2025 Medicare IRMAA Brackets

Related Articles: 2025 Medicare IRMAA Brackets

- Project 2025 Family: Empowering The Future Of Mobility

- What Will 2025 Look Like?

- Tamil Calendar May 2025

- When Is The Super Bowl In 2025?

- Thanksgiving 2023: A Time For Gratitude And Togetherness

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to 2025 Medicare IRMAA Brackets. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about 2025 Medicare IRMAA Brackets

2025 Medicare IRMAA Brackets

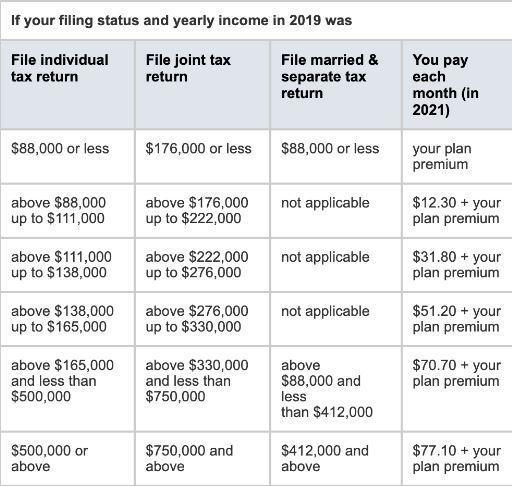

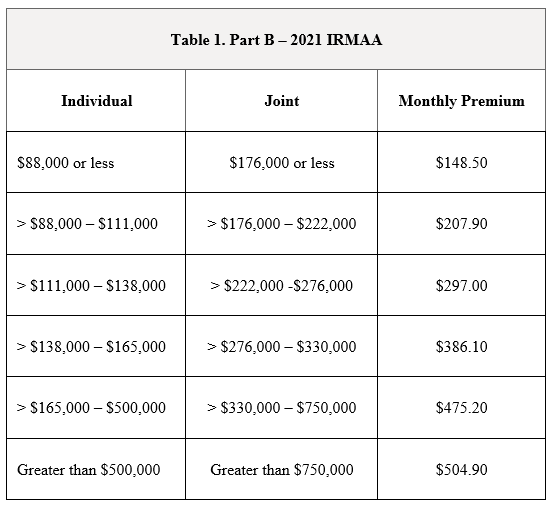

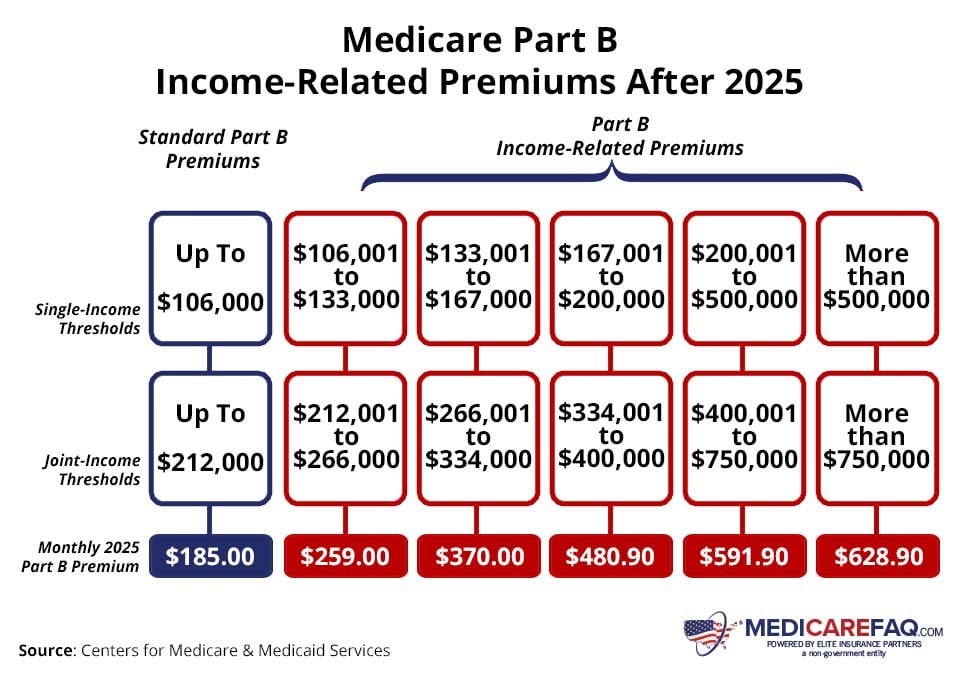

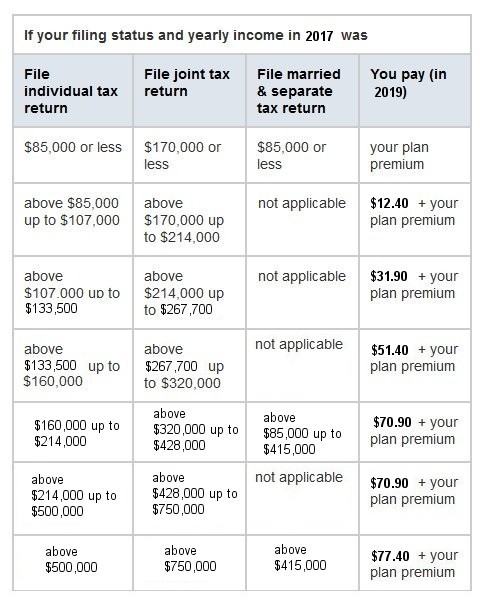

The Income-Related Monthly Adjustment Amount (IRMAA) is a surcharge that is added to the Medicare Part B and Part D premiums of high-income earners. The IRMAA brackets are adjusted annually to reflect changes in the cost of living. For 2025, the IRMAA brackets are as follows:

Part B IRMAA Brackets

| Filing Status | Single | Married Filing Jointly |

|---|---|---|

| Below $97,000 | $0 | $194,000 |

| $97,000 – $129,000 | $56.40 | $112.80 |

| $129,000 – $161,000 | $121.80 | $243.60 |

| $161,000 – $218,000 | $194.60 | $389.20 |

| $218,000 – $275,000 | $282.60 | $565.20 |

| Over $275,000 | $370.60 | $741.20 |

Part D IRMAA Brackets

| Filing Status | Single | Married Filing Jointly |

|---|---|---|

| Below $91,000 | $0 | $182,000 |

| $91,000 – $122,000 | $33.10 | $66.20 |

| $122,000 – $157,000 | $73.90 | $147.80 |

| $157,000 – $214,000 | $126.20 | $252.40 |

| $214,000 – $272,000 | $185.30 | $370.60 |

| Over $272,000 | $252.40 | $504.80 |

How to Calculate Your IRMAA

