by security breaches, market downturns, or regulatory concerns, can lead to sell-offs and price declines.

Factors to Consider for 2025 Prediction

To make an informed prediction about Bitcoin’s price in 2025, it is crucial to consider the following factors:

- Continued Institutional Adoption: If major financial institutions and corporations continue to embrace Bitcoin, it will provide a significant boost to its credibility and demand.

- Regulatory Clarity: Clear and supportive regulatory frameworks can instill confidence in investors and accelerate Bitcoin’s adoption.

- Technological Innovations: Advancements in blockchain technology and the development of new applications can enhance Bitcoin’s utility and value.

- Economic Environment: Economic conditions, such as inflation or geopolitical uncertainty, can influence investors’ risk appetite and impact Bitcoin’s price.

- Market Sentiment: Overall market sentiment, driven by news and events, can have a substantial effect on Bitcoin’s price.

Potential Price Ranges

Based on the analysis of historical performance, market trends, and expert predictions, the following price ranges are plausible for Bitcoin in 2025:

- Conservative Estimate: $50,000 – $75,000

- Moderate Estimate: $75,000 – $125,000

- Bullish Estimate: $125,000 – $200,000

Conclusion

Predicting Bitcoin’s crypto price in 2025 is a complex endeavor influenced by a myriad of factors. However, by considering historical performance, market trends, expert predictions, and potential influencing factors, we can make informed estimates. While Bitcoin’s price may experience volatility along the way, its long-term growth potential remains promising. As the crypto market matures and Bitcoin gains wider adoption, it is reasonable to expect its value to continue to appreciate over the coming years.

![[New Research] Bitcoin Price Prediction 2025: Bitcoin In 5 Years](https://img.currency.com/imgs/articles/1472xx/shutterstock_763067344.jpg)

Closure

Thus, we hope this article has provided valuable insights into Bitcoin Crypto Price Prediction 2025: A Comprehensive Analysis. We appreciate your attention to our article. See you in our next article!