Best Target Date Funds for 2055

Related Articles: Best Target Date Funds for 2055

- 2025 Ford Expedition Render: A Glimpse Into The Future Of American SUVs

- The 2025 Kia Soul Turbo: A Compact Crossover With A Punch

- Easter Half Term 2025: A Comprehensive Guide To The Perfect Family Break

- 2025 Troon Drive: A Luxurious Oasis In The Heart Of Henderson

- Zodiac Year 2025: The Year Of The Snake

Introduction

With great pleasure, we will explore the intriguing topic related to Best Target Date Funds for 2055. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Best Target Date Funds for 2055

Best Target Date Funds for 2055

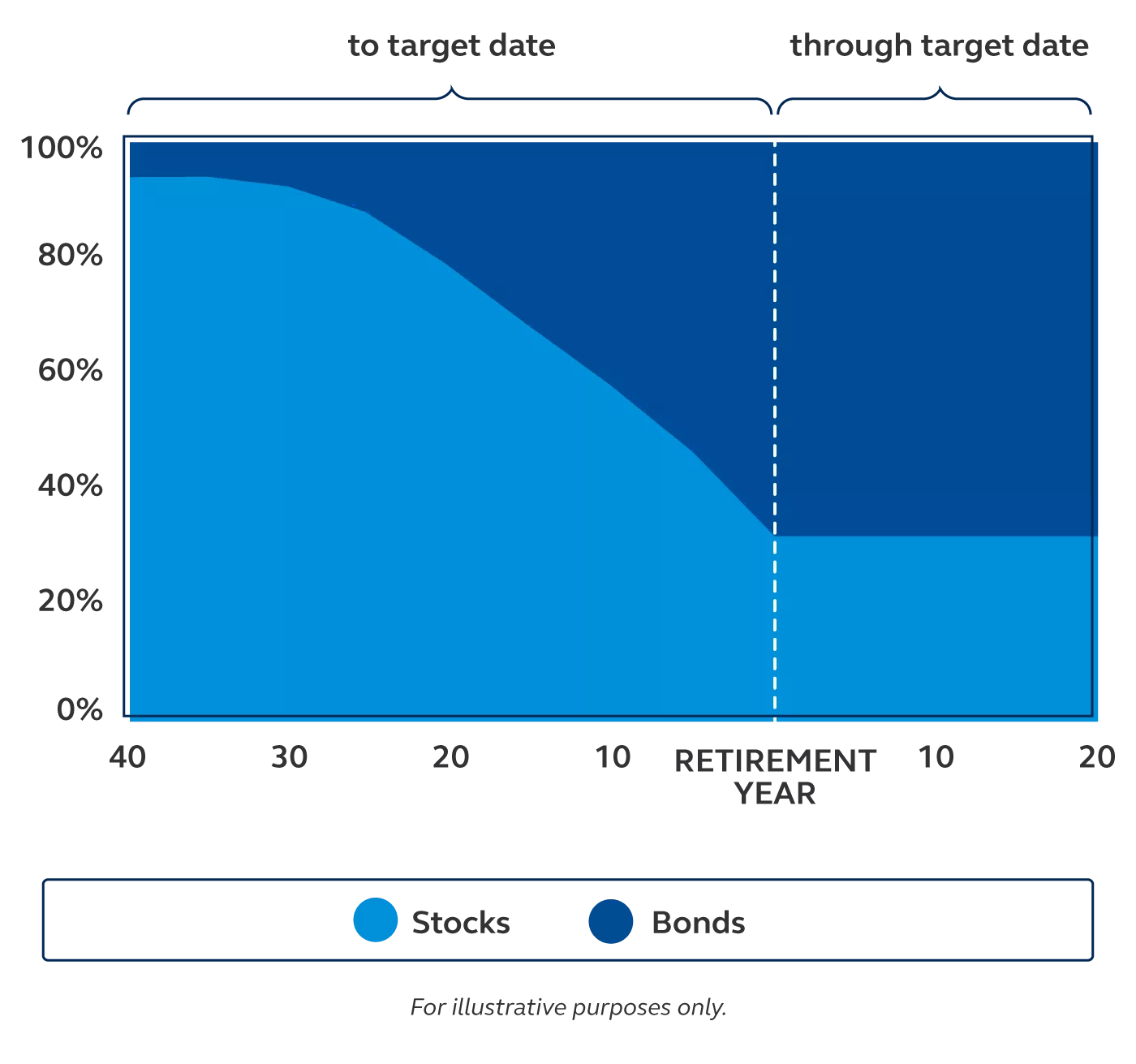

Target date funds are a type of mutual fund that automatically adjusts its asset allocation based on your expected retirement date. As you get closer to retirement, the fund will gradually shift its investments from stocks to bonds, which are typically less risky. This helps to reduce your risk of losing money in the years leading up to retirement.

Target date funds are a popular choice for investors who want a simple and hands-off approach to retirement planning. However, not all target date funds are created equal. Some funds have higher fees than others, and some funds invest in more aggressive or conservative assets than others.

If you’re looking for a target date fund for 2055, here are a few things to keep in mind:

- Fees: Target date funds typically have annual fees of around 0.50% to 1.00%. However, some funds have fees as high as 2.00% or more. When choosing a target date fund, be sure to compare the fees of different funds.

- Asset allocation: Target date funds invest in a mix of stocks, bonds, and other assets. The asset allocation of a target date fund will change over time as you get closer to retirement. In the early years, the fund will invest more heavily in stocks, which have the potential to grow more quickly than bonds. As you get closer to retirement, the fund will shift its investments to bonds, which are less risky.

