Amazon Stock Price Prediction 2025: A Comprehensive Analysis

Related Articles: Amazon Stock Price Prediction 2025: A Comprehensive Analysis

- BMW X5 M 2025: A Comprehensive Overview Of Pricing And Features

- Athletics World Championships 2024: Budapest Gears Up For A Track And Field Extravaganza

- 2025 Football Schedule: A Comprehensive Overview

- How Many More Days Until June 14th, 2025?

- 2025 Mustang Rumors: A Comprehensive Outlook

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Amazon Stock Price Prediction 2025: A Comprehensive Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Amazon Stock Price Prediction 2025: A Comprehensive Analysis

Amazon Stock Price Prediction 2025: A Comprehensive Analysis

Introduction

Amazon, the e-commerce behemoth, has been a consistent market leader in the technology sector for decades. Its stock price has witnessed a remarkable upward trajectory, driven by its innovative business model, robust financial performance, and a rapidly expanding global presence. As we approach 2025, investors are eager to ascertain the future prospects of Amazon’s stock price. This article provides a comprehensive analysis of the factors that will shape Amazon’s stock performance in the coming years.

Key Factors Driving Amazon’s Stock Price

-

E-commerce Dominance: Amazon’s dominance in the e-commerce market is a key driver of its stock price. The company’s vast product selection, efficient logistics network, and customer-centric approach have made it the preferred destination for online shoppers. Amazon’s continued investment in its e-commerce operations, including the expansion of its Prime subscription service, is expected to bolster its market share and drive future revenue growth.

-

Cloud Computing: Amazon Web Services (AWS), Amazon’s cloud computing division, is a significant contributor to its revenue and profitability. AWS provides cloud infrastructure and services to businesses of all sizes, enabling them to scale and innovate their operations. The growing adoption of cloud computing is expected to fuel the growth of AWS and positively impact Amazon’s overall financial performance.

-

Artificial Intelligence: Amazon is investing heavily in artificial intelligence (AI) technologies, which are being integrated into its various products and services. AI is expected to enhance the customer experience, improve operational efficiency, and create new revenue streams for Amazon.

-

Expansion into New Markets: Amazon is actively expanding into new markets, both domestically and internationally. The company has recently entered the healthcare industry with its acquisition of PillPack and is exploring new opportunities in areas such as transportation and manufacturing. Amazon’s ability to successfully penetrate new markets will be a key factor in driving its future growth.

-

Competition: Amazon faces intense competition from other e-commerce giants, including Alibaba, Walmart, and eBay. The company must continue to innovate and differentiate its offerings to maintain its competitive advantage and sustain its market share.

