2025 401(k) Contribution Limits: Maximizing Your Retirement Savings

Related Articles: 2025 401(k) Contribution Limits: Maximizing Your Retirement Savings

- 2025 Peterbilt 589 Day Cab: A Pinnacle Of Engineering Excellence

- Chinese Lunar New Year 2025: The Year Of The Snake

- Yorkshire Water Business Plan 2025: Securing A Resilient Water Future For Yorkshire

- 2025 Chevrolet Silverado 3500HD Dually: The Ultimate Workhorse

- Tamil Calendar December 2025

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to 2025 401(k) Contribution Limits: Maximizing Your Retirement Savings. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about 2025 401(k) Contribution Limits: Maximizing Your Retirement Savings

2025 401(k) Contribution Limits: Maximizing Your Retirement Savings

Introduction

A 401(k) plan is a tax-advantaged retirement savings account offered by many employers in the United States. Contributions to a 401(k) are made on a pre-tax basis, meaning they are deducted from your paycheck before taxes are calculated. This reduces your current taxable income, potentially lowering your tax bill.

The Internal Revenue Service (IRS) sets limits on how much you can contribute to your 401(k) each year. These limits are adjusted periodically to keep pace with inflation. For 2025, the 401(k) contribution limits are increasing, providing you with an opportunity to save even more for your retirement.

2025 401(k) Contribution Limits

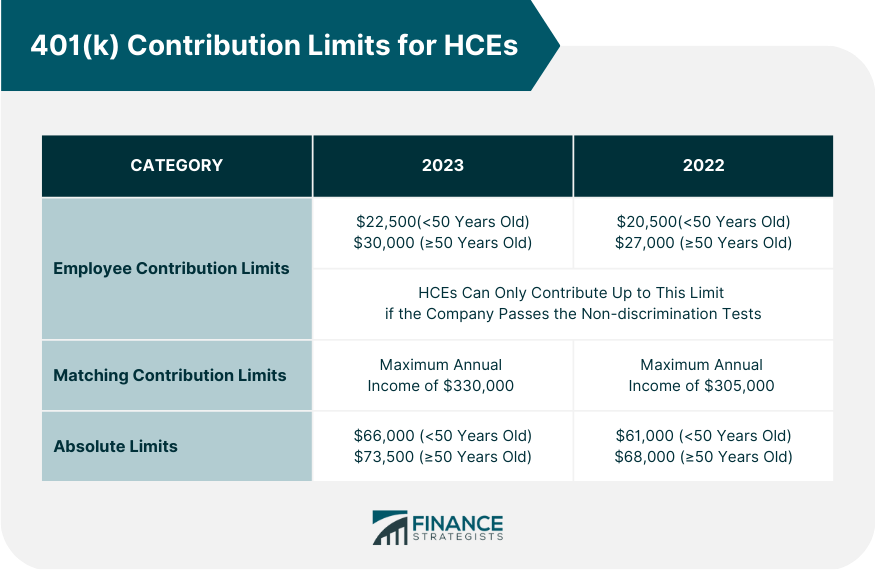

For 2025, the following contribution limits apply to 401(k) plans:

- Employee Elective Deferrals: The maximum amount you can contribute to your 401(k) from your salary is $22,500. This is an increase of $1,000 from the 2024 limit.

- Employer Matching Contributions: Employers can contribute up to 100% of your compensation to your 401(k) plan, up to a maximum of $66,000 in 2025. This limit includes both your elective deferrals and employer matching contributions.

Catch-Up Contributions for Individuals Age 50 and Older

Individuals who are age 50 or older by the end of the calendar year are eligible to make catch-up contributions to their 401(k) plans. For 2025, the catch-up contribution limit is $7,500. This means that individuals age 50 and older can contribute up to $30,000 to their 401(k) plans in 2025.

Benefits of Maximizing Your 401(k) Contributions

Maximizing your 401(k) contributions has several benefits, including:

- Tax Savings: Contributions to a 401(k) are made on a pre-tax basis, which reduces your current taxable income. This can result in significant tax savings, especially if you are in a high tax bracket.

- Investment Growth: The money you contribute to your 401(k) is invested in a variety of funds, such as stocks, bonds, and mutual funds. Over time, these investments have the potential to grow, providing you with a larger nest egg for retirement.

- Compound Interest: The earnings on your 401(k) contributions are compounded, meaning they earn interest on both the principal and the accumulated interest. This can significantly increase the value of your retirement savings over time.

- Retirement Security: Having a substantial retirement savings account can give you peace of mind, knowing that you will have financial security in your later years.

How to Maximize Your 401(k) Contributions

To maximize your 401(k) contributions, follow these steps:

- Contribute as much as possible: If you can afford it, contribute the maximum amount allowed to your 401(k) plan each year.

- Take advantage of employer matching: If your employer offers matching contributions, make sure you contribute enough to receive the full match.

- Consider catch-up contributions: If you are age 50 or older, take advantage of the catch-up contribution limit to save even more for retirement.

- Increase your contributions gradually: If you are unable to contribute the maximum amount immediately, gradually increase your contributions over time as your income increases.

- Review your investment options: Choose investment options that align with your risk tolerance and retirement goals.

Conclusion

The 2025 401(k) contribution limits provide an excellent opportunity to maximize your retirement savings. By taking advantage of these limits and following the strategies outlined above, you can build a substantial nest egg for a secure financial future. Remember, the sooner you start saving for retirement, the more time your money has to grow.

%20%26%20SEP%20IRA%20Self-Employed%20Retirement%20Plan%20Contributions.png?width=1200u0026name=Solo%20401(k)%20%26%20SEP%20IRA%20Self-Employed%20Retirement%20Plan%20Contributions.png)

Closure

Thus, we hope this article has provided valuable insights into 2025 401(k) Contribution Limits: Maximizing Your Retirement Savings. We appreciate your attention to our article. See you in our next article!