2025 Bitcoin Predictions: A Comprehensive Analysis of Market Trends and Technological Advancements

Related Articles: 2025 Bitcoin Predictions: A Comprehensive Analysis of Market Trends and Technological Advancements

- Difference 2025 Vs 2032

- Morocco To Host 2025 Africa Cup Of Nations

- 2025 Toyota Camry Fuel Economy: A Comprehensive Overview

- 2025: Year Of The Snake

- 2025 Ram 1500 RamCharger: A Revolutionary Truck With Unprecedented MPG

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to 2025 Bitcoin Predictions: A Comprehensive Analysis of Market Trends and Technological Advancements. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about 2025 Bitcoin Predictions: A Comprehensive Analysis of Market Trends and Technological Advancements

2025 Bitcoin Predictions: A Comprehensive Analysis of Market Trends and Technological Advancements

Bitcoin, the world’s leading cryptocurrency, has captivated the financial landscape since its inception in 2009. As the crypto market continues to evolve rapidly, predicting the future of Bitcoin becomes a complex but fascinating endeavor. This article aims to provide a comprehensive analysis of 2025 Bitcoin predictions, examining market trends, technological advancements, and expert insights to offer a well-informed outlook on the potential trajectory of this digital asset.

Market Trends

1. Institutional Adoption:

Institutional investors are increasingly recognizing the potential of Bitcoin as a store of value and a hedge against inflation. The entry of major players, such as hedge funds and pension funds, into the crypto market is expected to continue, driving up demand and bolstering Bitcoin’s credibility.

2. Regulatory Framework:

Governments worldwide are actively working on establishing regulatory frameworks for cryptocurrencies. Clear and consistent regulations would enhance investor confidence and facilitate wider adoption, positively impacting Bitcoin’s price and stability.

3. Economic Conditions:

Bitcoin has often been viewed as a safe haven asset during economic uncertainty. In the event of a global recession or financial crisis, demand for Bitcoin could surge as investors seek alternative investment options.

Technological Advancements

1. Layer-2 Solutions:

Scaling solutions like the Lightning Network and sidechains are addressing the scalability limitations of the Bitcoin blockchain, enabling faster and cheaper transactions. These advancements could significantly enhance Bitcoin’s usability as a medium of exchange.

2. Proof-of-Stake Consensus:

Proof-of-stake (PoS) is a consensus mechanism that consumes less energy than Bitcoin’s current proof-of-work (PoW) algorithm. If Bitcoin were to transition to PoS, it would improve its environmental sustainability and reduce operating costs.

3. Smart Contracts:

Smart contracts are self-executing agreements that run on the blockchain. The integration of smart contracts into Bitcoin would expand its functionality and enable the development of decentralized applications and financial services.

Expert Insights

1. Tim Draper, Venture Capitalist:

Draper predicts that Bitcoin will reach $250,000 by 2025, driven by growing adoption and the limited supply of 21 million coins.

2. Raoul Pal, Macro Investor:

Pal believes that Bitcoin could hit $1 million by 2025, as it gains widespread acceptance as a global reserve currency.

3. Cathie Wood, ARK Invest CEO:

Wood forecasts that Bitcoin could reach $500,000 by 2025, citing its potential to disrupt traditional financial systems and its role as a store of value.

