2025 US Tax Brackets: A Comprehensive Guide

Related Articles: 2025 US Tax Brackets: A Comprehensive Guide

- UA 250 Flight Status: A Comprehensive Guide To Real-Time Updates

- The 2025 Toyota 4Runner: A Comprehensive Overview

- 2025: A Dystopian Vision Of A Technologically Advanced Society

- World Juniors 2025: A Showcase Of Rising Hockey Stars

- 2025 Quarters Release Dates: A Comprehensive Guide To Upcoming Coin Releases

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to 2025 US Tax Brackets: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about 2025 US Tax Brackets: A Comprehensive Guide

2025 US Tax Brackets: A Comprehensive Guide

Introduction

The United States tax system is a complex and ever-evolving entity. As part of this system, tax brackets play a crucial role in determining the amount of income tax an individual owes. These brackets are adjusted periodically to account for inflation and other economic factors. This article provides a comprehensive overview of the 2025 US tax brackets, including the rates, income ranges, and implications for taxpayers.

Overview of Tax Brackets

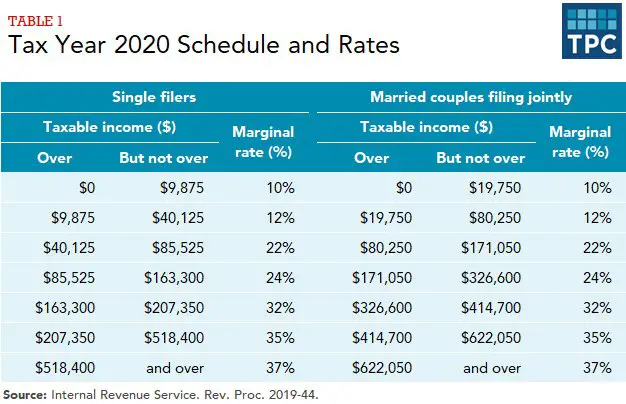

Tax brackets are a series of ranges of taxable income, each of which is subject to a different tax rate. As an individual’s taxable income increases, they move into higher tax brackets, resulting in a higher overall tax liability. The 2025 tax brackets for individuals are as follows:

| Tax Bracket | Taxable Income Range | Tax Rate |

|---|---|---|

| 10% | $0 – $10,275 | 10% |

| 12% | $10,275 – $41,775 | 12% |

| 22% | $41,775 – $89,075 | 22% |

| 24% | $89,075 – $170,050 | 24% |

| 32% | $170,050 – $215,950 | 32% |

| 35% | $215,950 – $539,900 | 35% |

| 37% | $539,900 and above | 37% |

Implications for Taxpayers

The 2025 tax brackets have several implications for taxpayers. First, it is important to note that the income ranges in the brackets are adjusted annually for inflation. This means that the actual income thresholds may change slightly from year to year.

Second, the tax rates associated with each bracket remain the same as in 2023. This means that taxpayers will not see any significant changes in their overall tax liability due to changes in the tax brackets.

Third, the 2025 tax brackets provide a roadmap for taxpayers to plan their finances and minimize their tax burden. By understanding the income ranges and tax rates, individuals can make informed decisions about their income, investments, and deductions to optimize their tax efficiency.

Standard Deductions and Personal Exemptions

In addition to tax brackets, the standard deduction and personal exemptions also play a role in determining an individual’s tax liability. The standard deduction is a specific amount that is subtracted from taxable income before taxes are calculated. The personal exemption is an amount that is subtracted from taxable income for each dependent.

The standard deduction and personal exemptions are also adjusted for inflation each year. For 2025, the standard deduction is $13,850 for single filers and $27,700 for married couples filing jointly. The personal exemption is $4,500 for each dependent.

Additional Tax Considerations

Beyond the tax brackets, standard deductions, and personal exemptions, there are several other factors that can impact an individual’s tax liability. These include:

- Itemized deductions: Itemized deductions are expenses that can be subtracted from taxable income in lieu of the standard deduction. Examples include mortgage interest, charitable contributions, and medical expenses.

- Tax credits: Tax credits are dollar-for-dollar reductions in tax liability. Examples include the child tax credit and the earned income tax credit.

- Capital gains and losses: Capital gains and losses refer to the profit or loss on the sale of assets such as stocks, bonds, and real estate. Capital gains are taxed at preferential rates compared to ordinary income.

Conclusion

The 2025 US tax brackets provide a framework for determining the amount of income tax an individual owes. By understanding the income ranges, tax rates, and other relevant factors, taxpayers can plan their finances and minimize their tax liability. It is important to note that the tax brackets and other tax provisions are subject to change, so it is advisable to consult with a tax professional for the most up-to-date information.

Closure

Thus, we hope this article has provided valuable insights into 2025 US Tax Brackets: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!