To calculate your IRMAA, you will need to know your modified adjusted gross income (MAGI). Your MAGI is your adjusted gross income (AGI) plus certain other types of income, such as tax-exempt interest and foreign income.

Once you know your MAGI, you can use the IRMAA brackets to determine how much your IRMAA will be. For example, if you are single and your MAGI is $130,000, your IRMAA for Part B will be $56.40 per month.

Paying Your IRMAA

Your IRMAA will be added to your Medicare Part B and Part D premiums. You can pay your IRMAA in monthly installments or in a lump sum.

If You Don’t Pay Your IRMAA

If you don’t pay your IRMAA, you may be subject to a penalty. The penalty is equal to 50% of the IRMAA that you owe.

Getting Help with Your IRMAA

If you have questions about your IRMAA, you can contact the Social Security Administration (SSA) at 1-800-772-1213.

Additional Information

The IRMAA is not a tax. It is a surcharge that is used to help cover the costs of Medicare Part B and Part D.

The IRMAA brackets are adjusted annually to reflect changes in the cost of living.

High-income earners who are subject to the IRMAA may be able to reduce their IRMAA by taking advantage of certain tax deductions and credits.

Conclusion

The IRMAA is a surcharge that is added to the Medicare Part B and Part D premiums of high-income earners. The IRMAA brackets are adjusted annually to reflect changes in the cost of living. If you are subject to the IRMAA, you can pay it in monthly installments or in a lump sum. If you don’t pay your IRMAA, you may be subject to a penalty.

Closure

Thus, we hope this article has provided valuable insights into 2025 Medicare IRMAA Brackets. We hope you find this article informative and beneficial. See you in our next article!