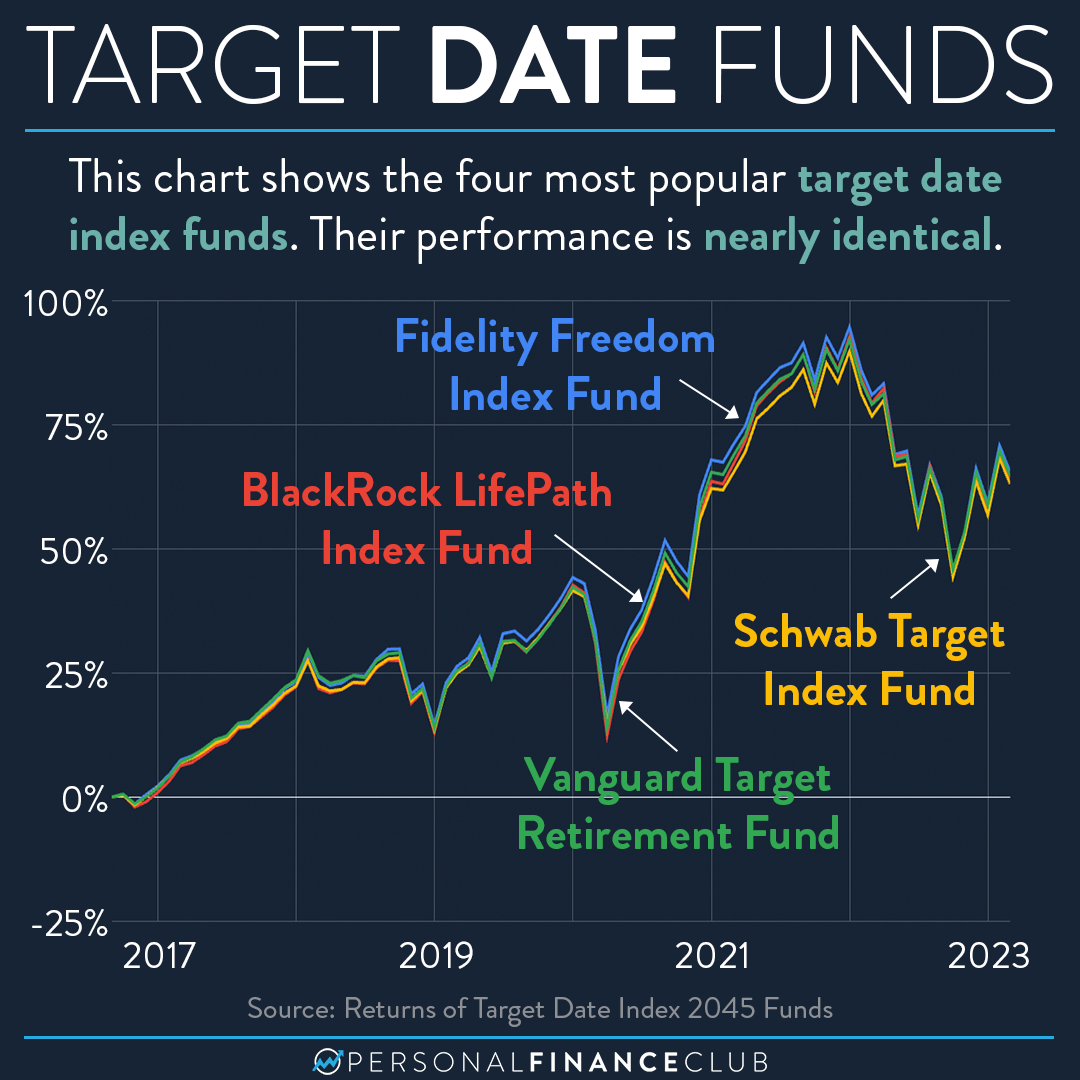

- Performance: Target date funds have varying performance records. When choosing a target date fund, be sure to compare the performance of different funds over time.

Here are a few of the best target date funds for 2055:

- Vanguard Target Retirement 2055 Fund (VFFVX)

- Fidelity Freedom Index 2055 Fund (FFNOX)

- T. Rowe Price Retirement 2055 Fund (TRRIX)

- Schwab Target Retirement 2055 Index Fund (SWTHX)

- American Funds Target Retirement 2055 Fund (AOTRX)

These funds have low fees, a reasonable asset allocation, and a strong performance record. They are a good choice for investors who are looking for a simple and hands-off approach to retirement planning.

How to choose a target date fund

When choosing a target date fund, there are a few things to keep in mind:

- Your risk tolerance: Target date funds invest in a mix of stocks and bonds. The asset allocation of a target date fund will change over time as you get closer to retirement. In the early years, the fund will invest more heavily in stocks, which have the potential to grow more quickly than bonds. As you get closer to retirement, the fund will shift its investments to bonds, which are less risky. If you are more comfortable with taking on risk, you may want to choose a target date fund that invests more heavily in stocks. If you are more risk-averse, you may want to choose a target date fund that invests more heavily in bonds.

- Your investment horizon: Target date funds are designed to help you reach your retirement goals. The investment horizon of a target date fund is the number of years until you plan to retire. When choosing a target date fund, be sure to choose a fund that has an investment horizon that is similar to your own.

- Your fees: Target date funds typically have annual fees of around 0.50% to 1.00%. However, some funds have fees as high as 2.00% or more. When choosing a target date fund, be sure to compare the fees of different funds.

Conclusion

Target date funds are a good choice for investors who want a simple and hands-off approach to retirement planning. However, not all target date funds are created equal. When choosing a target date fund, be sure to compare the fees, asset allocation, and performance of different funds.

Closure

Thus, we hope this article has provided valuable insights into Best Target Date Funds for 2055. We hope you find this article informative and beneficial. See you in our next article!