Historical Performance and Analyst Estimates

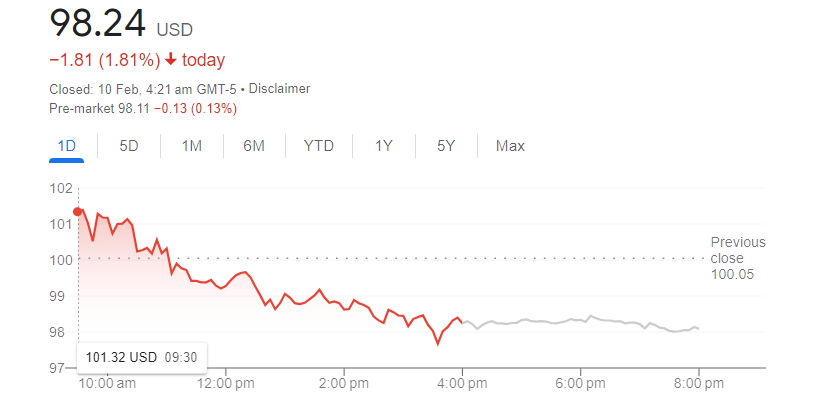

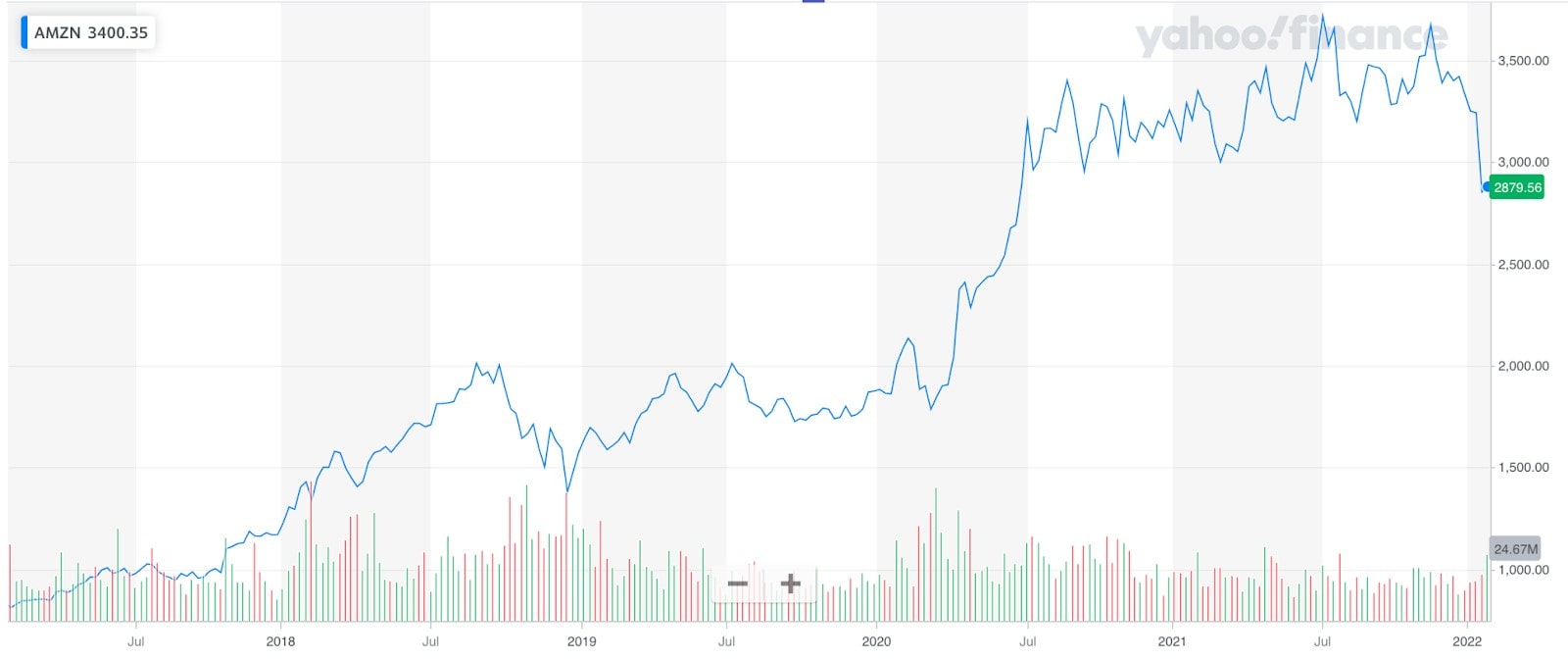

Over the past decade, Amazon’s stock price has consistently outperformed the broader market. The stock has delivered an average annual return of over 20%, significantly higher than the S&P 500 index. Analyst estimates for Amazon’s stock price in 2025 vary widely, but the consensus is that the stock has significant upside potential.

-

Bullish Estimates: Some analysts believe that Amazon’s stock price could reach as high as $5,000 per share by 2025. This estimate is based on the company’s strong fundamentals, growth prospects, and the potential for further market expansion.

-

Bearish Estimates: Other analysts are more cautious in their estimates, citing potential headwinds such as increased competition and regulatory challenges. They predict that Amazon’s stock price could reach around $3,000 per share by 2025.

Risks and Challenges

While Amazon has a strong track record of success, there are several risks and challenges that could impact its future stock performance.

-

Economic Downturn: A recession or economic downturn could negatively impact consumer spending and reduce demand for Amazon’s products and services.

-

Regulatory Scrutiny: Amazon has faced increasing regulatory scrutiny in recent years, particularly in the areas of antitrust and labor practices. Adverse regulatory actions could impact the company’s operations and financial performance.

-

Cybersecurity Breaches: Amazon’s vast network of customer data and infrastructure make it a target for cyberattacks. A major data breach could damage the company’s reputation and lead to financial losses.

Investment Thesis

Based on the analysis of the key factors driving Amazon’s stock price, the historical performance, and the potential risks and challenges, we believe that Amazon’s stock has significant upside potential in the long term. The company’s strong fundamentals, growth prospects, and ability to adapt to changing market dynamics make it a compelling investment opportunity.

Conclusion

Amazon’s stock price is expected to continue its upward trajectory in the coming years, driven by the company’s continued dominance in e-commerce, its growing cloud computing business, and its investments in artificial intelligence and new markets. While there are some risks and challenges that could impact the stock’s performance, Amazon’s strong track record and the potential for further growth make it a compelling investment for the long term.

Closure

Thus, we hope this article has provided valuable insights into Amazon Stock Price Prediction 2025: A Comprehensive Analysis. We thank you for taking the time to read this article. See you in our next article!