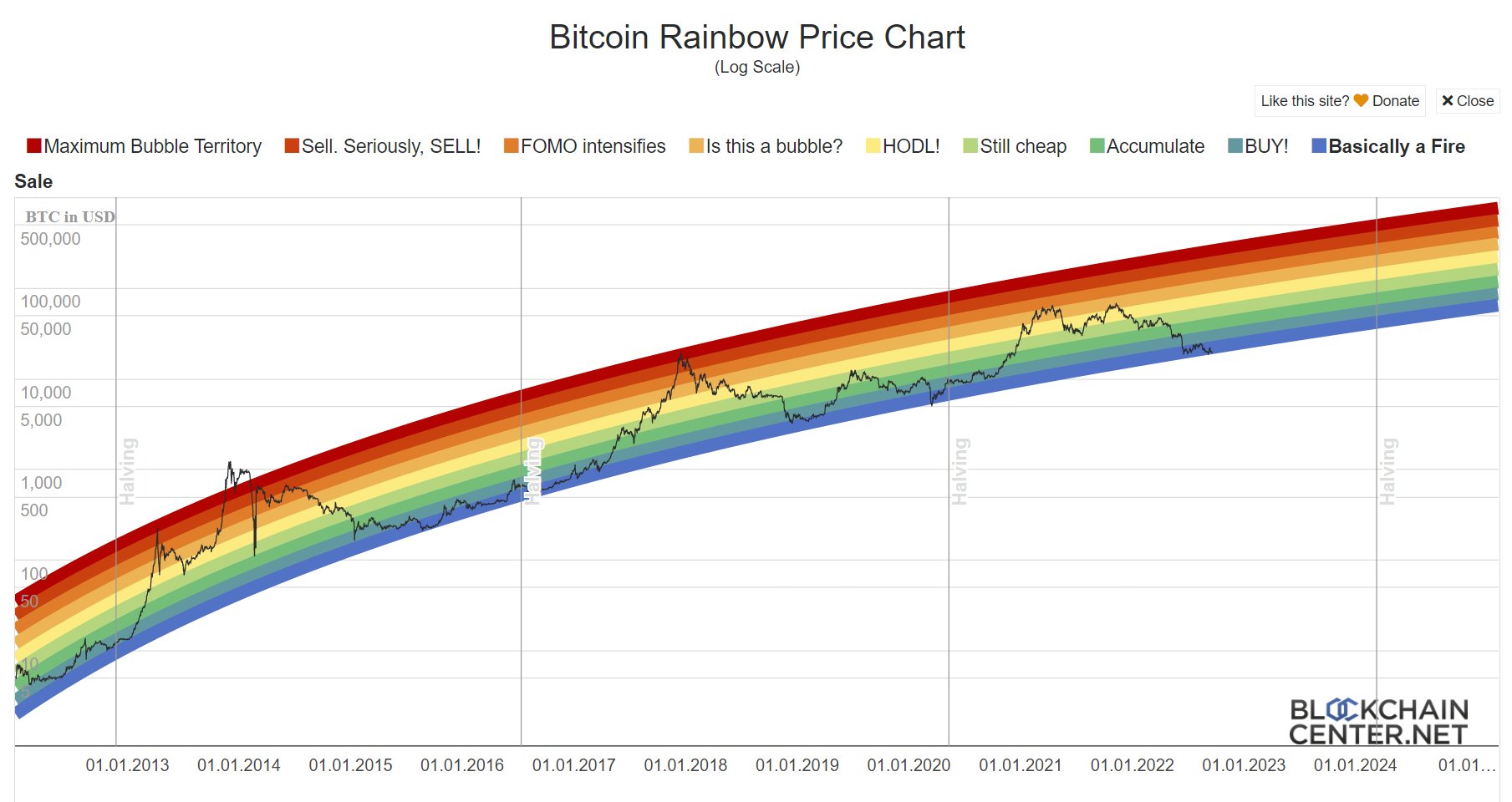

2025 Price Predictions

Based on the aforementioned market trends, technological advancements, and expert insights, here are some possible 2025 Bitcoin price predictions:

Conservative: $100,000 – $150,000

Moderate: $200,000 – $300,000

Bullish: $400,000 – $500,000

Factors Influencing Predictions

1. Regulatory Environment:

A favorable regulatory landscape would boost investor confidence and accelerate adoption, potentially driving up Bitcoin’s price.

2. Economic Outlook:

Global economic conditions, such as inflation and recession, can significantly impact Bitcoin’s demand and value.

3. Technological Innovations:

Advancements in scaling solutions, consensus mechanisms, and smart contracts could enhance Bitcoin’s functionality and usability, increasing its desirability.

4. Competition:

The emergence of alternative cryptocurrencies and central bank digital currencies (CBDCs) could pose competitive challenges to Bitcoin’s dominance.

5. Investor Sentiment:

Market sentiment and speculative trading can significantly influence Bitcoin’s price, potentially leading to volatility and price fluctuations.

Conclusion

Predicting the future of Bitcoin is a challenging but exciting endeavor. While the market remains volatile, the convergence of positive market trends, technological advancements, and expert optimism suggests a promising outlook for Bitcoin in the coming years. By 2025, Bitcoin has the potential to reach significant milestones in terms of price and adoption, solidifying its position as a global digital asset and a transformative force in the financial landscape.

Closure

Thus, we hope this article has provided valuable insights into 2025 Bitcoin Predictions: A Comprehensive Analysis of Market Trends and Technological Advancements. We thank you for taking the time to read this article. See you in our next article!